Owning stocks is like being a passive proprietor of businesses, and like for most business owners, the payback period is often a top-of-mind concern. After all, getting your money back and then some is the reason for why you would start a business in the first place.

With all of the different channels on YouTube peddling “passive income” schemes like vending machines (which we all know is not passive), one may be fooled into thinking that passive income requires work, when in fact these side hustles require plenty of time and labor.

The beauty of owning stocks is that you have a professional management team in place to handle the hassles of running a business on your behalf, and if they pay you in return, then it becomes a truly passive source of income.

This brings me to Ares Capital (NASDAQ:ARCC), which I last covered in December last year, highlighting its track record of value creation and well-covered dividend. While ARCC hasn’t given much in way of capital returns, changing in price by just +0.3% since my last piece, it’s the dividends that make ARCC worthwhile, contributing to a 5.2% total return.

In this article, I provide key updates on ARCC including its portfolio health and operating metrics, and discuss why ARCC remains a quality choice for high income, so let’s get started!

Why ARCC?

Ares Capital is the largest BDC by asset size, and is externally managed by a leading alternative asset manager, Ares Management (ARES), which currently has $419 billion in assets under management of which $285 billion is related to credit investments. Having access to ARES gives ARCC a line of sight into the credit landscape and a valuable deal pipeline.

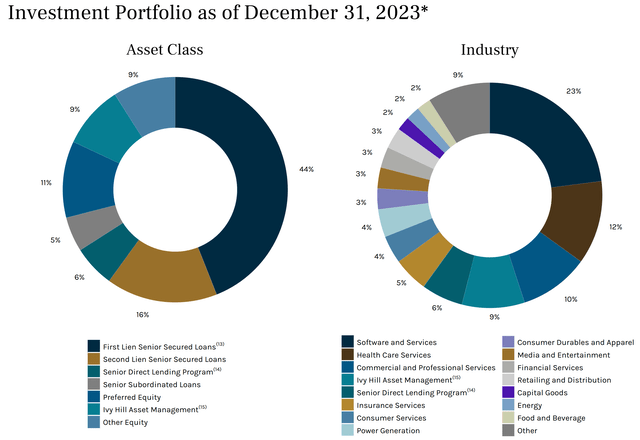

ARCC’s own portfolio consists of $22.9 billion in investments at fair value spread across 505 portfolio companies. Most of its investments (around 69%) are in the form of secured loans including first lien (44%), second lien (16%) and a 9% investment in Ivy Hill Asset Management, a related-party entity that invests primarily in secured debt. As shown below, ARCC invests primarily in growth and defensive industries with Software/Services, Healthcare, and Professional Services, which make up nearly half (45%) of the total portfolio.

Investor Presentation

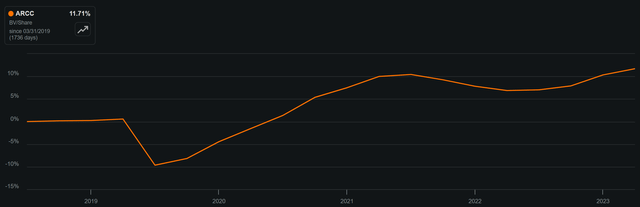

Importantly, ARCC has done a fairly good job of preserving and growing its NAV per share over the past 5 years and it was one of the few BDCs to actually grow its portfolio during 2020 when the pandemic hit. As shown below, ARCC’s book value per share now sits meaningfully higher than where it was pre-2020, and has grown by 11.7% over the past 5 years.

ARCC Book Value Per Share (Seeking Alpha)

This includes the latest Q4’23 results released on February 7th, which showed that NAV/share grew by a respectable 5% YoY (1.3% growth sequentially) to $19.24 along with record core EPS of $2.37 for the full year 2023, representing 17% growth from $2.02 in 2022. This enabled ARCC to grow its dividend by 10% in 2023, and the current annual dividend rate of $1.92 means that it’s amply covered by a 123% Core EPS-to-Dividend coverage ratio.

One of the drivers behind ARCC’s higher Core EPS is higher interest rates, as 69% of ARCC’s total portfolio is in the form of floating rate debt. This contributed to the 90 basis points YoY increase in weighted average yield on income-producing assets to 12.5% at the end of 2023.

ARCC’s gains over the past 12 reported months were driven not only by higher interest rates, but also by the continued pullback in lending from banks, a trend that began since the Great Recession in 2008. This is reflected by substantial market share gains by ARCC and by 90% of leveraged buyouts being completed by direct lenders rather than banks in 2023. During 2023, ARCC’s portfolio grew by $1.1 billion, with the bulk of the growth ($945 million) occurring in Q4, as deal activity picked across the BDC industry after a slowdown earlier in the year.

