A father who sacrificed his savings and his health to pay for his son to graduate from college debt-free said he feels “marginalized” amid the growing push for student loan forgiveness.

“I think we should pay our debts,” Daniel French, a Petco store manager, told Fox News Digital. “The debt I paid was with my body, and I sacrificed my retirement.”

“I have to work an extra 10 years just so I can get my retirement savings back up so that I can personally retire,” he continued. “So I don’t think my tax money and my hard work should go to paying somebody else’s loan off.”

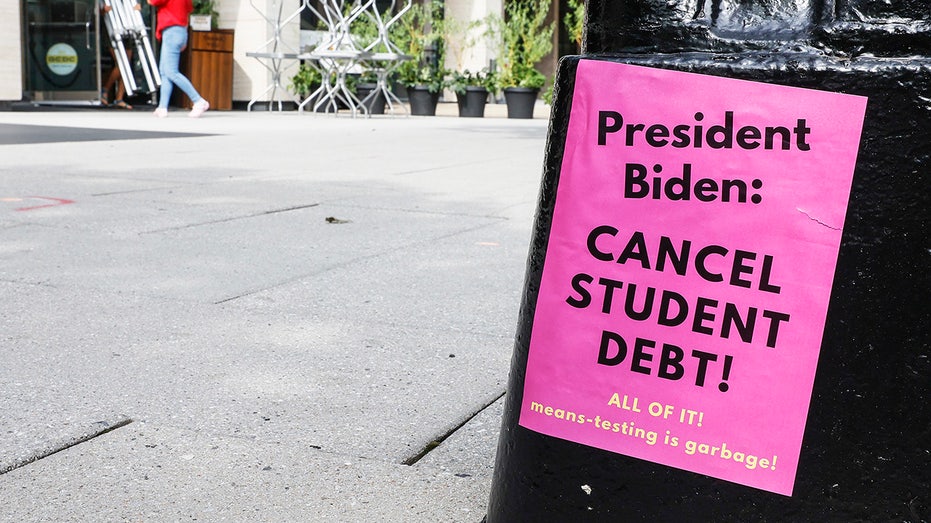

As the Biden administration continues to push for student loan forgiveness for millions of borrowers, French said he feels as though people like him — Americans who do not come from money but sacrificed so their kids could remain debt-free — are being left out of the national conversation.

WATCH MORE FOX NEWS DIGITAL ORIGINALS HERE

French, 58, lives in Roseburg, Oregon, and has worked in retail management for nearly 30 years. He served six years in the Army during the Gulf War. Growing up in a lower-middle class family, higher education was never something French considered.

“College was never really a conversation in my family,” he said. “The goal when I was growing up was more to graduate high school and to get a job.”

“My father told me that’s not a priority, and if I wanted to go to college, I would have to pretty much figure out how to pay for it myself,” French added.

BIDEN PLANS EVEN BIGGER STUDENT LOAN HANDOUT, DUMPING THE BILL ON YOU

So he was surprised when his teenage son, Nathan French, said he wanted to attend college.

“I had never thought about it before,” the elder French said. “And then I started thinking ‘how am I going to pay for this?’”

Having known people who spent their lives crippled with student loan debt, French made a promise to his son that he would pay for his college.

“My commitment to him was, he’s definitely going to college, and I was definitely going to pay for it,” he said. “So whatever I needed to do to get him through college, that’s what I was going to do.”

The first thing French did was liquidate some of his retirement accounts. He thought that lump sum would cover the entire cost of his son’s education, but it only lasted six months.

Over the next eight years, French did anything he could to make extra money to send to his son. He sold his house, took odd jobs, including construction and handyman work, and sent his son $1,000 out of his paycheck each month.

Nathan started college in 2016 at a nursing school in Arizona, then transferred to a school in Finland where he pursued a bachelor’s in business administration in international business. He graduated this year but opted to attend a year of graduate school in Finland before finding a job.

MAHER TORCHES BIDEN’S STUDENT LOAN HANDOUT

In total, French estimated he spent around $120,000 on his son’s college over that time period. He blamed his three spinal surgeries in recent years on the toll his efforts have taken on his body.

“I don’t foresee having to do any extra work and things from now on to help him, which is good because I’m pretty much worn out,” French told Fox News Digital. “I’ve broken my body up, so now I can just go back to doing the job that I have, rather than trying to do odd jobs and heavy lifting and manual labor like I have been.”

After the Supreme Court rejected President Biden’s first sweeping debt forgiveness proposal in 2022, he vowed he would “stop at nothing to find other ways to deliver relief to hard-working middle-class families.” Since then, he’s wiped away nearly $138 billion in federal student loans for almost 3.9 million borrowers through other actions while circumventing Congress, which holds the power of the purse.

The president’s latest wide-scale loan forgiveness proposal came last month as the U.S. national debt continues to surge, reaching almost $35 trillion.

The new plan would offer cancelation to five categories of borrowers, including people who have seen their balance grow due to unpaid interest and individuals who have been repaying undergraduate loans for 20 years or more. It would provide relief to an estimated 30 million borrowers, according to the administration.

French said he doesn’t think student loan debt should be a political issue or the responsibility of the government, and that it’s not fair to burden taxpayers with other people’s poor decisions.

“There’s options to pay for college if you don’t want to take out a loan. It’s a personal choice to take out a loan to go to college,” he said. “If you’ve made that personal choice to borrow money from a bank, from basically from the government, to pay for college, you should make plans to pay it back.”

After sacrificing so much for his son, French said watching politicians push student loan forgiveness is a “bitter pill” and he feels people like himself are left out of the national narrative around the issue.

“Whenever they’re talking back and forth about this, some people are saying they want student loan forgiveness, and politicians are saying that we need to do student loan forgiveness to help these people – I feel left out of the conversation. I feel marginalized,” French said.

He said parents who pay for their kids’ education are often dismissed with the assumption they are wealthy enough to afford it, “when in reality, a lot of parents put their life savings into their kids … and they’re not rich, they’re not upper middle class.”

Ultimately, French said he “doesn’t regret anything he’s done” for his kids and all of his sacrifices were “money well spent.”

“If I waited around for somebody to do something for me and for my children to go to college, it never would have happened,” he said. “I can’t think of a better way to spend my money.”

Read the full article here