Shares of Bank OZK (NASDAQ:OZK) are still lower than a year ago despite rallying substantially off of their lows. OZK has underperformed the broader market even as it has continued to report solid results, due in part to fears around regional banks following Silicon Valley Bank’s failure. However, OZK has proven to be a strong player in the fight for deposits. Over the past week, shares have been hammered over 13% after New York Community Bank (NYCB) reported large reserves on its real estate portfolio. While OZK has outsized real estate exposure, this is an opportunity to buy shares.

Seeking Alpha

Taking a step back, in the company’s fourth quarter, OZK earned $1.50, beating estimates by a nickel as revenue rose by 14% to $411 million. Full year earnings came in at an impressive $5.87 while it has a $36.58 tangible book value. Aided by its exposure to the Southeast, OZK has been aggressively growing. As a consequence, it halted buybacks during Q4, to fund loan growth instead. Still, its share count fell by 3.4% in 2023 to 113.1 million thanks to buybacks earlier in the year.

For investors in regional banks, I believe there are two items to focus on. First, the bank needs to have shown deposit stability. Second, credit quality trends and adequate reserving are crucial as we head into 2024. Looking at OZK, it passes the first test with very strong results.

Even as the industry has faced deposit outflows, OZK has been a grower. Deposits rose by $1.8 billion sequentially to $27.4 billion. This is up by over 25% from a year ago. 82% are insured or collateralized, which is a reason its base has been so stable. OZK has $4.1 billion in noninterest bearing deposits, down by $200 million last quarter. The pace of outflows here slowed sequentially, and we are likely near a floor.

OZK has been fairly aggressive in pricing deposits, which is why it has won significant market share. As of Q4, it is paying 3.89% on interest-bearing deposits, up 41bp sequentially and 256bp from a year ago. That is nearly 1% higher than competitors like Fifth Third Bank (FITB). Ultimately, if you offer higher deposit yields and are a financially sound bank, funds will flow to you. Because lower-yielding time deposits are still rolling off, management expects deposit rates to rise “over the next few quarters”

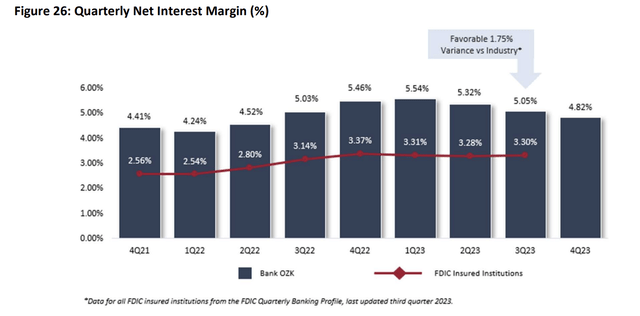

Now, this increase in deposit yields has reduced OZK’s net interest margin (NIM). As you can see below, NIM compressed by 23bp sequentially to 4.82%. Still, OZK’s balance sheet growth has more than offset its narrowing margins. As a result, net interest income (NII) was a record $371 million, up 1% sequentially and 11% from a year ago. NII rose during each quarter in 2023, which is highly unusual in a sector that has faced deposit outlaws and increased funding costs.

OZK

Even as OZK pays above-average deposit yields, it has maintained a wide NIM. It has been able to pay up for deposits because it has a strong, growing loan book, and it is not saddled with underwater fixed rate exposure. Many regional banks have large losses in accumulated other comprehensive income (AOCI) from securities purchases when yields were much lower.

These low-yielding assets restrict how much those banks and pay for deposits. Importantly, OZK has a very small securities portfolio of just $3.2 billion. Even as it has grown its assets over the past year, this portfolio is down by $0.3 billion from a year ago, making it even less relevant. It has a 2.84% yield, up from 2.66% last quarter. This portfolio also has a 3.8 year duration, and $1 billion in 2024 maturities. With these maturities, OZK can reinvest at much higher yields and boost net interest income.

With a small and shrinking securities portfolio, the focus of OZK’s balance sheet is loans. It has $26.4 billion in loans, up nearly $6 billion over the past year. Loan yields rose by 6bp sequentially to 8.64% as most are floating rate. This high asset yield more than pays for a higher deposit cost.

One thing I like about OZK’s loan book is that while its loans are floating rate, most have floors, which will limit how far yields can fall as the Fed cuts rates. Essentially, they float if rates go higher, but become fixed if rates fall by over 1-1.5%. If rates do fall substantially, OZK’s deposit yields will come down but asset yields will stabilize, which will support NIM expansion in 2025. As it is, even if NIM contracts, management expects net interest income to stay around Q4 2023 levels through 2024, or up by about $44 million from 2023 levels, thanks to asset growth.

