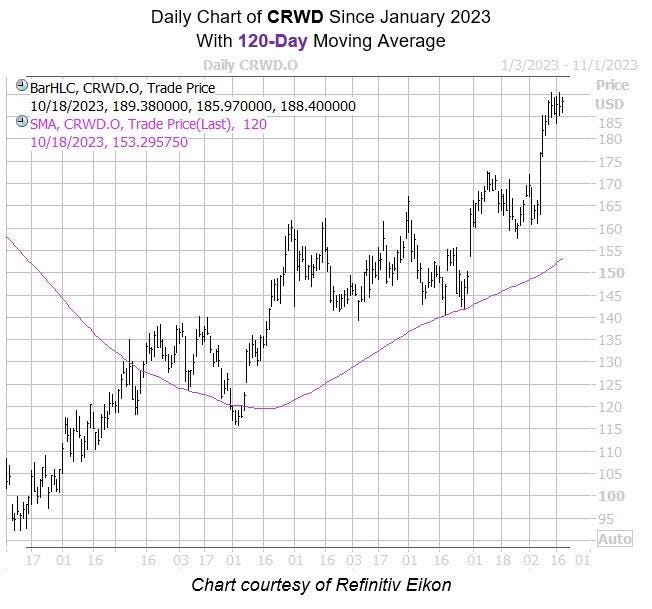

IT giant Crowdstrike (CRWD) has been enjoying performing within a channel of higher lows for the duration of 2023, now boasting a lead of nearly 80% for this time frame. This long-term rebound came off the equity’s early January lows, with added support at the 120-day moving average. Further gains could be on the horizon too, with a historic bull signal now flashing on CRWD.

Per Schaeffer’s Quantitative Analyst Rocky White, Crowdstrike stock’s 52-week high comes amid historically low implied volatility (IV), which has been a bullish combination in the past. White’s data points to four other signals over the last five years when CRWD was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) was in the 20th percentile of its annual range or lower.

This is now the case with the security’s SVI of 37%, which ranks in the 14th percentile of its annual range. The shares were higher just one month after each of these signals, averaging a 4.9% pop. From its current trading level, a move of similar magnitude would place CRWD at another fresh annual peak.

In the options pits, put traders have been running rampant. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CRWD carries a 50-day put/call volume ratio that ranks in the 96th percentile of readings from the past year. This means long puts have been picked up at a quicker-than-usual clip, and a shift in sentiment would bode well for the shares. Short-term traders have also been put-heavy, per the stock’s Schaeffer’s put/call open interest ratio (SOIR) of 1.06, which ranks in the 89th annual percentile.

Read the full article here