ARK Invest, founded by Cathie Wood, gained significant attention in the financial world for its focus on disruptive innovation and investing in companies that are at the forefront of technological advancements. Here’s a summary of Actively Managed ARK Innovation ETF’S (NYSEARCA:ARKK) recent performance:

- 2020: ARKK had a remarkable year in 2020, surging more than 152%. This exceptional performance was largely driven by the strong performance of several technology and innovation-related stocks during the COVID-19 pandemic.

- 2021: In 2021, ARKK underperformed the broader market, finishing the year down 24% compared to the Nasdaq’s 21.4% gain. This underperformance was notable as many investors had high expectations for innovation-focused stocks.

- 2022: The underperformance continued into 2022, with ARKK experiencing a substantial decline of 67%, while the Nasdaq also faced a notable 33.1% loss. This period was challenging for growth and tech stocks as interest rates rose and investors shifted towards more traditional sectors.

- 2023: As of October 9, 2023, ARKK has seen a rebound, with a gain of 29.3%. This recovery may be attributed to various factors, including a renewed interest in innovation stocks, improved financial performance of some of the companies within the ETF’s portfolio, and market sentiment shifts.

It’s important to note that the fund’s focus on innovative and disruptive companies can lead to significant volatility, and its performance can be influenced by factors such as interest rates, economic conditions, and market sentiment.

ARK Invest releases a list of its trades at the end of each trading day, which are published at 24/7 Wall St. (24/7 Wall St.). Cathie Wood, the CEO and CIO of ARK Investment Management, is a minority and nonvoting shareholder of 24/7 Wall St.

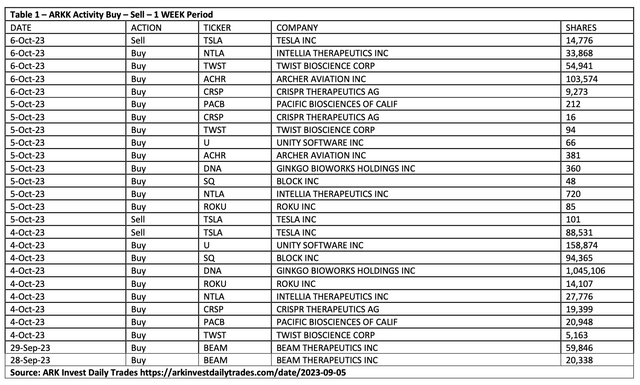

In Table 1, I show how active Cathie Wood is in managing her ARKK ETF. In just a 1-week period ending October 6, 2023, she made 26 major trades. In a 1-month period between September 6 and October 6, she made 84 major trades.

ARK Invest

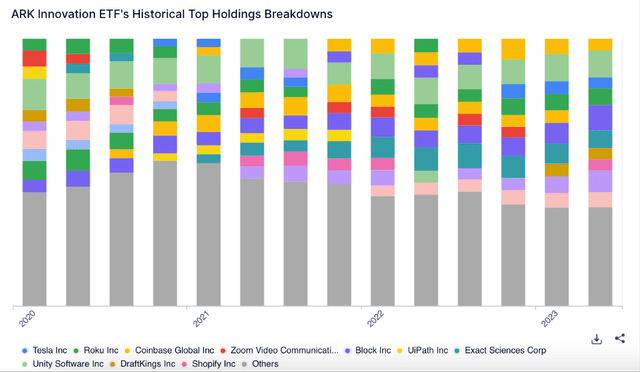

Not only does she add or subtract from her current holdings, sometimes these trades change the rank and percentage of assets, as shown in Chart 1.

ARK Invest

Chart 1 – Source: ARK Innovation ETF (ARKK) Stock Price, Holdings, Dividend Yield – GuruFocus.com

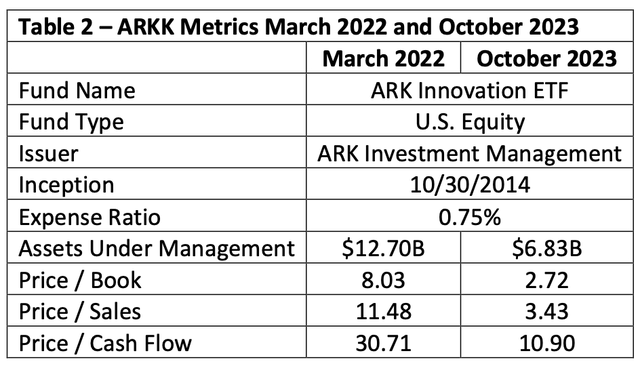

An analysis of ARKK is shown in Table 2 for March 2022 and October 2023, which I will detail later in this article. One of the key differentiators is Assets Under Management (“AUM”), which represents the total of all investor dollars invested in all share classes of the fund. Investors generally consider higher investment inflows and higher AUM comparisons as a positive indicator of quality and management experience.

The table shows that assets under management dropped from $12.70 billion in March 2022 to $6.83 billion currently, a drop of 46.2%. AUM for ARKK had dropped from $17.46 billion on December 9, 2021 to $12.70 in March 2022.

ARK Invest

Analyzing the Effect of Cathie Wood’s Labors

Despite efforts by Cathie Wood, ARKK has experienced over $900 million in outflows from the turn of the year to Oct. 5, taking its total assets under management to $6.8 billion, a dramatic fall in value from its $25.5 billion peak in June 2021.

In my March 25, 2022 Seeking Alpha article entitled “ARKK Vs. QQQ: A 3-Month Update As Inflation Surges,” I analyzed the performance of ARKK as of March 24, 2022, and hence my above data metric in Table 2 above for that date. I refer readers to Table 2 of that article.

