Introduction

Last month, I wrote an article on my three favorite REITs.

These REITs are Extra Space Storage (EXR), Equity LifeStyle Properties (ELS), and Rexford Industrial Realty (REXR).

If I had made the list longer, I would have included Public Storage (NYSE:PSA) as well, which is the first REIT I added to my long-term dividend growth portfolio after the pandemic.

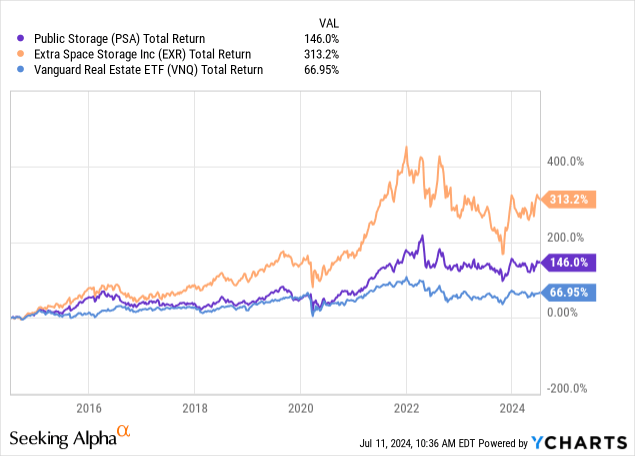

Although Public Storage has failed to beat Extra Space Storage’s impressive total return and somewhat neglected consistently growing its dividend, I believe it is one of the best REITs on the market and a company that comes with a terrific valuation – especially in light of slowly declining inflation.

In fact, I believe the somewhat poor return over the past ten years does not reflect what America’s second-largest self-storage giant is capable of.

My most recent article on this company was written on March 18. Since then, shares have returned 7%, slightly lagging the 9% return of the S&P 500.

In this article, I’ll share my view on the company and explain why annual double-digit returns in the years ahead are not unlikely.

So, let’s get to it!

There’s Deep Value In Public Storage

If someone were to tell me it does not make sense that both of my REIT investments in a concentrated portfolio of 22 stocks are self-storage REITs, I would agree. That’s not the most logical thing.

Just pick one. Right?

You have to believe me when I say that I have spent countless hours thinking about merging my two investments – or replacing one with a non-self-storage REIT.

However, I decided to wait, as I like both EXR and PSA.

In general, I really like the self-storage business despite current headwinds from a slow housing market and weak consumer sentiment.

This is what I wrote in my March article to explain why I like self-storage so much:

- Resilient demand: Self-storage tends to be recession-resistant. While consumer weakness can hurt demand for more storage, the need for storage is always high, especially because people tend to buy smaller homes.

- High occupancy rates & pricing power: Self-storage facilities typically maintain high occupancy rates because they rent on a month-to-month basis. This also allows self-storage companies to apply more flexible pricing.

- Low maintenance costs: Self-storage facilities are relatively cheap to construct and maintain. While they are increasingly using technology, it’s still just a big building with many boxes.

- Last-mile logistics and micro-warehousing: The rise of e-commerce has increased demand for smaller storage units well-located near urban areas. Self-storage units are perfect for this.

- Limited development: The development of new self-storage facilities can be restricted by zoning regulations. In some areas, this can provide supply tailwinds.

In this case, Public Storage is so large that it’s almost a proxy for the self-storage market – except it is extremely well-run, something most self-storage providers cannot compete with.

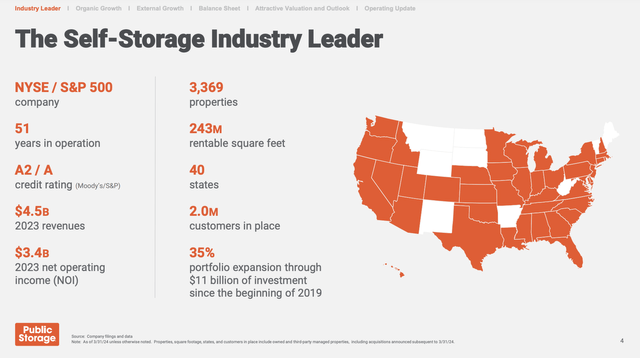

Founded more than 50 years ago, Public Storage was America’s largest self-storage operator until Extra Space Storage bought Life Storage last year.

