Well, it certainly was an eventful week as Fed Chair Powell delivered a dovish message to the markets at the FOMC press conference. While Fed Chair Powell left the door open for rates to remain where they are for the foreseeable future or even take them a bit higher, he reconfirmed that the most likely scenario was 3 cuts would occur in the back half of 2024. The Fed’s dot plot reaffirmed that the median points were 4.6% in 2024, 3.6% in 2025 and 3.1% in 2026. This market ripped into the close on Wednesday, 3/20/24 and the S&P 500 closed the week up 1.35% while the Nasdaq climbed 1.3%. Goldman Sachs (GS) now sees a scenario where tech stocks could lead the S&P 500 to around 6,000 to close the year out, which is well above their target of 5,200. I continue to believe we’re in the early innings of a multi-year bull cycle that will be fueled by technological advancements that will lead to earnings expansion throughout the broad market. Regardless of what occurs, I am going to keep allocating $100 per week to the Dividend Harvesting Portfolio, and I feel that the investments I made throughout the downturn will be rewarded in the future.

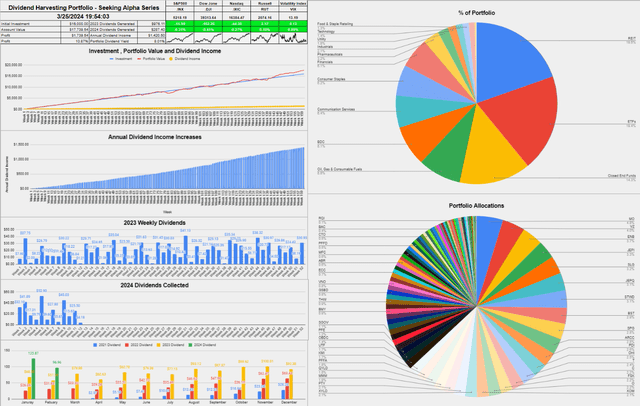

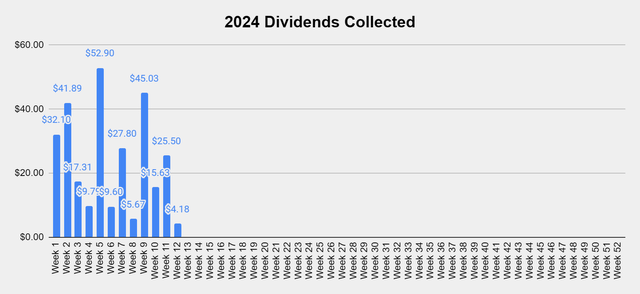

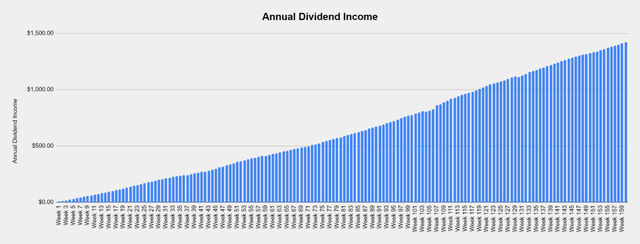

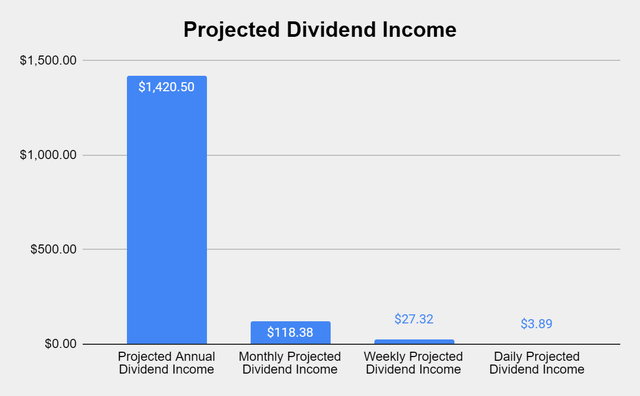

Over the past 160 weeks, I have allocated $16,000 dollars to the Dividend Harvesting Portfolio. This week three records were broken as the Dividend Harvesting Portfolio closed out the week with a double-digit return for the first time, record profitability was recorded, and the largest weekly finishing balance occurred. The Dividend Harvesting Portfolio finished week 160 with a balance of $17,739.54, placing it in the black by $1,739.54 or 10.87%. This was a light week, as $4.18 of dividend income was generated. Every 10th week, I either select a new position from the reader suggestions or allocate the weekly capital to a position I had added from a prior reader suggestion. This week, I added the NEOS Nasdaq 100 High Income ETF (QQQI) to the Dividend Harvesting Portfolio, which has been suggested several times. The combination of adding 2 shares of QQQI and reinvesting the $4.18 of generated income increased the Dividend Harvesting Portfolio’s forward projected income by $10.24 (0.73%). With roughly 3 months to go prior to summer, I think there is a strong possibility I reach $1,500 of projected forward dividend income by the summer and between $1,800 – $2,000 by the end of 2024.

