Summary

In our initial report on Digital Realty (NYSE:DLR), we rated the shares a Hold on valuation. We believed they were “too expensive to consider a Buy”, though we acknowledged that the near-term fundamentals of the DC market were too strong to allow significant underperformance.

We have updated our valuation for the recent earnings release, which saw record leasing activity and favorable pricing trends. Despite the strong quarter, and continued strength of the DC market, we are maintaining our Hold rating as we see the shares being priced to perfection, leaving limited upside potential and a poor margin of safety. Similar to last time, we see the strength of the DC market and declining leverage providing enough support to the shares to keep us from a Sell rating.

Earnings Updates

Capital Recycling

The quarter had many moving parts, with asset sales and developments in the company’s JVs, which we believe were net positives, but created some noise in the quarter. Some of the major developments are discussed below.

Cyxtera Resolution: As had been previously announced, DLR resolved its relationship with Cyxtera by closing a series of transactions with Brookfield Infrastructure Partners, Cyxtera Technologies, and Digital Core REIT. DLR received $277MM for its interest in four DCs and recycled $55MM to buy out Cyxtera’s leases in DLR’s Frankfurt and Singapore DCs. DLR also exercised its option to purchase a DC outside of London, UK.

Blackstone JV: DLR and Blackstone established the 1st phase of their $7Bn hyperscale DC development JV, which includes campuses in Paris and Northern VA. DLR expects to close the 2nd phase (which includes the Frankfurt campus), later this year.

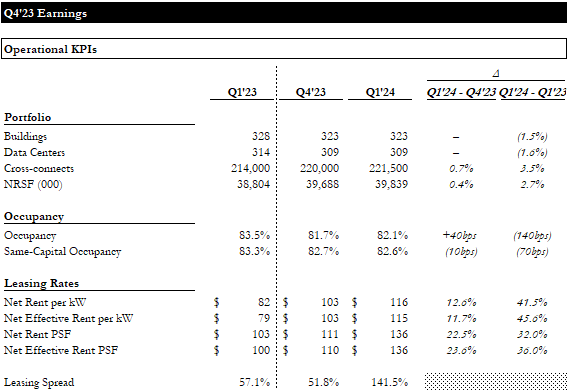

Quarterly Data

DLR’s portfolio size remained relatively flat QoQ. Occupancy remained stable at ~82%, though management has guided to a 100-200bps increase in occupancy by the end of 2024. Rental rates on new leases accelerated significantly from the prior quarter on a per kilowatt and per sqft basis. However, the renewal spreads benefitted from an outlier in the Other category and an early renewal in the >1MW segment. Excluding these two renewals, leasing spreads for Q1 would have been ~3% on a cash basis.

Earnings Update | Operations (Empyrean; DLR)

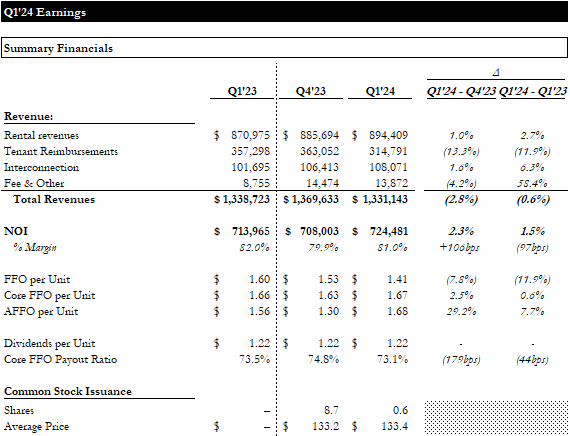

Total revenue declined slightly QoQ and YoY, mainly a function of lower tenant reimbursements. Despite the lower tenant recoveries, NOI increased modestly as margins improved. While FFO was lower for the quarter, Core FFO and AFFO both improved, maintaining a stable payout in the low-70s.

Earnings Update | Financials (Empyrean; DLR)

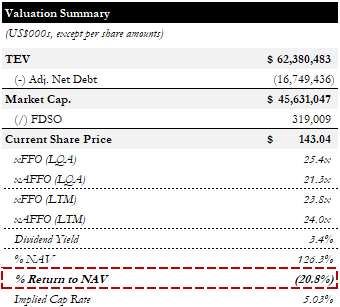

Valuation

DLR trades for ~25x LQA FFO and ~21x AFFO, yields ~3.4%, and is priced at a ~26% premium to our NAV estimate (n.b., ~5% implied cap rate). While this is much improved from the ~37% premium we observed at the time of our initial report, it is still quite rich.

Valuation Summary (Empyrean)

Our NAV estimate is based on an NTM NOI of ~$3.19Bn and a 6.5% cap rate. Our Hold rating is a function of the company’s premium valuation. For the valuation to make sense, the company’s growth initiatives must be executed flawlessly, and the leasing market must remain exceptionally strong for the foreseeable future. While we do not see any risks on the horizon for either of these points, we see little upside if they are proven.

Risks & Catalysts: Macro

Macro factors, such as supply chain pressure, inflation, and interest rates, have less pronounced impacts on DC than other sectors due to the strong secular demand tailwinds, the long-term nature of leases, and long-lead time vendor commitments. However, higher rates increase the cost of capital for DC operators that are not self-funding, and inflation can have negative impacts on development costs.

Some DC operators, including DLR, have begun passing through price increases in certain metros to offset rising development costs. Depending on the structure of a particular contract, operators may absorb higher energy prices for the short term but may have the ability to pass through longer-term or more significant energy cost increases to customers. DC leases also benefit from annual escalators that are sometimes indexed to local inflation rates. Overall, we see these risks as relatively immaterial for DLR. We also do not see much potential upside from the above-mentioned macro factors.

Conclusion

Despite a strong (but noisy) quarter and an especially strong DC leasing environment, DLR continues to trade at a premium valuation well above where we would be comfortable giving it a Buy rating. We will remain on the sidelines until we see an entry point at a valuation far closer, preferably below our NAV estimate. We acknowledge that this is unlikely as long as the supply/demand picture remains heavily imbalanced.

Read the full article here