Summary

A brief update from my last coverage (11th July): I gave Cellebrite (NASDAQ:CLBT) a buy rating as the business’s strong competitive advantage, mission-critical function, and great execution convinced me that it can continue to grow at 20%. In this update, I am revising my rating from buy to hold because valuation has caught up, which makes the upside much less attractive today despite a better fundamental outlook.

2Q24 results perform even better than I expected.

In the latest quarter (2Q24) reported two weeks ago, total revenue came in solid, growing by 25% y/y to $95.7 million, which beat the consensus estimate of 4.1% and my FY24 growth expectation of 20%. In particular, subscription software revenue grew 27% y/y. Profit metrics were also solid, with EBIT coming in at ~$20 million and adj. EBITDA at $21.6 million. By margin, EBIT margin improved by 300bps sequentially and ~840bps annually, while adj EBITDA margin expanded by 290bps and 810bps annually. With the solid performance, management has revised its guidance, now expecting $390 to $398 million (implying 20% to 22% growth) and EBITDA of $90 to $95 million.

Several metrics and initiatives progressing well

The 2Q24 results should further convince investors that CLBT can continue to grow at >20% for the foreseeable future, especially with all the positive progress seen. To start, the leading growth indicator—annual recurring revenue [ARR]—grew even faster than total revenue at 26% y/y to $345.9 million. The key driving force in the ARR growth equation is that cloud and SaaS-based solutions have almost doubled over the past year and are now generating a low-teens percentage of ARR. We know that subscription software revenue is growing at 27% y/y, which means ARR growth can potentially accelerate from here as cloud and SaaS-based solutions become a larger mix of the pie. Qualitatively, comments around Guardian and Pathfinder continue to indicate robust growth ahead. For instance, Guardian customers continue to grow, with the number of users (both examiners and investigators) and data storage having doubled in the last five months. Pathfinder footprint continues to grow and should gradually accelerate as Pathfinder becomes fully cloud-enabled.

Mentioned in the 2Q24 earnings call: We are pleased to see increasing traction for Guardian, our SaaS-based case and evidence management solution. The number of Guardian customers has continued to grow, along with the number of users in terms of both examiners and investigators, and data storage volumes have doubled in the past five months alone to over two petabytes.

We continued to grow our Pathfinder footprint with IUs during the second quarter, and I can say that we are excited about our potential to accelerate penetration into the IUs as Pathfinder becomes fully cloud-enabled over the coming quarters.

Secondly, the upgrading of CLBT’s installed base to Inseyets is progressing really well, which will serve as another strong growth driver in the near term. To put things into perspective, CLBT currently maintains an installed base of ~32,000 public and private digital forensic software licenses, and the expected timeline of completion (for the upgrade) is over 3 years. So far, the conversion rates have been very healthy, so much so that management raised expectations for conversion in 2024 from 10% to 15% of its installed base. As I noted previously, this conversion represents a 20–25% pricing uplift, so it was very encouraging to see the conversion progressing better than expected.

Mentioned in the 1Q24 earnings call: And there is also the investigative units, we are augmenting our continued growth in the digital forensic units by accelerating our business in the investigative units of our customers, maybe more specifically that digital evidence captured by Inseyets, open up cross sell and upsell opportunities for evidence management and analytic solutions.

Now, as we advance these initiatives to capitalize to our upgrade, upsell and cross sell opportunities within our installed public sector customer base, we will see our technology deployed more pervasively as we extend our reach into new units, new departments and new buying centers, what we consider to be new sub-logos within the logos we’ve already captured.

Specifically, on Inseyets, CLBT should see more upsell opportunities as it is currently upgrading the majority of its ~32,000 installed base of public and private digital forensic software licenses to Inseyets over the next three years. Execution has been sound so far in 1Q24, and management is expecting 2H24 and 2025 acceleration. Notably, adoption of Inseyets gives CLBT more pricing power as it provides a better value proposition, which management expects to see a 20 to 25% uplift.

Lastly, CLBT is also progressing well to gain the FedRAMP certification and is now expecting full authorization by 1H25. I see this as another growth accelerator, as it will allow CLBT to deploy their cloud-based offerings at a much faster pace.

Partnerships and acquisition to support growth

CLBT’s GTM strategy, which involves forming partnerships and acquiring other companies, is also showing great process. For instance:

- In late June, CLBT announced that Endpoint Inspector SaaS is now available on Amazon Web Services [AWS] Marketplace. Given the reach that AWS has to thousands of end-users, this greatly improves CLBT’s distribution capacity

- In mid-July, CLBT formed Cellebrite Federal Solutions and acquired Cyber Technology Services, Inc. In the long run, this improves CLBT’s distribution capabilities, allowing it to take part in a wider variety of federal programs and projects in the US. Note that this development also complements to CLBT efforts in gaining FedRAMP authorization.

Warrants overhang gone

An important development in the 2Q24 earnings report was CLBT’s offer to redeem the outstanding warrants to purchase ordinary shares. These warrants include 20 million public warrants and about 9.7 million private warrants. The current expectation is for these warrants to be converted into 8 to 9 million common shares. This is really great for shareholders because it is expected to be ~70% less dilutive than if all of the warrants were exercised for cash.

Valuation

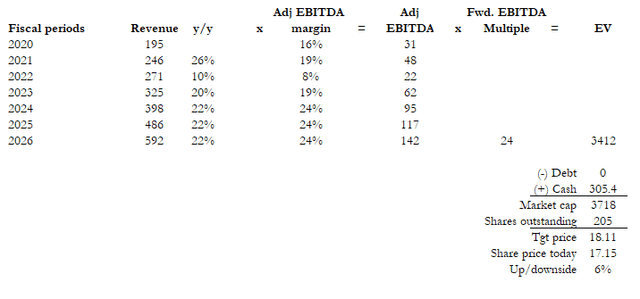

Source: Author’s calculation

In my current model, I have revised my growth estimates up by 200bps, from 20%/year to 22%/year, and my adj EBITDA margin upwards from 20% to 24%, to reflect the strong 2Q24 performance and management revised guidance. Given all the positive progress made and strong growth metrics, I believe the guidance is easily achievable and has the strength to be sustained over the near term.

However, while I am very positive about the business outlook, I think CLBT’s valuation has already priced in all the upside. Currently, the stock is trading at 31x forward EBITDA, a significant premium vs. its historical average of ~24x. Investors hoping for more upsides now have to expect valuation to sustain at this level, which is a risky maneuver in my opinion, as any underperformance is likely to send the stock down.

Based on my conservative assumption on multiples, if CLBT trades back to its average of 24x, the available upside based on today’s price is ~6%.

Conclusion

My downgrade from a buy to hold rating is because the strong valuation appreciation has made the risk/reward situation less attractive today. While I am still positive about the fundamentals, given the growth trajectory and strategic initiatives, I am not comfortable to assume valuation will sustain at 31x forward EBITDA just because growth is now 200bps higher (I now expect growth of 22% vs. 20% previously).

Read the full article here