Commerzbank (OTCPK:CRZBF) has reported an improved financial performance in recent quarters due to higher interest rates, but its profitability level is still quite low due to structural issues and its discounted valuation seems to be a trap.

As I’ve analyzed in a previous article, Commerzbank is one of the cheapest banks in Europe based on its discounted price-to-book value (P/BV) multiple, but this is largely justified on the bank’s fundamental issues. Despite that, its operating performance has improved in recent quarters due to higher interest rates in Europe, which has not been enough however to boost its share price in recent months.

Indeed, since my last article on Commerzbank its shares are slightly down, showing that higher rates in Europe have not lifted investor sentiment towards its shares.

Article performance (Seeking Alpha)

In this article, I analyze the bank’s most recent financial figures and update its investment case, to see if it remains a value trap or if improved operating momentum justify a cyclical long position.

Earnings Analysis

Commerzbank has restructured significantly its business following the global financial crisis of 2008-09, being nowadays mainly focused on retail and commercial banking, being largely exposed to the German market. Due to this profile, Commerzbank is nowadays somewhat geared to interest rates, which have been a tailwind for higher revenues and earnings in recent quarters.

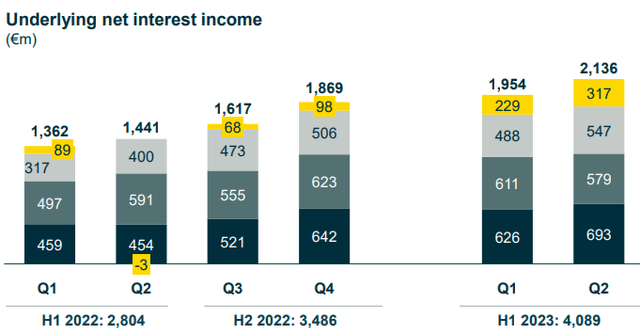

In Q2 2023, its revenues were €2.6 billion, an increase of only 8.6% YoY, which is not an impressive performance considering how much rates have increased in Europe during this period. Nevertheless, the bank’s net interest income was clearly higher in recent quarters, reaching more than €2.1 billion in Q2 2023, up by 48% YoY.

NII (Commerzbank)

For the full year, reflecting the higher for longer guidance from the European Central Bank, Commerzbank increased its NII guidance, expecting now to report more than €7.8 billion in 2023, which represents an annual increase of about 24%.

However, other revenue lines had a much weaker performance and justify why the bank’s overall revenue growth was only at high single digit.

Its fees and commissions amounted to €841 million in Q2 2023, a decline of 6% YoY, due to lower volumes on capital markets activities. Additionally, what had the most impact on the bank’s top-line was ‘other income’, which was negative by €321 million in the last quarter.

This is related to the burden of CHF mortgages in Poland, which in my opinion is not the best way to report this issue. These are provisions related to CHF mortgages that were originated before 2008 and is an issue that is still being addressed across the banking sector in Poland, which Commerzbank include as ‘other income’ in its P&L statement, instead of considering it on ‘risk result’.

Adjusted for this issue, Commerzbank’s adjusted revenues in Q2 were €2.94 billion, an increase of 25% YoY compared to adjusted revenues in Q2 2022, showing that Commerzbank is indeed a bank with significant leverage to higher rates, a trend that is not much visible on its reported revenues due to the extraordinary effect of CHF mortgage provisions.

On the cost side, total expenses increased slightly compared to 2022 due to wage increases and higher variable compensation, leading to cost growth of 4.1% YoY in Q2. Its cost-to-income ratio, a key measure or efficiency in the banking sector, was 56.5% in the last quarter. This is a much improved level compared to the bank’s history, but still above the most efficient banks in Europe, showing that Commerzbank still has to cut costs in the near future to improve efficiency.

