SL Green (NYSE:SLG) management never got the memo about the supposed downturn in “office.” Let’s hope they never get it as business is absolutely booming while the rest of the industry has a very different story.

Here is a summary of some of the second quarter accomplishments:

” SL Green Signs Retail Leases Totaling More Than 66,000 Square Feet”

” SL Green Announces Sale Closings Totaling $691 Million”

” SL Green Announces Sellout of Giorgio Armani Residences at 760 Madison Avenue”

” SL Green Office Leasing Volume Exceeds 1.4 Million Square Feet in 2024″

And just for good measure, management also slightly raised the guidance range for cash flow for the fiscal year. There was also an announcement that the summit part of the business will open a location in France. So, the company will now expand to the international part of this business. If business gets any better, this REIT will soon expand more operations.

All this is happening in New York City, which “everyone” knows was never supposed to recover. The key here seems to be what management discussed back when doing investor day. “You have to have the right price for the market conditions.” Clearly this company has the right price and inventory is moving. Occupancy of the buildings overall moved up slightly with all this activity.

This continues the progress noted in the last article. It’s not like all this activity just began. Instead, management reported that they are on track with the business plan they submitted during investor days toward the end of last year. In fact, they are ahead on a large number of plan goals and behind on only a few.

The market has long had doubts about the business plan. After all, any of us can name more than a few office REITs that are having a rough time. Not many of us can name another REIT matching this office specialist.

There was a mention of a building that will be converted to housing from office, and that process is likely to start next year when the planning completes. But clearly, the office business here is unlike the office business throughout much of the industry. The outperformance is stunning.

Earnings

Even the earnings show signs of the boom times management is talking about.

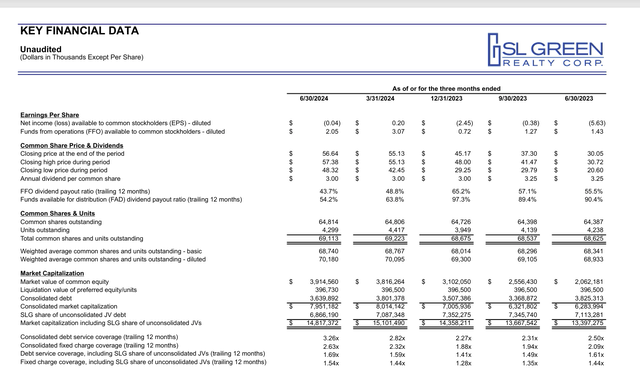

SL Green Summary Of Key Earnings Second Quarter 2024 (SL Green Supplemental Earnings Calculations Second Quarter 2024)

So far, the funds flow from operations is holding up much better than it was for the three quarters shown in the previous fiscal year. The latest quarter funds flow from operations may be down from the previous fiscal year. But the per share amount is far better than the previous fiscal year.

As a result, the ratios shown at the bottom are also better than they were a year ago.

It does appear that all this business has management relaxing some of the debt paydown goals, at least temporarily. But that may not concern investors as long as the current business pace keeps up. The activity levels would at a macro level appear to allow for more debt to accommodate business opportunities.

The likely key to earnings improvement is that this management “takes their lumps” and quickly moves on to the performing parts of the business. So many managements in many types of businesses wait “for value” in a less than desirable situation. Sometimes that leads to that part of the business sinking the company, or at least causing a financial panic. Here, decisions are quickly made, and the focus is on the part of the business that is successful.

The result is a company leading an industry recovery, when really the recovery has not begun yet for much of the industry.

Stock Price

It looks as though Mr. Market has noticed.

