Aemetis, Inc. (NASDAQ:AMTX) has experienced a significant share price decline of over 55% over the past 12 months.

Many investors are now wondering if the company will be able to make a turnaround, given that shares seem to be quite cheap at the moment.

In this article, I will review the recent financial performance of the company, with an emphasis on the headwinds and challenges that Aemetis is currently facing. These include extremely low cash reserves, and increased debt over the last years, while the company is operating at a significant loss. Additionally, the decline in biodiesel and ethanol prices over the past year adds to the company’s profitability challenges.

In my view, the future of the company hinges on its ability to secure financing from its recent $234 million mixed shelf offering. Considering the strong headwinds the company is facing, I believe there is a small chance of raising the entire $234 million, as investors will have to buy those securities when the company offers them. Additionally, even if they secure the entire amount, interest payments could have a negative impact on the company in the long run. Therefore, I maintain a sell rating.

Company Overview

Aemetis is a Californian-based renewable natural gas and fuels company that produces and sells ethanol, biodiesel, and renewable natural gas.

The company operates in three business segments:

- California ethanol: their Californian facility processes corn into ethanol and byproducts like wet distillers grains for animal feed.

- California dairy renewable natural gas (RNG): this segment is focused on the production of RNG from dairy waste using anaerobic digesters, selling gas through pipelines to transportation fuel markets.

- India biodiesel: their plant in Kakinada produces biodiesel using various feedstocks for sale in the domestic market. Management is planning to expand this segment into the export market.

I considered including below a breakdown of their revenue per business segment using data from their latest annual report.

| Segment | 2023 Revenue ($M) | 2022 Revenue ($M) |

|---|---|---|

| California Ethanol | 104.1 | 228.2 |

| California Dairy RNG | 5.5 | 1.2 |

| India Biodiesel | 77.2 | 28.1 |

| Total | 186.7 | 256.5 |

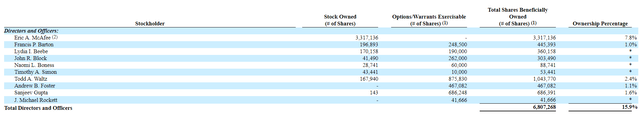

Ownership-wise, according to the latest 14A, the aggregate amount of common shares owned by all directors and executive officers adds up to 15.9% of the total common stock, which is a decent amount of skin in the game.

SEC 14A

The CEO and Chairman of the Board, Eric McAfee, has a beneficial ownership of 7.8%. Again, I view this as a good amount of skin in the game.

Rising Costs And Operational Inefficiencies

Let’s start dinner with dessert.

Aemetis reported in Q2 2024 an operating loss of $13.6 million, which is significantly worse than in Q2 2023, where the operating loss was only $7.8 million.

One of the drivers behind this decline was the accretion of Series A preferred units in its Aemetis Biogas subsidiary, adding up to $3.5 million in Q2 2024, down from $6.9 million in the same period last year.

This makes me sweat because, as you probably know, accretion represents a non-cash expense, similar to how interest accrues on a loan. Aemetis will eventually need to settle this growing obligation in the future, either through cash payments, by converting the units into shares, or through other agreed terms.

So, do they have enough cash?

Cash reserves at the end of the second quarter added up to only $0.23 million. In my view, this is a concerning amount, considering that interest expenses in Q2 2024 were $11.7 million, and current liabilities added up to $120.8 million.

In my view, without external financing, the company doesn’t have enough cash to deal with interest payments and to run its daily operations.

Will They Be Able To Secure Additional Financing?

I have to admit that my bear thesis hinges on their ability to secure more financing.

I believe the answer to this question is no, for the following reasons.

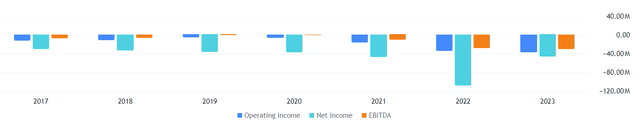

If we have a closer look at the evolution over the past years of the operating income, net income, and EBITDA, the trend does not look very promising.

TradingView

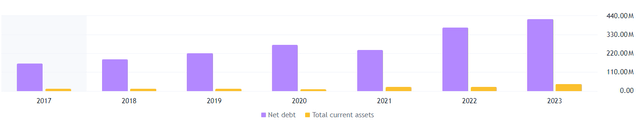

A look at how debt and total current assets have been evolving over time does not paint a more favorable picture.

TradingView

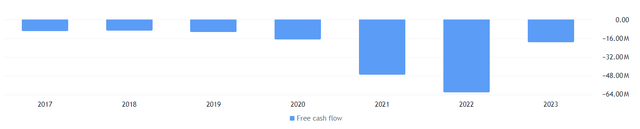

Finally, free cash flows have been negative over the last few years, although since 2023, I have to admit that there has been an improvement.

TradingView

Aside from the dire financial picture, their recent performance has also been quite disappointing.

Aemetis recorded a $3.6 million loss on asset disposals in Q2 2024 linked to the decommissioning of equipment associated with the ZEBREX unit at the Keyes ethanol plant.

Within the ethanol segment, which is their largest segment, the ethanol sales price decreased from $3.12 per gallon in Q2 2023 to $1.99 in Q2 2024. This, coupled with a high input cost of $6.36 per bushel, contributed to the gross loss of $1.8 million (compared to a gross profit of $2 million in Q2 2023).

In the India Biodiesel segment, production declined 20% YoY, which combined with a lower average sales price of $1,162 per metric ton (compared to $1,276 in Q2 2023), had a direct impact on profitability.

Therefore, I believe that securing external financing would be very difficult considering the magnitude of these headwinds and how long they have been impacting the financial performance of the company.

However, I Can Be Wrong

If they do manage to secure funding, then I believe the share price will increase significantly, breaking my bear thesis. And there has been one recent event that could potentially do exactly that.

On August 9, 2024, Aemetis filed for a mixed shelf offering of $234 million. In other words, the company is getting permission to offer up to $234 million worth of stocks, bonds, or other securities whenever it chooses.

So, does this mean they secured the $234 million? In my view, absolutely not. Filing for a mixed shelf only means they have the option to issue securities up to that amount over time. They will only raise the money if investors decide to buy those securities when the company offers them.

Even if we assume that they manage to secure the $234 million (or part of it), this would add significantly to the interest expenses, in addition to diluting the value of the shares of existing shareholders.

A quick look at the weekly chart below shows the share price trading very close to the $2 support level. Therefore, I am not surprised to see a high level of short interest (15.1%).

TradingView

So, to summarize, if they indeed manage to secure part, or the entire $234 million, the high short interest of 15.12% could move the price upwards significantly, as shorts will be closing their positions.

Conclusion

To conclude, I see a company with strained financials, rising costs, increasing debt, and limited cash reserves.

In my view, the future of the company hinges on its ability to secure financing. Considering the recent pressures and headwinds, including a decline in ethanol prices, the loss on assets disposals, and the decline in biodiesel production in India, I believe the chance of securing external funding is quite slim.

Nevertheless, if they manage to secure part of the $234 million mixed shelf offering, and considering the high short interest and the proximity of the share price to a support level, there is a risk of a significant increase in the share price.

However, I believe that the short-term risks overshadow the upside, and I am not confident in the company’s ability to navigate these headwinds successfully without securing more debt. Therefore, I rate this stock as a Sell.

Read the full article here