Investment Perspective: Valuation and Growth Post Stock Drop

While Coca-Cola’s (NYSE:KO) shares are off almost 14% since their highs earlier this year, they offer a tempting entry point for investors scouting for a top-tier firm with an impressive growth history.

Even with short-term challenges such as currency fluctuations and GLP-1 drug-related apprehensions (drugs like Ozempic), Coca-Cola’s enduring growth strategies stay robust. The Q3 2023 results surpassed projections, highlighting the brand’s tenacity and potential for growth from the current stance.

Strong Q3 Performance

For Q3 2023, Coca-Cola announced an adjusted earnings per share of $0.74, beating market predictions by $0.05. Sales witnessed an 8% growth year-on-year, reaching $11.91 billion.

Region-wise, Latin America spearheaded growth with a 24% revenue surge, trailed by Europe/Middle East/Africa at 10%. North America experienced a 6% growth, while Asia Pacific dropped by 2%, attributed to currency challenges. Even though operating margins tightened by 110 basis points year-over-year, standing at 27.4%, due to elevated input costs, the earnings saw a 9% boost, indicating margin durability. In essence, the results excelled in both revenue and profits.

Furthermore, Coca-Cola upgraded its annual earnings outlook, now projecting a 7-8% growth in comparable EPS as opposed to the earlier 5-6% estimate. This reflects their optimism about the ongoing momentum, in spite of potential economic volatility (Q3 Conference Call).

Enduring Earnings Growth

While the stock has retraced around 14% since the highs due to magnified perceptions that diet medications are denting Coca-Cola’s beverage sales, the enduring growth proposition is still appealing. Key elements bolstering this growth include:

-

Pricing leverage – With its unparalleled reach and potent branding, Coca-Cola can routinely hike prices to counteract cost surges. The recent 9% price/mix escalation this quarter underscores this leverage (Q3 transcript). Rivals lack a similar edge in promotional campaigns. This pricing strength also ensures consistent gross margin over time.

-

Engagement in rapid-growth international domains – A significant 63.5% of Coca-Cola’s earnings stem from beyond North American shores, boasting a robust foothold in emergent markets like Latin America, Middle East, Africa, and Global Ventures (e.g., robust sales from Costa® coffee globally). These regions present heightened growth trajectories as beverage consumption amplifies with escalating incomes.

-

Diverse product suite – Beyond classic sodas, Coca-Cola has branched into swiftly expanding sectors like water, juices, dairy/plant-derived products, and coffee via brands such as Dasani, Minute Maid, Fairlife, and Costa Coffee. There’s potential for further diversification, especially in segments like energy beverages and alcoholic drinks.

-

Technological overhaul – By digitizing its advertising, logistics, and sales routes, Coca-Cola aims to realize operational efficiencies and optimize data-driven decision-making. This could amplify margins in the future. For instance, their current digital media expenditure stands at 60%, a leap from 30% in 2019 (Q3 Transcript).

Collectively, these factors endorse a mid-tier annual profit growth, outshining numerous staple brands. Given that this dividend-yielding stock has dipped almost 14% within half a year, it seems a lucrative prospect. Coca-Cola’s commendable dividend growth legacy, spanning over five decades, coupled with the current ~3.33% yield, underpinned by robust cash flows, adds to its overarching allure.

GLP-1 Concerns (Ozempic Drugs & competitors) Are Over Exaggerated

There’s been growing concern in the food & beverage industry about the prospective surge of GLP-1 drugs, particularly Ozempic, in treating obesity and diabetes. Walmart claimed earlier this month that drugs like Ozempic were causing sales to trend downward in the grocery store division. These appetite-suppressing injectables have raised questions about potential dips in beverage consumption. Yet, for Coca-Cola, the influence appears controllable:

-

GLP-1 medications aren’t novel, and soda sales have remained resilient. Ozempic’s launch was back in 2017. Its current rise is more about heightened awareness than being a fresh challenge. About 1.1% of Americans had a prescription for a GLP-1 drug.

-

The anticipation of these drugs achieving widespread popularity seems dim, considering their hefty monthly price tag of around $1,000 and significant health repercussions. If individuals revert to old habits after drug usage, it may instigate a cyclical pattern of weight gain and loss. Some studies have shown that while patients will lose ~17% of their body weight while on a weight loss drug, they will gain 11% of their original body weight back on. This weight has to come back from somewhere, and if a patient chooses to not consume soft-drinks during their time on a weight loss drug, they are likely to consume them when they are off the drug.

