We previously covered ASML Holding N.V. (NASDAQ:NASDAQ:ASML) (OTCPK:ASMLF) in January 2024, discussing why we believe that its 2024 commentary had been on the cautious side, with multiple Big Tech companies and data center REITs still reporting growing appetite for cloud computing/ generative AI services and infrastructure related spending.

However, with the stock already recording massive recoveries since the recent October 2023 bottom, we had also recommended interested investors to wait for a more attractive entry point for an improved upside potential.

Since then, ASML has charted another +39.8% rally, well outperforming the wider market at +9.1%. Despite so, we shall discuss why it remains a long-term winner as we enter the next cloud super cycle, thanks to the insatiable demand for generative AI SaaS and Nvidia’s (NVDA) double digit growth.

Despite its growing bookings and multi-year backlog, readers may want to wait for a moderate retracement for an improved margin of safety, since most of the exuberance has also been embedded here.

The ASML Long-Term Investment Thesis Remains Promising, Albeit Inflated At Current Levels

With ASML set to report the FQ1’24 earnings on April 17, 2024, all eyes will be on the management, on whether it will be able to continue the consecutive earnings beat since 2010, except for the one-time top-line miss in 2021.

For context, the lithography company reported a stellar FY2023 sales of €27.55B (+30.1% YoY) and adj EPS of €19.91 (+40.8% YoY), with impressive net bookings of €20.04B (-34.6% YoY) and multi-year backlog of €39B (-3.4% YoY).

These numbers imply the robust demand for ASML’s market-leading offerings, despite the supposed competition from Canon (OTCPK:CAJPY) (OTCPK:CAJFF).

The latter has reported stagnant Industrial sales of 314.7B Yen (-4.4% YoY) in FY2023, with the unit sales growth for semiconductor lithography equipment negated by the weak demand for FPD lithography equipment.

If anything, the US government has recently confirmed $39B in CHIPs Act Subsidies, with:

- Intel (INTC) set to receive $8.5B in subsidies/ $11B in loans,

- Taiwan Semiconductor Manufacturing (TSM) $6.6B in subsidies/ $5B in loans,

- Samsung Electronics (OTCPK:SSNLF) (likely) $6B in subsidies, and

- Micron (MU) (likely) $5B in subsidies, amongst others.

With the ultimate aim of boosting domestic production of semiconductors, it goes without saying that ASML will be the main beneficiary of these grants, since most (if not all) foundries will have to order lithography equipment to support their new manufacturing plants.

This also explains why ASML has reported accelerating growth in net bookings to €9.18B by FQ4’23 (+253% QoQ/ +45.7% YoY), comprising €5.6B of EUV bookings (+1020% QoQ/ +64.7% YoY) and €3.6B of non-EUV bookings (+71.4% QoQ/ +24.1% YoY).

No matter the lack of profitability currently reported by INTC’s foundry segment or TSM’s ability to “enable almost all AI processing at the data center and the edge,” it is undeniable that their capex will be elevated over the next few years, with part of it attributed to ASML’s lithography equipment.

Most notably, the Memory segment has also reported increasing booking share at 47% (+27 points QoQ/ +13 YoY), compared to Logic at 53% (-27 points QoQ/ -13 YoY) in FQ4’23.

These numbers are interesting indeed, since it is apparent that the memory market is recovering by leaps and bounds, as similarly reported by MU in the recent earnings call.

This is attributed to the insatiable demand for generative AI SaaS, which requires immense “storage solutions that can handle vast volumes of data, deliver high throughput, offer low-latency access, and store data securely.”

As a result of the renewed growth opportunities post hyper-pandemic period, we believe that ASML may very well report accelerating net bookings and backlogs in the upcoming FQ1’24 earnings call, with sales likely to be gated by delivery timing and capacity.

This is attributed to the management’s relatively soft FQ1’24 net sales guidance of €5.25B (-27% QoQ/ -21.6% YoY) and gross margins of 48.5% (-2.9 points QoQ/ -2.1 YoY) at the midpoint, with “flattish sales growth in 2024.”

In order to meet its growing backlog, readers must also note that the company is expecting to incur significant capex in 2024 to ramp up its manufacturing capacity to 90 EUVs and 600 DPVs.

