By Jeremy Schwartz, CFA | Brian Manby, CFA

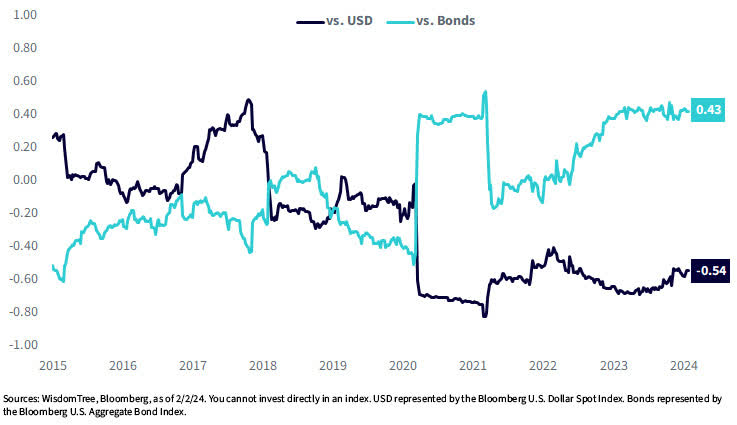

The inflationary era of the post-pandemic environment will be remembered for how it upended several long-standing market relationships.

Bonds are no longer diversifying equity risk as they reliably did for several decades.

The U.S. dollar has been freshly minted as a better diversifying hedge asset for equity allocations. Will this last? We think there are sound reasons for it to do so.

These relationships diverged at the onset of the pandemic in March 2020 and created an inflection point with critical implications for equity portfolio construction.

Rolling 52-Week Correlation: S&P 500 vs. USD & Bonds

But despite the changing relationships among U.S. asset classes, one notable overseas relationship remains within its historical norms.

Opposites (Do Not) Attract in Japan

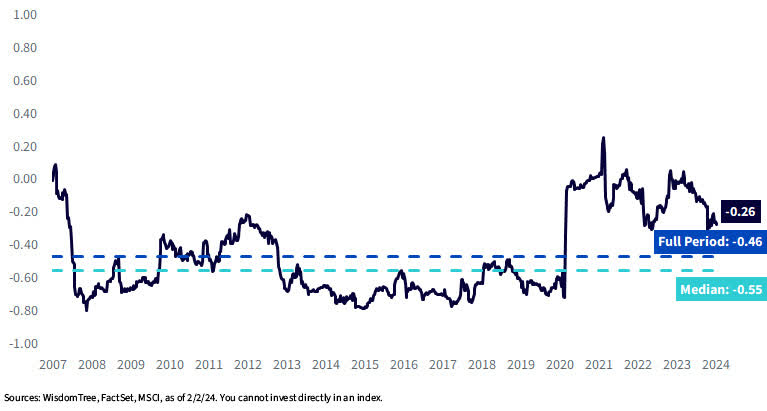

Though U.S. markets are becoming more negatively correlated to the U.S. dollar, Japanese indexes are well accustomed to moving opposite to the yen.

The Japanese economy and profit stream is very export-oriented, which means the most successful periods for equity markets often coincide with a weaker yen and a stronger dollar. During yen weakness, Japanese products are inherently cheaper in the global marketplace, which supports business prospects and earnings for local exporters.

Japanese equities, therefore, have a long-standing inverse correlation with the yen. Since the beginning of our available data history in 2006, Japanese equity market returns (exclusive of currency effects) maintained a consistently negative 52-week return correlation to the yen.

Rolling 52-Week Correlation: MSCI Japan (Local) vs. Japanese Yen

But as the old market adage goes, correlations spike toward 1 during a crisis, and the pandemic was no exception for this pair. The correlation briefly broke positive amid sharp fluctuations from 2020 to 2022 but has steadily declined since then and resumed its negative relationship.

