At a Glance

Atara Biotherapeutics (NASDAQ:ATRA), perched on the cutting edge with tab-cel and ATA188, encounters a pivotal phase, balancing its clinical ingenuity against financial constraints. Clinical strides, notably with tab-cel’s European Commission approval for EBV+ PTLD, suggest a gateway into wider oncological and autoimmune applications, promising yet hedged by stringent US regulatory pathways. Meanwhile, ATA188’s foray into the substantial MS market denotes clinical promise, pending validation of its underlying scientific premise. Financially, a cautious cash burn rate, alongside a tangible risk of dilutive capital raising, underscores the urgency for fiscal prudence. These elements, in concert with market sentiment and institutional maneuvers, sketch a picture of a biotech entity with tangible clinical potential yet encumbered by palpable fiscal challenges—a dynamic that investors must navigate with acuity, where my article’s subsequent sections delve into the nuanced prospects for Atara’s clinical and financial future.

Q3 Earnings

To begin my analysis, looking at Atara Biotherapeutics’ most recent earnings report, the company’s total revenue for the quarter was $2.14M with a sharp decline in license and collaboration revenue year-over-year from $4.46M to $118K. Commercialization revenue was $2.02M, marking progress since no such revenue was reported in the same period last year. The reported net loss has slightly decreased from $84.09M to $69.79M year-over-year, alongside a decrease in R&D expenses from $70.16M to $56.89M. G&A expenses also saw a reduction from $18.92M to $12.25M. There was an increase in basic and diluted weighted-average shares outstanding from 102.42M to 106.40M, suggesting some level of share dilution.

Financial Health

Turning to Atara Biotherapeutics’ balance sheet, liquidity is evidenced by ‘cash and cash equivalents’ and ‘short-term investments’ totaling $102.4M. The current ratio stands at approximately 1.5, reflecting sufficient short-term liquidity. Yet, with total liabilities surpassing total assets, the company’s financial stability is under some strain.

The monthly cash burn rate is approximately $15.8M, which would ordinarily imply a cash runway of 6.5 months. However, the recent deal with Pierre Fabre and restructuring efforts, including a 30% workforce reduction and a shift of costs related to tab-cel, will significantly alter this trajectory. With the $30M upfront payment, the cash runway extends substantially. Factoring in this influx, the runway is recalculated, resulting in an extended runway until Q3 2025, as stated by the company.

Despite these developments, and considering the potential $100M upon FDA approval (BLA submission planned for Q2 ’24), the upfront payment, and future royalties, the odds of requiring additional financing within the next twelve months seem medium, contingent on the progress of their pipeline and the realization of milestone payments. It’s important to note that while the upfront cash and cost reductions improve the near-term financial outlook, the longer-term viability hinges on successful commercialization and further pipeline advancements.

Notably, Atara Biotherapeutics registered a mixed shelf offering on November 1st with a potential to raise up to $400 million in capital. It’s important to recognize that such filings are commonplace and do not inherently indicate imminent or definite capital deployment.

Market Sentiment

According to Seeking Alpha data, Atara Biotherapeutics’ market capitalization of approximately $121.29 million, juxtaposed with a -74.52% performance against the SP500’s +14.84% over the last year, signals market skepticism towards the stock. While projected sales growth is strong, with a leap expected from $16.31M in 2023 to $143.20M in 2025, current short interest stands high at 15.75%, representing 12.27M shares and a days to cover ratio of 10.63, implying a significant bearish outlook from some market participants.

