Investment Thesis

I believe DICK’S Sporting Goods (NYSE:DKS) is a hold because of the issues of inventory shrinkage and escalating costs the company is facing, which reflect broader challenges within the retail industry. A significant concern is the evolving Direct to Consumer (D2C) trend, spearheaded by giant brands like Nike (NYSE:NKE), which presents a formidable challenge to DICK’S Sporting Goods by potentially reducing the variety of products offered and impacting its market competitiveness. Despite these hurdles, the company has demonstrated a trajectory of solid growth, boasting a strong balance sheet and showcasing an impressive knack for capital allocation, underlining its financial robustness amidst prevailing challenges. However, when delving into valuation, while there’s a suggestion of potential growth on the horizon for DICK’S Sporting Goods, the current share price falls short of meeting my desired return threshold, indicating a need for a cautious and well-considered approach moving forward in assessing its investment appeal. This tempered outlook substantiates a ‘hold’ stance, acknowledging the company’s robust financial position while recognizing the external challenges and valuation concerns that warrant a more conservative investment approach at this juncture.

Company Overview

Established in 1948, DICK’S Sporting Goods is a leading US sporting goods retailer offering a wide variety of sports equipment, apparel, and accessories. They prioritize providing top brands at competitive prices to cater to sports enthusiasts, athletes, and families. Utilizing a strong omnichannel retail strategy through brick-and-mortar stores, e-commerce platforms, and mobile apps, they offer a convenient shopping experience. They also focus on building strong customer relationships through personalized services, in-store workshops, and a loyalty rewards program. Despite facing recent financial challenges that led to a near 24% share price drop, the company continues to adapt to evolving market dynamics to uphold its market position amidst stiff competition in the sporting goods retail sector.

Retail Theft is Having a Material Impact on Margins

The most recent earnings for DKS were a disappointment, highlighted by their declining margins and outlook downgrade which prompted a sharp selloff of the stock. During the call, DICK’S management outlined some key concerns which contributed to disappointing earnings such as inventory shrinkage, supply chain and labor costs, both of which management talk about in detail.

The primary concern discussed by management was the increase in inventory shrinkage, which management mentioned significantly impacted the margins. The term inventory shrinkage primarily refers to losses incurred due to theft resulting from organized retail crime and theft in general, and according to the company, this issue has notably affected their Q2 results as well as their expectations moving forward for the rest of the year. The management stated that they are actively addressing the theft problem to ensure the safety of their stores, staff, and customers, although I am uncertain as to how well the company can address this issue.

The issue I have is that I fail to see how the company can meaningfully improve margins and accurately forecast their expectations so long as this problem persists. In my opinion, retail theft is a problem that DICK’S Sporting Goods, like many other retail entities, has to grapple with, and its impact is far-reaching. The direct hit on profit margins is something that cannot be understated, especially when we reflect on the impacts it had on DICK’S net income last quarter, which plummeted 23% year-over-year (YoY). When an item is stolen, not only does the revenue vanish, but the expenses tied to that item linger. In a competitive market, like the U.S. retail market which Dick’s operates in, where consumers are highly price-sensitive, this is a precarious position to be in.

I believe that the efforts to combat retail theft through enhanced security measures, though necessary, are a double-edged sword. On one hand, they deter theft, but on the other, they incur significant expenses which further strain the profit margins. The security measures implemented by DICK’S, such as LotCop cameras, loss prevention personnel and working with law enforcement, although crucial, contribute nothing to revenue generation and I believe reduce worker productivity, which in my view, will continue to be a drag on margins for the foreseeable future. Furthermore, given that this is an industry-wide problem which is also impacting DICK’S competitors such as Foot Locker (NYSE:FL) and Big 5 Sporting Goods (NASDAQ: BGFV), I believe retail theft is likely a societal issue arising from more complicated issues which can only be resolved through careful collaboration between businesses, consumers, government, and law enforcement.

Direct to Consumer Models Continue to Grow

While retail theft is an issue impacting a broad range of businesses from Walmart (NYSE:WMT) to Home Depot (NYSE:HD), D2C retail trends is an issue more specific to businesses such as DICK’S Sporting Goods which specializes in selling branded sports and apparel products to consumers.

The D2C model has notably been embraced by giants in the sporting goods and apparel industry like Nike and Adidas (ETR:OTCQX:ADDYY). This model, which entails brands selling directly to consumers via their platforms or stores, bypasses the traditional intermediaries or retailers such as DICK’S, and has been boosted by the digitization of retail which has made this model more reliable for D2C businesses.