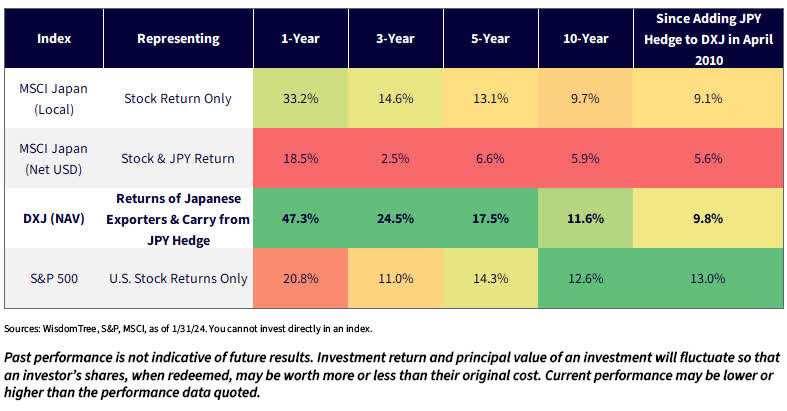

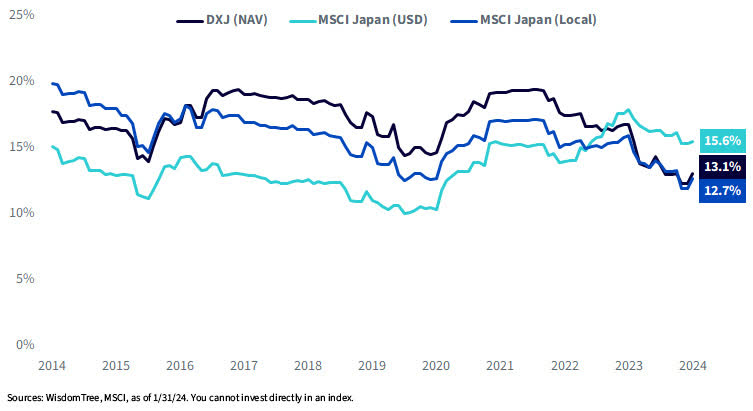

The inverse relationship between Japanese equities and the yen was a genesis for adding the yen hedge to the WisdomTree Japan Hedged Equity Fund (DXJ) in April 2010. Since then, several key features have prevailed:

1. Hedging Yen Exposure Was Additive—It was detrimental for a U.S. investor to buy Japanese shares without hedging yen exposures over the short-, medium- and long-term periods of the last 15 years. Investors lost between 3.5% and 6.5% per year from unhedged yen investments during this timeframe.

2. Pairing Japanese Exporters with a Yen Hedged Magnified Total Returns—Hedging currency exposures within an export- and dividend-focused equity allocation regularly outpaced the local Japanese market. The pairing outperformed U.S. equities as well over the past few years, disproving the notion that overseas investing is a worthless endeavor for U.S. investors.

Annualized Total Returns

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click here.

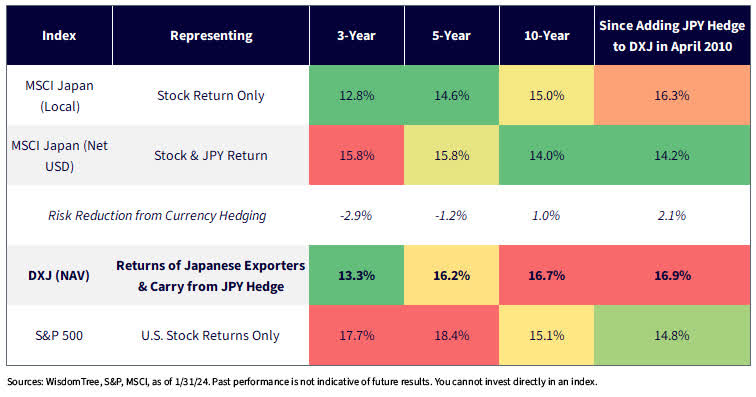

3. Hedging Yen Exposure Starting to Lower the Risk Profile of Japanese Equities—In the post-pandemic environment, DXJ outperformed unhedged Japanese stocks by over 10% per year with reduced (or comparable) volatility over the three- and five-year periods.