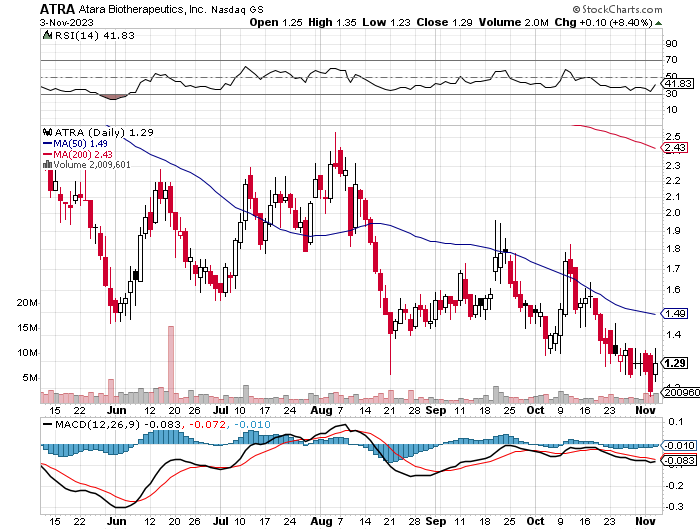

StockCharts.com

Technically, ATRA showcases a bearish trend, with the stock trading well below both its MA(50) and MA(200). Recent attempts to rally have been met with resistance. The RSI at 41.83 suggests neither overbought nor oversold conditions. The MACD line remains under the signal line, indicating bearish momentum. Immediate support lies around the 1.29 mark, and a breakthrough might accentuate the downtrend.

Institutional ownership, at 88.83%, shows engagement from major investors, but a higher number of decreased positions (19.93M shares) than increased (8.25M shares) or new positions (2.72M shares) indicates a trend towards divestment. However, the three to four key institutions like Baupost Group, Wasatch Advisors, and Blackrock reflect a mix of increasing and decreasing stakes, thus sending mixed signals. Insider trades suggest a net sell activity with a total net decrease of 73,071 shares over the past three months and a more significant net increase of 943,509 shares over the last year, hinting at possible optimism in the longer term amidst recent caution.

Tackling EBV with Atara’s Innovative Immunotherapy

Tabelecleucel (tab-cel) stands as a pioneering venture in addressing Epstein-Barr Virus (EBV)-positive post-transplant lymphoproliferative disease (EBV+ PTLD), a notably rare and aggressive hematologic malignancy. Developed by Atara Biotherapeutics, this allogeneic T-cell immunotherapy aims at targeting and eradicating EBV+ cells in an HLA restricted manner, thus inhibiting the proliferation of EBV-associated cancer cells and effecting lysis of EBV-infected cells.

Clinical trials have so far shown a favorable safety and efficacy profile for tab-cel. The ALLELE trial, a multicenter, open-label, phase 3 study, denoted tumor flare reaction as the sole identified risk from over 150 patients with EBV+ PTLD treated with tab-cel. Further, pooled data from three distinct studies exhibited that patients responding to tab-cel had a clinical benefit, with over 80% estimated 2-year survival rates, a noteworthy finding given the generally poor survival outcomes associated with this malignancy.

The European Commission marketing authorization under “exceptional circumstances” for tab-cel has set a significant precedent for allogeneic T-cell immunotherapies. This approval, though initially serving the EBV+ PTLD market, potentially unveils broader therapeutic horizons in oncology and autoimmune disorders. Moreover, ongoing Phase 2 multicohort studies are extending the exploration of tab-cel’s efficacy across various EBV-associated diseases, indicating a robust development trajectory.

On the commercial front, tab-cel unveils a substantial opportunity. With plans for partnership in the US commercialization and anticipated peak sales of $500 million in the US market, assuming success beyond the very niche market of EBV+ PTLD, the commercial scope appears promising. The potential for label extensions could further bolster the commercial outlook, though the milestones for European market authorization remain unspecified.

However, the journey ahead for tab-cel is not devoid of challenges. Some of the potential hurdles could include:

-

Regulatory Hurdles: While the European approval is a positive stride, obtaining regulatory clearances in other regions, including the US, could pose challenges. The regulatory landscape is complex and dynamic, which could result in delays or additional requirements for approval.

-

Market Penetration: Breaking into established markets and gaining a significant market share against existing or upcoming competitive therapies might prove challenging. Effective market penetration will require robust marketing strategies and perhaps favorable pricing and reimbursement landscapes.

-

Manufacturing and Supply Chain: Ensuring a consistent and high-quality supply of tab-cel will be crucial for its success. Any disruptions or failures in the manufacturing or supply chain process could adversely impact its market availability and, subsequently, its commercial success.

-

Post-Marketing Surveillance: Post-marketing surveillance to monitor the long-term safety and efficacy of tab-cel will be essential. Unanticipated adverse events or diminished efficacy over time could affect its market standing and patient trust.

