Shares of ConocoPhillips (NYSE:COP) fell over 3% on Wednesday after it announced an acquisition of Marathon Oil Corporation (MRO). Shares are now more than 10% off their highs, though still up 16% from a year ago. Back in September, I rated shares of Conoco a “buy,” but since then, they have been dead money, losing 2% as the market rallied over 20%. Given their complementary assets and strong capital returns, I view this deal positively, and it can be a catalyst to lift shares over time.

Seeking Alpha

Under the terms of the transactions, COP will pay 0.255 of its shares for each share of MRO, paying roughly a 15% premium, towards the low end of M&A premiums. COP will assume MRO’s $5.4 billion in net debt, for a $22.5 billion purchase price. Conoco is trading today at a 13.3x P/E, based on consensus estimates. Based on consensus estimates and a deal price of ~$29.50, MRO is being bought at 10.1x consensus earnings. MRO is smaller, less diverse, and its focus on buybacks over dividends have all contributed to a persistent discount multiple, though I have viewed its underlying asset base favorably. COP is wise to take advantage of this discount.

In other words, even with a premium, MRO is trading discounted to COP, a reason why Conoco anticipates the deal to be accretive to its shareholders—a view I share. COP also expects about $500 million of cost synergies, given their overlapping asset base. Based on this, Conoco expects to repurchase $7 billion of stock in year 1 and $20 billion over three years. It also will be raising its dividend by 34% irrespective of deal closing to $0.78 by year-end, and anticipates about $2 billion of asset sales as it optimizes its portfolio.

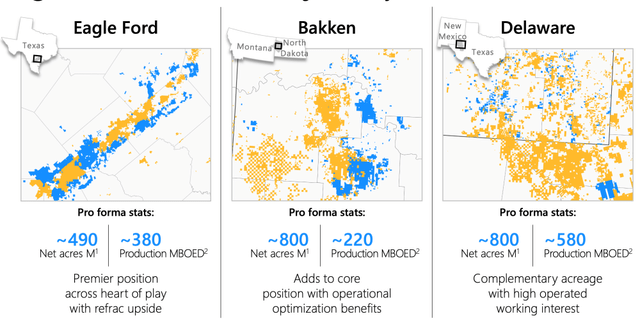

As you can see below, the two companies have overlapping asset bases (COP’s properties are in orange and MRO’s are in blue). This overlap is why the company expects to take out so much cost: $250 million of G&A, $150 million of operating costs, and $100 million of cap-ex. The combined company has about 2.3mboe/d of production. This operating cost reduction is about $0.18/BOE and cap-ex is about $0.12/BOE. These are fairly modest reductions, and each assume a less than 1.5% cost-saving vs. the pro forma company’s spending. I view such a target as credible, if not conservative. Given how much overlap there is, COP & MRO should be able to optimize drilling crews and use even larger scale to negotiate better prices with suppliers.

ConocoPhillips

The G&A target strikes me as a bit more ambitious. COP will spend about $700 million on G&A this year. MRO should spend about $320 million on G&A, so the target here is a 25% reduction. Now, Conoco is more than 5x MRO’s size, so the fact that MRO spends nearly 40% as much on G&A speaks to the potential for significant cost cuts. This is the benefit of scale. Even as you grow production, you still only need one CEO, one CFO, one investor relations team, likely a similar-sized accounting department, etc. I do expect there to be material scaling opportunities and job cuts due to redundancies. Even running MRO at COP’s level of efficiency and assuming no benefits from incremental scale could reduce G&A at legacy MRO by about $180 million.

As such, while the $250 million target at first appears considerable, it only assumes about $70 million of “ambition” in my view. I view this as doable. That said, the G&A target appears a bit more aggressive than the production-related cost cuts. Given how modest that target is, I see some upside to capital savings vs the $100 million target, which could offset a bit of underperformance on the G&A savings front. Overall, I view ~$500 million of run-rate savings after one year as a very achievable target, though the mix may be slightly different.