Annualized Volatility

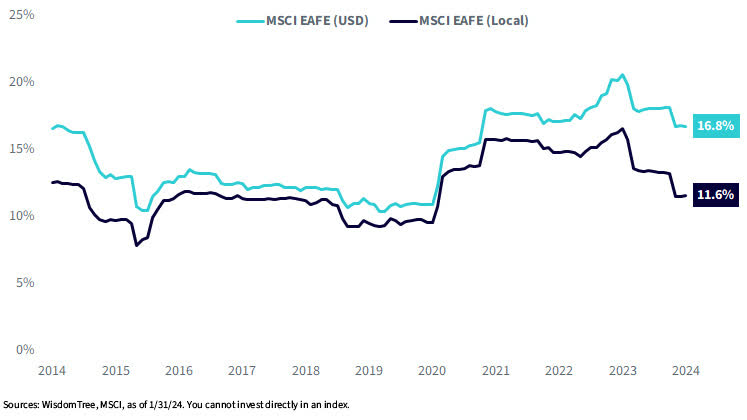

Over the longer term, DXJ was more volatile than unhedged indexes because of the strong inverse correlation between the yen and the local stock market. But over the past few years, Japan has seen falling volatility among currency-hedged strategies, which is more consistent with broader international markets where unhedged currency exposure usually adds to the volatility profile.

Rolling 36M Volatility: JPY-Hedged Strategies Becoming Less Risky

Currency hedging is becoming more rewarding due to greater volatility reduction across international markets. Within the Europe, Australasia, Far East (EAFE) region, unhedged currency exposure added an average of 230 basis points (bps) of incremental volatility on a rolling 36-month basis over the last 10 years. More recently, they’re adding about 500 bps of increased volatility compared to a static currency hedge.

Rolling 36M Volatility: Currency Hedging Reduces Risk in EAFE Region

As a final point on DXJ’s volatility, its longer-term risk profile resembles that of the S&P 500, which dispels the misconception that international investing is inherently riskier. At times it can be, but employing a currency hedge to Japanese equities may deliver a more palatable volatility profile already familiar to U.S. investors.

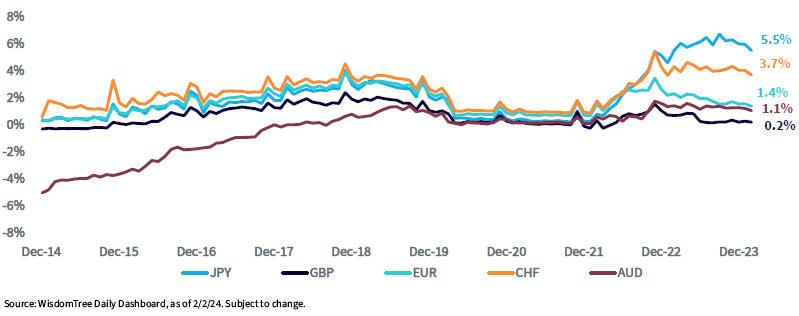

4. Policy Rate Differentials Mean U.S. Investors are Paid to Hedge Currency Risks – Over the past decade, policy rates set by the Bank of Japan (BoJ) have been greatly exceeded by those in the U.S., creating a compelling opportunity to earn an incremental return on top of the local market return by hedging yen exposures.

Today, investors can earn 5.5% of additional return by virtue of interest rate carry, which effectively neutralizes long yen (i.e., short dollar) exposures with an offsetting short yen (i.e., long dollar) position. U.S. investors theoretically earn the 5.5% rate differential by using yen exposure to fund a dollar investment.

Annualized Carry by Currency

Japan Remains an Opportunity amid Uncertainty

Being exposed to foreign currency risk for the last decade has been one of the biggest mistakes investors have made in their global portfolios.

Currency returns are quite unpredictable. There is no fundamental rule or theory that suggests the yen should always appreciate, and unhedged strategies are positioned for such an outcome. Since our first currency-hedged ETF launched 15 years ago, our own research suggests taking a more strategic approach to hedging and focusing a portfolio on risks you are compensated to take—equity risk. Unhedged currency risk serves as an added directional bet, in our view, that often does not pay off and more reliably adds to things that can go wrong—creating unnecessary volatility.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations and derivative investments, which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here