-

Competitive Landscape: The oncology and immunotherapy sectors are rapidly evolving with numerous players striving for breakthroughs. The emergence of novel or more effective therapies could overshadow tab-cel’s market position.

ATA188 (Phase 2), on the other hand, pioneers a targeted approach against progressive Multiple Sclerosis (MS), leveraging a novel mechanism that addresses EBV infected B cells believed to underlie MS. Early clinical evaluations show promise in halting or potentially reversing disability progression, hinting at a significant market entry within the substantial $24 billion MS market by 2024. However, challenges loom, primarily surrounding the scientific premise. The assertion that targeting EBV will ameliorate MS, while grounded on epidemiological associations, faces uncertainty until further validated by robust clinical evidence, potentially impacting ATA188’s clinical and market trajectory. Furthermore, the MS market is already packed with several disease-modifying therapies.

My Analysis & Recommendation

Navigating through the intricate avenues of biopharmaceutical investment requires a keen eye on multiple variables, not the least of which are financial viability, clinical progress, and market dynamics. Atara Biotherapeutics stands at a crucible, with its financial health teetering on the verge of exigency, underscored by a limited cash runway. The imminent readout from the Phase 2 EMBOLD study of ATA188 in early November could, however, provide a much-needed thrust to its equity stature, mitigating substantial share dilution and bolstering its capital influx, a necessity mirrored by its restructuring and focused realignment towards ATA188 and CAR-T assets.

Recent maneuvers, including the partnership expansion with Pierre Fabre, pivot towards a promising albeit challenging horizon. The tab-cel deal not only augments an upfront capital of $30M but sets a stage for potential regulatory payments and tiered royalties, a pathway that could potentially ease the liquidity concerns. Yet, it’s a double-edged sword as the relinquishing of US commercial rights and a substantial workforce reduction reflects a strategy of consolidation perhaps at the expense of broader operational scope.

Investors should closely monitor the clinical progress of ATA188, whose potential market entry could disrupt the $24 billion MS market. However, the scientific premise targeting EBV necessitates further clinical validation to mitigate uncertainties surrounding its efficacy. Similarly, tab-cel’s journey through regulatory channels, market penetration, and competitive onslaught requires a vigilant appraisal. The European approval has set a precedent, yet the US regulatory landscape could pose a formidable hurdle.

Investment strategies could encompass a cautious approach, perhaps leveraging options to hedge against downside risk while remaining poised to capitalize on positive clinical or regulatory milestones. The mixed signals from institutional stakeholders and the bearish short interest outlook necessitate a balanced strategy, perhaps with a lean towards caution until clearer signals emerge from the clinical and regulatory fronts.

My recommendation is “Hold”, although leaning slightly bearish. The potential upside from successful clinical advancements and market penetrations of ATA188 and tab-cel is juxtaposed against substantial financial and operational risks. The road ahead is fraught with both opportunities and challenges, the scales of which will tip based on forthcoming clinical data, regulatory interactions, and market dynamics.

Risks to Thesis

In considering the “Hold” recommendation for Atara Biotherapeutics, it’s critical to acknowledge the potential underestimation of sector-specific risks inherent in microcap investing. These companies, like Atara, often exhibit heightened volatility and liquidity concerns. Given Atara’s financial position, the necessity for further capital raising is almost certain, potentially leading to further dilution for current shareholders. This is a common risk in microcap biotechs, where cash flow positivity is typically distant and financing needs are recurrent.

Additionally, the investment thesis may have placed excessive confidence in the forecasted sales growth without fully considering the execution risks and the likelihood of encountering commercialization headwinds. The optimism surrounding the product pipeline, especially tab-cel and ATA188, could be overemphasized, particularly if the upcoming Phase 2 results do not align with expectations.

There is also the risk of technological obsolescence, given the rapid pace of innovation in biotechnology. A single adverse event in post-marketing surveillance or a breakthrough by a competitor could significantly derail Atara’s prospects.

Lastly, while the bearish market sentiment, reflected in the high short interest, might seem to some as an opportunity for a contrarian investment, it may also signal market doubts about the company’s ability to navigate forthcoming challenges.

Read the full article here