Investment Thesis

Amidst the escalating police staffing crisis in the US, law enforcement agencies are seeking innovative solutions to address the shortage of officers and rising public safety demand. Axon Enterprise (NASDAQ:AXON) has emerged as a compelling investment opportunity with its transformational portfolio that utilizes advanced technologies like AI, VR and Robotics to directly address these challenges. By automating administrative tasks, enhancing officer training, and ensuring officer safety through devices like Tasers and body-worn cameras, Axon is at the forefront of modernizing law enforcement operations.

Our analysis suggests that Axon’s potential is underestimated by the market, indicating significant upside potential. Despite potential risks related to regulations and competition, Axon’s disruptive technologies and compelling business model make it an attractive investment opportunity.

We rate Axon as a Buy.

The US Police Staffing Crisis

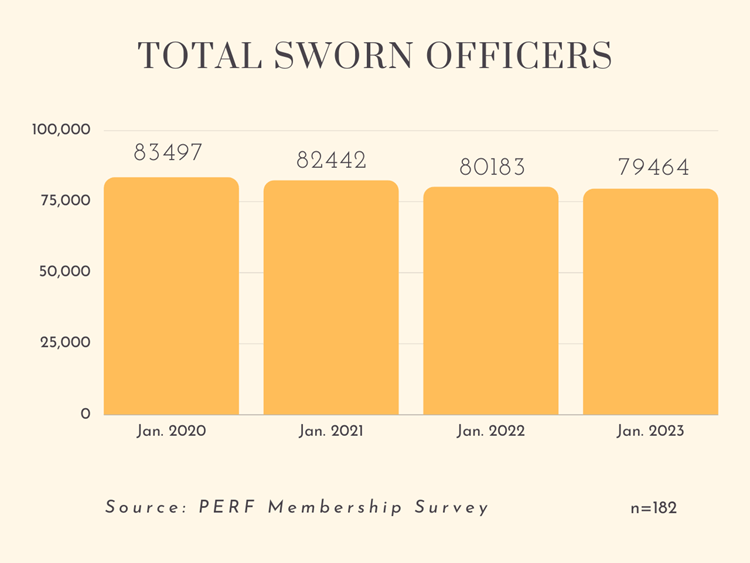

The United States is facing a serious police shortage crisis. The total number of police officers in the country goes down but police demand is growing. A survey conducted by the Police Executive Research Forum of 182 law enforcement agencies shows that police agencies are losing officers faster than they can hire new ones. As a result, the number of officers has dropped by almost 5 percent in the last three years(see below)

US Total Number of Active Police Officers (Police Executive Research Forum)

According to the IACF (International Association of Chiefs of Police) the US police shortage is driven by the following factors:

- High attrition rates of officers quitting or retiring due to workload, stress, and low morale.

- Low recruitment rates of qualified candidates due to public perception, generational differences, and increased risk and scrutiny.

- Growing demand for police services due to population growth, new crimes, and social issues.

The police officer shortage problems appears to be a complex and multi-dimensional issue. Although the data represents US, we think this is a global concern. Countries are looking for ways to keep and attract more police officers, while improving their working conditions, training, and public relations.

Axon is Customer-Centric

Axon is obsessed with solving the challenges and needs of the police officers. Whether it is through their product introductions, press releases, or CEO Rick Smith’s talks, Axon always focuses on the officers’ perspective. Axon’s goal is to improve the officers’ day-to-day processes, streamline their administration, increase their operational safety, and enhance their overall effectiveness. Every product that Axon develops is to help agencies overcome their daily challenges. Here are the most common problems that police officers face today and how Axon is positioned to help:

- Paperwork and administrative tasks, which consume almost half of the officers’ time and cause burnout. Axon reduces the paperwork burden and streamlines the workflow with its cloud-based software and evidence management system.

- Training and development, which are often limited by time and cost constraints. Axon Virtual Reality can offer immersive and low cost training options that can enhance the officers’ skills and confidence.

- Officer safety and public trust, which are threatened by the increasing number of officers shot and killed on duty. TASER devices, body-worn cameras, and Axon Respond can help increase the safety and accountability of the officers and the public.

We believe that Axon is rightly positioned to lead the law enforcement technology transformation, as it has a strong competitive advantage with its officer-centric portfolio and customer focus.

