A businessman works at his office on his laptop.

When investing, it is wise to construct your portfolio so that it can handle the worst of situations. This is because according to Murphy’s Law, anything that can go wrong will go wrong.

My approach is to own or consider owning businesses that can hold up no matter what is going on economically or geopolitically. Utilities and most specifically, water is a safe bet in an uncertain world. Even in a recession, nobody is going to be cutting out water from the budget.

As we’ll come to find out as the article unfolds, California Water Service (NYSE:CWT) is a premier water utility. Let’s dig into the company’s fundamentals and valuation to understand why I am initiating a buy rating now.

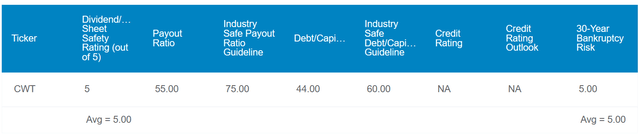

DK Zen Research Terminal

Though it may not catch your attention, CWT’s 2.1% dividend yield is greater than the S&P 500 index’s (SP500) 1.6% yield. What makes it an especially attractive dividend growth pick is that its payout is very safe. This argument is supported by a 55% EPS payout ratio, which is well below the 75% payout ratio that rating agencies prefer from the water utilities industry per Dividend Kings.

Additionally, CWT also has an excellent balance sheet. The company’s debt-to-capital ratio of 44% is considerably less than the 60% that rating agencies view as safe for a water utility according to Dividend Kings. These financial metrics relative to the industry safe guidelines imply a modest 5% risk of bankruptcy in the next 30 years. Thus, the water utility earns a 5/5 dividend and balance sheet safety rating from Dividend Kings.

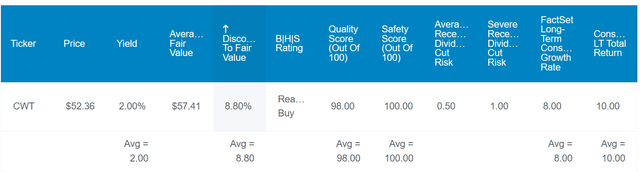

DK Zen Research Terminal

Fundamentals aside, CWT also looks to be a decent value at the current $50 share price (as of November 9, 2023). Based on valuation metrics including historical dividend yield and P/E ratio, Dividend Kings estimates its fair value to be $57 a share – – or about a 14% discount versus the current share price.

If CWT puts up 8% annual earnings growth as expected by FactSet Research per Dividend Kings and reverts to historical fair value, total returns could be as follows over the coming 10 years:

- 2.1% yield + 8% annual earnings growth + 1.5% annual valuation multiple expansion = 11.6% annual total return prospects or a 200% cumulative total return against the 10% annual total return potential of the S&P or a 160% cumulative total return

An Established Water Utility

Founded in 1926, San Jose-based CWT boasts a rich corporate history. Unsurprisingly, the company is a major player in the water utility industry. Serving over 2 million people throughout California, Washington, New Mexico, Texas, and Hawaii, CWT is the largest regulated water utility west of the Mississippi River.

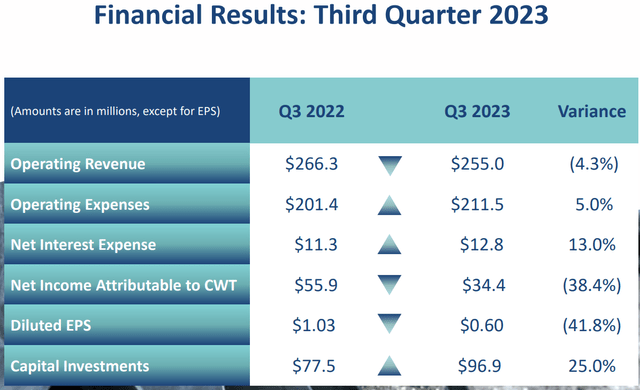

CWT Q3 2023 Earnings Presentation

CWT’s operating revenue dipped 4.3% year-over-year to $255 million for the third quarter ended September 30, 2023. A decline in the topline is something you don’t generally like to see. But considering the circumstances, the water utility’s results were fine.

