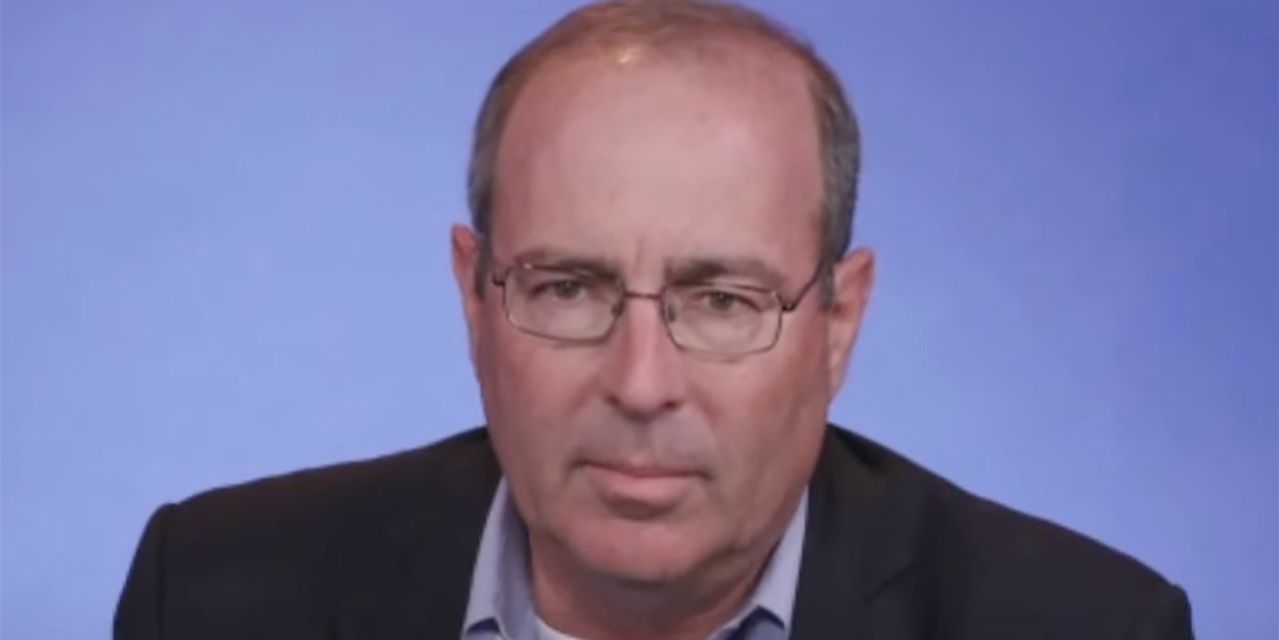

The movement in long-term bond yields may be capturing headlines, but it isn’t a great guide for deciding what to do with interest rates, Richmond Fed President Tom Barkin said Thursday.

“I don’t think long rates are quite useful as a policy variable,” Barkin said during a conversation webcast by MNI. “They can move, you know, pretty significantly over a relatively short time period.”

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

topped 5% before sliding after the Fed meeting in early November.

Barkin added he doesn’t ignore bond rates, but tries to take a more “holistic” view of financial conditions.

“Have they loosened since the last meeting? Sure,” Barkin said. “Where will they be at the next meeting, I have no idea.”

In his talk, Barkin said he expects the economy will experience “some sort of slowdown” in coming months.

He cited lagged negative effects of past rate hikes as a concern. The Fed has raised its benchmark rate by 525 basis points over the past year and a half.

“I just have to believe the net impact of all this tightening will eventually hit the economy harder than it has,” he said. “I think there is more lags to come.”

Economists at Goldman Sachs argued in a research note Wednesday that they believe most of the negative effects from past rate hikes are behind the economy.

Barkin said inflation “is headed in the right direction,” but cautioned that further progress “will be bumpy.”

Given the supply-chain problems during the pandemic, he said, “a whole bunch of people” got the opportunity to raise prices.

“What they found out is they liked it,” he said. “It’s the quickest way to get to the bottom line.”

While the “spiky supply-chain-oriented price increases” are a thing of the past, he said, companies in some sectors that think they can raise prices “are going to try,” he said.

This won’t stop until competitors or customers put enough pressure on the companies, Barkin added.

Read the full article here