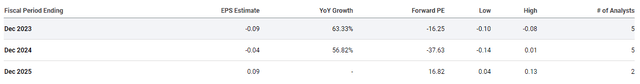

In the volatile arena of healthcare investments, investors are constantly seeking opportunities that not only offer lucrative returns but also align with the developing trends in the sector. One such promising industry that has been gaining traction is the nutraceuticals and supplement industry. As the global population becomes increasingly health-conscious, there is a surge in demand for products that promote well-being. Nutraceuticals and supplements, which include vitamins, minerals, herbal extracts, and other bioactive compounds, play a pivotal role in meeting this demand. Despite these growing trends, I have decided to avoid these investments due to some of these supplement trends being short-lived. However, I have discovered ChromaDex Corporation (NASDAQ:CDXC), whose proprietary platform technology, Niagen, is centered on nicotinamide riboside (NR) to boost NAD+ levels in the body. Not only does ChromaDex have an interesting technology and product, but they have attractive earnings with Q3 total net sales of $19.5M, representing a substantial 14% increase from the prior year. Considering CDXC’s market cap is only $108M, the ticker is trading around 1.3x price-to-sales and is rapidly approaching breakeven. I believe CDXC is flying under the radar, yet, it offers growth at a reasonable valuation. As a result, I am looking to add CDXC to Compounding Healthcare’s “Bio Boom” portfolio watchlist for 2024.

I intend to provide some background on ChromaDex and their Q3 performance. In addition, I will discuss some of the company’s primary growth drivers and the healthcare trends that could fuel the company’s evolution. Then, I will point out some downside risks that CDXC investors need to consider when managing their position. Finally, I discuss my strategy for potentially initiating a pilot position in CDXC in 2024.

Background on ChromaDex

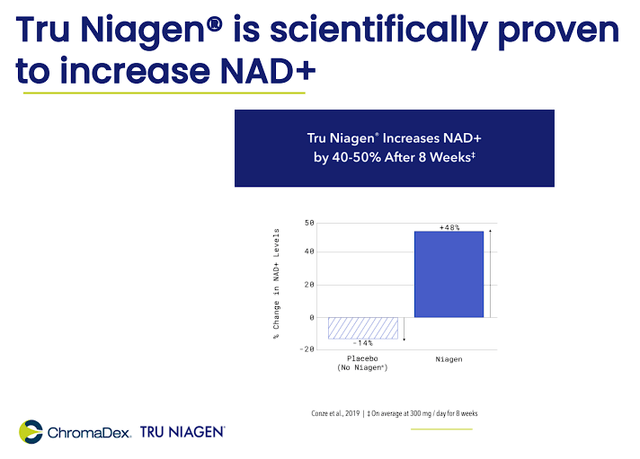

ChromaDex Corp., a player in the health and wellness industry, is taking their proprietary platform technology, Niagen, an innovative technology centered on nicotinamide riboside (NR), a distinctive form of vitamin B3. Niagen is said to boost cellular levels of nicotinamide adenine dinucleotide (NAD+), a vital coenzyme associated with various biological processes and can have a positive impact on aging, metabolism, and overall cellular health.

ChromaDex TRU Niagen NAD+ (ChromaDex)

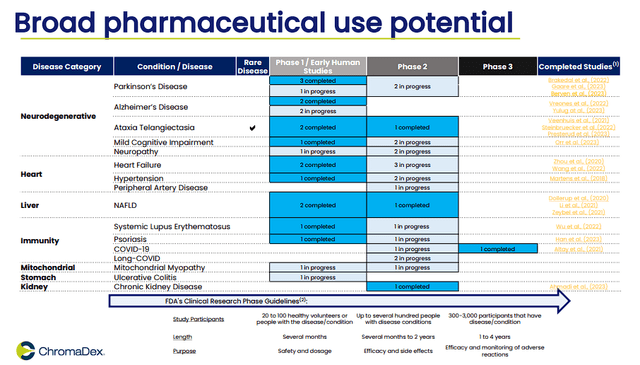

ChromaDex’s robust pipeline is weighted on Niagen and its potential applications in addressing age-related health issues. The company’s consumer product, TRU Niagen, is backed by extensive research, comprising 29 clinical studies and over 100 preclinical studies. Furthermore, Niagen has undergone successful reviews by the FDA, with three notifications under the new dietary ingredient (NDI) program and recognition as generally recognized as safe (GRAS).

ChromaDex NAD+ Studies (ChromaDex)

ChromaDex holds a significant portfolio of over 50 owned and licensed patents connected to the production and distribution of Niagen. Additionally, the company collaborates with more than 275 research institutions globally to explore the full potential of NAD, and expand the utility of its platform technology across different sectors, and possibly make some headway into pharmaceuticals.

