The Advent Convertible & Income Fund (NYSE:AVK) is a closed-end fund, or CEF, that income-focused investors can utilize to achieve their goals. This is immediately apparent in the fund’s whopping 14.12% yield, which puts most other income-focused funds to shame. This fund also has a few advantages over many other fixed-income funds. This comes from the assets in which it invests. Much like the Calamos funds that I have discussed over the past few weeks, the Advent Convertible & Income Fund bills itself as investing its assets heavily into convertible securities, which do not require an investor to sacrifice income for capital appreciation. This is because they can be converted into common shares under certain conditions, which can allow an investor to take advantage of the massive capital appreciation that can accompany the success of an early-stage company or a corporate turnaround. However, they are less risky than common stocks due to the fact that they still provide a steady stream of income and are senior to common stock in the event of a bankruptcy or liquidation event.

Unfortunately for many investors, this fund has not performed as well as might be hoped in today’s market environment. Investors in this fund have basically broken even year-to-date compared to a 13.68% gain in the S&P 500 Index (SP500):

Seeking Alpha

As is the case with most closed-end funds, it is necessary to look at the distribution when calculating the realized return, because the fund pays out most to all of its investment gains as distributions. These distributions can help to offset any share price decline, as they did year-to-date. If we only look at the share price movement, the actual performance that investors realized is not shown. This can make it appear as if the owners of the fund are losing more money than they actually are. For reference purposes, this fund’s shares are down 10.11% year-to-date but the distributions that the fund has paid out have almost completely offset this.

The long-term proposition here comes from both the income provided from the securities in the portfolio as well as the potential for generating capital gains as the companies that issue them grow and prosper. Let us investigate and see if this could make sense for your portfolio today.

About The Fund

According to the fund’s webpage, the Advent Convertible & Income Fund has the primary objective of providing its investors with a high level of total return through a combination of capital appreciation and current income. Specifically, the website states the following:

The Fund’s investment objective is to provide total return, through a combination of capital appreciation and current income. Under normal market conditions, the Fund will invest at least 30% of its managed assets in convertible securities and up to 70% of its managed assets in lower-grade, non-convertible income securities, although the portion of the Fund’s assets invested in convertible securities and non-convertible income securities will vary from time to time consistent with the Fund’s investment objective, changes in equity prices and changes in interest rates and other economic and market factors. The Fund may invest without limitation in securities of foreign issuers and the Fund’s investment in foreign securities may vary over time at the discretion of the Fund’s investment advisor.

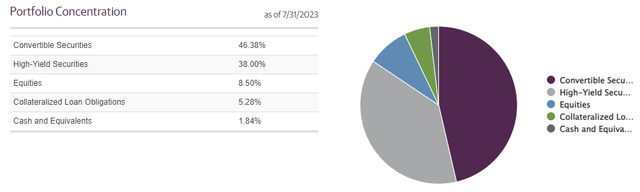

This description almost makes it sound as though the fund is an ordinary junk bond fund and is only investing in convertible securities as an afterthought. However, right now bonds account for 38.00% of the fund’s portfolio while convertible securities only account for 46.38% of its assets:

Guggenheim

However, what the description actually says is that the fund will always invest at least 30% of its assets into convertible securities. The remainder of the portfolio can be invested either in convertibles, junk bonds, or some other asset. The fund seems to be fulfilling that requirement right now, although the common stock allocation is somewhat surprising. We should expect that a fund like this could contain some common stock at any given time though, since the conversion of a convertible security to common stock is the primary way to realize capital gains from these securities. This is perhaps the only real advantage that convertibles have over traditional bonds. After all, convertible securities usually have lower yields than a traditional bond issued by the same company. This is because investors are willing to sacrifice a bit of yield in order to get the conversion feature. I explained this in a recent article.

It is conceivable that some of the fund’s common stock portfolio came from the conversion of convertible securities into common stock in order to get capital gains.