-

The big kicker is if insurance will cover this drug. Many of these drugs are not approved for weight loss right now, just diabetes. The cash price (without insurance) often averages over $1200/month. There is only a select group of people (globally that can afford this). With this high price tag (good price table in this article) most of the customers from Coca-Cola will not be able to afford this drug, meaning this is not a threat to their business.

-

Coca-Cola exudes confidence in its strategic resilience. A noteworthy 68% of their beverage array offers low or no-calorie alternatives. Their commitment to continuous investment and innovation is evident, ready to tackle future obstacles (as discussed in the Q3 earnings report). So even if a large percentage of their customers were on the drug, Coca-Cola could bill many of their products as a low calorie option to avoid the desire to quit soft-drinks. Their CEO even commented how they out maneuvered drugs like Ozempic with low or zero calorie options.

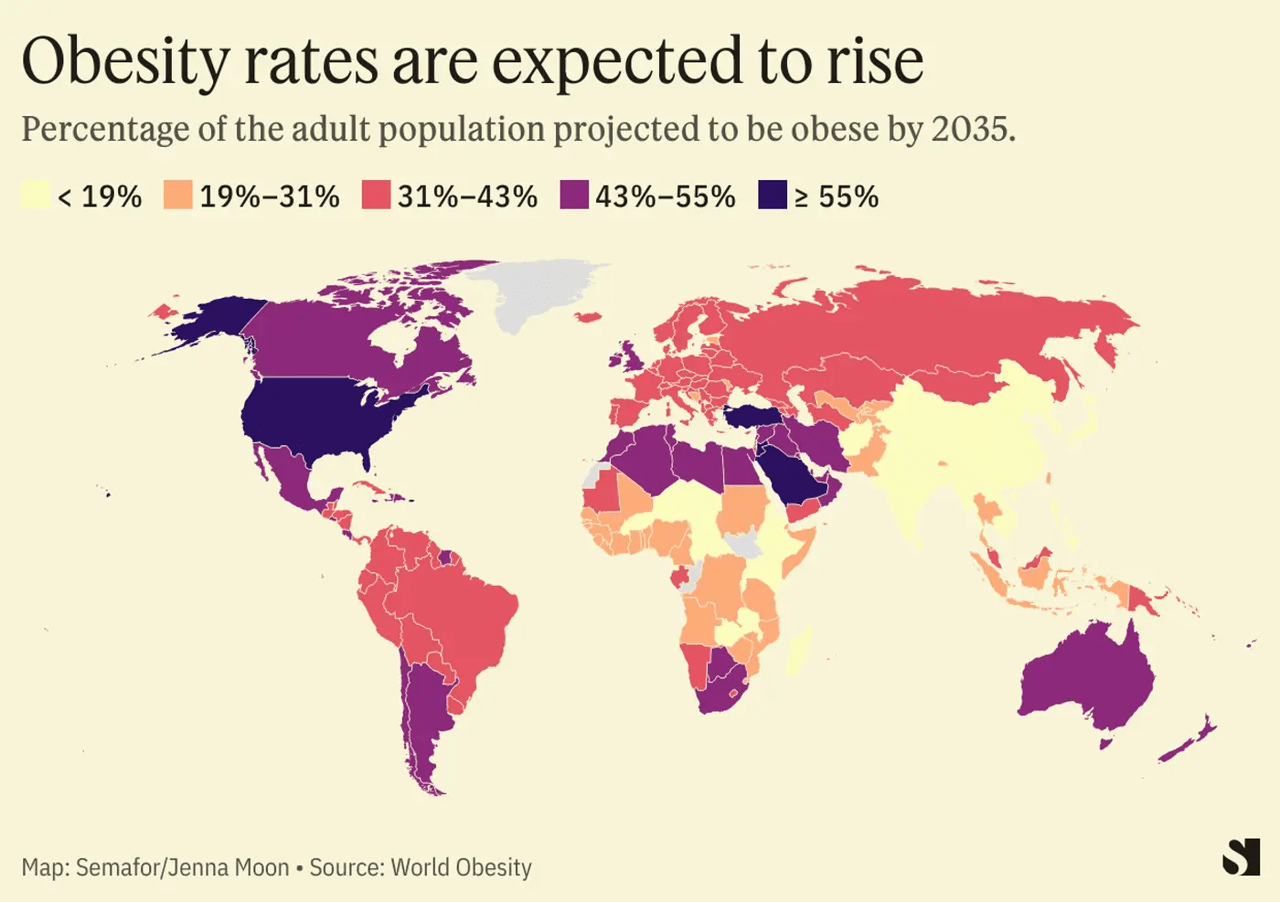

Considering Coca-Cola’s vast global outreach, with 63.5% of its revenue being international, the impact of weight-loss drugs, predominantly consumed in the US, appears minimal. A subsequent illustration showcases the comparison of obesity rates across nations (where they are expected to be over the next 12 years), based on World Population View data. Globally, the overweight populace is typically 10-20% less than in the US. This insinuates a relatively lesser influence of weight-loss medications in these countries, thus cementing Coca-Cola’s dominant position, especially given most of their sales come from outside the US.

Projected Obesity Rates 2035 (World Obseity)

The crux is, while GLP-1 treatments do suppress food cravings and consumption, there’s no solid proof I could find to suggest they’ll cut down liquid intake. Monitoring the GLP-1 trend is essential, but the perceived risk seems overstated, given Coca-Cola’s historical tenacity and its brand strengths. This moderate percentage implies that these drugs would need monumental leaps to truly impact the food sector.

Should the stock’s decline persist due to these drug-related concerns, investors should view the further discounted rate in perspective; this factor doesn’t fundamentally threaten the world’s leading non-alcoholic beverage giant’s future.

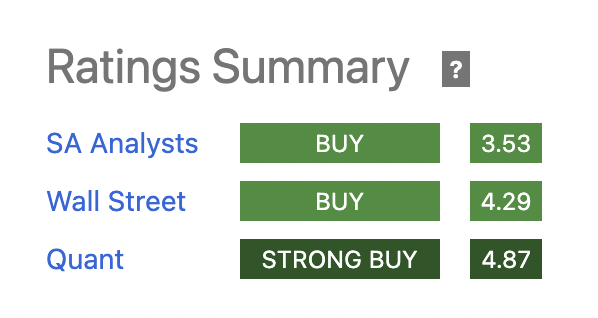

Valuation Prospects Post-Retraction

