Investment thesis

Our current investment thesis is:

- Burlington has generated impressive returns through its quality business model. The company is able to attract regular visits from customers, withstand the threat of e-commerce, grow its store count, and generate healthy margins.

- The pandemic has contributed to a decline in margins, although the business is in a period of improvement as pressures subside and demand remains robust.

- Burlington has shown an impressive ability to outperform, achieving double-digit growth in its most recent quarter despite the economic slowdown.

- Despite its respectable performance relative to peers, we do not see upside at its elevated valuation.

Company description

Burlington Stores (NYSE:BURL) is an American discount department store chain that offers a wide range of branded and private-label products, including apparel, footwear, home goods, and accessories. The company operates under the “Burlington” brand and aims to provide customers with quality merchandise at affordable prices.

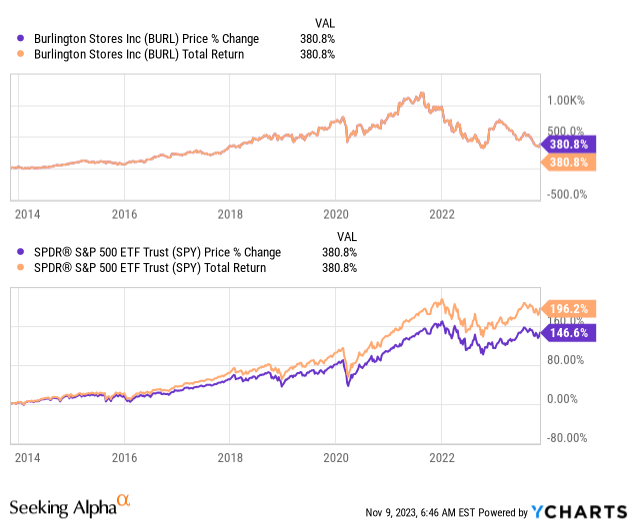

Share price

Burlington’s share price has performed exceptionally well, returning over 350% to shareholders during a period in which the S&P has only risen over 150%. This is driven by strong financial results alongside a healthy development in its commercial profile.

Financial analysis

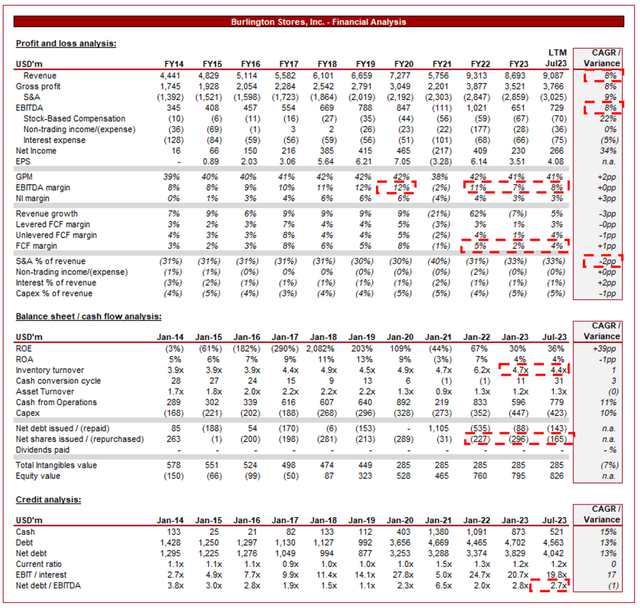

Burlington’s financials (Capital IQ)

Presented above is Burlington’s financial performance in the last decade.

Revenue & Commercial Factors

Burlington’s revenue has grown at a CAGR of 8% in the last 10 years, with highly consistent growth in the lead-up to the pandemic, and a return to this from FY22.

Business Model

Burlington Stores follows an off-price retail model. It sources brand-name, unbranded, and designer merchandise from manufacturers and retailers at discounted prices due to overstock, closeouts, and canceled orders. These products are then sold to consumers at prices significantly lower than department stores and specialty retailers, creating an attractive value proposition to consumers.

The “treasure hunt” shopping experience is central to Burlington’s business model and is quite unique (and intriguing). The constantly changing inventory of discounted products, driven by the access to products and opportunities available, encourages customers to visit stores regularly, creating a sense of urgency and excitement (with marketing focused on this). This has afforded Burlington, and its direct peers, an impressive level of customer visits, far above the wider industry average. This is highly lucrative due to the correlation between visits and purchases.