As I have pointed out in a few articles on other convertible debt funds (as I have never discussed this particular one before), convertible securities are frequently issued by start-up companies or financially distressed companies that otherwise would have difficulty obtaining financing at an affordable price. This is because the common stock of these firms can deliver enormous capital gains if the company is successful in its growth or turnaround efforts. As such, investors are willing to sacrifice a bit of the yield that they would otherwise demand for lending to such a company in exchange for the conversion feature. As such, we might expect that the fund’s portfolio is going to contain a large number of younger start-up companies.

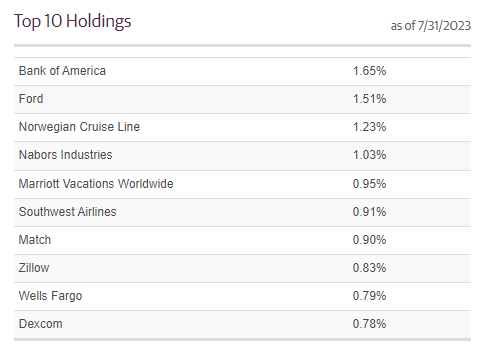

Here are the largest holdings in the fund’s portfolio:

Guggenheim

A few of these holdings may seem to disprove the statement that I just made about convertibles frequently being issued by financially distressed companies or start-up companies. After all, Bank of America Corporation (BAC), Ford Motor Company (F), and Wells Fargo & Company (WFC) hardly qualify as either type of company. However, all three of these companies were distressed over the 2007 to 2009 period and were forced to take some unusual steps to raise money. Ford also issued convertible securities in the aftermath of the COVID-19 pandemic. Norwegian Cruise Line Holdings Ltd. (NCLH) did the same thing when the company’s finances were devastated by the pandemic-driven lockdowns and the general fear of traveling.

Thus, it may be more appropriate to say that it is common for companies to issue convertible securities anytime they need to raise money and their stock price is suffering from a period of weakness.

One thing that we see here is that the holdings of the Advent Convertible & Income Fund are very different from the holdings of the Virtus Convertible & Income Fund (NCV), which we discussed earlier this week. That is something that is very nice to see from a diversification perspective, as it should mean that both of these funds can be included in a portfolio without overconcentrating an investor in any position. That is one of the biggest problems with including multiple funds in a portfolio. In short, an investor might think that their portfolio is diversified because they include multiple funds, but their portfolio is actually not diversified because every fund is holding the exact same assets. The fact that this one has different holdings from the popular Virtus convertible funds is nice to see.

As mentioned earlier, the Advent Convertible & Income Fund has the ability to invest in assets from around the world. However, many of the companies in the largest positions list are American companies:

|

Company |

Home Nation |

|

Bank of America Corporation |

United States |

|

Ford Motor Company |

United States |

|

Norwegian Cruise Line Holdings Ltd. |

Bermuda (headquartered in USA) |

|

Nabors Industries Ltd. (NBR) |

United States |

|

Marriott International, Inc. (MAR) |

United States |

|

Southwest Airlines Co. (LUV) |

United States |

|

Match Group, Inc. (MTCH) |

United States |

|

Zillow Group, Inc. (Z) |

United States |

|

Wells Fargo & Company |

United States |

|

DexCom, Inc. (DXCM) |

United States |

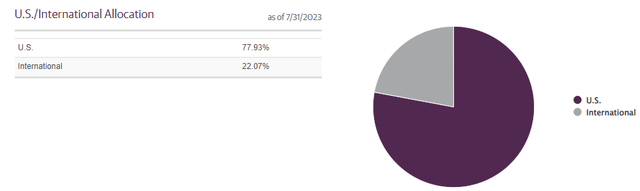

This might lead us to believe that the Advent Convertible & Income is nearly exclusively invested in the United States, despite its ability to invest in foreign assets. However, this is not the case as 22.07% of the fund’s assets are invested in foreign issuers:

