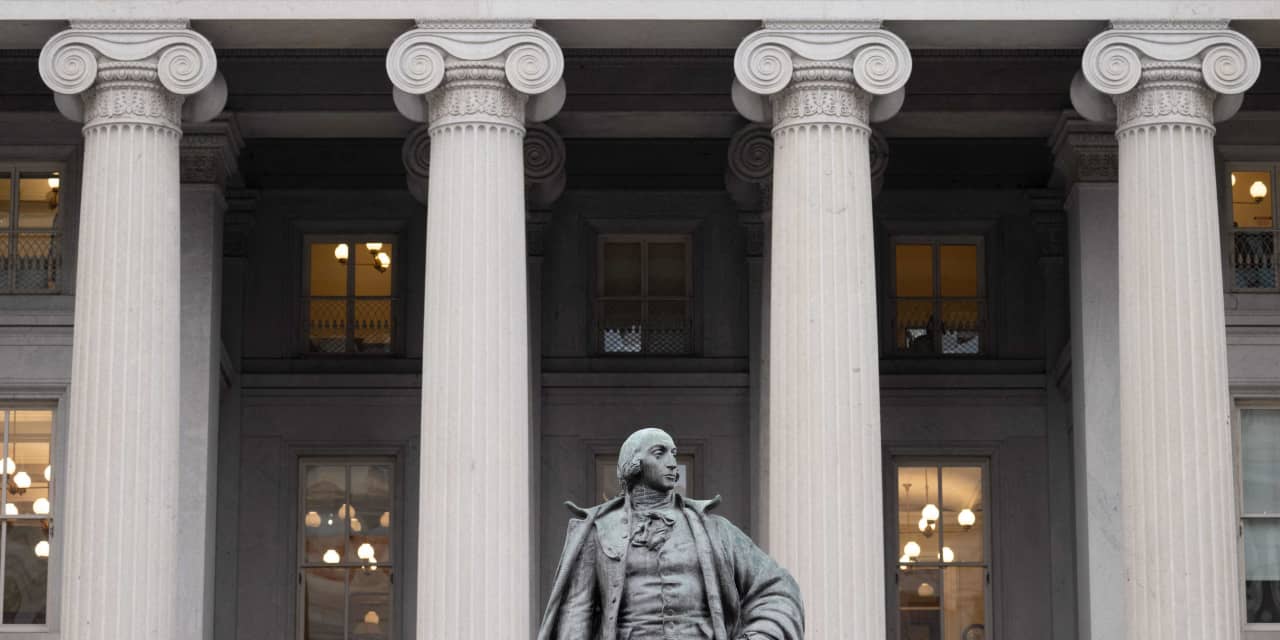

The numbers: The U.S. federal budget deficit widened to $129 billion in December, up from $85 billion in the same month last year, the Treasury Department said Thursday.

For the first three months of the fiscal year, the deficit widened to $510 billion, up from $421 billion in the same period last year.

Key details: In December, spending increased at a faster pace, while receipts shrank, the department said.

Receipts were down $26 billion to $429 billion from a year ago, while outlays were up $19 billion to $559 billion.

Interest on the federal debt was up $78 billion, to $288 billion, over the first three months of the fiscal year compared with the same period a year earlier. The Federal Reserve’s rapid increase in interest rates is leading to higher interest payments.

Spending was also boosted by outlays of the Federal Deposit Insurance Corp., which were needed to resolve bank failures that occurred last year. The FDIC hopes to recover much of that amount in part through higher insurance premiums for banks.

Big picture: Economists are expressing increased alarm over the upward trend in the budget deficit. They argue that at some point, the higher spending will curtail the economy’s long-run growth potential. Government spending soared during the pandemic, but Congress has not used the relatively strong economic growth of the last few years to curb spending.

What are they saying? The federal deficit is expected to widen to be 5% of GDP in 2027, “which is huge,” said James Hines, an economics professor at the University of Michigan. In 2029, federal debt held by the public will exceed the debt level seen during World War II, he noted.

To bring down the deficit, Americans will have to pay higher taxes and get used to reduced government spending, he said. “It is a pretty ugly path,” Hines concluded during a panel discussion on the debt outlook hosted by the American Economics Association last weekend.

Market reaction: The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

rose slightly to 4.04% after the consumer inflation data was released earlier Thursday. Stocks

SPX

DJIA

were lower in afternoon trading.

Read the full article here