We previously covered Iron Mountain Incorporated (NYSE:IRM) in August 2023, discussing its highly promising data center prospects, thanks to the generative AI boom.

With growing backlog, expanded capacity, and higher service base prices, we believed that its Data Center segment might be a long-term top and bottom line driver.

In this article, we will be discussing IRM’s mixed prospects in the near term, as the management aggressively expands its data center capacity at a time of elevated interest rate environment, triggering its increased reliance on debt.

While its dividend income investment thesis remains robust, investors may want to temper their near-term expectations, with the Fed expecting a normalized economy only by 2026.

The IRM Investment Thesis Remains Robust Here

For now, IRM reported an underwhelming FQ3’23 revenues of $1.38B (+2.2% QoQ/ +7.9% YoY) and AFFO per share of $0.99 (+5.3% QoQ/ +1% YoY), missing the consensus estimates.

Perhaps part of the pessimism is also attributed to the REIT’s slower revenue growth of $127.53M (+8% QoQ/ +27.1% YoY) in the Data Center business, with its top line driver still tied to the Global RIM Business at $1.18B (+2.6% QoQ/ +8.2% YoY).

Despite all the generative AI hype, IRM’s bottom line driver remains in the legacy business as well, at $516.54M (+3.5% QoQ/ +6.7% YoY) or the equivalent of 90.6% (+0.4 points QoQ/ -1.2 YoY) its overall adj EBITDA generation in the latest quarter.

Despite the projected improved cash-on-cash returns for its data center segment, it is apparent that the REIT has not been able to ramp up fast enough to meet demand, with much of its pre-lease contract currently under construction.

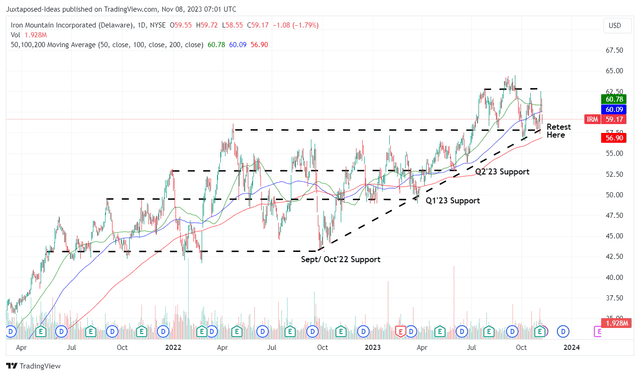

IRM 3Y Stock Price

TradingView

Perhaps this is why the IRM stock has failed to break out of its H2’23 resistance levels, with it likely to retest its critical support levels of $57 in the near term.

Naturally, it remains to be seen if the stock is able to sustain its upward momentum, with the stock already trading sideways since July 2023.

On the one hand, we believe the key to the generative AI investment thesis directly hinges on NVDA’s upcoming earnings call on November 20, 2023, with Mr. Market likely waiting with bated breath.

With multiple semi chip companies reporting mixed data center sales results, including Intel Corporation (INTC) at $3.8B (-5% QoQ/ -11.6% YoY) and Advanced Micro Devices at $1.59B (+20.4% QoQ/ inline YoY), it remains to be seen how things may develop in the near term.

On the other hand, it is apparent that the appetite for cloud services and generative AI remains insatiable, with multiple cloud providers already guiding intensified capital expenditure and investments in FY2024.

For example, Amazon.com, Inc. (AMZN) expects “increased infrastructure CapEx to support growth of our AWS business, including additional investments related to generative AI and large language model efforts,” with the same sentiments echoed by Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG) (GOOGL) in the recent earnings calls.

Meta Platforms, Inc. (META) has already gone ahead and offered an aggressive capex guidance of up to $35B in FY2024, up drastically from the FY2023 range of between $27B and $29B, “with growth driven by investments in servers, including both non-AI and AI hardware, and in data centers as we ramp up construction on sites with the new data center architecture we announced late last year.”

These forward commentaries continue to imply IRM’s near-term tailwinds as a data center REIT, especially since it caters to over 1.1K customers, including cloud providers, global enterprises, and local market organizations.

Most importantly, Gartner already expects the global public cloud services spending to grow by +21.3% YoY from $597.32B in 2023 to $724.56B in 2024.

In addition, IRM already exceeds its FY2023 leasing projection of 80 MWs (+19.4% YoY), with 120 MWs leased YTD. The insatiable demand for cloud capacity is apparent indeed, especially since 60 MWs of the 65 MWs leased in FQ3’23 carries a 15-year term, way longer than the company’s weighted average lease expiration of 8.1 years.

Therefore, while the REIT stock’s trajectory may have temporarily stalled, we believe that its long-term prospects remain excellent, with the management looking to aggressively expand its intermediate-term capacity.

IRM is already acquiring additional land and power to eventually grow its overall data center capacity from the current operation of 225 MWs to over 860 MWs, while also repurposing its previous records management facility in Miami and other locations for data center purposes.

With the momentum surrounding cloud computing and generative AI unlikely to stall, we believe that the stock’s recent correction is only temporal.

For now, while IRM may boast a sustainable FWD AFFO Dividend Payout Ratio of 64.03% and a growing Interest Coverage ratio of 1.85x, investors may want to monitor its increased debt at $11.54B (+6.4% QoQ/ +15.9% YoY) by the latest quarter.

With an intensified FY2023 capex guidance of $1.3B (+48.5% YoY), we believe the management may further rely on debt to finance its growth in the data center segment, with it likely to pose headwinds to its near-term profitability as the elevated interest rate environment triggers higher interest expenses.

So, Is IRM Stock A Buy, Sell, or Hold?

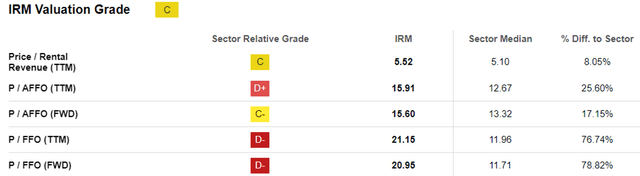

IRM Valuations

Seeking Alpha

As a result of these promising developments, we believe that IRM deserves its premium FWD Price/ AFFO valuations of 15.60x, compared to its 3Y pre-pandemic mean of 11.86x and sector median of 13.32x.

The same premium continues to be observed with its data center REIT peers as well, with IRM still trading well below Digital Realty Trust, Inc. (DLR) at 21.71x and Equinix, Inc. (EQIX) at 23.80x.

Based on the IRM management’s FY2023 AFFO per share guidance of $3.955 (+4% YoY) and its FWD Price/ AFFO valuation of 15.60x, it appears that the stock is trading near its fair value of $61.69 as well.

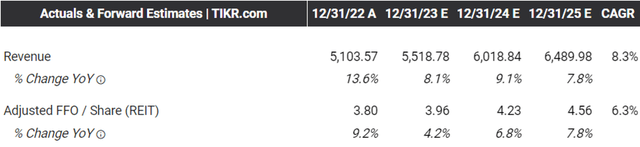

The Consensus Forward Estimates

Tikr Terminal

Based on the consensus FY2025 AFFO estimates of $4.56, it appears that there is an excellent upside potential of +20.2% to our long-term price target of $71.13 as well.

As a result of the attractive risk/ reward ratio, we continue to rate the IRM stock as a Buy, with no specific entry point, since it depends on individual investors’ dollar cost average and risk appetite.

Bottom fishing investors may consider waiting for a little longer and adding only if the stock’s support level of $57s holds for an improved margin of safety.

Read the full article here