The company operates roughly 3,400 properties in 40 stages, covering 243 million rentable square feet – that’s more than 4,200 football fields.

Public Storage

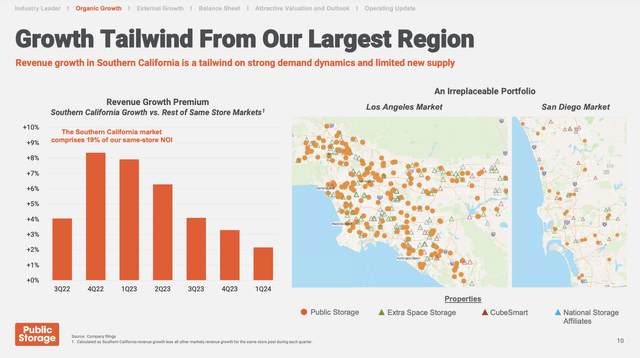

It also has major exposure (more than 10%) in California, a market with supply constraints and a huge consumer market. This has provided the company with consistent outperformance – especially in Southern California.

Public Storage

With that said, one issue people often bring up is Public Storage’s dividend growth.

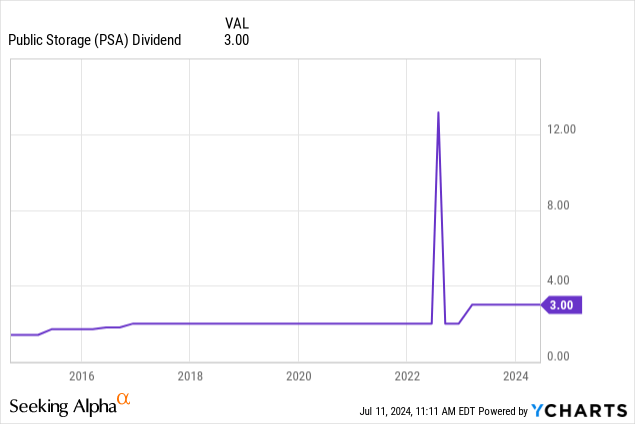

This is what its dividend chart looks like:

If we ignore the spike, which was a $13.50 special dividend after the company’s PS Business Parks merger consolidation, it has raised its dividend just three times over the past ten years.

PSA currently yields 4.2% with a favorable payout ratio in the low 70% range.

While I respect it when investors prefer stocks that hike their dividends more consistently, there are a few things I need to bring up at this point:

- Despite only three dividend hikes, the company has not ignored its shareholders. On February 6, 2023, it hiked its dividend by 50%. This brings the five-year dividend CAGR to 8.5%, a number that beats many of its peers.

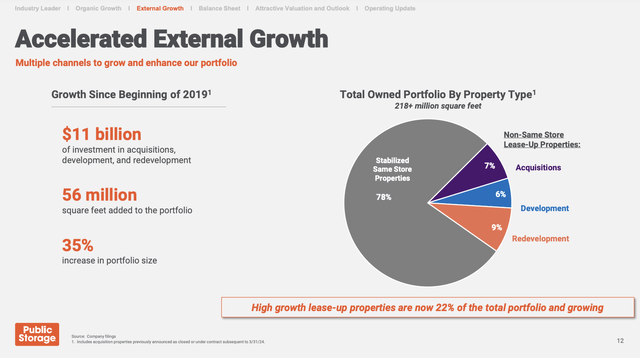

- During the prolonged period without dividend growth, the company has been busy aggressively expanding its footprint.

Since the beginning of 2019, it has spent $11 billion on acquisitions, developments, and re-developments. This added 56 million SF to its portfolio – a 35% increase!

Public Storage

In fact, none of its competitors have added more than 30 million SF during this period.

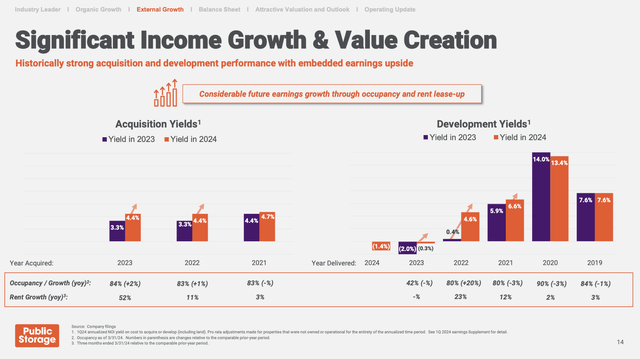

Even better, its investments have generated elevated returns.