Guggenheim

This is also very good from a diversification perspective. After all, as I have mentioned in a few previous articles, many American investors are overly exposed to the economy of the United States. This is partly because of home country bias and partly because the stock market of the United States has outperformed most other major economies over the past fifteen years or so. After all, the nation accounts for less than a quarter of global economic output but currently accounts for 69.69% of the iShares MSCI World ETF (URTH). The problem with this for American investors is that a country-specific event that hurts the American economy could cost them both their savings (as the U.S. stock market declines) and their income (as companies start laying people off). While it is true that any economic problem in the United States will almost certainly spread abroad, a certain amount of protection can be obtained by having part of your assets invested abroad due to foreign asset valuations being much more reasonable. This fund has clearly taken a few steps towards that goal, but it still has a high exposure to the United States.

With that said, the high asset valuations in the United States relative to many other countries in the world could also work to the fund’s benefit if it exercises the conversion feature on the securities that constitute nearly half of its portfolio. Thus, it might be a good thing for this fund to be heavily invested in the United States. Still, it is important to ensure that the rest of your portfolio has sufficient foreign exposure to be properly diversified internationally.

Leverage

As is the case with many closed-end funds, the Advent Convertible & Income Fund employs leverage as a method of boosting the effective yield of its portfolio. I discussed how this works in various articles on other closed-end funds. To paraphrase myself:

Basically, the fund borrows money and uses that borrowed money to purchase convertible securities, junk bonds, and other income-producing assets. As long as the purchased assets deliver a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the fund’s portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

With that said, this strategy is much less effective at boosting portfolio yields today than it was a few years ago when money was basically free. This is because the difference between the rate at which the fund can borrow and the rate that it receives from the purchased securities is much narrower than it used to be.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund does not employ too much debt as that would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Advent Convertible & Income Fund has leveraged assets comprising 47.44% of the portfolio. That is one of the highest levels of debt that is employed by any fund. This does explain the yield somewhat, as the higher leverage allows the fund to generate a higher effective yield than peers. However, at the same time, this leverage is going to cause the fund’s shares to be more volatile than some of its peers.

The worst is probably behind us at this time though, as it seems unlikely that the Federal Reserve will raise interest rates further. It is, admittedly, possible that the market will force interest rates up going forward but it seems that this market is pointing towards lower interest rates in the future, not higher ones. Thus, the fund’s leverage is still a big risk, but so far, the yield has been sufficient to offset most of the fund’s disappointing performance:

Seeking Alpha

As we can see, investors in the fund only lost 1.61% over the past three years when the distribution is considered. That is despite the fact that the fund’s shares are down 26.90% over the period. This is not really a bad situation compared to most indices or other closed-end funds. In this case, the leverage appears to be boosting the yield sufficiently to offset the volatility risk.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Advent Convertible & Income Fund is to provide its investors with a high level of total return. In order to achieve this objective, it invests in a portfolio of convertible securities and junk bonds that deliver most of their returns in the form of direct payments to their shareholders, although convertible securities can also have considerable upside via the conversion feature. The fund collects the payments that it receives from these securities, and artificially boosts the yields that it receives by applying a layer of leverage. It then pays out all of the money from these activities to the shareholders, net of its expenses. If the fund manages to realize capital gains, these will be paid out too, which results in an even greater amount of money being paid out to the shareholders over time.

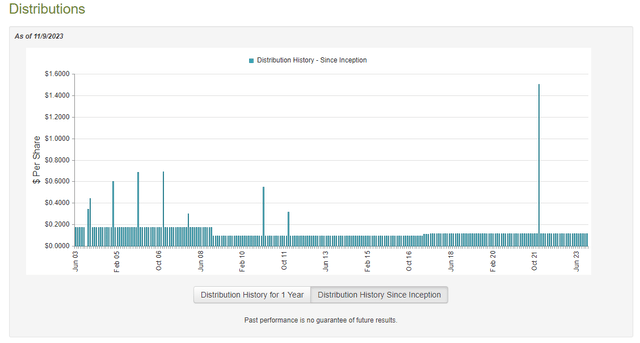

It might be expected that these activities will give the fund’s shares a remarkably high distribution yield. This is certainly the case, as the Advent Convertible & Income Fund pays a monthly distribution of $0.1172 per share ($1.4064 per share annually), which gives the fund a whopping 14.12% yield at the current price. This fund has been reasonably consistent with respect to its distribution over the years, as it has not cut since the Great Recession of 2009:

CEF Connect

This will certainly appeal to any investor who is seeking to earn a safe and consistent income from the assets in their portfolios. However, there are very few funds that were not adversely affected by the rising rate environment over the past two years. In fact, pretty much the only funds that actually saw their performance improve consistently are those ones that invest in energy infrastructure companies or floating-rate securities. This fund does neither, so it seems likely that it has taken some losses that have caused the distribution to have a destructive effect on its net asset value. Indeed, the fund’s net asset value is down 36.08% over the past three years:

Seeking Alpha

This suggests that we should have some serious questions about this fund’s ability to sustain its net asset value. We should investigate in order to determine if this is indeed the case.

Unfortunately, we do not have an especially recent report that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. As such, this report will not include any information about the fund’s performance over the past six months. This is disappointing, as the past six months were characterized by generally rising interest rates that almost certainly had a negative impact on the assets in the fund’s portfolio. This report will not give us any idea of how well it handled this market environment. Rather, what we will get here is mostly how well the fund performed in the generally easy market that dominated the first half of this year. That was a period of time when just about anyone could make money as investors were bidding up assets in expectations of rate cuts (that have not materialized).

During the six-month period, the Advent Convertible & Income Fund received $15,487,431 in interest and $2,062,664 in dividends from the assets in its portfolio. This gives the fund a total investment income of $17,550,095 over the period. It paid its expenses out of this amount, which left it with $5,957,893 available for the shareholders. As might be expected, that was nowhere close to enough to cover the distributions that the fund paid out over the period. This fund paid out $24,326,338 over the period. This is something that could be very concerning to any reader, as it suggests that the fund is not generating nearly enough investment income to afford the distribution that it is paying out.

With that said, this fund does have other methods through which it can obtain the money that it needs to cover the distribution. For example, it might have been able to generate capital gains through either price increases of the securities in its portfolio or by converting securities into common stock. The fund had somewhat mixed results in this task during the period. It reported net realized losses of $3,709,263 but was able to offset these with $19,667,195 net unrealized gains during the period. Overall, the fund’s net assets declined by $2,410,513 after accounting for all inflows and outflows during the period.

Thus, we can see that the initial guess was correct. Advent Convertible & Income Fund’s distribution is currently too high, and it is destroying the fund’s net asset value. This was the case during the preceding year as well, as the fund’s net assets declined by $266,198,518 during the full-year period that ended on October 31, 2022. We now have a situation in which the fund is clearly unable to sustain its distribution, and the declining net asset value makes this an ever more difficult problem for the fund to fix. Investors may have to prepare themselves for a cut at some point.

Valuation

As of November 9, 2023 (the most recent date for which data is currently available), the Advent Convertible & Income Fund has a net asset value of $11.18 per share but the shares currently trade for $10.11 each. That gives the fund’s shares a 9.57% discount on net asset value at the current price. This seems like an overly small discount considering the potential risks to the distribution, and in fact, it is not nearly as attractive a price as the 12.22% discount that the shares have had on average over the past month. As such, it may be a good idea to wait for a better price before buying the shares.

Conclusion

In conclusion, the Advent Convertible & Income Fund is one of the more novel closed-end funds available in the market today, as it is one of the few that invest in convertible securities to any significant degree. These can be very attractive securities for income investors, as they allow an investor to receive a regular stream of income just like a bond, but it is not necessary to sacrifice the upside potential of common stock to obtain income. Unfortunately, the risks here are pretty high. This is one of the most leveraged funds that is available in the market today and its distribution has been destructive to its net assets for the past eighteen months at least. As the current valuation is also a bit higher than normal, it might be best to wait for a better entry point.

Read the full article here