Alimentation Couche-Tard’s (OTCPK:ANCTF, TSX:ATD:CA) stock price fell over 14% in two months! At the time of writing, it’s still down almost 13%. As you know, I’ve been a huge fan of this stock for years. Is it time to let this one go?

Not before investigating and seeing what’s going on.

What happened?

In short, a bad quarter. A very bad quarter, considering we’re accustomed to seeing this company showing double-digit or high single-digit growth everywhere. Not this time; sales slowed down a bit but, most importantly, earnings per share fell by double digits. Why? Problems with growth, with margins, and with the economy. Consumers are spending less and margins on fuel have shrunk.

Then the media circus arrived. BNN Bloomberg said it was a really bad quarter and warned ATD was facing economic headwinds. The Globe and Mail said that companies owning gas stations weren’t able to sell them, they were struggling and not making any money. The Hustle Daily had reported something similar two years ago; gas stations weren’t making money anymore and they were going to die soon. Is everybody driving a Tesla and I didn’t notice?

Déjà vu for Alimentation Couche-Tard

This instantaneous doom and gloom picture from the media was the same in 2021. At the time, I spelled out in a video what an amazing opportunity ATD was after it announced its intention to buy the Carrefour chain in France. The deal fell through and ATD’s stock price dropped by over 10%. Did I panic and sell? No. I nearly doubled my ATD position, and it was an amazing play.

If, when a stock goes down and the narrative surrounding it becomes very negative, I see that the company reported a poor quarter, what do I do as an investor? I start by looking at my investment thesis, my reasons for investing in it, to verify that the company’s dividend triangle still supports it.

Go back to my investment thesis

Below is the investment thesis for Alimentation Couche-Tard published on Dividend Stocks Rock.

What is key for Alimentation Couche-Tard is its several growth vectors. ATD acquires other businesses, gas stations and other competitors. It is skilled at integrating them seamlessly while improving margins.

It’s not only growth by acquisition though; ATD’s management found other ways to grow. Selling their own brand of products that offer higher margins for example. Also, they ensured they were in great locations everywhere with both convenience stores and gas stations (now charging stations). These are the reasons why I have it in my portfolio. Does a bad quarter mean all these growth vectors have vanished? Doubtful.

The next thing to investigate is the company’s dividend triangle.

Is the dividend triangle supporting the thesis?