Steven Fiorillo, Seeking Alpha

The overall performance of the Dividend Harvesting Portfolio

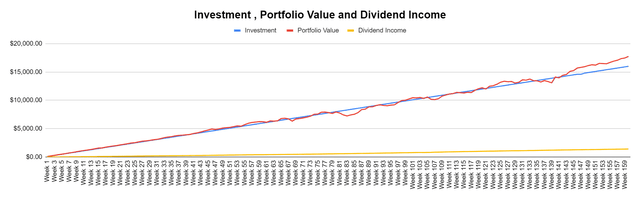

There is a lot of data to unpack with this series, and the chart below simplifies the progress. For the first 45 weeks or so, the spread between invested capital and the portfolio balance was tight, and then we witnessed some fluctuations in the following weeks. In week 79, the Dividend Harvesting Portfolio fell into negative territory and didn’t recover until week 92. There were some ups and downs after that stretch, but recently, the Dividend Harvesting Portfolio has been working its way to the upside. With 160 weeks of data, the Dividend Harvesting Portfolio has demonstrated that it can mitigate risk quite well and live up to my investment goals.

This series is strictly about building out an income-producing portfolio that will mitigate downside risk while generating recurring income. My intention is not to focus on capital appreciation but rather have that be a byproduct as a secondary objective. This series is not trying to replicate or outpace a particular index. Rather than allocating capital toward bonds, I have built a personalized ETF consisting of individual equities, REITs, ETFs, CEFs, and BDCs. My intention was to demonstrate how anyone could get started in dividend investing without having a large amount of capital to start with. Every aspect of the portfolio is documented throughout the series, and I plan on continuing adding $100 per week to the Dividend Harvesting Portfolio until I retire. These are not my only investments, and I plan to have the Dividend Harvesting Portfolio generate a significant amount of income when I retire. Several years from now, I should be at the point where I can add a covered call overlay strategy to some positions to generate additional income. I am excited for the future and to document the progression of the Dividend Harvesting Portfolio in not just the good times but also the difficult times.