Fair Financials

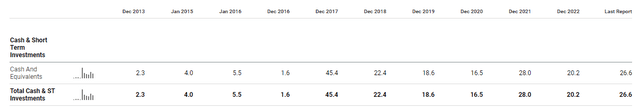

Looking at ChromaDex’s balance sheet on Seeking Alpha, the company has had a fair financial performance over the past decade.

ChromaDex Balance Sheet Cash Position (Seeking Alpha)

The cash and short-term investments have remained stable, with a significant increase observed from 2016 to 2017, indicating strong cash flows. Furthermore, current assets have shown a positive trend, particularly driven by higher cash and short-term investments.

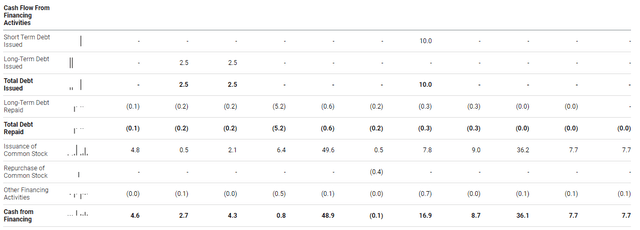

Looking at the cash flow statement on Seeking Alpha, ChromaDex has had challenges in generating positive cash flows from operations but suggests efforts to raise capital through offerings.

ChromaDex Cash Flow From Financing (Seeking Alpha)

Furthermore, The company’s ability to control working capital and work through variations in cash flow has been an ongoing issue. Moreover, the company h.

Despite operating in the red and failing to generate positive cash flows from their core operations, ChromaDex appears to be in a fair financial position, with positive trends in liquidity, solvency, and efficiency moving into 2024.

Q3 Performance

ChromaDex had an encouraging Q3 earnings where they reported total net sales of $19.5M, representing a substantial 14% increase from 2022. Notably, $17.4M of these sales were attributed to Tru Niagen, reflecting a remarkable 19% growth versus the same period last year. A standout metric was the gross margin, which stood at an impressive 61.4%, marking a 160 basis points improvement over the previous year. This improvement can be attributed to supply chain management optimization efforts, including enhancements in yield loss and the realization of economies of scale.

ChromaDex achieved a net loss of $1M, remaining stable year-over-year. This achievement is particularly noteworthy as the prior year’s results included a one-time Employee Retention Tax Credit recognition of $2.1M. Adjusted EBITDA was a positive $0.5M, a hefty $1.7M improvement year-over-year.

ChromaDex Q3 Overview (ChromaDex)

According to Seeking Alpha, ChromaDex’s last reported financial position was $26.62M in cash and no debt.

Growth Prospects

ChromaDex has several growth drivers that could unlock another phase of evolution for the company. I believe the company’s primary growth driver is the rapidly aging global population, and their increased focus on solutions that support healthy aging. ChromaDex, with its NAD+ supplementation efforts, is well-positioned to tap into this growing market. Moreover, the escalating awareness of wellness and preventive healthcare trends further supports the demand for the company’s products.

ChromaDex has strategically aligned itself with partnerships that amplify its reach and impact. Collaborations with research institutions, pharma companies, and consumer brands have opened avenues for its platform technology and products. Recently, ChromaDex successfully launched Tru Niagen on iHerb, a leading global destination for supplements, which should increase their market penetration. Furthermore, the company has also announced a partnership with Zesty Paws, a prominent name in pet supplements. The launch of a Healthy Aging NAD+ Precursor supplement for pets extends Niagen’s market to pets.

Another growth driver comes from clinical validation, which plays a pivotal role in the nutraceutical and supplement industry. ChromaDex’s efforts to adhere to scientific objectivity have instilled confidence in both consumers and potential partners. In fact, ChromaDex introduced Tru Niagen 1,000mg in October, which is the most researched dosage of NR in clinical studies. Thus, providing customers with the optimum clinical dosage to elevate their NAD levels significantly, and providing ChromaDex with a competitive edge in the market.

Growth At A Reasonable Price

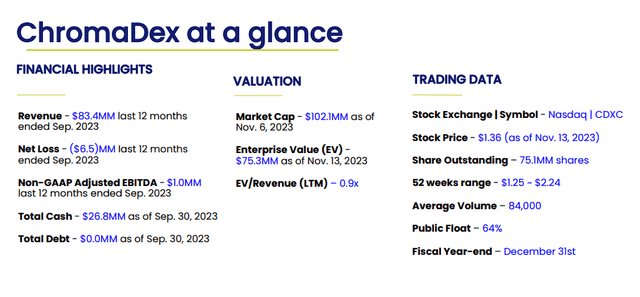

My primary attraction to CDXC is the ticker’s growth at a reasonable valuation. ChromaDex has reported respectable growth and is projected to report double-digit growth in the coming years. Yet, the ticker is trading at a discount for their current sales with a 1.29x forward price-to-sales for their 2023 estimates. Considering the sector’s average price-to-sales is around 4x, we can say CDXC is trading at a discount at this time.