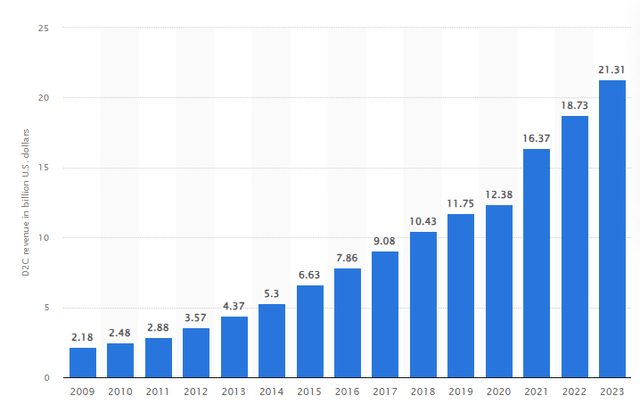

For example, in the fiscal year (FY) concluding on May 31, 2023, NIKE Direct, which is Nike’s D2C brand, raked in a staggering revenue of approximately $21.3 billion. This figure is a testament to the substantial revenue streams that can be harnessed directly from consumers, underlining the efficacy of the D2C model. Moreover, in its most recent quarterly report, Nike unveiled that its Direct sales soared by 6% to $5.4 billion, significantly outpacing the wholesale revenue growth rate of 1%. This ascent is indicative of a robust consumer reception towards Nike’s D2C offerings and digital engagement strategies. Furthermore, the data depicting the share of D2C sales as a percentage of the total revenue of Nike brand unveils a strategic gravitation towards the D2C model, spotlighting its growing significance in Nike’s overarching sales strategy.

Nike brand’s direct-to-consumer revenue worldwide from the fiscal years of 2009 to 2023 (Statista)

In my opinion, this maneuver towards D2C by Nike and other brands like Under Armour (NYSE:UAA), which has also been delving into D2C, unveils a larger industry trend. Brands are trying to establish direct relationships with consumers, accrue invaluable data, and exercise better control over brand representation and the consumer experience. This D2C wave, while beneficial for brands, presents a daunting challenge for traditional retailers like DICK’S Sporting Goods. The more brands transition to or augment their D2C operations, the more I believe DICK’S may see a dip in the variety of products they can offer, which could potentially dent their sales and market appeal. Furthermore, the competitive prices, personalized experiences, and the brand authenticity offered by D2C models could divert consumers from DICK’S to purchase directly from brands. I think this trend will continue to impact DICK’S for the foreseeable future and will require management to be creative with innovations and possibly explore partnerships or exclusive arrangements with brands to sustain their market competitiveness and ensure sustainable growth into the future.

Financial Analysis

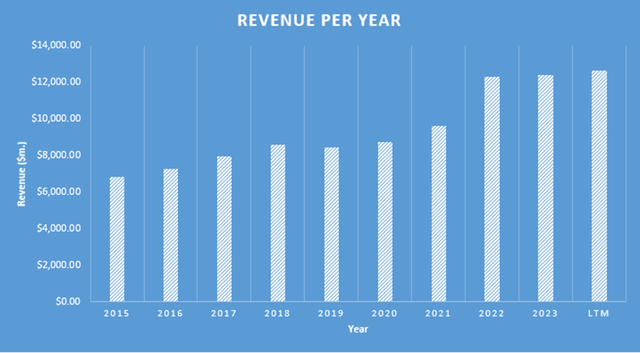

Over the past 5 years, DICK’S Sporting Goods has showcased a robust financial performance. The revenue growth has been solid, growing from $8.44 billion in 2019 to $12.62 billion in the last 12 months (LTM), equating to a compound annual growth rate (CAGR) of approximately 8.4%. The earnings per share (EPS) growth has been even more impressive, growing from $3.24 in 2019 to $11.24 in the LTM, although it’s worth noting the LTM EPS is down from 2022.

Revenue Per Year for DKS (DJTF Investments)

The book value per share (BVPS) has steadily grown during this time frame, ascending from $20.29 in 2019 to $31.57 in LTM, demonstrating the company’s ability to amplify its intrinsic value across the span.

As of the most recent quarter, the firm disclosed cash and cash equivalents amounting to $1.9 billion, which showcases a decrease compared to previous years. The total debt of the company stands at $4.26 billion, indicating a reasonably large debt level although more than manageable in my opinion given the cash on hand and the LTM free cash flow (FCF) generation of $1.07 billion for the business. Overall, I believe that DICK’S has a strong balance sheet relative to many of its retail counterparts.