What if Cathie Wood Went on Vacation for 18 Months on March 25, 2022

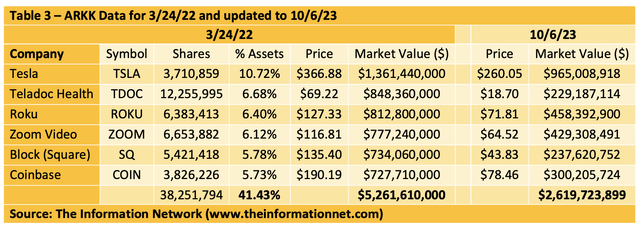

In this article, I updated and expanded those data in Table 3 below. In Table 3, I present date for market value on 3/24/22. On the right side, I compare market value as of 10/6/23 based on share price had Cathie Wood had DONE NOTHING, and kept the same companies and number of shares making up the top 41.43% of Assets. Note that these six stocks make up the top six stocks as they were on 3/24/22.

In this analysis, Market Value for these Top 6 dropped from $5.262 billion to $2.620 billion – a drop of 50.2%.

The Information Network

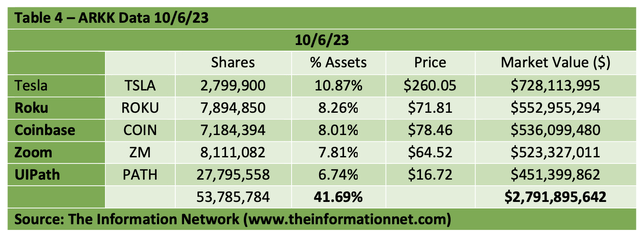

In Table 4, I present analysis for the current Top 5 holdings of ARKK for 10/6/23. These five companies represent 41.69% of current ARKK assets, similar to the 41.43% in Table 3.

Market Value is $2.792 billion, $172 million greater than the $2.620 billion from Chart 3 had Cathie Wood made no changes to its ETF portfolio 18 months earlier. This represents a growth of 6.6% over the 18 months, or 4.4% for the year.

The Information Network

What if Investors Only Purchased Tesla, Cathie Woods Top Stock, instead of ARKK

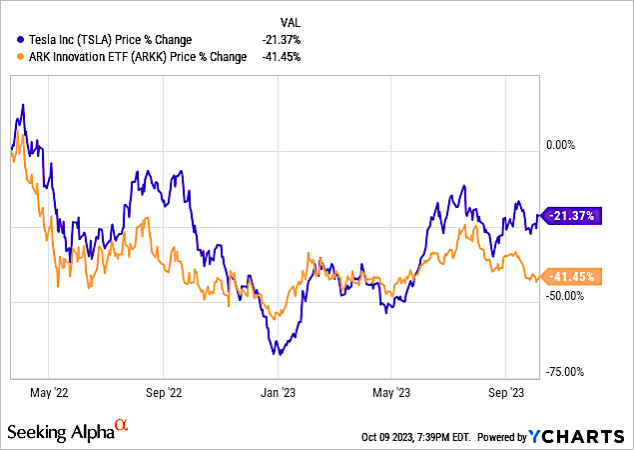

In Chart 2, I show share price performance for Tesla (TSLA), Cathie Wood’s top stock as a percentage of assets over the past 18 months, from March 24, 2022 to October 6, 2023.

Tesla share price shows a growth of -21.37% compared to a growth of -41.45% for ARKK.

YCharts

Chart 2

Investor Takeaway

Please note that this article was first published for my subscribers in my Semiconductor Deep Dive marketplace newsletter on October 9, 2023, which I now release to the public. Indeed, Tesla announced its recent earnings call on October 18, 2023, so metrics have changed as of October 21, 2023. But keep in mind that TSLA is a component of ARKK in both March 2022 and October 2023.

In the first section of this analysis, I show that had Cathie Wood made no changes to her ARKK ETF between March 24, 2022 and October 6, 2023, investors would have missed out on a Market Value growth of 6.6%, But in the meantime, ARKK share price dropped 41.45%, so the net effect would be a -34.85% growth.

At the same time, had the same amount of money been invested in Tesla instead of ARKK, investors would have been rewarded with a -21.37% growth.

ARKK is a fully actively managed ETF. With an expense ratio (or management fee) of 0.75%, investors paid $75 per year for every $10,000 invested. With an AUM of $6.83 billion, that management fee, and assuming no additional inflows or outflows, comes to $51.2 million for 1 year and $76.8 million for the 18 months she was NOT on vacation. But by doing so, investors gained $172 million for her active management.

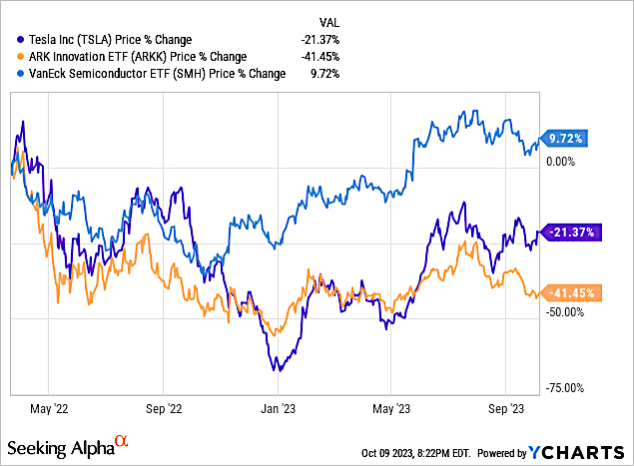

While Cathie Wood (ARK company total) earned $76.8 million for her efforts, investors were the losers for their heroics in sticking with the ETF, but would have fared better by investing in VanEck Semiconductor ETF (SMH), and would have realized a gain of +9.72% over the same period, as shown in Chart 3.

YCharts

Chart 3

Read the full article here