Summary

Following my coverage of American Eagle Outfitters (NYSE:AEO) in Mar’24, which I downgraded to a hold rating as the valuation is no longer attractive and AEO is unlikely to meet its FY26 guidance, this post is to provide an update on my thoughts on the business and stock. I remain neutral rated for AEO despite the positive surprise in topline performance, as I worry about the upcoming gross margin headwinds and an increase in operating costs per store. The risk/reward at the current price is also not attractive enough.

Investment thesis

On 29/05/2024, AEO released its 1Q24 earnings, which saw revenue of $1.144 billion, slightly below consensus expectations for $1.153 billion. On a growth basis, revenue grew 5.8%, which was 90bps below expectations, driven mainly by 7% growth in same-store sales [SSS]. Gross profit saw $464 million (40.6% gross margin), which beat consensus on both an absolute ($456 million) and margin (39.6%) basis. As a result, EBIT margin also beat expectations, by 50bps at 6.8% vs. 6.3%. Altogether, EPS saw $0.34, which was $0.06 higher than consensus.

Own calculation

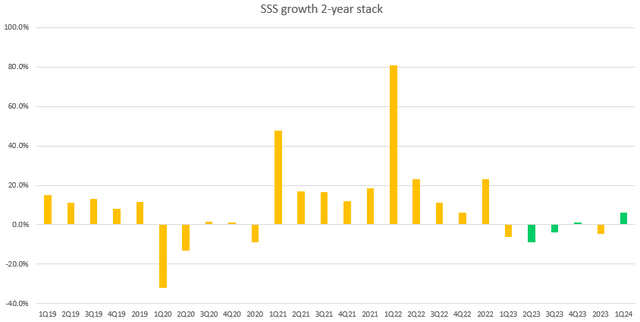

I view AEO’s 1Q24 results as a mix of both positives and negatives. On the positive end, SSS’s performance surprised me on the upside. To be specific, SSS on a 2-year stack basis accelerated for the 4th consecutive quarter, and 1Q24 saw 500 bps of sequential acceleration. This was a really strong performance when we consider the weak macroeconomic environment. Importantly, the strength was driven by both banners.

The American Eagle [AE] brand saw 1Q24 SSS growth of 7%, an acceleration from 4Q23’s 6%. On a 2-year stack basis, SSS growth accelerated sequentially by 600 bps to 3% (from -3% in 4Q23). Execution was on point for this brand as consumers reacted very well to AE’s launch of: (1) new social casual dressing; and (2) the AE 24/7 Activewear collection.

Aerie Brand saw SSS growth of 6% in 1Q24. While this was a deceleration vs. 4Q23 of 13%, the actual SSS performance excluding the weather impact would have been 11%. Which means SSS growth on a 2-year stack would have remained in the low-teens range; in fact, it would have been an acceleration from the 4Q23 2-year stack of 11%, and I would consider this very positive performance in light of the inflationary environment. Similar to AE, management continues to get it right when determining consumers’ preferences, as Aerie saw a strong customer response to new styles in soft dressing and activewear, continued traction with new fabrications in intimates, and strength in Offline Sports Bras and Leggings.

At this rate of SSS growth momentum, it is increasingly likely that AEO is able to deliver at least mid-single-digit topline growth if the macro conditions do not worsen (my bull case previously expected 5% top-line growth).

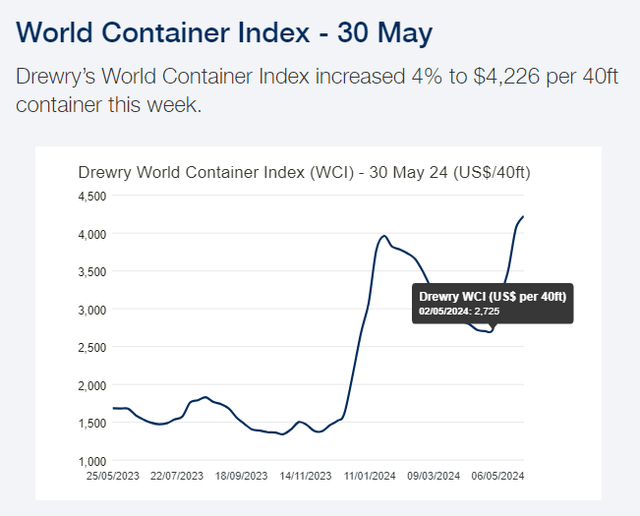

On the negative end, the 1Q24 results made me feel more uncertain about AEO’s likelihood of achieving its EBIT margin in FY24. Recall that this was a 3-year target that management set out in FY21 (to be achieved in FY24) but was delayed by 3 years (now expecting to be achieved by FY26). While I give management credit for driving gross margin back to >40% (a level that it has hardly gone above over the past 12 years; the other times were 3Q23 and 1-3Q21), I continue to find it hard to believe that they can sustain >40% gross margin given the surging freight cost (the last recorded price on May 30 was close to 30% higher than the 1Q24 average) are way above 2023 levels. Recall in my previous post, I noted that a large part of the EBIT margin improvement between FY20 and FY24 was due to a sharp increase in gross margin, and if we remove the COVID lockdown and post-COVID pent-up demand period in FY21, the largest major gain in gross margin was in FY23 (FY22 gross margin: 35% vs. FY23 of 38.7%), which saw freight costs at more than half the current run rate levels.