CWT sustained a $29.6 million drop in operating revenue during the third quarter as its mechanisms to generate this revenue concluded at the end of 2022. This was partially offset by $13.7 million of general rate increases and a $1.8 million reduction in deferred revenue in the quarter. CFO David Healey believes that the delayed rate case with the California Public Utilities Commission impacted revenue by between $14 million and $27 million. Factoring this out, revenue would have grown.

The inflationary environment pushed interest costs and operating expenses higher. Along with the lower operating revenue base, this is what led to a 41.8% decrease in diluted EPS to $0.60 for the third quarter.

Fortunately, there is plenty of good news to report for CWT despite these adverse results. For one, the company anticipates that a favorable decision will be reached by the CPUC in 2024. Upon approval, this will be retroactive to January 1, 2023.

Also, CWT has deployed $274 million in capital to investments year to date per CEO Marty Kropelnicki. This is a record amount, which bodes well for the company’s future growth.

The company also isn’t being financially irresponsible to make these investments happen. CWT had $69 million in cash on its balance sheet (about half was unrestricted) as of Sept. 30 and a short-term borrowing capacity of $485 million (all details sourced from CWT Q3 2023 Earnings Presentation, CWT Q3 2023 Earnings Press Release, and CWT Q3 2023 Earnings Call).

As the CPUC approves new rates and these investments begin to pay off, the company should return to growth. This is why FactSet Research anticipates that earnings will grow by 8% annually over the long term. For context, this is a decent growth consensus compared to many other water utilities. Per Dividend Kings, FactSet Research expects just 6% annual earnings growth from SJW Group (SJW), 4.9% from York Water (YORW), and 2.7% from Middlesex Water (MSEX). Only the likes of American States Water (AWR) and American Water Works (AWK) offer better growth prospects of 14% and 8.5%, respectively.

Solid Dividend Growth Can Be Maintained

CWT has hiked its dividend for 56 consecutive years. These dividend increases haven’t been what you’d expect from such a lengthy dividend growth streak, either. The company’s quarterly dividend per share has grown cumulatively by 38.7% in the last five years to the current rate of $0.26.

Analysts expect CWT to generate $1.86 in diluted EPS in 2023. Against the $1.04 in dividends per share to be paid this year, that equates to a 55.9% payout ratio. Thanks to this manageable payout ratio, decent dividend growth should persist moving forward.

Risks To Consider

CWT is an exceptional business. Yet, even well-managed water utilities aren’t risk-free.

One risk to CWT is that the company is quite concentrated in California: Over 90% of its total operating revenue was derived in the state in 2022 (page 6 of 106 of CWT’s 10-K filing). If CWT can’t get favorable outcomes on rate cases, the fundamentals of the business could be harmed.

Another risk is that the company operates in service areas that are at high risk of earthquakes and wildfires. If major natural disasters were to occur, CWT’s operating results could be significantly disrupted. There is also no guarantee that CPUC or other regulatory bodies would approve cost recovery mechanisms.

Finally, CWT’s stock could continue to be pressured as long as risk-free rates remain high. This could weigh on stock performance in the near term and also make share issuances unfeasible if it persists.

Summary: A Water Utility With Strong Return Potential

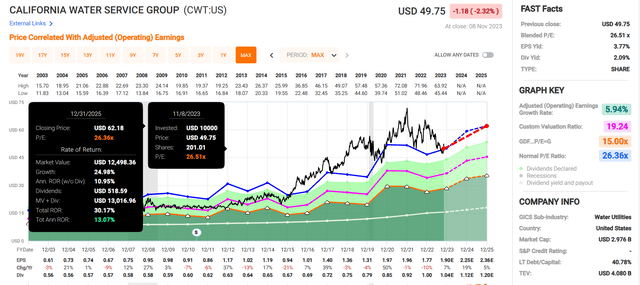

FAST Graphs, FactSet

CWT’s healthy operating fundamentals and balance sheet place it in the company of the best businesses in the world in my opinion. Yet, the valuation doesn’t look to be excessive.

Shares of CWT are trading at a blended P/E ratio of 26.5, which is in line with the normal P/E ratio of 26.4 per FAST Graphs. Coupling the 2.1% dividend yield with 19% consensus earnings growth in 2024 and 5% in 2025, CWT can deliver 13% annual total returns through 2025. That’s why I’m rating the stock a buy at its current share price.

Read the full article here