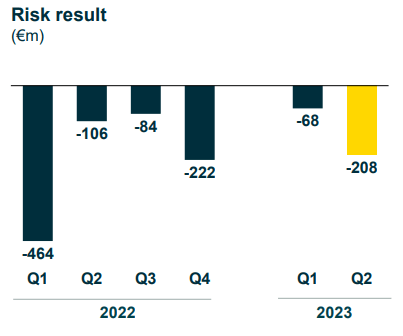

Regarding asset quality, like for many other European banks, the hiking pace of the European Central Bank has not so far led to higher credit issues for Commerzbank, as households and corporates have remained resilient and loan defaults remain at historically low levels. In Q2 2023, Commerzbank’s provisions amounted to €208 million, with the vast majority being reported at the corporate segment. During the first half of the year, its cost of risk ratio was only 21 basis points (bps) of total loans, which is a relatively low level of credit provisions.

Provisions for loan losses (Commerzbank)

Due to the combination of rising top-line, good cost control and resilient credit quality, Commerzbank’s net income increased to €565 million in Q2 2023 (+20% YoY). While this is a positive outcome, its profitability remains somewhat low compared to its peers, given that its return on tangible equity (RoTE) ratio was 7.9% in the last quarter, which is a below-average profitability level within the European banking sector.

Regarding its upcoming Q3 2023 earnings release, scheduled for November 8, 2023, the bank is expected to report a positive operating momentum, boosted by rising rates. According to analyst’s estimates, its quarterly revenues should amount to nearly €2.7 billion, representing a small quarterly increase, of which NII is expected to represent more than €2 billion. Its net income is expected to be about €609 million, up by close to 8% from the previous quarter.

While Commerzbank’s financial performance is expected to remain positive in the short term, the prospects of peak rates in Europe mean that further top-line growth may be much more subdued in the coming quarters. Indeed, the European Central Bank has maintained its key rate in its last meeting, and further hikes are not much likely going forward. This means that higher yields on assets aren’t much likely beyond Q4, while on the liabilities side there is some headwinds in the short term as deposits and wholesale debt costs are usually slower to re-price, thus Commerzbank should experience some net interest margin pressure in 2024.

This means that its major growth driver in recent quarters is expected to end in the near term, thus Commerzbank’s earnings should reach a peak somewhere in Q3 or Q4 2023, which does not bode well for its profitability in the short term.

Moreover, assuming the bank is near peak earnings, this also doesn’t bode well for the sustainable profitability of its business given that its ROE ratio is not expected to rise above 7.5% during this upswing cycle, a profitability level that is substantially below its cost of equity. This shows that Commerzbank’s business model has some serious flaws as the bank is not able to generate enough profits above its cost of capital throughout the economic cycle, being a major reason for a low valuation of its shares over the long term.

On the other hand, the bank has recently upgraded its capital return goals for the next few years and expects to reach a RoTE ratio of more than 11% by 2027, assuming a capital ratio of 13.5%. Given that its CET1 ratio was 14.4% at the end of June, this means Commerzbank’s capital position is strong and above its desired target over the medium-term, thus the bank can distribute a large part of its earnings to shareholders over the next few years.

This has been the bank’s strategy in recent years, given that is payout ratio was 30% related to 2022 earnings, which is expected to grow to 50% in 2023 and reach 70% next year. This will be made through a combination of dividends and share buybacks, being the major positive factor of its investment case in the near term in my opinion. However, considering its expected dividend per share of €0.48 related to 2023 earnings, its forward dividend yield is about 4.7%, which is a level below the average of the European banking sector.

Regarding its profitability target, it seems quite difficult to achieve considering the uncertain economic outlook and the bank’s muted growth prospects, even though it shows some confidence from management in the bank’s business prospects. Investors should note that Commerzbank will present a strategic update alongside its quarterly earnings in a few days, where it’s expected that Commerzbank will explain in more detail its efforts and actions to achieve a RoTE of more than 11% by 2027.

Conclusion

While Commerzbank has benefited from higher rates in Europe due to a business profile heavily exposed to retail and commercial banking, its woes in Poland have been a serious headwind for higher earnings in recent quarters. Despite some improvements in its profitability, its RoTE ratio remains at a relatively weak level and prospects of peak earnings is not positive for a re-rating of its shares.

Therefore, while Commerzbank continues to trade at a discounted valuation compared to its peers based on the P/BV multiple (0.45x vs. 0.82x for the European banking sector), this seems to be justified by the bank’s fundamental issues and its shares remain a value trap for long-term investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here