Commentary

The Polen Focus Growth Composite Portfolio declined -3.28% and -3.47%, gross and net of fees, in the third quarter. This was roughly in line with the -3.13% and -3.27% returns of the Russell 1000 Growth and S&P 500 indexes, respectively. Due to recent U.S. Federal Reserve commentary, performance for July-August was meaningfully different than September. The Portfolio was meaningfully ahead of both benchmarks through early September. Then, the Federal Reserve indicated that rates could stay higher for longer, spurring a jump in interest rates. The 10year U.S. Treasury bond was yielding over 4.8% at the time of this writing, nearly 150 basis points higher than it was for a good part of the second quarter. September introduced another duration driven sell-off in equities similar to what we saw in 4Q 2021 and during parts of 2022 and reversed the outperformance we achieved in July-August.

As a reminder, our Portfolio’s weighted average P/E ratio is higher than the indexes because we demand that companies have strong competitive advantages, balance sheets, and growth to qualify for inclusion in our Portfolio. Therefore, a trade-off is usually required to invest in this level of quality, which can be higher-than-average P/E ratios. This trade-off has historically been worthwhile as our Portfolio’s durable mid-teens EPS growth has allowed for compounding, which has more than overcome the P/E differential. In the last two years, the equity markets have rapidly reacted to changes in interest rates regardless of the long-term quality or growth of individual companies. Over time, though, it is the earnings power of these companies and our Portfolio that we believe will well more than offset the mark-to-market duration impact on P/E ratios that we can experience from time to time in the short run.

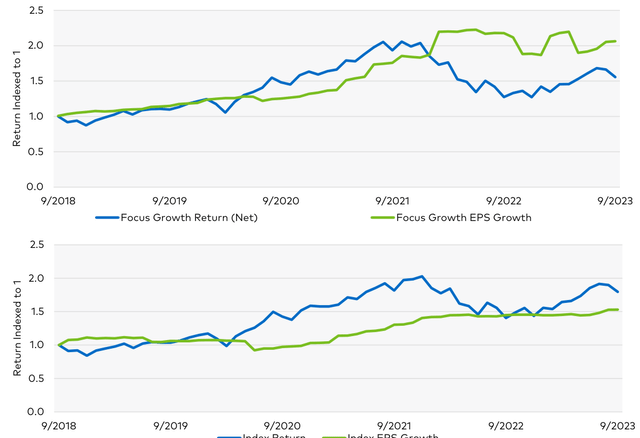

Figure 1: EPS Growth vs. Returns: Five Years

Sources: Polen, Bloomberg. Data from 9-30-2018 to 9-30-2023. See next page for full disclosure. Past performance is not indicative of future results.

