Dear readers/followers

You may recall that a number of months ago, back in March, I started covering a UK-based REIT called Big Yellow (OTCPK:BYLOF). I considered the company a “BUY” at the time, and now I’m updating given a double-digit outperformance to market. I’m downgrading the company at this time for reasons related to company valuation – in layman’s terms, it’s become too expensive at this particular time.

The Big Yellow Group is the largest self-storage business in the UK. I’ve recently covered other UK REITs as well that you’ll see articles on here on Seeking Alpha, and I believe the UK market offers a very compelling, low-valuation entry into what is without a doubt – to my mind – qualitative real estate plays.

And this company, dear readers, is most definitely one of those plays.

I invest quite a bit in European REITs like Gecina and Icade, as well as now in the Supermarket Income REIT (OTCPK:SUPIF), which is one of those plays you will get to read about. But the point here is Big Yellow. Since my last article, we can see the following outperformance for the company here.

Seeking Alpha Big Yellow Article TSR (Seeking Alpha Big Yellow Article TSR)

As you can see, the outperformance is material, indicating if nothing else that the short-term valuation at the time of my last article was wrong.

There’s no doubt to me that European REITs are more volatile than their American counterparts. However, I really believe that this has to do with them being misunderstood in terms of risk/reward, such as aforementioned Icade and Gecina. While the European real estate segment is currently in a downturn, this creates what I believe to be excellent investment opportunities for the next 5-15 years.

And above all, I look to the long term.

Aside from that, England or Great Britain is a great market for me. There is no dividend withholding tax, which makes any investment there even more hassle-free than most of the other European markets I invest in, even with my current circumstances of getting 99.8% of all withholding back within 12 months (specific DTS circumstances in Sweden relatively unique to our tax domicile). So I have a stated target of finding attractive UK-based plays/LSE-based tickers.

Let’s see, therefore, what we have here.

Updating on Big Yellow – a lot to like even now.

So, a quick rundown of the company again, self-storage player, the biggest in the UK, has never missed a 5-year estimate negatively, and one of the trickiest markets not only in the UK but in Self-storage. It’s already part of the FTSE250, and According to surveys done by the Self-Storage Association in the UK, Big Yellow has the largest brand awareness in the UK self-storage sector.

It’s comparable, as I see it, to something like Public Storage (PSA) here.

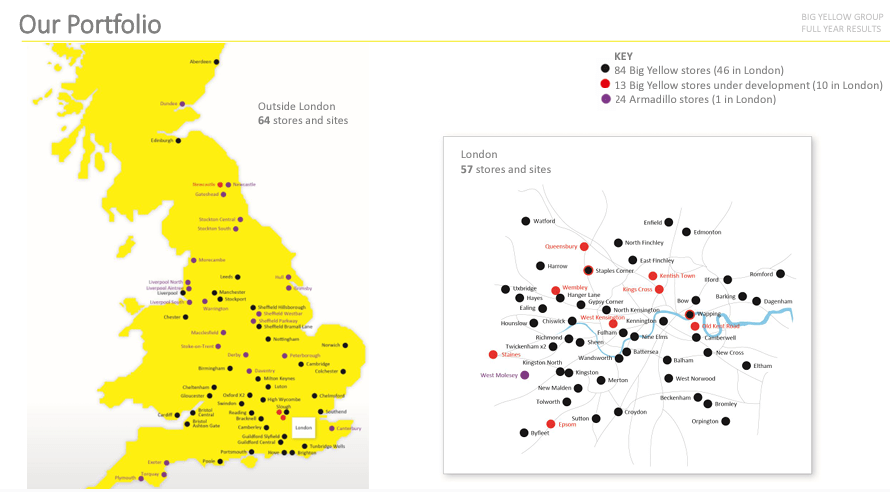

The company is 26 years old, and exists in the following geography, with an apparent focus, as you can see, on the larger London area.

Big Yellow IR (Big Yellow IR)

As I said in my initial piece, the company is in a very underpenetrated and fragmented market, offering both growth and consolidation potential. This is unlike the US, which I would characterize as a mostly mature market, especially on the coasts and in urban areas.

With customer satisfaction and other quality indicators and the company already mostly digitized, Big Yellow already operates what in the USA would be considered a qualitative operation with scale and very good synergies. The company’s assets are primarily freehold RE, with a concentration in large population areas like London and the Southeast.