Drewry

Based on the above, AEO is in a situation where:

- The demand trend remains positive, but my fear is that the macro situation continues to be negative, and AEO is a company that is under the mercy of macro cycles. As rates continue to stay higher for longer and potentially go up again, discretionary spending will surely be impacted, and AEO will likely see demand fall.

- Gross margin faces a big freight cost headwind (that was not reflected in 1Q24 results, as it really only started inflecting in May).

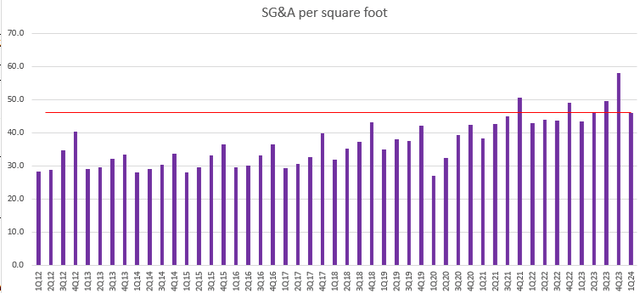

Adding the two together paints a rather negative outlook for gross profit performance. This, coupled with the fact that SG&A per square foot continues to rise, with 1Q24 representing the higher 1Q high over the past decade (with SG&A expected to continue growing by mid-single-digits in 2Q24), makes it hard to believe that AEO can achieve its FY24 EBIT margin guidance of 8.5% at the midpoint (140bps expansion vs. FY23).

Own calculation

Valuation

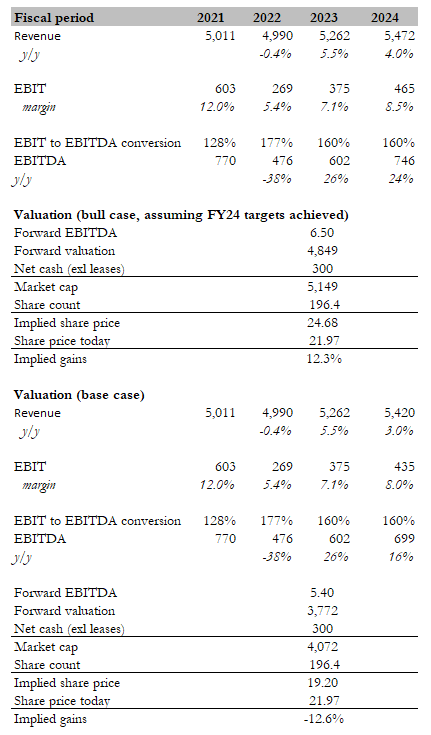

In my previous post, I discussed the various scenarios for AEO over the medium term, with a focus on whether it can meet its FY26 targets. I am not going to repeat everything here. Instead, I am shifting focus to the nearer term (FY24), as I see potential for AEO to miss the FY24 EBIT target.

Own calculation

My base case target price for AEO is $19.20 and ~$25 in the bull case. My bull case assumes that all goes well where AEO achieves the top end of FY24 growth and EBIT guidance, and that the stock trades at the high end (+1 standard deviation) of its historical EBITDA multiple range. All this translates to 12% upside.

However, as I mentioned above, I think this is quite optimistic. I do agree that top-line growth has a high chance of meeting the midpoint of FY24 guidance, given that 1Q24 saw significant strength, and the upcoming series of marketing campaigns should further support at least low-single-digits top-line growth. But I am a lot more pessimistic about the EBIT margin expansion outlook. I believe the gross margin headwinds and increases in SG&A per square foot are going to hurt AEO’s ability to expand margins. Also, the FY24 EBIT margin target assumes another year implies FY24 to be the second year of consecutive EBIT margin expansion, a phenomenon that has only happened once over the past decade, in FY15 and FY16, which averaged out to be ~130bps on average per year. Assuming the same thing happens again (average of FY23 and FY24 expansion to be ~130bps per year), it implies FY24 margin to expand by around 90bps, of FY24e EBIT margin of 8%. In the base case, AEO should trade at its historical EBITDA multiple, which translates to a target share price of $19.20, or ~13% downside.

Given that the risk/reward ratio is 1:1 and that the headwinds are more visible and easier to track than the tailwinds (i.e., sales improvement from marketing campaigns), I don’t think the risk/reward situation is attractive enough.

Conclusion

In conclusion, my rating for AEO remains a hold. While strong SSS growth is commendable, I am not confident enough to believe that the macro conditions will not worsen, which will impact demand. Moreover, coupled with the potential increase in freight costs and expected increase in SG&A, there is a chance for AEO to miss FY24 EBIT targets. Overall, I don’t think the current risk/reward situation is favorable.

Read the full article here