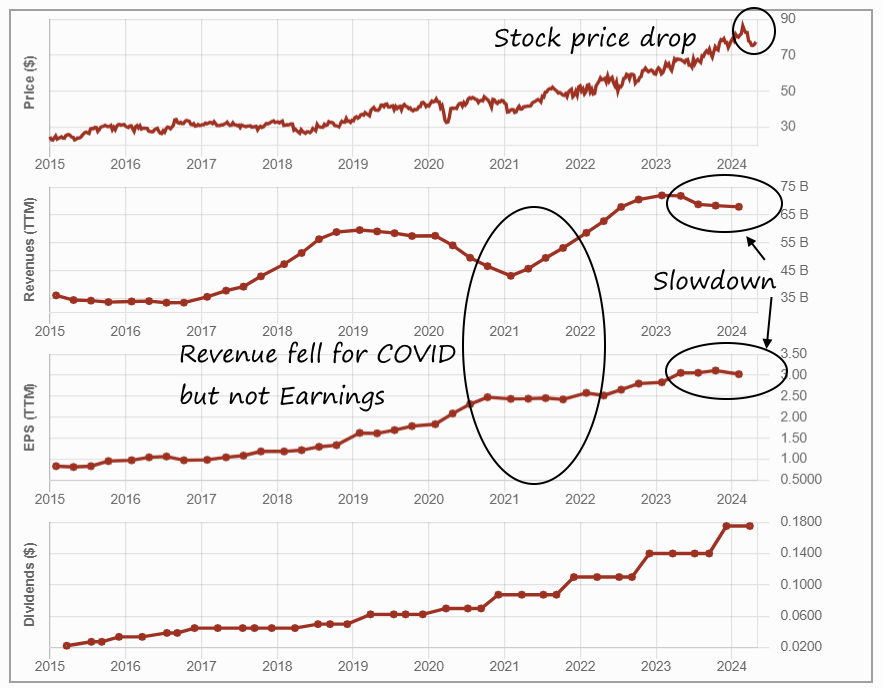

Below is Alimentation Couche-Tard’s dividend triangle taken from Dividend Stocks Rock, where we publish 10 years of information and metrics. ATD has a strong dividend triangle; revenue, earnings per share (EPS), and dividends keep growing steadily.

Notice that revenue dropped sharply during COVID but earnings didn’t. Also, the five-year annualized growth rate is 8% for revenue, almost 17% for EPS, and above 22% for dividends.

Not only does this business grow by high single to double-digit leaps, but it can also sail through a recession without problems. Yet another reason for loving this stock.

There has been a slowdown in revenue and earnings over the past year. Since we are facing economic headwinds, this isn’t necessarily alarming. Not seeing double-digit growth over the past few months makes sense, right?

It’s time to review ATD’s business model.

Alimentation Couche-Tard business model

Looking at the product mix, we see that ATD generates much of its sales from fuel. However, it makes more profit from convenience store sales; fuel contributes 74% of sales, but only half of the profit. The key to growth is attracting more customers into the store and improving their in-store experience.

Historically, ATD’s growth came largely from growth by acquisition. ATD management knows when to make a deal and how much to pay. It did it again, buying 2200 convenience stores, including gas stations, from Total Energy. Looks like some companies are buying gas stations after all; they see the value in them.

With this acquisition, ATD improved its geographic mix. It isn’t as dependent on the U.S. anymore. It has almost 17,000 stores in the U.S., Canada, Europe, and other international markets.

Stories about gas stations dying are premature; we’ll need fuel for at least 10 years, probably longer. The transition towards renewable energy isn’t easy and will take time. Before the Total Energy deal, ATD’s presence in Europe was mostly in Norway, which has the highest number of electric vehicles per capita, and ATD thrives there. I’m confident it can navigate the energy transition well. After all, even when fuel sales stop, we’ll still need to recharge somewhere.

Alimentation Couche-Tard’s future

ATD’s experienced management team has a clear vision, which it shares with investors. In 2018, it was to double earnings within five years, backed by a clear plan. Between 2018 and 2023 they executed flawlessly, more than doubling their earnings per share.

They’ve come back with a similar plan, not quite doubling, but almost in the next five years. We’re in year one. The plan includes growth by acquisition and organic growth; getting more ATD brand products in the stores and emphasizing food and beverages to attract more clients in the store when fueling/charging.

The other focus is on the fuel supply chain. ATD wants to be everywhere to serve trucking companies. We’re still a long way from having only electric trucks and, when we get there, truckers will need charging stations and a place to get a snack or coffee. I think the fuel business still has at least 10 years to go, and ATD improving that business makes sense.

The plan to improve the in-store experience includes adding quick cash where customers can complete the transaction themselves, in addition to loyalty cards and bonuses. ATD wants to attract customers and keep them coming back. It’s a tough business right now, but such improvements will win more customers.

At the core of ATD’s model is its customers. The company will keep it that way, but perhaps not only with gas stations and convenience stores. Perhaps grocery stores; the previous attempt with Carrefour didn’t work, but it could elsewhere. I trust ATD’s management with that as well.

What will I do with my ATD.TO stock?

Getting rid of Alimentation Couche-Tard stock today because of a bad quarter seems like a nearsighted reaction, one that would be influenced by noise from the media.

No business increases its profits in a straight line. Things go up and down. ATD’s down a bit while facing the headwinds of an economic slowdown. However, I see that my investment thesis is still valid. I also see strong three- and five-year growth trends for dividend triangle metrics. In my opinion, it’s still a good pick for my portfolio. I’ll sleep well at night, and I won’t bother looking at the stock price every day.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here