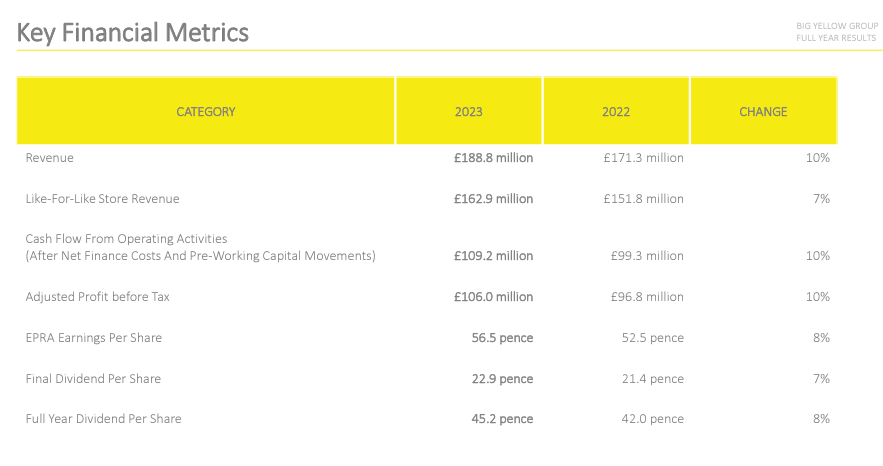

The company’s metrics continue to show growth over time, and we’re not just talking about any growth, but double-digit growth in profit and revenues.

Big Yellow IR (Big Yellow IR)

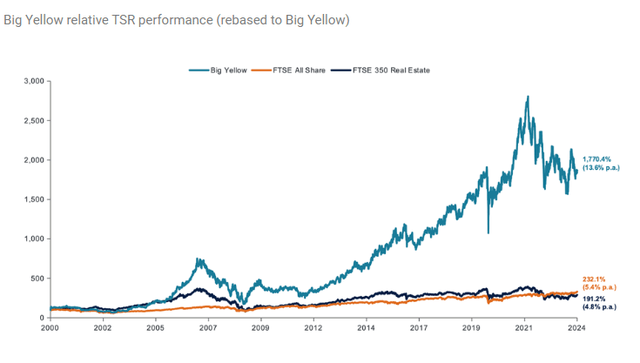

The big news is that we have end-year results reported as of May 20th. But first, I want to show you Big yellows overall returns over time, if you had invested in the company. We’re talking quadruple digits 20-year returns, and significant overall market outperformance.

Big Yellow TSR (Big Yellow TSR )

Key KPIs for the full fiscal of 2024 include significant revenue growth, a 7% growth in store EBITDA, a 1% growth in profit before tax adjusted, and a flat dividend that nonetheless keeps BYG’s payout and yield at a competitive level in the broader perspective, though not necessarily “great” as such.

BYG currently has a market cap close to £2.5B, which once again makes it a relatively small player. But I want to be perfectly clear that this company does not miss estimates. Despite the lack of a credit rating, the sheer forecast accuracy and earnings and dividend safety could arguably raise it to the safety level of something like a larger, US-based storage REIT.

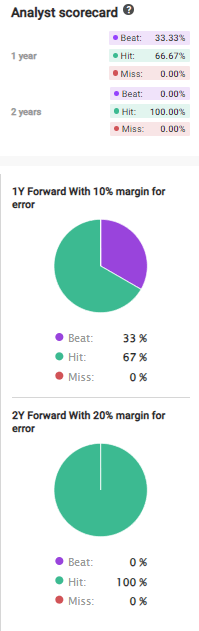

BYG Forecast Accuracy F.A.S.T Graphs (BYG Forecast Accuracy F.A.S.T Graphs)

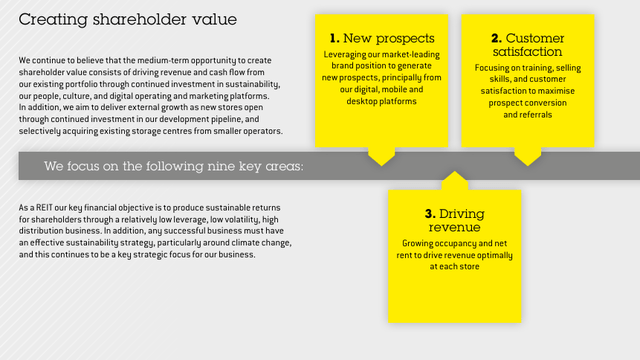

The company has the core focus of driving shareholder value through a combination of new prospects, customer satisfaction, revenue driving.

BYG IR (BYG IR)

Operating numbers for the year and overall demand indicators are very solid. The total number of move-ins is up 1% for the year. The company characterized this as “muted conditions”, which mirrors what we’re seeing across the pond in the US. Companies are seeing the effects of higher inflation and higher cost awareness. Current occupancy in the established BYG units/stores is at around 84-85%, which is slightly down from last year, with a total occupancy across the entire group nonetheless above 80%. This is slightly below some US averages. I would characterize the reason for this not as a requirement of growing the company portfolio, but rather a current general muted trend, that’s likely to reverse over time as inflation and other indicators do so.