Steven Fiorillo, Seeking Alpha

The Dividend Harvesting Portfolio dividend section

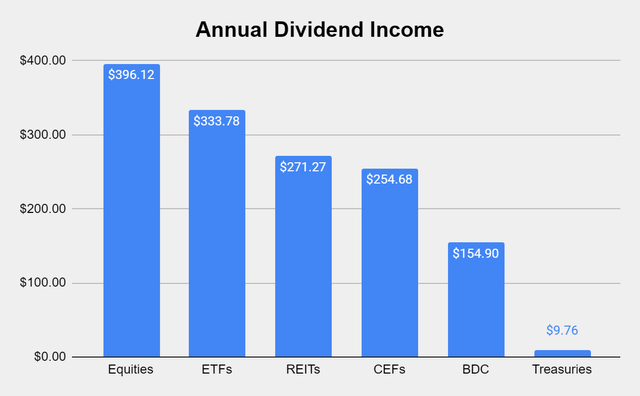

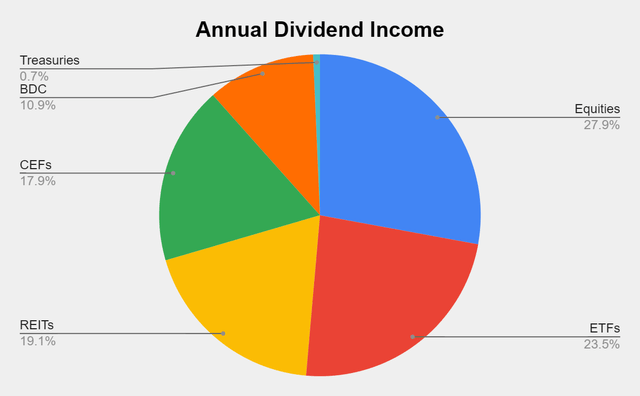

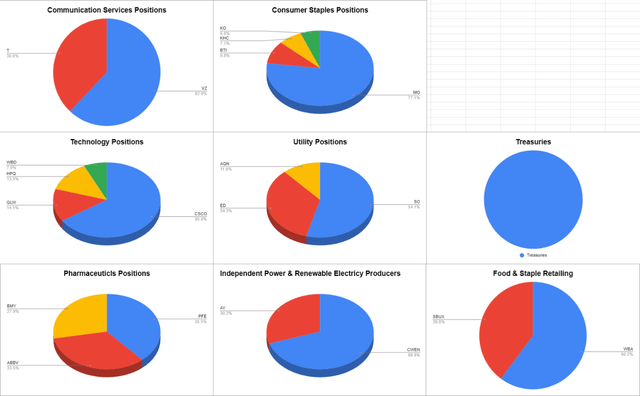

Here’s how much dividend income is generated per investment basket:

- Equities $396.12 (27.89%)

- ETFs $333.78 (23.50%)

- REITs $271.27 (19.10%)

- CEFs $254.68 (17.93%)

- BDCs $154.90 (10.90%)

- Treasuries $9.76 (0.69%)

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

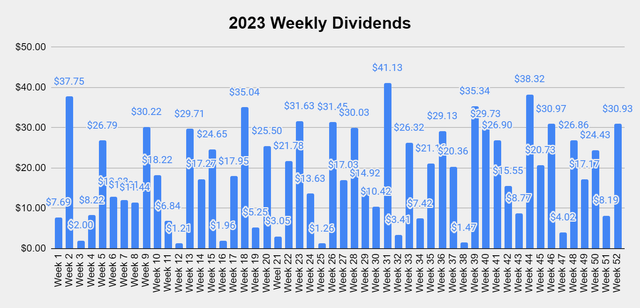

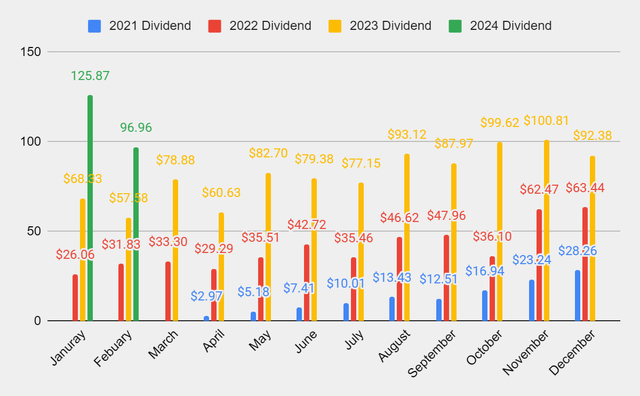

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off of them. I’m building a dividend portfolio for myself 30 years into the future. In 2022, I collected $507.80 in dividend income from 533 dividends. In 2023, I collected $978.11 in dividend income from 660 dividends. After the first 12 weeks in 2024, I have collected $287.40 from 151 dividends. This is 29.44% of the total dividend income generated in 2023 from 22.88% of the dividends produced.

These dividends allow me to gain additional equity in my investments, while increasing my future cash flow in down markets. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. The Dividend Harvesting Portfolio finished strong in 2023, and I am looking to generate $1,800 of dividend income in 2024 while getting to the point where I never dip below $100 of monthly dividend income being generated.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Well, there wasn’t a lot of dividend income produced in week 160, and I am a bit surprised, considering how the monthly dividend amounts in 2023 occurred. While it’s the last week of the month, I am starting to think that I may not hit $100 of income as there has only been $69.94 generated so far in March of 2024. The last week of March will certainly be interesting, and I am excited to see how much dividend income ends up being produced.

Steven Fiorillo, Seeking Alpha

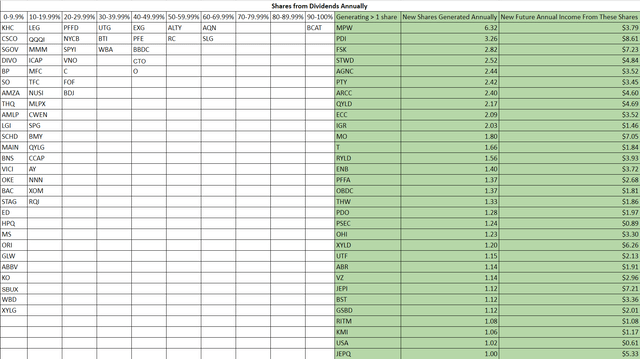

There are 32 positions generating at least 1 share per year, and in week 160, the BlackRock Capital Allocation Term Trust appreciated, which caused it to fall into the 90-100% category. I will end up adding another share sometime soon to have it cross over back into the green section of the table below. Over the next several months, I will be making an effort to have more positions get to the point where they are generating at least 1 share from their dividends on an annual basis. This will help harness the powers of compounding in the future, especially while I am still allocating to the Dividend Harvesting Portfolio on a weekly basis. Currently, the new shares being generated are projected to produce $102.85 in annual forward dividend income.