Axon is a Digital Transformation Company

Axon’s business is hard to categorize and assign to a specific sector. It is listed as an Industrial company in Nasdaq, because of its taser device. However, its software business is very significant, so it can be considered as an IT company as well. Moreover, it does communications services and video equipment, and it makes consumer devices like body cameras. It can also be classified as a Media company, because of their VR business. We think these are characteristics of a disruptive company that is very customer focused.

We believe that Axon is changing the way law enforcement agencies work. The company is using advanced technologies like AI, Robotics, VR and IoT to change the industry. Its vision is to build a connected network of devices, software, and people that can give useful insights, guide and perform tasks for law enforcement officers.

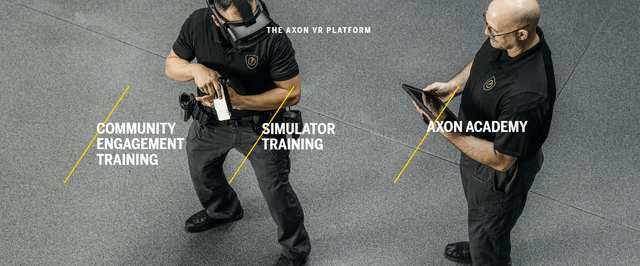

Axon Virtual Reality Training (Axon)

Expanding TAM Opportunity

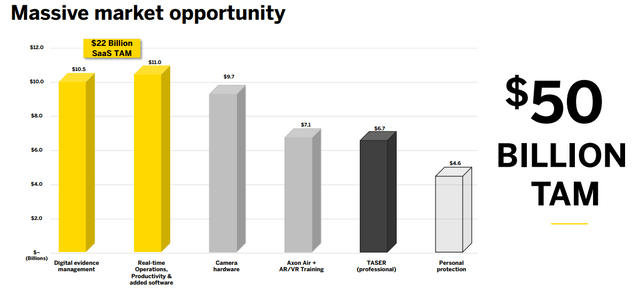

Company is showing $50B TAM as their addressable market opportunity but our view is that their future potential TAM is much bigger than what is being projected.

Axon Market Opportunity (Axon 2023 Q3 Earnings Investor deck)

We think that some of Axon’s products can increase the total market size beyond what is shown. Here are some examples of those products:

- Axon VR, which is a Virtual Reality (VR) platform that offers immersive training scenarios for officers . We think that Axon VR has a huge growth potential beyond public safety as VR Training and Simulation is a $600B market.

- Axon Performance, which is an analytics based performance management tool that analyzes officer performance data and provides feedback to management. This software can be adopted in any industry and has a $10B market size.

- Axon Respond, which is a service that uses AI to detect critical events, such as gunshots and vehicle crashes, and notifies personnel. This software can be positioned in any public sector market as a security product. It has a $9B market size.

- Axon Auto-Transcribe, which is an AI assisted editing tool to create police transcripts quickly. This tool can target the transcription services market, which is worth $36B across various industries.

Axon’s Future-Vision Will Further Increase its TAM

Axon is focused on the future of law enforcement as they are constantly innovating, developing and acquiring new solutions to further improve their portfolio. There are some future projects that we think will grow its market potential even more. Some of them are as follows:

- AI Assisted Policing: a concept that envisions an AI assistant that can provide real-time guidance and advice for officers, review compliance, generate automatic reports and suggest best practices.

- Robotics Security: Using autonomous robots that can perform dangerous or risky tasks that are too dangerous for police officers, such as bomb disposal or hostage rescue.

- Drone First Responders (DFRs): Drones that can provide air support and surveillance for police officers, respond to emergency calls and deliver medical supplies.

Axon Police Drones (Axon)

Based on some hints from CEO Rick Smith during the Q3 earnings call, we expect that Axon will announce some important Generative AI-related product announcements in 2024.