BYG IR (BYG IR)

The full-year results, while muted, provide a good basis for further growth and profit for Big Yellow. The market dynamics, as I see them, are intact. The UK self-storage market remains underpenetrated, especially in urban areas, where concentration remains low. Even at an average 80% occupancy, the company can drive profit with such numbers. Self-storage is also far more a part of the current societal ecosystem than it was only 20 years ago, and the company, like its US counterparts here, has shown resilience and excellent performance during the pandemic.

Out of other self-storage players, BYG is by far the largest in the UK, with 90% of inquiries now online-based, and the company’s stores are usually located on arterial or main roads, with extensive frontage and high overall visibility. Continued innovation and investment CapEx means the company’s technology and solutions are up to par here, and the company’s customer satisfaction scores are, as mentioned, one of the highest out there.

Fundamentally speaking, despite the lack of a credit rating, nothing is really in a worrying state here. BYG has less than 15% long-term debt to capital, making it one of the most conservatively leveraged players in the entire industry.

Let’s look at the updated valuation.

Valuation for Big Yellow – no longer as appealing

So, unfortunately, we no longer have an appealing valuation for entry with Big Yellow. That has nothing to do with company fundamentals, but instead everything to do with pricing for the share. It’s a bit sad that I “have to” change my rating only 2–3 months, but that’s what I do when new facts present themselves – I change my thesis.

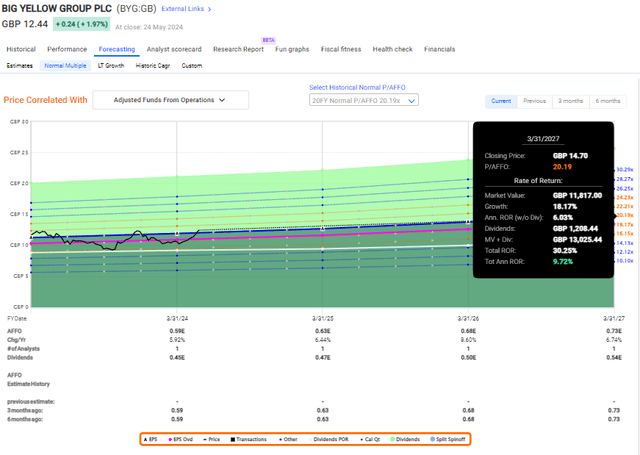

The new fact here is that we have BYG trading at a P/AFFO of something like 20x, which is not only on par with but above companies like Public Storage (PSA), a similar REIT where I own a significant portfolio stake. PSA, as a comparison, trades at around 18x, but with a yield of 4.41%, far above that of BYG at 3.6%, and also comes with very compelling accuracy ratings. That would mean that currently, between these two, PSA is by far the more preferred “BUY” as I see it, and is also reflected in the fact that I recently added to PSA – but did not add to BYG.

BYG instead offers us the following upside at a P/AFFO of 20x.

Big Yellow Upside F.A.S.T graphs (Big Yellow Upside F.A.S.T graphs)

And despite the company’s fundamentals, I remind you that I in fact, in my last article, put my PT on BYG at a level of £11/share. I also mentioned that it becomes more interesting as it drops below the 18x level, which it hasn’t. It has instead approached 21x.

Therefore, my stance change to “HOLD” is entirely logical and in line with my overall expectation of a PT of £11/share, and where I put my attractive target ranges.

Other analysts are fairly clear on where they consider this company to be interesting. Big Yellow is currently followed by 15 analysts, 7 of which give the company a positive “BUY” or “outperform” rating. This comes with a low PT of around £9 to a high PT of about £14.3. The average lies at £12.1, which at a price target as it currently is does not really give us any sort of upside.

We’re also no longer buying BYG at a discount to EPRA NAV. We’re, in fact, paying a non-trivial premium to the company’s EPRA NAV of just above £11/share. (Source: Author calculations, Big Yellow Group IR)

For that reason, I no longer believe this company to be a worthy investment for any value-oriented investor’s portfolio, and would consider it a “HOLD” with the following updated thesis for May of 2024.

Thesis

- Big Yellow Group is Great Britain’s largest self-storage REIT and one that I view as still in its basic growing stages. This company has what I view as a bright future and good prospects to grow even further both inorganically and organically as its services expand to other UK cities and geographies.

- I also want to point to the company’s fundamentals, which are actually very solid. The company may lack a formal credit rating, but it nonetheless offers safety to a degree that I consider to be good enough for investing. It’s diversified enough that the company isn’t likely to see a sudden downturn from any one market, with perhaps the exception of London, which I consider unlikely.

- However, as of the most recent update, we do have the company rising too far based on my share price target – and I am not changing my share price target here.

- I consider Big Yellow Group to be a “HOLD” with a PT of £11/share and a P/FFO target of around 18-20x P/FFO at most, and becoming less interesting as it rises above 20x.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

For that reason, the company doesn’t fulfill my valuation-related criteria, and now represents a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here