Steven Fiorillo, Seeking Alpha

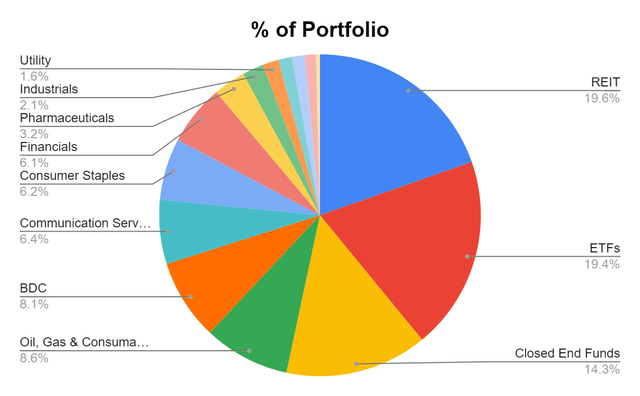

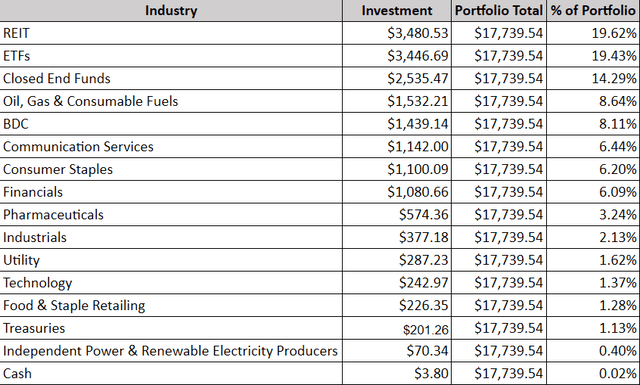

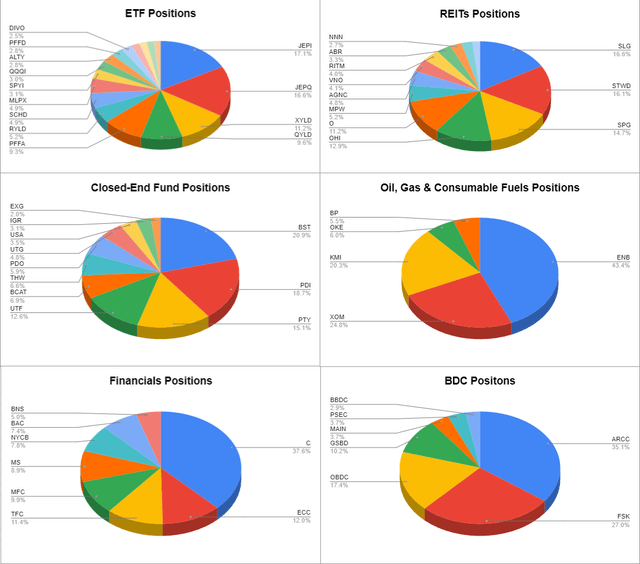

The Dividend Harvesting Portfolio Composition

Steven Fiorillo, Seeking Alpha

While REITs remained at 19.6% of the portfolio, ETFs jumped up to 19.4% after this week’s allocation. I will be focusing on individual equities over the next several months, and while I may add to REITs, ETFs, or CEFs, I am planning on making an effort to even out my holdings a bit further. It’s difficult because I want to add to many of the positions I am holding as I see future value to be unlocked. While REITs and ETFs are under my 20% threshold, I would like for them to be under 18% of the portfolio.

Individual equities now represent 37.39% of the Dividend Harvesting portfolio while generating 27.89% of the dividend income. REITs, ETFs, CEFs, and BDCs make up 62.61% of the portfolio and generate 72.11% of the forward income. I plan on adding to every asset class within the Dividend Harvesting Portfolio throughout 2024, but in the early stages, I will try to divert capital away from REITs in the short term.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