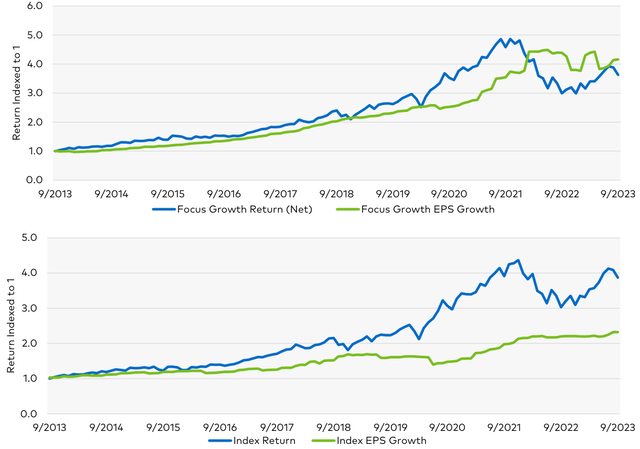

Figure 2: EPS Growth vs. Returns: Ten Years

| Sources: Polen, Bloomberg. Data from 9-30-2013 to 9-30-2023. Polen Capital, Bloomberg. Earnings per share (EPS) growth methodology for the Focus Growth Portfolio is consistent with EPS growth methodology for other index providers. Please contact Polen Capital for more details. The calculation methodology for CAGR is as follows: [(1+% Change in P/E Multiple)*[(1+EPS CAGR)t]1/t. This information is not intended to be construed to equate to the expected or projected future performance/returns of a Polen Capital investment or portfolio. There is no guarantee that performance will follow earnings growth. Periods over one-year are annualized. Performance figures are presented gross and net of fees and have been calculated after the deduction of all transaction costs and commissions, and include the reinvestment of all income. Please reference the GIPS Report. CAGR = compounded annual growth rate. EPS (earnings per share): The portion of a company’s income available to shareholders and allocated to each outstanding share of common stock. Past performance is not indicative of future results. |

As Figures 1 and 2 show, the fundamental earnings growth of the Portfolio has supported our trailing returns. At the same time, the Index has experienced far lower earnings growth, with roughly half of its return coming from P/E multiple expansion, not fundamental earnings growth.

We feel very good about the underlying earnings growth of the companies in the Portfolio, which is currently on pace for over 20% EPS growth in 2023. We believe the mid-teens-or-better annualized earnings growth over the next three to five years is highly achievable for the Portfolio, just as we have delivered to clients for over three decades.

Consumer spending with higher interest rates, ongoing inflation due to various factors, and the added headwind of resuming student loan debt repayments are justifiable concerns. It is indeed possible that consumer spending will slow, but at least for now, employment rates remain very strong in the U.S., which is a positive for the consumer backdrop.

Although our Portfolio’s earnings growth would be affected by a weak economic environment, just like almost all companies, our companies are positioned to grow earnings by at least low-double-digit percentages in the aggregate, even in recessionary environments. While we are cognizant of the lower growth rates some of our companies would likely experience in a weak macroeconomic backdrop, we would still expect the Portfolio to grow its earnings at a respectable rate if we see a more negative impact on consumer spending. In addition, several of our holdings, including Amazon and Netflix, already experienced a much weaker year in 2022 versus how we believe they would fare in a recession due to the other side of COVID.

These businesses are growing at higher rates in 2023 as they move further past the 2022 COVID-19 grow-over issues. In 2022, several of our companies’ financial metrics looked weak at exactly the wrong time as inflation concerns spiked. This created a “double negative” for their share prices. But, we now expect these companies to be showing robust financial metrics, as they have year to date, amid the possibility of another bout of inflation and interest rate-related concerns.

Portfolio Performance & Attribution

In the third quarter, the top relative contributors to the Portfolio’s performance were Apple (AAPL), Airbnb (ABNB), and Adobe (ADBE). The top absolute contributors were Alphabet (GOOG,GOOGL) , Airbnb, and Adobe.

Apple has been a meaningful detractor to relative performance in recent quarters as the company has seen moderate earnings growth but substantial P/E multiple expansion. In our view, Apple is a great business but one with more risk factors related to China than we would prefer: relatively low EPS growth, which is being heavily aided by share buybacks (slower EPS growth than every single company in our Portfolio); and a high P/E ratio for this level of growth. This combination rarely leads to excellent long-term share price performance in our experience.

Last quarter, Apple’s new iPhone introduction failed to generate much excitement, with iPhone units declining year over year. There was also news that the Chinese government was blocking its employees from using iPhones. Apple is exposed to the rising geopolitical tensions between the U.S. and China. The latter is responsible for much of the company’s incremental iPhone growth, and nearly all of Apple’s supply chain is China-based. The relatively small action by the Chinese government was a reminder to investors that Apple is not immune from geopolitics or other risks.

Airbnb continues to see double-digit growth in nights booked and revenue. Private rentals continue to take market share from hotels globally, and Airbnb continues to take market share within private rentals. We expect many years of robust earnings and cash flow growth, but this quarter’s share price appreciation was more likely tied to Standard & Poor’s decision to add Airbnb to the S&P 500 index.