Axon is Underrated

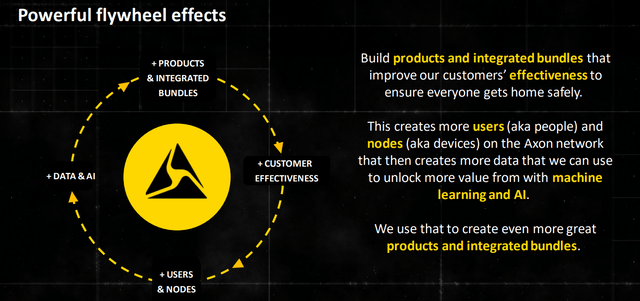

We think that the market is underestimating Axon, even though it has shown strong price performance this year. Our view is that Axon should be valuated as a high-growth disruptive technology company that is transforming an industry with innovative products. Its products have strong competitive advantages and its business is difficult to imitate due to its flywheel model (see below). The user-device-software-data circle is creating a flywheel effect that grows customer retention and recurring revenue.

Axon Business Model (Axon)

Axon has several factors that support our case:

- Strong financial performance, with revenue growing 33% year over year to $414 million in Q3 2023, and annual recurring revenue growing 54% year over year to $619 million. Company guided $1.55B revenue for full year 2023 which we think is still conservative and has upside (our forecast for full year is $1.58B)

- Healthy operating margins which are above industry levels (Q3 Adj. EBITDA margin is 21%) and their free cash flow is also increasing year over year (Q3 Adj. FCF increased by 70% YoY)

- A strong balance sheet as the company ended the quarter with $1.12 billion in cash and $690 billion in debt, with a net cash position of $432 million. We did not see anything worrisome on the balance sheet.

- High customer retention, with net revenue retention of 122% in Q3 2023, indicating that existing customers are spending more on Axon’s products and services over time. This metric is increasing every year and indicates very satisfied customer base.

- A growing addressable market, with an estimated global market size of $50 billion for law enforcement technologies. We think Axon products have a much bigger potential market, as they can also serve other industries.

- Diversified and recurring revenue streams, with revenue coming from hardware sales, software subscriptions, and professional services.

- Innovative and differentiated products, with a focus on Data, AI, Robotics and Virtual Reality, creating a strong and innovation portfolio. We don’t see many companies that can compete with Axon on such a full stack.

- Visionary leadership, with founder and CEO Rick Smith leading the company with an ambitious mission to protect life and make the world a safer place.

Valuation

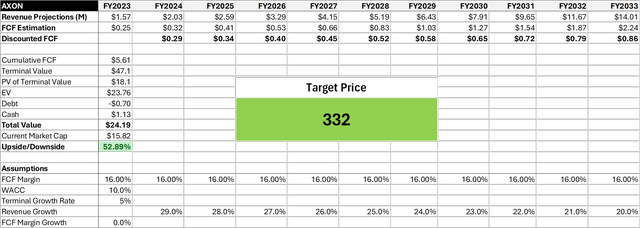

Based on a 10 year discounted cash flow analysis, we estimate that Axon’s fair value is $332 per share, implying a significant upside from the current price levels.

Axon DCF Model (Author)

We base our analysis on the following assumptions:

- We estimate Axon to close 2023 with $1.57B revenue (Company guiding for $1.55B)

- We project Axon’s revenue to grow at 29% in 2024 and then gradually decline to 20% in the final year, consistent with its current growth trend.

- We estimate Axon’s FCF margin to be 17% for the next decade, taking into account its potential increase in R&D and SBC costs.

- We apply a 10% discount rate, which reflects Axon’s weighted average cost of capital and risk profile.

- We assume a 5% terminal growth rate, which aligns with the long-term growth rate of the law enforcement industry.

Risks

Here are two possible risks for our valuation:

- Regulatory and legal risk, which is a possibility that Axon’s products and services could face regulatory scrutiny, lawsuits, or bans due to privacy, ethical, or human rights concerns. For example, some towns are suing Axon for antitrust violations and monopolistic practices.

- Competitive and technological risk, which is the possibility that Axon’s products and services could become less attractive due to the emergence of new competitors, technologies, or customer preferences. Axon has a variety of competitors in each of its product segments and we think that Motorola Solutions (NYSE:MSI) is of the main ones.

Conclusion

In conclusion, Axon’s disruptive technologies, high customer retention, expanding market and flywheel business model position it as a leader in the industry. We think the market is underestimating Axon’s potential, making it a very appealing investment opportunity.

Our DCF analysis, that verifies our thesis, shows that Axon’s fair value is $332 per share, implying a significant upside from the current price levels.

Read the full article here