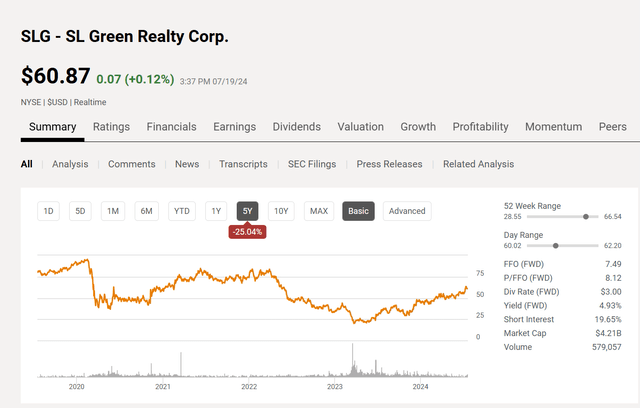

SL Green Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 19, 2024)

Clearly, the stock price has bounced off the low, back in fiscal year 2023. In fact, the stock price has more than doubled off its low.

As an aside and as a contrarian investor, this looked like good value to me around $40 and the first article came out with a buy near that. One of the very typical reactions to the fact that I rarely if ever find the bottom was that the stock went lower, and the comments on those articles indicated that Mr. Market was darn sure this stock was “going to the woodshed.” There was going to be a bloodbath and, man, would I be sorry I got in?

But even missing the bottom, I have a very reasonable profit from that level because I purchased what I thought was a bargain. More to the point, as the chart clearly shows, the stock price had previously gotten near $80. So, when I purchased at $40, the stock had already declined 50%. Now, if that previous high was not based totally on a fantasy idea, then the decline should have taken out a lot of the downside risk.

That appears to be exactly what happened. I had chances to buy more if I wanted to. Many investors will open a position and then average down, knowing that Mr. Market often goes to unimaginable extremes. Clearly that happened here because the market did not believe what management had to say on investor day.

But when management continued to execute as planned, then the market took notice because clearly when management stated they had the right price, they were not kidding.

This shows several well-known parts about contrarian investing that make contrarian investing difficult for most people. Most great investors like Peter Lynch and John Templeton buy bargains. Too many investors want to find the bottom. This is something that great investors just do not spend time on. It’s also why great investors often get good results. They may be invested too early, and they also get out too early in the eyes of many. But they sure make money doing what they do.

Summary

This contrarian idea is coming together rather quickly. The recovery in this company is on track because they really never participated in the current office downturn.

This management differs from some REITs in that the emphasis here is on buying and rehabbing old buildings in great locations (and then filling them up). This is a business that not only looks for value, but then adds more value through the upgrading process. Clearly, this is working for the company.

The expansion into France has to be a risk elevator until it’s proven that management can properly deal with this new situation. However, given the past record here, I like the chances of success. Nonetheless, a little caution is called for.

There’s one full building that needs to be rehabbed, and it’s a big one. However, given the success of this strategy in the past, the chances are good for success with this project. However, the completion of the whole process may free up more money for shareholders next year. It all depends upon what’s available for upgrading and what management decides to do.

The continuing rise of occupancy (in a market where few have any occupancy increases) and the rise in rents would appear to validate the budget and likewise indicate more FFO in the next fiscal year for shareholders.

As a result, this stock remains a strong buy as management continues to build the business and returns to shareholders. There’s an old saying about buying good management and the rest will follow. Clearly the rest is following here, and the stock price shows it.

Risk

Interest rates are always a key risk for an REIT, as that can affect values and all kinds of business activity levels depending upon what’s causing those rates. Therefore, any REIT investor needs to watch the economy closely and the Federal Reserve response to economic conditions. Right now, that trend points towards declining interest rates (which is good) but that can change on short notice.

Next year, some tax cut provisions are scheduled to expire. Should that happen, that’s basically the same as a tax increase, which is generally not good for real estate. If those tax cut provisions are renewed, then there’s a huge budget deficit that likewise needs to be dealt with. Either way, a potential recession is likely. It may well be of short-term duration, as the Federal Reserve has been independent under this administration. The Federal Reserve therefore acts as it feels best. We, as a country, have the best inflation record in the world when the Federal Reserve is left to act on its own.

The ability to “have the right price” in the current environment is a rare ability, as shown by the sheer number of “office” REIT’s that are experiencing a downturn. Therefore, the loss of key personnel behind that “right price” strategy would be a significant setback to this company.

Read the full article here