Ares Capital (NASDAQ:ARCC) is the largest business development company [BDC] by market capitalization. It currently offers a dividend yield of almost 9.7%, which is well-covered by its net investment income. ARCC has also shown signs of improvement in its portfolio with a decline in the percentage of its portfolio graded as the riskiest investments, i.e. those at higher risk of default.

The portfolio

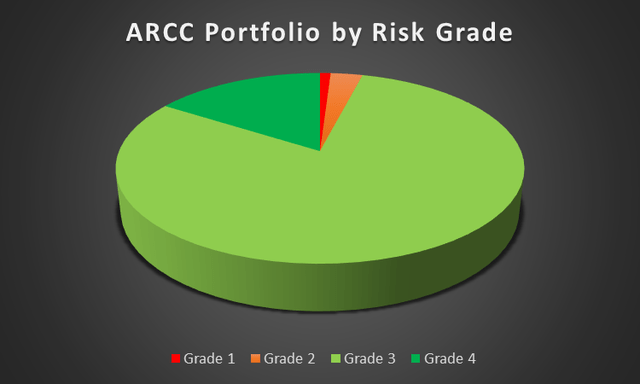

In my previous coverage of ARCC, I looked at the portfolio and the risk of rising non-accruals in the current high interest rate environment. At that time, I noted that the decline in the percentage of ARCC’s portfolio graded in the risk grade of Grade 4, suggests that fewer of ARCC’s investments are expected to outperform initial expectations. ARCC assigns a Grade 4 to investments that present minimal risk to the original capital and have demonstrated favourable trends and risk factors since their initiation or acquisition. These positive signs can include the strong performance of the portfolio company or the likelihood of a successful exit strategy.

Since the time of my last coverage, there has been a further decrease in the percentage of ARCC’s portfolio that enjoys the best risk grading. The percentage of its portfolio graded as Grade 4 declined from 18% of its portfolio at fair value to around 16% at the time of its most recent results. The percentage of its portfolio companies graded at the best level, i.e. Grade 4, also declined from around 13% of portfolio companies to around 11% of portfolio companies. These figures were not unexpected and do not in themselves signal a substantial deterioration in portfolio quality.

Author created based on data from company filings

What merits closer scrutiny on an ongoing basis is the percentage of the portfolio at the lowest grades, such as Grade 2. Where ARCC assigns a risk grade of 2 it is an indication that the risk of recovering the initial investment has significantly increased since the origination or acquisition, due to factors such as deteriorating performance or failure to comply with debt covenants; however, payments are typically not more than 120 days overdue. Interestingly, the percentage of ARCC’s portfolio risk graded at Grade 2 has declined since the time of my previous coverage from around 6% of the portfolio at fair value then to around 3% of the portfolio at fair value at the end of the second quarter of 2024, as depicted in the chart above.

Additionally, non-accruals have remained low despite managements earlier expectation of a potential increase in non-accruals in 2024. In ARCC’s most recent earnings call, management observed that –

our portfolio also continues to perform well, and companies have adjusted well to the higher base rate environment. Our nonaccrual rates declined quarter-over-quarter and remain at levels well below industry averages. In addition, the fair value of our risk-rated 1 and 2 loans, which are typically our underperformers and watch-list names, also declined from the first quarter.”

These factors all point out the continued strong performance of the portfolio and may be an early indicator that the risk of a substantial increase in non-accruals has become less likely since the time of my previous coverage of ARCC. While investors should still monitor these developments closely, I am less concerned about portfolio risks than I was a few months ago.

Earnings and the dividend

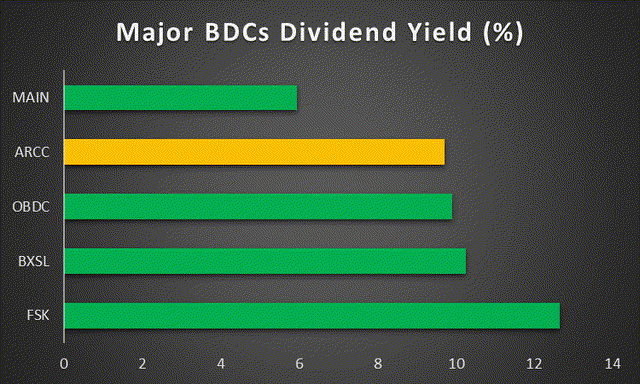

ARCC offers a highly attractive dividend yield of around 9.7%, which is the second lowest of the major BDCs considered in the peer-comp chart below. While ARCC has a reasonable history of increasing its dividend over time, the current $0.48 quarterly dividend has remained the same since late 2022. In my view, the current $0.48 quarterly dividend is also unlikely to be increased in the near term. While the dividend is sustainable at its current level, a decline in interest rates could impact ARCC’s floating rate investment portfolio negatively and in so doing somewhat reduce the opportunities available for expanding its net investment income [NII] in the near future.

Author created based on data from BDCUniverse

Nevertheless, ARCC currently has a reasonable buffer, with NII being comfortably above the quarterly dividend. In the second quarter of 2024 the BDC reported NII per share of around $0.58 which provides a NII dividend coverage ratio of almost 120% for the quarter. Its one-year average NII coverage ratio is approximately 115% and again indicates the sustainability of the current dividend even if interest rates should come down.

Valuation

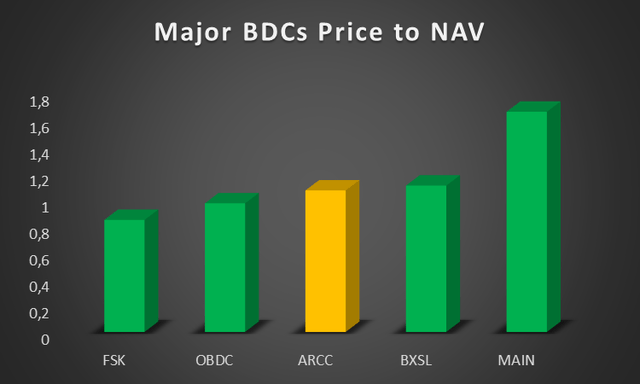

ARCC is currently trading at a slight premium to net asset value [NAV] of just under 7% which is broadly in line with its 3-year average premium to NAV of around 5.1%. It is also right around the middle of the pack of the major BDCs considered in the peer comp chart below.

Author created based on data from BDCUniverse

In my view, the stock is currently trading around fair value. The prospects of an interest rate cut are likely to prevent any rerating of the stock to a higher premium to NAV in the near term. Nevertheless, this does not necessarily mean that there isn’t more room for the stock price to increase, as ARCC has been steadily growing its NAV per share. It’s just that I see growth in the share price as more limited, while the primary motivation for buying ARCC would be the dependability of the dividend.

Conclusion

The decrease in riskier investments graded at Grade 2, along with the maintenance of low non-accruals, suggests that ARCC’s portfolio continues to perform well even in a high-interest rate environment. These improvements in its portfolio since the time of my previous coverage makes me cautiously optimistic that the risk of a sudden increase in non-accruals has declined in recent quarters. Continued improvement in its portfolio. ARCC’s attractive dividend yield of around 9.7%, supported by a solid NII coverage ratio, further enhances its appeal as an investment.

Read the full article here