Using the company’s data below, properties delivered before 2023 all have development yields of more than 4%. The same goes for acquisition yields.

Thanks to higher occupancy rates and strong rent growth, the company has done very well allocating its capital in recent years.

Public Storage

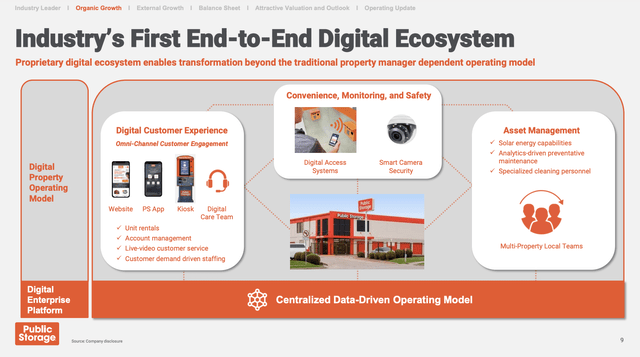

One reason why Public Storage is able to add value is its end-to-end digital ecosystem, which significantly improves convenience.

This includes an omni-channel experience, where customers can use apps and kiosks to rent storage. The company also has a digital care team and digital access systems.

The company also uses technology to smoothen the process of managing its many assets, which includes analytical-driven maintenance.

Public Storage

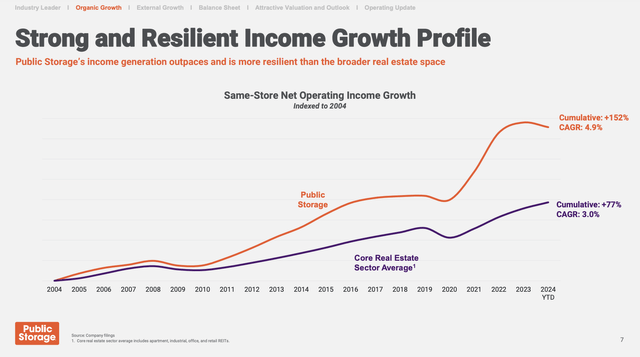

In general, PSA has been a great place to be for strong same-store net operating income (“NOI”) growth, as it has grown NOI by 152% since 2004, that’s 4.9% per year, 190 basis points above the core real estate sector average.

Public Storage

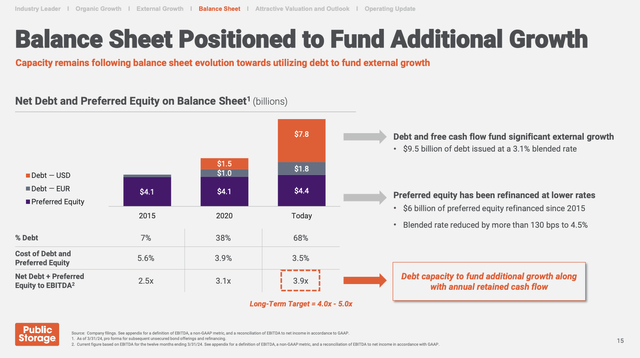

Last but not least, the company has a very healthy balance sheet with an A credit rating from S&P.

This balance sheet is 68% financed by debt. Including preferred equity, the company has a leverage ratio of 3.9x EBITDA, slightly below its 4.0-5.0x long-term target range.

Public Storage

This brings me to the next part of this article.

Recent Events & Valuation

As great as everything so far sounds, self-storage REITs haven’t been immune to investor pessimism. After all, sticky inflation, poor consumer sentiment, and a stuck housing market aren’t very bullish.

Nonetheless, PSA continues to perform well.