Adobe also continues to see consistent double-digit growth. It has recently added a generative AI tool called Firefly to its digital media creation tools, which is seeing robust customer uptake. While there may be risks from new generative AI providers encroaching on Adobe’s market, we think the company’s fast innovation in this area helps to solidify its competitive advantages.

The quarter’s largest relative and absolute detractors were Netflix (NFLX), Illumina (ILMN), and Eli Lilly (LLY).

Netflix shares sold off after their CFO Spence Neumann spoke at a conference. He emphasized more than usual that the company’s prior long-term margin guidance, which called for 300+ basis points of operating margin per year on average, is no longer the expectation. We were neither expecting this level of margin expansion (and we do not believe many other investors were either), nor has the company delivered this level of margin expansion over the past two years. It seems market participants took Neumann’s tone on margins as a negative indicator of the company’s earnings momentum.

We believe that Netflix has plenty of room to expand operating margins from year to year, the magnitude of which will depend largely on annual revenue growth. We view Netflix’s share price weakness simply as an unfortunate reaction to the way Neumann communicated his margin views during the conference.

According to our research, Netflix is the only profitable streaming company of any significance in the world. We continue to expect that paid password sharing and ad-supported subscriptions will allow Netflix to be meaningfully larger and more profitable over the next five years than it is now. Future margin expansion will be more modest than in the recent past. Still, we also expect revenue growth to accelerate from monetizing borrowed passwords and advertisers seeking to buy time in Netflix’s high-value content.

Several issues have hampered Illumina over the last few years, including a regulator penalizing it for closing an acquisition without approval and the subsequent dilution of the acquisition. In addition, the core business has slowed meaningfully due to macroeconomic pressure on their research customers, and they have lost some senior members of their management team, including their former CEO Francis DeSouza.

These issues are all clearly negative, but for balance, we believe most of these issues have been or soon will be rectified. Illumina has already hired a new operations-focused CEO, Jacob Thaysen from Agilent Technologies, with a strong track record of execution in this industry. Thaysen arrives as the company has recently launched its next-generation genomic sequencing products that should help re-ignite growth in the core business. The divestiture of Grail should be imminent, which would end the substantial shareholder dilution from Grail and allow the healthy operating margins of Illumina’s core business to become more visible. While we would prefer for Illumina to be allowed to own and optimally run Grail, this seems highly unlikely now based on European regulatory concerns. That said, we are looking forward to getting back to owning the strong core business.

Eli Lilly was a new purchase toward the end of the quarter. We explain this further in the Portfolio Activity section. The primary reason it was a leading detractor is because we didn’t own it earlier in the quarter when it had a large positive stock price move.

Portfolio Activity

We added new positions in Eli Lilly and Novo Nordisk (NVO) in the third quarter. We slightly trimmed Amazon and eliminated our position in DocuSign (DOCU).

Eli Lilly is a 150-year-old pharmaceutical company that, today, has durable growth coming from drugs for oncology, immunology, and neurology.

Lilly also holds a duopoly position with Novo Nordisk in diabetes and obesity.

Lilly had been a consistent but moderate growth company until the launch of its GLP-1 drug, Mounjaro, for diabetes (and now obesity), which has caused growth to accelerate strongly. We expect the GLP-1 drug class, particularly Mounjaro, to be very large and possibly the largest drug class ever created. These drugs are very effective for glycemic control for Type 2 diabetics and have also proven to be highly effective in weight loss for overweight and obese patients with and without Type 2 diabetes.

We have been monitoring Lilly and Novo Nordisk for some time, and new clinical results from a recent drug trial give us confidence in the large upside potential for GLP-1s. These results from a Novo Nordisk study showed impressive cardiovascular outcomes for its GLP-1, Wegovy. This study of over 17,000 overweight or obese people with established cardiovascular disease (but without diabetes) showed that Wegovy reduced the likelihood of major adverse cardiovascular events (heart attack, stroke, sudden cardiac death) by over 20% for up to five years. This large and well-controlled trial helps to demonstrate that the weight loss benefits of GLP-1s (likely similar for Mounjaro and Wegovy) lead to better health outcomes for patients and likely save the healthcare system significant amounts of money over the long term. In our view, this makes it very unlikely that payors and governments will deny patient access and reimbursement for these drugs for the long haul (hence the positive stock price moves for Lilly and Novo when the data was released mid-quarter).

