ETF Profile

The iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE) is a 12-year-old ETF, with $700m in AUM that offers exposure to 100 dividend-paying emerging market (EM) stocks (do note that REITs are not considered). Currently, the portfolio deals with stocks from a plethora of differing EMs such as Brazil, Chile, China, Czech Republic, Greece, India, Indonesia, Malaysia, Mexico, the Philippines, Poland, Qatar, South Africa, Taiwan, Thailand, and the UAE, and the goal is to cap country-specific exposure at 25% and 30 stocks from a single country.

Given the wide exposure to a vast group of countries, one would think that DVYE is spoiled for choice, and one gets a sense of this in the manner of churn that takes place every year. Typically, more than 1 out of 2 stocks get turned over from this portfolio every year.

Also note that this product doesn’t just randomly pick dividend-paying stocks from various emerging markets. Rather, the stock’s indicated yield (excluding special dividends) is used as the key differentiating gauge. And prior to this, prospective stocks are also required to have generated positive EPS on a trailing-twelve-month basis.

In addition to that, these stocks are also required to maintain a trailing annual dividend track record of at least 3 years. It would’ve been preferable for DVYE’s tracking index to also include a gauge that measures dividend sustainability or dividend coverage, particularly as a 3-year track record of dividend payments feels too short.

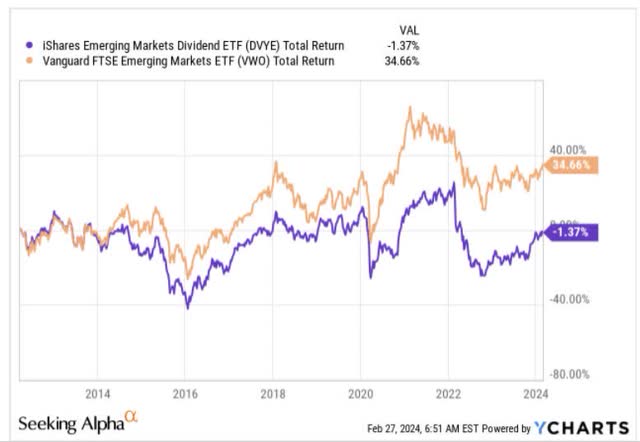

Nonetheless, DVYE’s sub-par screeners haven’t been particularly useful in picking out quality names, and this can be validated in the poor return profile of this product since its inception. Admittedly EMs haven’t been a great return-generating haven over the past decade, but do consider that the most popular EM-themed ETF around (by AUM)- the Vanguard FTSE EM ETF (VWO) has still managed to deliver around 34% returns; in contrast, our focus ETF has eroded wealth by 1% since it got listed.

YCharts

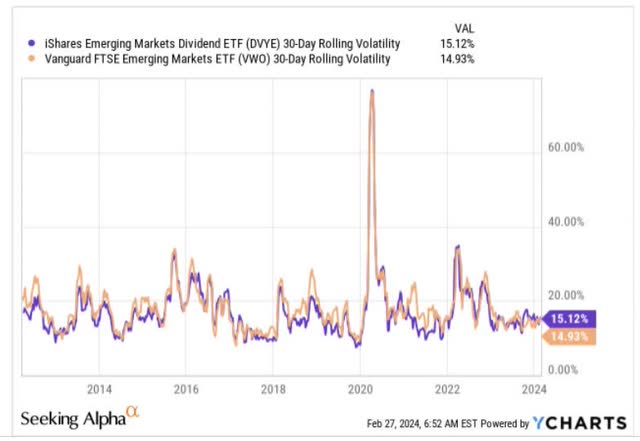

One would think that EM stocks with dividend characteristics would also come across as less-volatile than your plain vanilla EM stocks, but that isn’t the case with DVYE’s portfolio; as far as its rolling volatility is concerned, note that it has a slightly higher volatility profile than VWO.

YCharts

Should You Buy DVYE Now?

As noted in the previous section, DVYE has its fair share of flaws, but if you still want to persist with it, here are a few things worth noting.

Perhaps the most attractive facet of DVYE is its dirt-cheap valuations; the ETF can currently be picked up at a deeply discounted P/E of just 7.24x, which translates to a massive 39% discount to the multiple of VWO, priced at almost 12x.

DVYE’s low valuations are largely driven by its key exposure to Brazilian dividend-based stocks which is one of the cheapest EM counters across the world. When it comes to Brazilian equities, we are not entirely convinced it’s the most attractive EM region to be exposed to and we’ve written about that recently, particularly on account of the massive expected drop-off in GDP relative to some of the other major EM terrains.

A Reuters poll amongst 50 economists suggests that FY24 GDP growth will slump to only 1.6% (expected range of 0.4%-2.5%) vs 3% in the growth in the previous year. El Nino effects this year will likely ensure that Brazil’s key agriculture sector doesn’t see another year of record harvests, and there are also concerns that the Lula administration may not quite be able to wipe out the primary deficit as originally targeted by the end of this year.

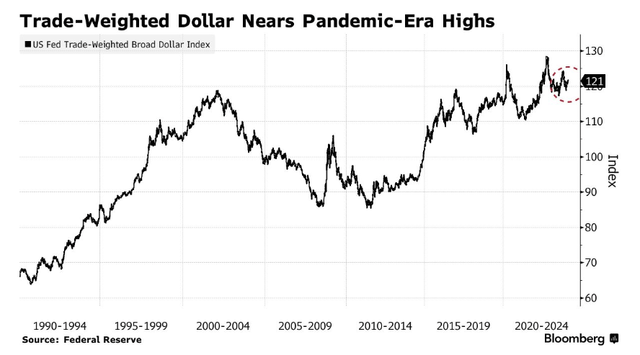

The other key point to note is that DVYE is also dominated by stocks from the material and energy sector (jointly accounting for 38% of the total portfolio), and these are sectors that are particularly vulnerable to the strength of the dollar, which in trade-weighted terms is now 17% higher than its two-decade average.

Bloomberg

The higher-for-longer stance by the Fed is doing a world of good for the dollar, and this has meant that short dollar positions are now essentially flat.

Then the other key theme to consider is that traditionally, if you’ve been looking for dividends, emerging markets aren’t really the most appropriate place to be looking at. A lot of firms here are still relatively early in their growth cycle, and are thus invariably plowing back a lot of cash back into growing the business organically (rather than rewarding investors with juicy payouts). This is exemplified by the subdued nature of the EM-specific sub-index of Janus Henderson’s portfolio of global sub-indices. Janus Henderson, a firm that specializes in measuring dividend trends across the world, has also suggested that dividend growth in 2024 will likely come in at a much slower pace compared to previous years.

Janus Henderson

All these factors suggest that DVYE may not be a great buy now.

Closing Thoughts- Technical Considerations

Even the charts suggest that an investment in DVYE at this juncture may not be too rewarding.

The chart below measures the relative strength (RS) of DVYE’s portfolio versus a basket of high-yielding global stocks. DVYE would’ve come across as a great rotational option within this space, had the RS ratio been trading at the lower end of this chart, but conversely, we have a situation where these stocks looked quite overbought, trading at a 36% premium to the mid-point of its long-term range.

Stockcharts

Finally, if we look at DVYE’s own price imprints over the last 20 months, we can see that it has become a trading play, chopping around within a certain range (marked by the two black lines). Given that the price is now hardly a breath away from the upper boundary of this range, we don’t think it would be too prudent to take a punt at these levels.

Investing

Read the full article here