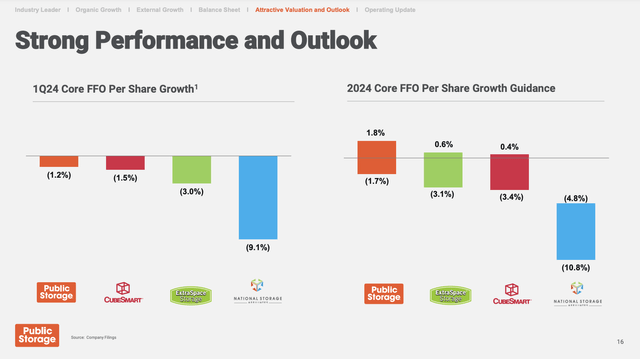

In the first quarter, the company reported core funds from operations (“FFO”) of $4.03 per share, which is a good result despite a 1.2% decline compared to the first quarter of 2023. It’s also better than the results of any of its major peers.

Public Storage

Moreover, the company’s non-same-store assets, which consist of 538 properties and 22% of its overall portfolio, showed roughly 50% NOI growth.

Adding to that, the company witnessed sequential improvements in industry-wide customer demand, the ability to raise move-in rates as the peak leasing season approached, and positive customer behavior with a longer-than-normal length of stay and lower delinquency rates.

The company also reported sequential revenue growth acceleration in multiple key markets, including Washington, D.C., Baltimore, Seattle, San Francisco, New York, Chicago, Philadelphia, Detroit, and Minneapolis.

It maintained a >92.0% occupancy ratio.

All of this indicates a turnaround compared to 2023 and allowed the company to reaffirm its full-year guidance, which sees a midpoint FFO result of $16.90 per share.

This also gives PSA the best outlook among its peers, as we can see in the overview above.

It also helps its valuation.

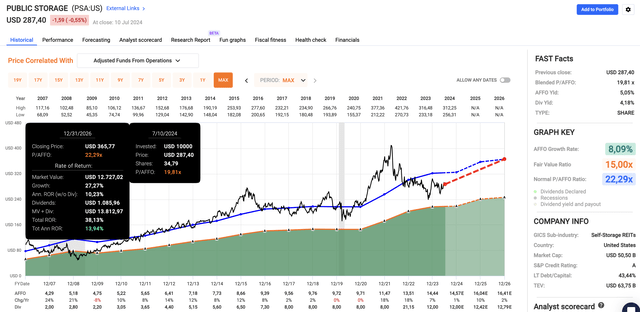

PSA currently trades at a blended P/AFFO (adjusted FFO) ratio of 19.8x. This is below its normalized P/AFFO ratio of 22.3x and comes with favorable analyst expectations.

Using the FactSet data in the chart below, this year, per-share AFFO is expected to rise by 1%. That would be a fantastic result in this environment.

In 2025 and 2026, growth is expected to be 10% and 2%, respectively.

FAST Graphs

Although it will likely require a path to lower rates to unlock a higher multiple, the company should be able to deliver more than 10% annual returns going forward, potentially beating the S&P 500.

As such, I have been adding to PSA on weakness instead of selling it.

I really like the mix of value and growth and expect it to remain a cornerstone of my investment strategy for a very long time.

Takeaway

Public Storage remains a compelling REIT in my portfolio despite its mixed dividend growth history.

The company’s massive footprint, strong operational numbers, and strategic expansion efforts highlight its resilience and potential for substantial returns.

Even in light of economic headwinds, PSA’s ability to maintain strong occupancy rates, leverage technology, and manage its assets effectively sets it apart from its peers.

Trading at a favorable valuation and reporting promising future growth rates, I believe PSA is poised for double-digit returns.

I’m confident in its long-term value and will continue to hold and add to my position.

I kept the pros and cons unchanged since my last article.

Pros & Cons

Pros:

- Resilient Income: PSA offers steady income through dividends, backed by its consistent performance and dividend growth history.

- Growth Potential: Despite economic headwinds, PSA shows strong growth prospects, fueled by its innovative strategies and resilient business model.

- Strong Track Record: PSA has a history of outperforming the broader REIT space.

- Technological Advancements: PSA’s focus on cost efficiency and technological innovation provides a competitive edge, allowing it to gain market share in a highly fragmented industry.

Cons:

- Economic Sensitivity: PSA’s performance may be impacted by economic downturns, as consumer weakness could affect demand for storage space.

- Near-Term Challenges: Although the company is resilient, PSA faces near-term challenges such as rising costs and potential revenue slowdown.

- Interest Rate Risks: Elevated interest rates are a risk to PSA’s financing costs and valuation.

- Market Volatility: Like any investment, PSA is subject to market fluctuations and volatility.

Read the full article here