Burlington’s inherent focus is on delivering value to consumers through its “More for Your Money” philosophy. For this reason, it generally targets those in the lower income brackets, although is wide-reaching to those who are value orientated.

In order to maximize its reach and target market, Burlington offers a wide variety of products across categories including apparel, footwear, home goods, furniture, toys, and more.

Burlington’s inventory turnover is relatively quick due to the nature of off-price retail. In many cases, the company can only purchase a limited amount of goods, many of which will sell rapidly. The limited-time availability of products encourages customers to make decisions on the spot, further fostering a sense of urgency and spontaneity in purchasing. Operationally, this is also beneficial as it improves cash conversion and reduces the downside of stock build-up if demand unexpectedly declines.

Burlington’s growth has been driven by an aggressive store expansion strategy. The company has opened new stores in both existing and new markets, allowing it to capture a larger customer base and increase its geographic footprint. Although e-commerce has represented a major issue for most retailers, contributing to declining margins and poor growth, Burlington has been able to maintain growth and footfall. This is due to the “treasure-hunting” business model, which does not translate well online. Consumers currently see sufficient value to continually visit Burlington’s stores, an impressive achievement given the benefits of e-commerce.

Competitive Positioning

Burlington has optimized its supply chain to ensure the efficient movement of merchandise from suppliers to stores. Its ability to source and deliver attractive products quickly is vital to the success of its model, with revenue suggesting an impressive ability.

Unlike many of its directly comparable peers, the business has a focus on mixing in unbranded/highly-affordable products within the range of branded and designer products. This increases the range of products and options for consumers to choose from, while diversifying its reliance on highly coveted products. The business can thus always maintain its reputation for deals and bargains.

Burlington launched a customer loyalty program called “Burlington Loyalty” to incentivize repeat business. The program offers benefits such as exclusive discounts, special offers, and early access to new arrivals. Various retail industries have seen strong success with such programs, encouraging repeat purchases and providing invaluable data for targeted sales/product purchases.

Burlington often seeks to lease or buy space in shopping centers or malls where other anchor tenants have vacated, allowing it to secure prime real estate locations at favorable terms. These prime locations have broad access to key demographics, improving the ability to maintain and grow footfall.

Burlington faces competition from various retailers in the discount and off-price retail sector, including Ross Stores (ROST), TJX Companies (TJX) (T.J. Maxx, Marshalls), and Kohl’s (KSS).

Retail Industry

E-commerce Growth continues to pose a reduced (relative to the wider industry) risk to Burlington. Consideration must be made to whether the development of e-commerce capabilities could be an option for the business, utilizing its stores as export hubs.

Burlington’s key opportunity is to open new stores in underserved markets, allowing the business to gain greater market share as its wider peers retreat and focus more greatly on e-commerce.

A continued widening of the wealth gap, as well as mediocre wage inflation, has the potential to gradually worsen the financial position of many. This is particularly the case if we experience another period of inflation exceeding wage growth. This has the potential to encourage more value-oriented individuals to shop with Burlington.

Economic & External Consideration

Current economic conditions represent a near-term risk to the business, although we do see long-term potential as struggling consumers get increasingly forced into its demographic, particularly as the wealth gap widens.

With high inflation and elevated rates, consumers are seeing their finances squeezed, contributing to reduced discretionary spending and a negative impact on wealth.

Our expectation is for conditions to remain difficult in the coming quarters, as rates remain elevated in order to combat inflation.

Burlington has done fantastically to buck this trend, with total sales up 8% in Q2, alongside GPM expansion despite pressures on costs. This is a reflection of unwinding inflationary pressures and overhang from its increased pricing. By contrast, both TJX and Rost have also experienced 8% growth in their most recent quarter. There is a risk that growth now slows, which could cause near-term price action from spooked investors.

Margins

Burlington’s margins had been on an upward trajectory prior to the pandemic, currently falling to FY15 levels. This is due to inflationary pressures across the business which it is only now recovering from, with GPM down and S&A spending up.