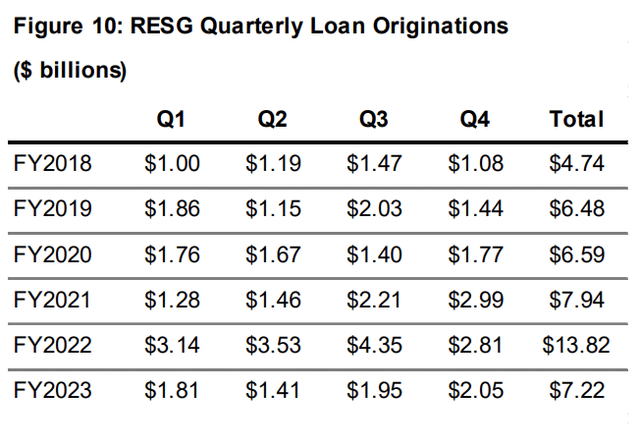

What has hit shares recently is that OZK is primarily a real estate lender. Real estate lending accounts for 65% of its non-purchased loan book. As you can see below, while it has slowed originations from the breakneck pace of 2022, they do remain elevated at $7.2 billion. They have also recently accelerated as management has decided the higher rates on these loans more than offsets the risk facing the sector.

OZK

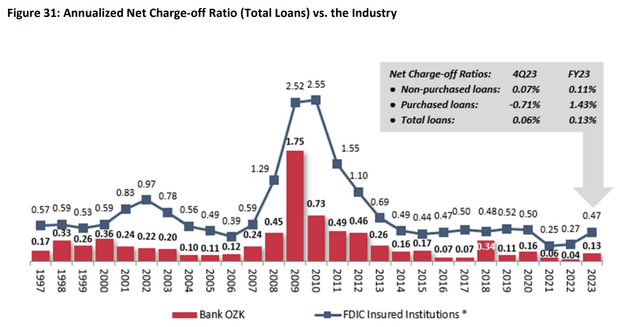

While I am cautious on elements of real estate, on the whole, I agree with OZK’s management here. First, I think it is important to note that management begins with credibility. The bank has historically been a good underwriter. It had just 13bp of charge-offs in 2023. Management expects some increase to still-below industry levels in 2024. As you can see below, OZK has consistently had better net charge-offs than the industry, in large part because its loan book is largely secured by assets.

OZK

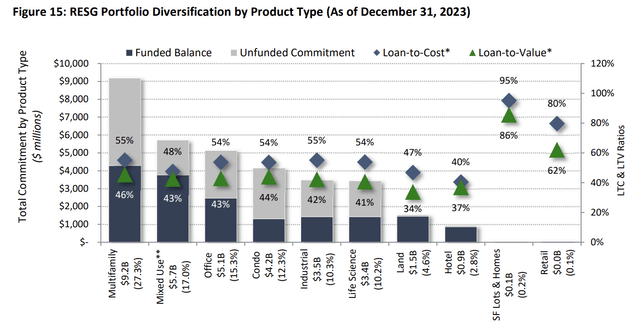

While OZK has grown loans aggressively, it has a fairly conservative approach to underwriting. If every loan is fully drawn, its real estate loan-to-value is 52%. Essentially, asset values could nearly be cut in half in aggregate before OZK faces losses. Additionally, the majority of loans are new construction. Particularly in office, which faces demand issues, I expect new properties, with more amenities and better energy efficiency to outperform demand for older assets. As such, the buildings it is lending to should see better-than-industry performance. Furthermore, the Southeast is seeing ongoing economic and population growth, which should support real estate demand.

OZK is not primarily a legacy office lender—an area where I expect significant losses. Indeed, most of its buildings are residential, with multifamily, condo, and mixed-use nearly 57% of its portfolio. Office is just 15% of the portfolio with a loan-to-value of just 43%.

OZK

Not all real estate exposure is equal. OZK’s sunbelt, multifamily focus as well as its strong asset coverage should limit losses. It also is conservatively reserved with $501 million in allowances, or 1.07% of loans and unfunded commitments. That provides more than 400% coverage of its $123 million of nonperforming assets, well above the 250% level I view as healthy. OZK even added $40 million in reserves in Q4 because it is weighting reserves to an “economic downturn” scenario even as a recession seems less likely.

In other words, OZK has built such large reserves that we likely would have to see a meaningful deterioration in credit before it needs to set aside further funds for loan losses. Beyond strong reserves, OZK is conservatively capitalized. It has a 10.8% common tier 1 equity (CET1) ratio, above the 9.5-10% I would view as necessary to maintain given its loan book. With this excess capital, OZK can continue to grow its loan book and deposit base, building further scale, or if shares fall further, it can launch a buyback.

Assuming a similar pace of reserve building as in 2023, modest expense growth, and flat net interest income, OZK should earn $6-6.10 in 2024. At 7x earnings, shares are now clearly on sale. Unlike some banks, OZK already has conservative reserves and a fairly attractive real estate portfolio. This knee-jerk sell-off has created an opportunity, and I view shares as a compelling buy. Given its real estate focus, I do not expect it to get to 10x earnings, but I view 8.5-9x as a reasonable target as ongoing solid underwriting results calm investors. That can push shares to $52-54, or about 25% higher than current levels.

Read the full article here