Introduction

Per my July 2023 article, ASML (NASDAQ:ASML) is a powerhouse. The business remains outstanding but the stock can be another matter. My thesis is that the company is still wonderful, but the stock does not look cheap based on the latest financials from the 1Q24 results and the 2023 annual report.

At the time of this writing, €1 is equivalent to about $1.07.

The Numbers

ASML is still a great business despite disappointing numbers from the 1Q24 period. They are the only company in the world capable of making NXE/EUV units which are used by fabrication companies such as TSMC (TSM) and Samsung (OTCPK:SSNLF) to make high end semiconductor chips. These units have made up a substantial portion of system revenue over the last five years, but they were a higher percentage of sales in 2021 and 2022 than they were in 2023:

|

Year |

NXE/EUV Units |

NXE/EUV Total (in millions €) |

NXE/EUV Average (in millions €) |

NXE/EUV % of system sales |

|

2016 |

4 |

€331 |

€83 |

7% |

|

2017 |

11 |

€1,084 |

€99 |

17% |

|

2018 |

18 |

€1,880 |

€104 |

23% |

|

2019 |

26 |

€2,800 |

€108 |

31% |

|

2020 |

31 |

€4,464 |

€144 |

43% |

|

2021 |

42 |

€6,284 |

€150 |

46% |

|

2022 |

40 |

€7,045 |

€176 |

46% |

|

2023 |

53 |

€9,124 |

€172 |

42% |

11 NXE/EUV units were sold in 1Q24 relative to 13 in 4Q23.

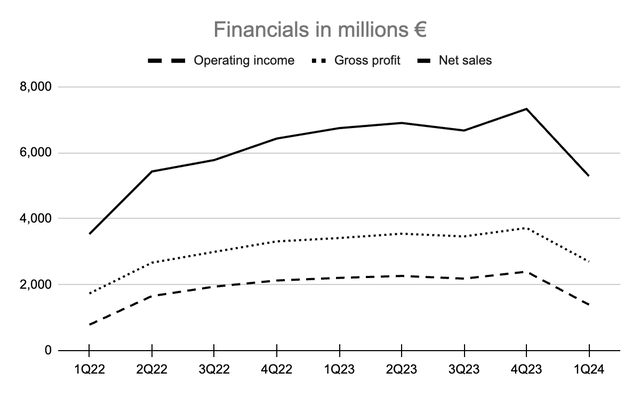

The income statement numbers for 1Q24 were disappointing:

Income statement figures (Author’s spreadsheet)

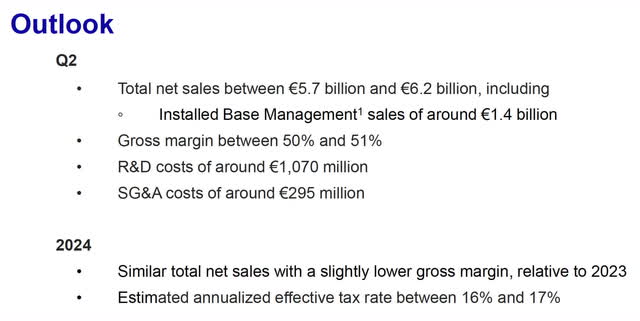

The outlook from the 1Q24 presentation is underwhelming. If the total net sales figure for 2024 is similar to 2023 but with a lower gross margin then we’re positioned to have lower operating income:

Outlook (ASML 1Q24 presentation)

The business model portion of the November 2022 investor day presentation says 2025 net sales should be between €30 and €40 billion with a gross margin of 54-56%. The midpoint of this scenario is a gross margin of 55% and net sales of €35 billion. I think management needs to do a better job explaining how this is still realistic given the low numbers from the 1Q24 period.

Valuation

Leadership is an important factor with respect to valuation. The departure of CEO Peter Wennink who led the company for 40-plus quarters was discussed in the 1Q24 earnings call. Forward-looking investors need to monitor progress under his successor, Executive VP Christophe Fouquet.

Looking at the 1Q24 results and the 2023 annual report, TTM operating income is €8,228.7 million or €1,391.4 million + €9,042.3 million – €2,205.0 million on TTM revenue of €26,102.3 million or €5,290.0 million + €27,558.5 million – €6,746.2 million. The gross margin has been 51% for five of the last six quarters. In USD, this operating income is equivalent to $8,804 million. Knowing operating income and revenue are expected to increase in the second half of 2024, we could use a generous multiple of 30 to 40x TTM operating income to have a valuation range of $265 to $350 billion when rounding to the nearest $5 billion.

The 1Q24 results show 393.4 million basic shares which we multiply by the April 17 share price of $907.61 to get a market cap of $357 billion.

It looks like ASML is near the top of a generous valuation range, even after the share price fell 7.09% on April 17. This is a great company, but the valuation seems lofty given the results we saw in 1Q24 and the expected results for 2Q24.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Read the full article here