Our view is that there is scope for further improvement as cost pressures decline, continuing on from its QoQ gains. Due to the inherently competitive nature of the industry, returning to its peak levels will likely take several years.

Outlook

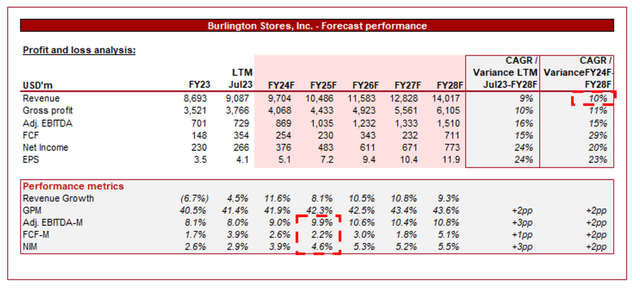

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting 9% growth into FY27, an impressive level given the maturity of the industry. This is a reflection of the resilience of its business model, as well as continued store growth.

Further, margins are expected to gradually appreciate, although will not reach the 12% EBITDA-M it did in FY20. This is a conservative but fair assessment.

Industry analysis

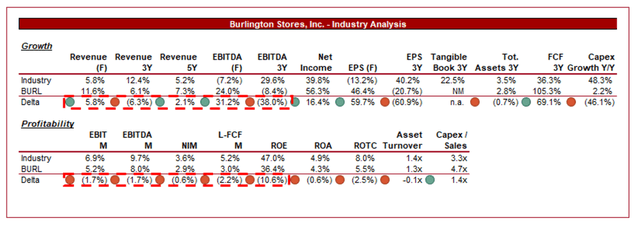

Apparel Retail Stocks (Seeking Alpha)

Presented above is a comparison of Burlington’s growth and profitability to the average of its industry, as defined by Seeking Alpha (25 companies).

Burlington performs well relative to its peers, although is not wholly reflected in the results. Its growth has been strong and outperforms the average, which is impressive given the group includes faster-growing e-commerce businesses.

The company’s current margins are lacking but we know they are on an upward trajectory (which could be the case for many of the other businesses). The important factor is that we know the business has the ability to improve its FCF to a greater degree and has a strong ROE.

Financials are not the only aspect to consider. We believe the Burlington business model is superior to the “average retailers”, with greater demand resilience (as illustrated by the forward guidance), and greater growth potential.

Based on this, we suggest Burlington should trade at a small premium to the average trading multiple of the industry, factoring in the commercial aspects of the business alongside the scope for superior financials in the coming 2-5 years.

Valuation

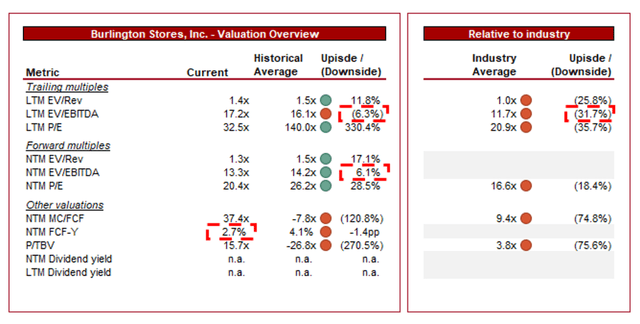

Valuation (Capital IQ)

Burlington is currently trading at 17x LTM EBITDA and 13x NTM EBITDA. This is a discount to its historical average.

Our view is that a discount is justifiable, as the business has seen its margins contract with no clear route to immediate improvement. The business model remains strong and Burlington is inherently highly attractive within the industry, but this was the case for most of the decade (so is priced into the average). With debt now restricting its ability to increase distributions further, we could see returns soften. The decline in NTM FCF yield (-1.4ppts) strongly reiterates our view.

The business is also trading at a substantial premium to its peer group (47% NTM EBITDA and 76% FCF). Again, this is not justifiable based on the financial or commercial profile of the business.

Final thoughts

Burlington is a fantastic business that has made many very wealthy. The share price appreciation is a reflection of its superior business model driving financial improvement. The business now looks to be in a consolidation phase, as it improves profitability and looks to successfully navigate the current economic conditions. We struggle to see any immediate upside given the time needed for its margins, although an earnings beat could certainly cause short-term price action.

Read the full article here