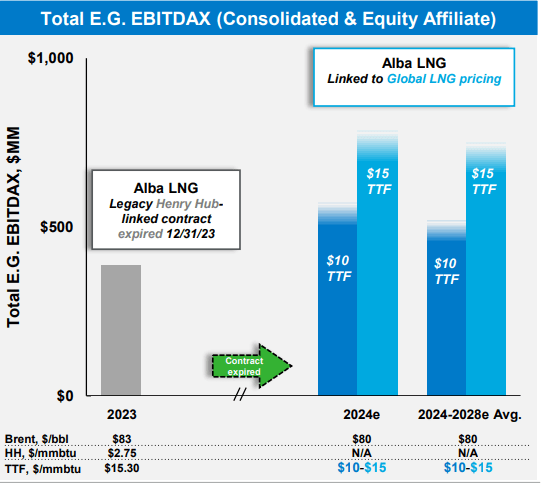

I also view MRO’s asset mix favorably. About 53% of its U.S. production is oil. Just under 50% of Conoco’s production is oil, so MRO will slightly increase the liquid-orientation of the company vs natural gas. I view this favorably, given oil has wider margins. OPEC+ provides some floor under oil prices, whereas natural gas has no cartel supporting prices. Moreover, oil is a global market, while natural gas is relatively local, given high transport costs and limited export capacity. With the U.S. having abundant natural gas, prices have struggled to stay about $3 for sustained periods of time; I assume this remains the case. Now, just a quarter of MRO’s international operations are oil (they represent just 11% of the combined company). However, half of its natural gas is sold as LNG rather than gas, providing oil-like returns, given Europe’s demand for LNG as it has pivoted away from Russian gas. MRO has a stake in the Equatorial Guinea LNG export hub, which is now benefitting from the expiration of lower-priced contracts, providing an over $200 million tailwind COP will benefit from.

Marathon oil

This asset also fits well within Conoco’s own LNG efforts, and with Russian gas exports to Europe unlikely to resume anytime soon in my view, demand for LNG should remain strong. The Biden Administration is also delaying new U.S. LNG export facilities, which can continue to constrain supply and support elevated margins. Of course, the election outcome could change this, but given these projects can take years to complete, every delay just prolongs supply constraints, pointing to ongoing favorable economics for longer.

At $80 oil and $2.50 natural gas, MRO can generate about $2 billion in free cash flow, and with combined cost cuts, this could improve. I view $75-$85 as the base case for oil, assuming no recession globally and current OPEC policy, and $2.50 as a reasonable U.S. natural gas estimate, recognizing weather can swing this meaningfully in the short term. COP is paying about 9x free cash flow, which I view as attractive. COP should generate about $10 billion in free cash flow in this environment, trading at about 14x. This is a meaningful valuation gap it is exploiting.

With ~$12.5 billion in combined free cash flow, it can safely meet its $7 billion buyback target and pay its dividend which will now cost about $5.5 billion, assuming energy prices just stay flat. The combined company has a pro forma free cash flow yield of 8%, which I view as attractive, given the potential for modest production growth, LNG upside, and potential further capital cost cuts. COP has found an accretive asset to add to its portfolio in MRO, and with the combined company still smaller than Exxon Mobil (XOM) and Chevron (CVX), I do not expect significant antitrust challenges.

I continue to rate COP a buy, and while stocks often fall when announcing M&A, this is a dip to buy. An 8% free cash flow yield for a premier and scaled oil & gas company is attractive, and I see upside risk to its $20 billion 3-year buyback target, assuming oil stays above $75. With 1-2% production growth and cost discipline, even in a flat commodity environment, the new COP can generate sustained 10% returns with rising oil prices as a potential further tailwind. I expect shares to move towards $130 over the next year as buybacks reduce share count, and we see the benefits of this transaction come into focus.

Read the full article here