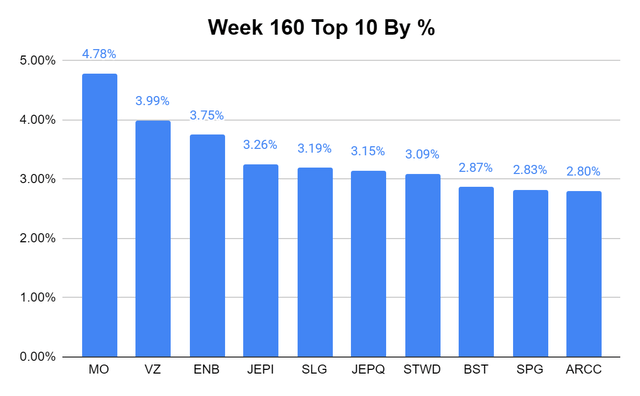

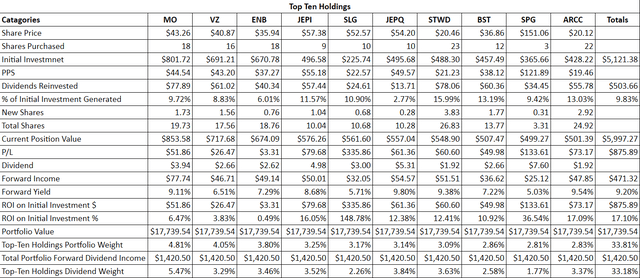

While the same companies are in the top-10 holdings, its changed a bit. SL Green Realty (SLG) took over the 5th largest position while the BlackRock Science and Technology Trust (BST) moved from the 10th position to 8th. Altria Group (MO) is still the largest holding in the Dividend Harvesting Portfolio, and it has recently made a run from around $40.80 to over $43. I think MO is undervalued, and while I would like to add to the position again, it represents 4.78% of the portfolio, so I am going to wait before allocating more capital toward it. In the coming weeks, I think the top-10 holding will change a bit, and some new positions will find their way on the list.

Steven Fiorillo, Seeking Alpha

I am trying to find the time to set up another table like the one below for the next 10 positions in the Dividend Harvesting Portfolio. I am finding it interesting to see how much each position has generated from their original investments and the raw data behind these positions. So far, I have invested $5,121.38 in the top-10 positions within the Dividend Harvesting Portfolio. There has been $503.66 in dividends generated, which is 9.83% of the initial investment. The current value of the top-10 positions is $5,997.27, which is a profit of $875.89. The top-10 positions are projected to generate $471.32 in forward dividend income, which is a 9.2% yield. The top-10 positions represent 33.81% of the total portfolio and are expected to generate 33.18% of the total forward dividend income.

Steven Fiorillo, Seeking Alpha

Week 160 Additions

Week 160 was reader suggestion week, and I added the NEOS Nasdaq 100 High Income ETF (QQQI) to the Dividend Harvesting Portfolio.

NEOS Nasdaq 100 High Income ETF

- QQQI is similar to the NEOS S&P 500 High Income ETF (SPYI) but rather than investing in the companies within the S&P it focuses on the Nasdaq 100

- QQQI was launched in 2024 and has less than $50 million in assets under management (AUM) while SPYI has exceeded $1 billion in AUM.

- QQQI has paid 2 monthly distributions since going public, $0.59 in January and $0.60 in February. I used a conservative $5 per share in my forward distribution income estimate, while at this rate QQQI is more likely to produce around $7 per share. There isn’t enough data to see what the fluctuation will be.

- I am a fan of the strategy as I feel the market is going to continue higher. QQQI sells covered calls against its positions and buys call options with a portion of the premium to capture some of the additional upside in rising markets. This allows investors to benefit in bull cycles because the upside potential isn’t completely capped.

- I think QQQI will be a strong ETF for a combination of capital appreciation and income during 2024 and I plan on adding to this position in the future.

Week 161 Gameplan

In week 161, I plan on adding to my position at British American Tobacco (BTI) and The Kraft Heinz Company (KHC).

Conclusion

The Dividend Harvesting Portfolio has come a long way, and it’s acting as a superior proxy for allocating capital toward the T-bill and chill movement. There have been ups and downs along the way, but right now, the portfolio is up $1,739.54 (10.87%) while generating $1,420.59 (8.01%) in forward dividend income. The 2 charts below show the income history since inception and how much-projected income is being generated over different time frames. I am 27.32% of the way to generating $100 in weekly dividend income, which would match my capital allocation. This portfolio is still in its infancy, and I am excited to see how the powers of compounding will shape the portfolio down the road when I am producing more on a weekly and monthly basis from dividends than what I am allocating. This investment style isn’t for everyone, and I am not trying to beat the market. I am creating a portfolio that can generate recurring income while mitigating downside risk through diversification. I think 2024 will be a strong year for the Dividend Harvesting Portfolio, as many of the investments I have made should do well in a lower-rate environment.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Read the full article here