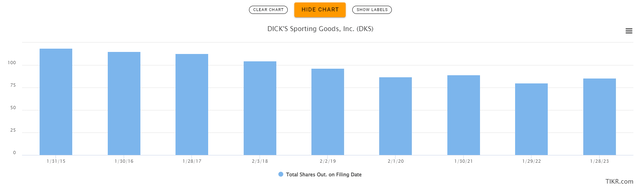

I also want to highlight that the company has been buying back shares at an impressive rate over the past 10 years, with the DICK’S shares outstanding dropping from 118.79 million in FY 2015 to 85.02 million in the LTM. Additionally, the company pays a dividend of $2.98 which the company has raised for the past 7 years. The buybacks and dividend highlight to me that one of the management team’s key priorities is returning values to shareholders which for me is a must when considering an investment.

Total Shares Outstanding Per Year for DKS (TIKR)

As previously elaborated, the forthcoming quarterly earnings outcomes for DICK’S Sporting Goods are anticipated to encapsulate mixed narratives, with margins continuing to be influenced by retail theft and supply costs as I outlined earlier. A focal point of attention will be whether the management sustains their present guidance or opts for a downward revision, which, in my opinion, could evoke concerns among investors and possibly hint at deeper-rooted challenges.

While I have expressed concern throughout this article around DICK’S Sporting Goods and the challenges it faces, I still believe the company is a solid business that is a market leader and has a management team that has demonstrated good capital allocation in the past. Looking beyond the imminent 12 months, under the premise of stable macroeconomic conditions, I believe the company, and the industry as a whole, may find a solution to the retail theft and supply chain cost issues which have been impacting DICK’S business and reducing their operating margins. As a result, I imagine margins will stabilize and steady growth will return to the company, albeit at a slower rate than in the years prior.

Valuation

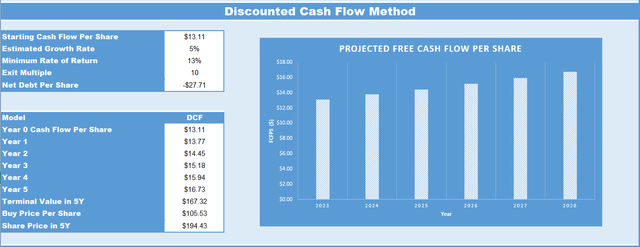

When diving into valuation, my approach hinges on comparing what we are paying for the business against what we are receiving, being the underlying business fundamentals and prospective earnings. I am inclined to believe that a discounted cash flow analysis of the business serves as a sound method for estimated expected future earnings.

DICK’S Sporting Goods had a LTM FCF per share as of the LTM stands at $13.11. DICK’S has seen excellent growth in recent years but I believe has headwinds to deal with in the short to medium term that I believe will impact the growth of the business going forward. Anticipating this slowdown in growth, my conservative projection is that DKS should grow at a rate of approximately 5% annually over the ensuing five years. Consequently, by the end of the model, 5 years from now, DICK’S Sporting Goods’ FCF per share is envisaged to ascend to $16.73. Proceeding to employ an exit multiple of 10, a multiple the entity has traded around frequently over the past decade, the price target in five years is $194.43. Hence, based on these approximations, an investment into DKS at the current share price of $105.26, would culminate in a CAGR of roughly 13% over the forthcoming five years. While this return is solid, it is important to consider that this valuation does not include a margin of safety which would offer protection should any of the forecast be wrong. As such, due to my investment philosophy of trying to achieve a return greater than 15%, I do not believe that DICK’S Sporting Goods is a buy at current prices.

DCF Model for DKS (DJTF Investments)

Conclusion

DICK’S Sporting Goods recently encountered a disappointing earnings period, primarily driven by issues of inventory shrinkage and escalating costs, mirroring broader challenges within the retail industry. A significant concern is the evolving D2C trend, spearheaded by behemoth brands like Nike, which presents a formidable challenge to DICK’S Sporting Goods by potentially reducing the variety of products offered and impacting its market competitiveness. Despite these hurdles, the company has demonstrated a trajectory of solid growth, boasting a strong balance sheet and showcasing an impressive knack for capital allocation, underlining its financial robustness amidst prevailing challenges. However, when delving into valuation, while there’s a suggestion of potential growth on the horizon for DICK’S Sporting Goods, the current share prices falls short of meeting my desired return threshold, indicating a need for a cautious and well-considered approach moving forward in assessing its investment appeal.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here