By Howard Schneider

WASHINGTON (Reuters) – The October jobs report likely was a relief to Federal Reserve officials who hope the U.S. economy can edge down softly from a period of high inflation and torrid job growth without rolling over into recession under the weight of their own rate hikes and overall tougher credit conditions.

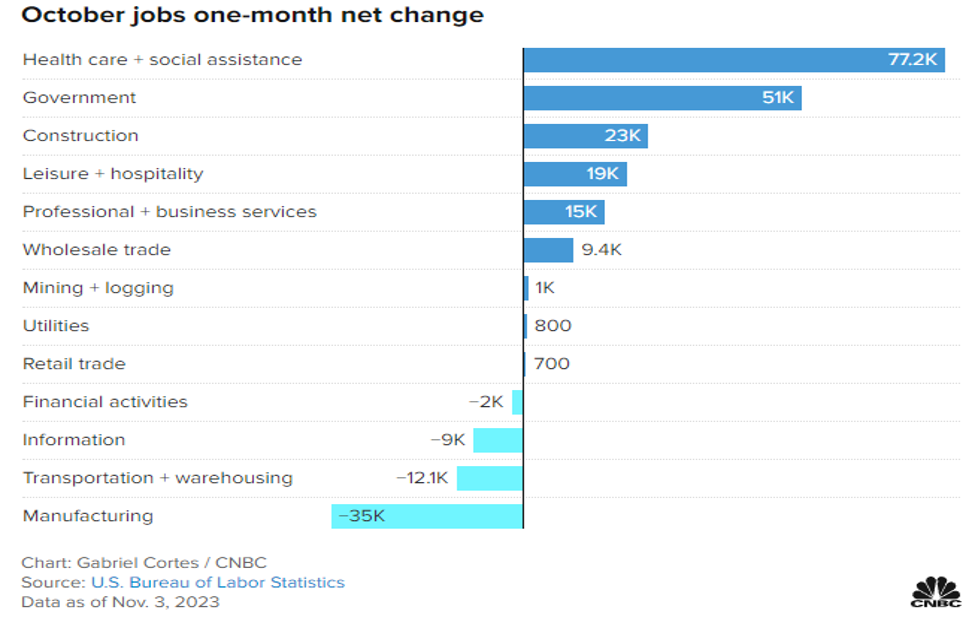

The monthly data does comes with a footnote: The headline job gains of 150,000 were depressed by a United Auto Workers strike.

But even accounting for that the number was close to the 183,000 monthly pace of job growth sustained for the 10 years before the pandemic, from 2010 to 2019, and to that extent looked “normal” after years of outsized job gains.

Revisions to the August and September numbers were also both lower, knocking 101,000 positions from the total and pushing September’s blockbuster first estimate of 336,000 jobs down to 297,000, and August to 165,000, also below the pre-pandemic average.

The pace of wage gains also slowed, something many Fed officials feel needs to happen for inflation to dependably slow from the current 3.4% to its 2% target. Though the level of wage increase consistent with price stability depends in part on productivity, which has been higher of late, the Fed generally feels comfortable with wage gains of around 3% and queasy if the number is much higher. The pace of annual wage growth eased down to 4.1% in October in a continuing decline, while the month-to- month increase of 0.2% annualizes to around 2.4%, within the Fed’s comfort zone.

The unemployment rate is also giving Fed officials room to view the economy as undergoing a steady adjustment to the shock of the pandemic, rather than stuck in an inflationary status quo – which would force policymakers towards further rate increases – or a rush off the cliff toward recession – which would amp up political pressure on the central bank and foil its hopes for a “soft landing.”

The jury may be out on how the inflation endgame unfolds, with some economists still convinced unemployment will have to rise more significantly for price pressures to fully abate, a view based on the need for economic “slack” in the form of lower demand for goods and services and the workers to produce them.

But so far progress on inflation has come with surprisingly little pain on the employment front, consistent with a improved supply chain and better overall supply side conditions that are letting the economy produce more without increasing the pressure to raise prices.

The report wasn’t all rosy.

At a press conference Wednesday after the Fed’s latest policy meeting, Fed Chair Jerome Powell highlighted how recent gains in the number of people in the labor force – either working or looking for work – showed the economy moving into better balance. More people in the job market lets businesses fill a still-large number of vacant positions while easing the sort of competition for workers that forces wages higher and that drove the high levels of job quitting and reshuffling during the pandemic years.

Though the monthly figures on the labor force can be volatile, the number fell by more than 200,000 in October, the first decline since a small drop in April and the largest since June of 2022.

If labor force growth is coupled with an easing of open jobs, it could show a job market moving closer to balance. But if consumption remains strong and drives still-high numbers of openings, then a stall in labor force growth could reignite wage pressures.

Read the full article here