As we enter the next cloud super cycle, we believe that these investments will eventually be accretive to ASML’s top/ bottom lines, while widening the gap in its 20Y lithography moat.

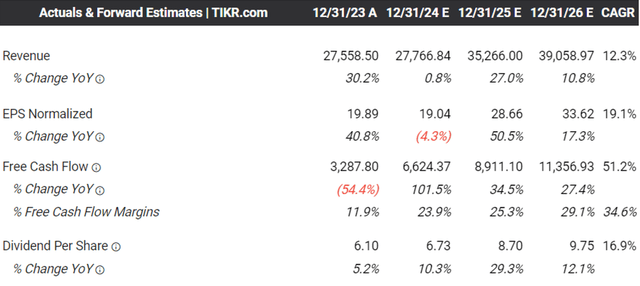

The Consensus Forward Estimates (€)

Tikr Terminal

The same has been projected by the consensus, with ASML expected to generate an accelerated top/ bottom line growth at a CAGR of +12.3%/ +19.1% through FY2026.

This is compared to the previous estimates of +8.4%/ +16.6%, while building upon the historical expansion at +22.1%/ +28.5% between FY2016 and FY2023, respectively.

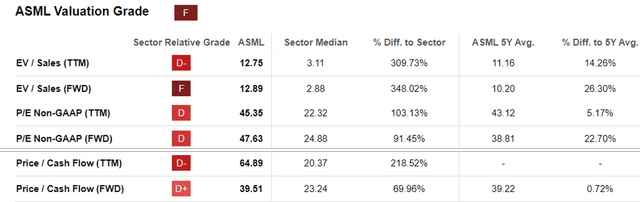

ASML Valuations

Seeking Alpha

As a result of the long-term tailwinds, it is apparent that the market has opted to upgrade ASML’s FWD P/E valuations to 47.63x and FWD Price/ Cash Flow valuations to 39.51x, with it being second to none in the “very high-end semiconductor lithography equipment market.”

Nonetheless, we are not certain if it is wise to award this overexuberance in the stock, in contrast to its 1Y mean of 35.55x/ 36.90x and 3Y pre-pandemic mean of 26.50x/ 29.30x, respectively.

Even when compared to its peer, Canon at 15.68x/ 9.06x, it is apparent that ASML may be rather expensive here, especially since the latter is already trading near its hyper-pandemic peak valuations of 52.30x/ 56.87x, respectively.

So, Is ASML Stock A Buy, Sell, or Hold?

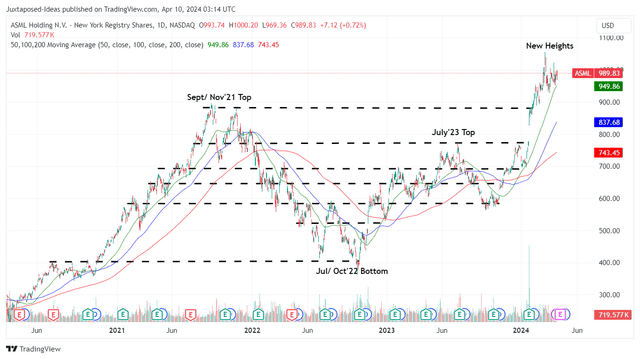

ASML 5Y Stock Price

Trading View

The same over optimism is also observed in ASML’s stock prices, with it currently charting new heights while running away from its 50/ 100/ 200 day moving averages.

Based on its 1Y P/E mean of 35.55x and the FY2023 adj EPS of $21.65, it is apparent that the stock is trading way above our fair value estimates of $769.60.

While there remains an excellent upside potential of +30.3% to our long-term price target of $1.29K, based on the consensus FY2026 adj EPS estimates of $36.50, we believe that there is a minimal margin of safety here.

While we may continue rating ASML as a Buy, attributed to its bright long-term prospects, readers may want to time their entry points, preferably after a moderate retracement to its previous trading range of between $770s and $880s.

We believe that those levels may materialize sooner than expected, with the wider market already trading sideways over the past three weeks as we enter the Q1’24 earnings season.

Depending on how the tech and semiconductor stocks perform, there may be moderate volatility ahead, especially since ASML has recorded a YTD rally of +30.7% compared to the wider-market at +9.2%. Patience for now.

Read the full article here