Shares of Charles River Laboratories (NYSE:CRL) have had a difficult year, losing about 21% of their value, and those losses continued on Tuesday as shares fell 4% in response to a mixed earnings report. Last year, I recommended investors sell shares given CRL’s valuation and near-term headwinds. With the stock now below $180, now is an opportune time to revisit CRL to see if the bad news has been sufficiently priced in. Ultimately, I see shares at fair value with limited upside, even after the fall.

Seeking Alpha

In the company’s third quarter, Charles River earned $2.72 in adjusted EPS, beating estimates by $0.35 with revenue growth of 4% to $1.03 billion. Organic growth was 4.1%. However alongside these results, management negatively revised guidance to 2.5-3.5% revenue growth for the full year from 2.5-4.5% previously. Non-GAAP EPS guidance was also tightened to $10.50-$10.70 from $10.30-$10.90. This drove the decline.

Last year, I expressed concern that CRL could be significantly impacted by the Federal Reserve’s tightening in two ways: that higher rates could reduce demand for research and development by pharmaceutical companies as cost of funding rose, particularly from venture-backed firms and by raising CRL’s own financing costs. Both of these have played out and weighed on results. First, let’s look at Charles River’s underlying business.

CRL’s DSA (discovery and safety assessment) unit saw 5.3% organic revenue growth to $664 million, accounting for over 60% of the business. Safety was particularly strong, and this part of the business tends to be less cyclical. It also assists in testing for drugs further along the development pipeline. Because they are later stage and closer to market, even if fundings costs are higher, biopharma firms are likely to continue spending. It’s analogous to having a contract for a half-built bridge; at that point, it would take a severe economic downturn to opt against completing it. Given that, CRL is seeing a lower cancellation rate than in previous quarters.

However, while CRL continues to get work on these existing projects, it is struggling to get new work. The company’s book to bill remains below 1.0x with the backlog down from $2.8 to $2.6 billion. With a $200 million decline, this implies just about $464 million of net orders or less than 0.75x of sales. For now, backlog is helping to support activity, but we are likely to see ongoing organic growth deceleration next year until orders show signs of improvement.

Its RMS (research models and services) unit posted just 3.2% organic growth to $187 million, as mid-tier clients saw weaker demand. China shipping timing also shifted revenue away from Q3 to Q4. Operating margins contracted by 460bps to 18.9%, as mix shift moved towards academic clients who tend to have less economic sensitivity to their work but also pay lower prices.

Manufacturing revenue was up 1%, adjusting for divestitures, at $176 million with softness across end markets. Cost cutting and de-stocking of COVID inventory is reducing testing volumes. Margins were down 410bp from last year at 24.5%.

Based on these results, management expects that organic growth will be down mid-single-digits in Q4 with adjusted EPS of $2.30-$2.50. Management is “cautious” on biopharma demand. They believe the environment “will stabilize,” meaning it has yet to. In other words, some deterioration is still likely, but it hopes a floor is near. Clients are streamlining costs and preserving cash. In particular, smaller firms are being even more cautious.

I am not surprised to see that smaller and mid-sized biopharma firms are showing weaker demand than large ones. A company like Merck (MRK) has so much free cash flow that it can internally fund its development pipelines. Conversely, pre-revenue firms with drugs in clinical trials need outside funding, either by raising equity from venture firms or through debt markets, to support their spending. Higher interest rates and lower valuations for speculative assets have hit both of these funding sources, forcing firms to pull back on their budgets.

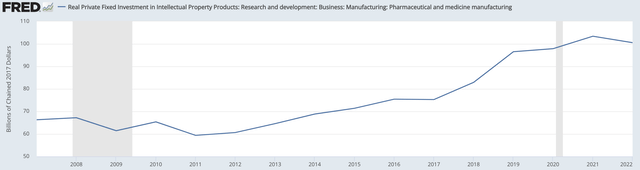

I do not see a meaningful shift in the rate environment coming soon to change this dynamic. Interestingly, after surging in the latter half of last decade, pharmaceutical development spending has largely flatlined in recent years indicative of the weakening demand CRL is seeing.

St. Louis Federal Reserve

There is another potential factor here. The 2017 tax cuts allowed companies to fully expense their R&D spending, rather than capitalize it over five years, reducing their tax bills. This effectively incentivized R&D investment, encouraging firms in the pharmaceutical sector to spend more developing drugs. That may have played a role in the jump in investment. That tax change was temporary, and research and development costs can no longer be expensed. It may be that some of that rise was a tax-related shift, rather than a new secular trend.

The other challenge facing CRL has been its balance sheet. Last year half of its rate was floating rate. Subsequent to that, CRL has used swaps to make 80% of its debt fixed rate. But given the higher rates environment, its interest expense has tripled to $34 million from $11 million last year. That is even as long-term debt of $2.5 billion has fallen from $2.7 billion at the start of the year.

This rise in interest expense has reduced quarterly earnings by about $0.30. If not for higher interest expense, EPS growth would have been around 13% not 3%. This rise in rates has greatly reduced CRL’s profit growth, but the good news is that this headwind has essentially played out. Significant further increases by the Fed appear unlikely, and while rates are unlikely to fall back so much that CRL returns to $11 million in quarterly interest expense, we are unlikely to see costs rise much further.

Shares are now trading at about 16.5x earnings, from 19x when I recommend a sell last year. This lower multiple has definitely taken risk out of the stock. That said, earnings growth is likely to be quite slow. Next quarter, earnings will decline sequentially, and with a falling backlog, it will be difficult to generate much organic growth next year with ~$10.50-$11 a likely place for 2024 EPS to land.

The company will generate about $340-$360 million in free cash flow this year, for just a 4% free cash flow yield, which again is not overly compelling. My concern is that CRL is not just experiencing cyclical headwinds within a secular growth industry. Rather, there are signs, between likelier permanent higher funding costs on average and less friendly tax policy, that pharma research spending will not grow as quickly as it did from 2016-2020. In this case, slower growth will persist for longer.

At their current price, shares are no longer expensive, and I do not see enough downside to merit actively shorting shares. However with the demand backdrop still weakening, I do not see a catalyst for shares to really recover in a meaningful way. I expect shares to remain rangebound in the $170-$185 area, and I think investors can find better opportunities elsewhere.

Read the full article here