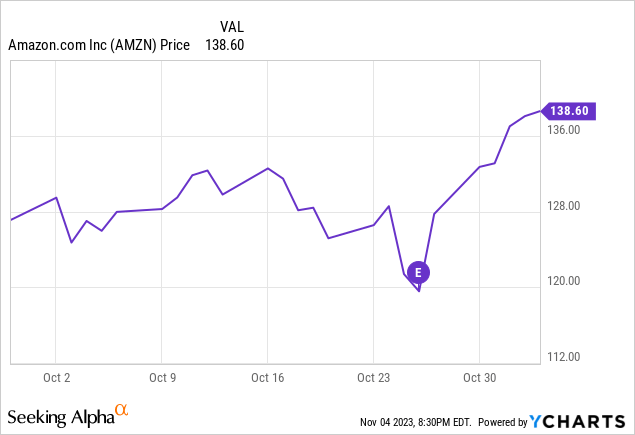

Investors had a right to be nervous heading into Amazon’s (NASDAQ:AMZN) Q3 earnings announcement on October 26th. The Nasdaq and S&P 500 had dipped into correction territory (defined as a 10% decline from recent highs), and Alphabet (GOOG)(GOOGL) stock dropped 10% following its earnings announcement earlier that week. But Amazon showed why it is one of the most popular stocks and a terrific investment. The stock has skyrocketed 15% off of earnings, as shown below.

Here are three reasons I am upgrading to Strong Buy.

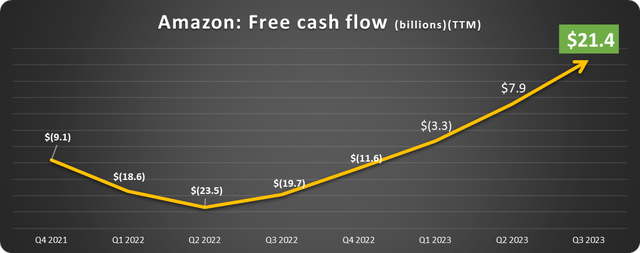

Free cash flow is back in a big way.

2022 was a tough year for Amazon for many reasons. Challenges like logistics, labor, and inflation added significantly to expenses. Amazon’s cash flow was also a victim of the success of AWS. After nearly doubling AWS revenue, from $45 billion in 2020 to $80 billion in 2022, Amazon had to spend billions on property and equipment (capital expenditures, or “CapEx”) to increase capacity enough to keep up with demand.

CapEx doesn’t appear as an expense on the income statement, but it reduces

free cash flow (FCF) – the money left over after a company funds its operations and purchases equipment. Amazon spent just $17 billion on CapEx in 2019, then $40 billion in 2020, and more than $60 billion each in 2021 and 2022.

Increased expenses plus increased CapEx equaled decimated free cash flow, which fell from a peak of $31 billion in Q4 2020 to a trough of -$23.5 billion in Q2 2022 on a trailing-twelve month (TTM) basis.

In fact, FCF was underwater for six straight quarters before breaking through in Q2 2023, as shown below.

Data source: Amazon. Chart by the author.

The renaissance in free cash flow accelerated impressively in Q3. Since FCF is a leading indicator, it is no surprise that operating income jumped 103% to $26.4 billion.

Advertising is on fire.

One revenue stream that doesn’t get the attention it deserves is Amazon’s digital advertising. The segment has continued steamrolling despite an economywide advertising spending slowdown. The reason is that Amazon’s advertisements, like featured products and pay-per-click, are very efficient for brands. People searching for products are already active buyers, so reaching them is an excellent way to increase sales without breaking the bank.

Advertising sales grew 26% year over year (YOY) to $12.1 billion in Q3. It now makes up 8% of total sales and 15% of non-product sales. Look for this segment to become even more important to Amazon in the future.

Has AWS turned the corner?

AWS growth concerns have plagued Amazon this year. When companies budgeted for data usage for 2023, many were betting on a recession and looked to cut costs. This hurts AWS because it operates much like a utility, where users page based on how much data they use. Amazon made the wise decision to actively assist customers in reducing their costs. This hurt AWS sales this year but will keep these customers with Amazon for the long haul.

After years of prolific growth, AWS sales increased only 15.8% and 12.2% YOY in Q1 and Q2, respectively. Some of us were bracing for the downtrend to continue in Q3; however, sales growth was slightly higher than in Q2, coming in at 12.5%. For the first time since 2021, the segment added more revenue on a YOY dollar basis than the prior quarter ($2.4 billion in Q2 to $2.6 billion in Q3).

This could signal a stabilization that could soon turn into acceleration.

Another reason to expect AWS to turn the corner is the rise of artificial intelligence (AI). AI programs require oodles of data to be processed in the cloud.

Those writing off AWS as a growth segment are missing the big picture.

Is Amazon stock a strong buy?

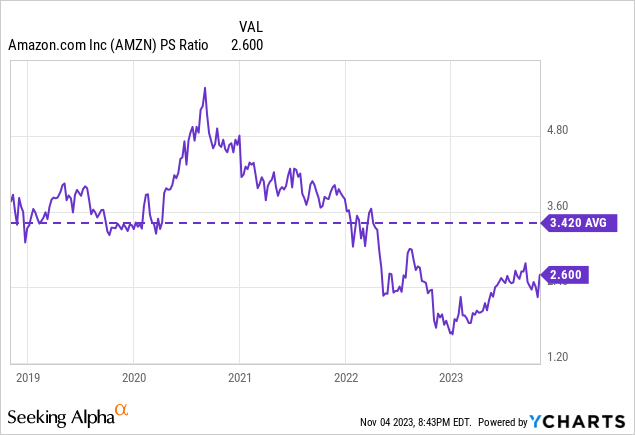

Amazon stock is tricky to value. The company is unique, and price-to-earnings (P/E) isn’t too helpful since ((a)) profits are just ramping back up and ((b)) there is no proper comparison. Those of us who have followed the company closely will tell you that Amazon stock trades on sales growth more than anything, so I prefer the price-to-sales (P/S) ratio.

As shown below, the stock would need to increase 32% to reach its average over the past five years.

The 5-year average just happens to be right around where it traded before the pandemic caused stock market pandemonium.

I wrote many times over the last couple of years not to count out Amazon because of short-term headwinds, even though they were severe. The future looks brilliant again after Amazon’s Q3.

Read the full article here