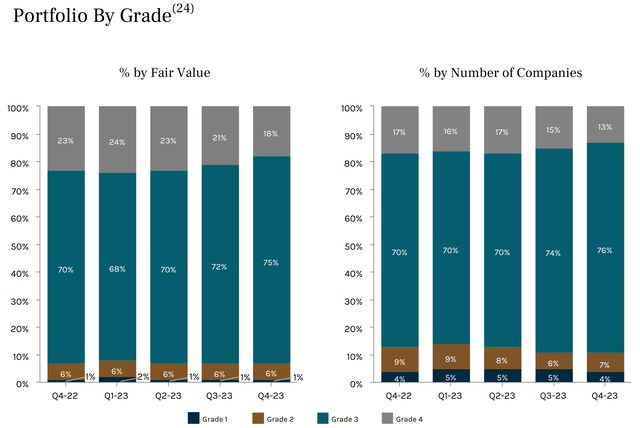

Notably, ARCC’s growth and higher interest do not appear to have negatively impacted the quality of its underlying investments, as investments on non-accrual actually declined by 50 basis points YoY to 0.6% of fair value (no change on a sequential QoQ basis). Portfolio quality is also supported by the percentage of ARCC’s investments at Grade 3 and 4 (on a scale from 1-4, with 4 being the highest quality) rising by 2 percentage points YoY to 89%, while the percentage of investments at the lowest Grade 1 remained stable at 4% from 2022 to 2023, as shown below.

Investor Presentation

Looking ahead, ARCC is poised to continue to ride heightened demand, as it’s reasonably low leveraged with a debt-to-equity ratio of 1.07x, sitting well below the 2.0x statutory limit and below the 1.29x at the end of 2022. In the first month of Q1’24, ARCC had already made $705 million of new investment commitments, of which 89% were first lien senior secured loans and 94% were floating rate, enabling it to take advantage of higher interest rates. Management noted the momentum around its business during the last conference call:

In 2023 and into 2024, we’ve witnessed large high-quality companies that were traditionally financed by the broadly syndicated markets turned to us to refinance their capital structures, not because they were unable to access the public markets, but because they preferred the stability that we provide through market cycles.

By leveraging the broader scale of Ares’ U.S. direct lending platform, we believe we can unlock value for a wide range of businesses, whether they are large high-quality companies seeking multibillion-dollar financings or strong-performing core middle-market companies seeking a lender with flexible capital and the ability to support growth over time.

Risks to ARCC include potential for lower interest rates as the Fed Chairman recently stated 3 rate cuts for this year as being the goal. This would lower the effective yield on ARCC’s debt investments. Alternatively, a higher-for-longer interest rate environment could harm borrowers and their ability to make payments on loans, especially if there is a hard landing for the economy.

Over the next few quarters, I would look for signs of ARCC’s ability to grow its portfolio through management’s statements on borrower demand, as that could provide an offset to potentially lower rates. In addition, I would also focus on portfolio quality as it would be ideal for ARCC to maintain a low non-accrual rate as described earlier. Higher non-accruals above 1.5% would be a sign that more borrowers are facing problems and be indicative of a higher-risk environment.

Turning to valuation, I continue to find ARCC to be attractive at the current price of $19.99, which equates to a price-to-book value of 1.04x. This is actually slightly cheaper than the 1.05x price-to-book value from when I last visited the stock at the end of Q3, due to ARCC’s NAV/share growth since then. This is reasonably attractive, as ARCC has traded as high as a 17% premium to NAV over the past 5 years, as shown below. Considering ARCC’s strong balance sheet, portfolio quality, and heightened potential for deal activity, I believe investors would do well to buy ARCC up to 1.1x Price-to-NAV as a conservative estimate.

ARCC Price-to-Book (Seeking Alpha)

Investor Takeaway

While some social media influencers highlight “passive income” that is not really passive, investors who know better may do well to tune out that noise and layer into high-quality names like ARCC. ARCC has performed respectably well in recent years, and is well positioned to continue its growth trajectory. With a strong balance sheet, diversified portfolio, NAV/share growth, and favorable industry trends, ARCC is poised to benefit from continued demand for direct lending. While investors should keep an eye on interest rates and portfolio quality, I find the stock attractive at the current valuation with a 9.6% yield that’s well covered by earnings. As such, I maintain a “Buy’ rating on the stock.

Read the full article here