BRASILIA (Reuters) -Brazil’s Finance Minister Fernando Haddad on Monday said President Luiz Inacio Lula da Silva will nominate Paulo Picchetti as central bank director of international affairs and Rodrigo Alves Teixeira as director of institutional relations.

The nominations must receive approval from the Senate before the new directors can take office. They will replace outgoing directors Fernanda Guardado and Mauricio Moura, whose terms are set to expire at the end of December.

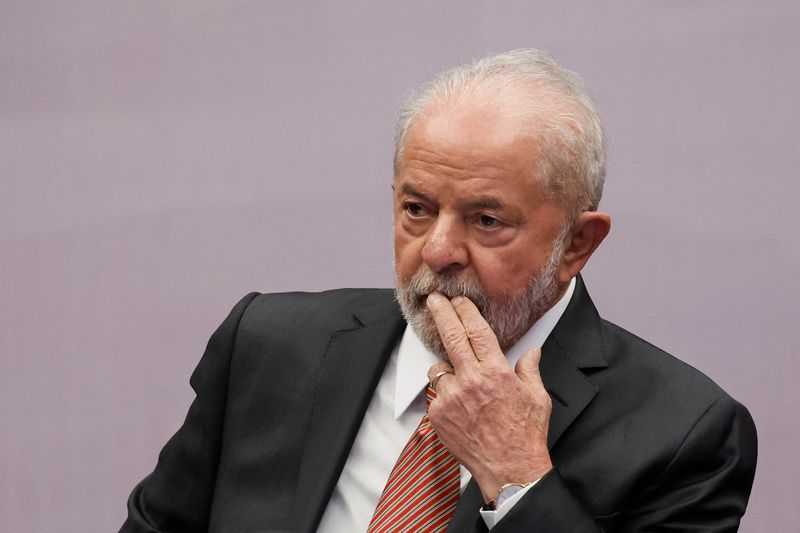

With the new picks Lula, who took office in January with harsh criticism of the central bank’s monetary policy, will see four of his chosen candidates seated on its nine-member board.

Government officials had told Reuters that the president was moving swiftly to secure his nominations so that the new directors could vote on the first policy decision of 2024.

Picchetti, a professor at Fundacao Getulio Vargas (FGV), is widely regarded by the market as a close associate of Haddad. He holds a master’s degree in economics from the University of Sao Paulo (USP) and a doctorate from the University of Illinois.

“Picchetti’s appointment to the central bank is very positive,” Warren Rena’s chief economist Felipe Salto said. “He is an extremely respected academic, with extensive experience in inflation and price indexes.”

Teixeira, meanwhile, is career civil servant at the central bank. He holds a degree in economics and earned both his master’s and Ph.D. from USP. He held two positions in the Sao Paulo city government during Haddad’s tenure as mayor.

The central bank nominations have been closely monitored by analysts, as some expect that as Lula’s nominees gain more influence in the board, the central bank’s approach to fighting inflation may become more lenient.

Policymakers acknowledge this perception as a potential hindrance to anchoring inflation expectations in line with the official target.

The central bank kicked off an easing cycle in August after holding its benchmark interest rate unchanged at a cycle high for nearly a year to battle inflation.

So far, interest rates have been reduced by 100 basis points to 12.75%, and policymakers have flagged their intent to keep implementing 50 basis-point cuts in the upcoming meetings.

Read the full article here