ChromaDex Revenue Estimates (Seeking Alpha)

Not only do Street analysts expect the company to hit those numbers for the full year 2023, but the company expects 14% – 16% revenue growth for the full year, driven by global e-commerce business and new partnerships. Furthermore, the Street expects to cross over $100M in revenue in 2025, which would be less than 1x forward price-to-sales.

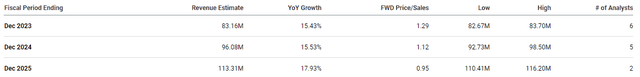

Not only should we see revenue growth, but we should also see CDXC’s EPS move closer to the positive side. The Street projects ChromaDex to report strong double-digit EPS growth these next couple of years and finally report a positive EPS for 2025.

ChromaDex EPS Estimates (Seeking Alpha)

This appears to be achievable considering the company reporting stable gross margin, and reduced SG&A expenses in 2024 and beyond.

Indeed, we don’t know if the company will hit these estimates, however, it does illustrate the opportunity CDXC offers at the moment. Considering the company’s growth drivers and market trends, I don’t see anything that is going to stop ChromaDex from hitting their internal projections and the Street’s forecasts.

If all goes well, the company should be reporting a positive in 2025, with roughly $113M in revenue. Using the sector’s average price-to-sales of 4x, we could see CDXC’s market cap around $450M and trading at around $6 per share. Considering the ticker is trading around $1.30-$1.50 per share, I would say that is a favorable risk-reward. Even if the company was to double their float over the next year, I would still take the possibility of $3 per share in a couple of years.

Risks To Consider

It is no secret that the nutraceutical and supplement industry is incredibly volatile and ChromaDex is not immune to the hazards of this arena. First and foremost, the nutraceutical and supplement industry is subject to evolving regulations. Changes in regulatory frameworks can pose challenges to ChromaDex’s product development and market entry. The FDA and other regulatory agencies have a difficult job regulating supplement companies that are attempting to pull some nefarious tricks on their customer base. Unfortunately, some of these trouble-makers can ruin it for some of the legitimate companies attempting to provide high-quality products to the public. Regulatory agencies may make a broad ruling or policy change that impacts ChromaDex’s ability to manufacture or sell their products.

Another major concern is the competition and the threat of market saturation. The health and wellness industry is highly competitive, and the supplement arena has numerous players vying for market share. ChromaDex faces the risk of increased competition and the potential saturation of the market for wellness products that promote similar benefits to their NAD+-based products. Elysium Health, which also focuses on NAD+ supplementation. Even though ChromaDex is a leader in NAD+ products, they are still attempting to market against countless other supplements and nutraceuticals that can grab the attention of ChromaDex’s customers.

Furthermore, ChromaDex is relying on their TRU Niagen brand and NAD+ pipeline, which makes them niche. If NAD+ supplementation becomes obsolete or overregulated, it would most likely require the company to go back to formula to figure out how they can revamp or pivot the company in another direction.

ChromaDex also has to deal the R&D uncertainties that can impact the successful translation of scientific discoveries into competitive, or possibly conflicting data for nicotinamide riboside supplementation. ChromaDex’s success is contingent on the outcomes of ongoing research supporting the use of nicotinamide riboside and NAD+ precursors, which inherently carry risks.

These risks listed above could have a dramatic impact in ChromaDex’s ability to report growth and hit breakeven. Considering the company only had $26.62M in cash at the end of Q3, we have to wonder if the company would be able to make the proper adjustments without requiring extensive dilution. As a result, I am assigning CDXC a conviction rating of 2 out of 5 and will be a watchlist ticker for the Compounding Healthcare “Bio Boom” speculative portfolio.

My Plan

ChromaDex Corporation’s near-term outlook is promising, driven by a combination of ongoing research initiatives, strategic collaborations, and a growing market demand for health and wellness solutions. The company’s ability to navigate regulatory challenges, differentiate itself in a competitive market, and successfully bring innovative products to market. Furthermore, ChromaDex’s financial strength, coupled with its strategic initiatives, paints a promising picture for investors seeking growth at a reasonable valuation in the rapidly evolving nutraceutical industry.

Despite my positive assessment of the company, I am not looking to make a larger investment at this point in time. For me, the risks along with CDXC’s chart technical rating have me waiting for more favorable conditions.

CDXC Daily Chart (Trendspider)

Admittedly, CDXC is not far off from going from a bearish technical rating to a bullish rating. If CDXC can break the long-term downtrend and rise above the 200-day EMA, we could see the ticker gain some momentum in Q1 of this year. Therefore, I am going to set some alerts for a break of the 200-day EMA and will attempt to identify a potential entry point for CDXC.

Read the full article here