For long-haul investors, Coca-Cola presents a blend of steady revenue growth, consistent margin enhancement, robust cash inflow, and dividends – all at a slashed valuation. Despite a noticeable fall in recent months, apprehensions around health trends appear inflated. The firm’s robust stance in burgeoning global markets makes it an enticing option, deserving a ‘buy’ recommendation. The Q3 figures validate that growth strategies are on point. Amidst short-term macro uncertainties, Coca-Cola emerges as a persuasive addition to a premium staples portfolio especially in crazy markets like what we have now. All three Seeking Alpha ratings systems rate Coca-Cola as a “buy,” with Quant even rating it as a “strong buy.”

Seeking Alpha KO Ratings (Seeking Alpha)

Who could really be at risk with Ozempic (Or other GLP-1s):

While Wall Street has been concerned about the effects of GLP-1 drugs on soft-drink makers, companies that make snacks, like Coca-Cola’s arch nemesis Pepsi (PEP) could actually be at risk.

Morgan Stanley noted that with wider adoption of GLP-1 drugs like Ozempic, sales of baked goods and salty snacks could go down by 3%. While that doesn’t sound like a lot, this is almost 12 years of declining revenue in an industry that has been growing. This would certainly hurt PE multiples for snack makers like Pepsi.

People tend to perceive drinks as calorie-less while snacks have obvious calories. When people choose to go on weight loss drugs, the first thing they’ll likely cut is not what they drink but rather what they snack on.

Conclusion

The recent dip in Coca-Cola’s stock, approximately 14%, unveils a rare investment window. The Q3 2023 results outperformed predictions, emphasizing Coca-Cola’s robustness and potential for expansion. Its foray into global markets, diverse product lineup, pricing leverage, and tech-driven shifts position it for a mid-tier annual profit hike, eclipsing several rivals. With a rich dividend history and a 3.24% yield, the stock is undoubtedly enticing.

The perceived repercussions of GLP-1 drugs on beverage sales seem to be more of a media hype than a genuine threat, given the real dynamics of diet drugs, Coca-Cola’s worldwide reach, and their focus on low or zero-calorie options. In essence, the recent stock valuation of Coca-Cola, post its quarterly dip combined with positive earnings outcomes, offers stability and promise for long-term investors.

Read the full article here