With durable franchises in multiple therapeutic areas and exceptional growth in diabetes and weight loss, we expect Eli Lilly’s revenue to grow at a mid-teens or better rate over the next five years and potential EPS growth above 20%. This growth does not include any benefit from the company’s Alzheimer’s drug, Donanemab, which should be approved soon but has a debatable risk/benefit profile.

We view Lilly’s P/E ratio in the mid-40s as optically high but still reasonable as we expect revenue growth to be robust, and Lilly’s margins are starting from below the pharmaceutical industry average and should expand rapidly with the compelling revenue growth.

We have started with a small 1% position in Lilly, but when paired with our new holding in Novo Nordisk at 2% (NVO is slightly larger as its valuation is lower), it represents a 3% combined position in the two companies we expect to maintain a duopoly in this large drug class over the next several years.

Novo Nordisk has a long history as the leader in diabetes pharmaceuticals. It is much more narrowly focused on diabetes than Lilly with its GLP-1 drugs, Ozempic and Wegovy (Wegovy is the same drug as Ozempic but uses a different name for obesity), driving most of the company’s revenue and earnings growth. The cardiovascular outcomes trial mentioned above is a big positive for Novo. It establishes the duopoly with Lilly in insulin management for Type 2 diabetics and weight loss for the huge number of overweight and obese people across the globe.

Novo has more legacy diabetes products that its newer drugs will cannibalize, but our research indicates that we can expect high teens earnings per share growth from Novo over the next five years. In addition, both Novo and Lilly have next-generation diabetes and weight loss drugs in development that appear even more effective than the current offerings while also offering new treatment modalities, such as oral drugs versus today’s auto injectables.

Novo and Lilly’s drugs address two very large disease states with different formulations, and both companies have next-generation drugs deep in the pipeline.

We think this provides a unique opportunity for these pharmaceutical companies to grow revenues and earnings at a double-digit pace over the next several years.

We eliminated our remaining 1% position in DocuSign. While the company remains the leader by a wide margin at the higher end of the digital signature market, it has become clearer to us that its addressable e-signature market is likely significantly smaller than we had believed or will take much longer to develop than we had anticipated. The lower end of the market is highly competitive. We were patient with our very small position. Impressive new management joined from Google and The Trade Desk in hopes of them being able to reinvigorate growth in core esignature. Still, it does not appear that this is likely anytime soon with new management articulating that the company will need to develop new products to achieve higher levels of e-signature growth despite what we considered to be low penetration rates within existing e-signature products. As such, we used the proceeds of our sale as part of the funding for our Novo position.

We modestly trimmed our large Amazon weighting in the quarter purely for risk management purposes after the shares appreciated nearly 40% from when we last added to the position earlier in the year. We still expect excellent revenue and free cash flow growth over the coming years, and as such, Amazon remains, by far, our largest holding.

Outlook

Speculation on the future level of interest rates and the impact on the economy continues to affect equity prices in the short term. Still, our Portfolio holdings continue to compound earnings growth at healthy rates. According to our analysis, the Portfolio is currently on pace for over 20% earnings per share growth this year, on a weighted0average basis. Several of our Portfolio companies already experienced their challenging year in 2022 due to COVID versus post-COVID growth comparisons, putting them in an even better position to show financial resilience if further economic weakness ensues in the near term. Over the long term, we target at least mid-teens EPS growth, as we always have. Given where valuation levels are for the Portfolio today, we expect that our returns will at least roughly track this earnings growth over the next three to five years, as it has for the last 34 years.

Thank you for your interest in Polen Capital and the Focus Growth strategy. Please feel free to contact us with any questions or comments.

Dan Davidowitz and Brandon Ladoff

Read the full article here