Investment summary

My previous investment thought for Dynatrace (NYSE:DT) (published on 24th May) was a buy rating because I believe the business will see growth acceleration in FY26, supported by a revamped go-to-market strategy. I give DT a buy rating as recent performance was impressive, and there are more reasons to believe that growth will accelerate over the foreseeable future.

1Q25 results update

Total revenue grew ~20% from $332.9 million in 1Q24 to ~$400 million in 1Q25, driven primarily by subscription revenue growth of 20.6%. On a constant currency [CC] basis, total revenue grew 21%, in line with the past 2 quarters. Gross margin saw minor improvements of 10bps from last year, which combined with a lower cost structure drove an adj. EBIT margin expansion of 100bps to 28.6%. FCF was also a bright spot, as DT reported a 57% FCF margin this quarter, a robust expansion from the past few quarters, which marked a new high for the business in FY19.

Remarkable performance with more to look forward to

DT showed remarkable performance this quarter, and based on my read, various data points and operating data point to growth stabilizing with potential for growth acceleration ahead.

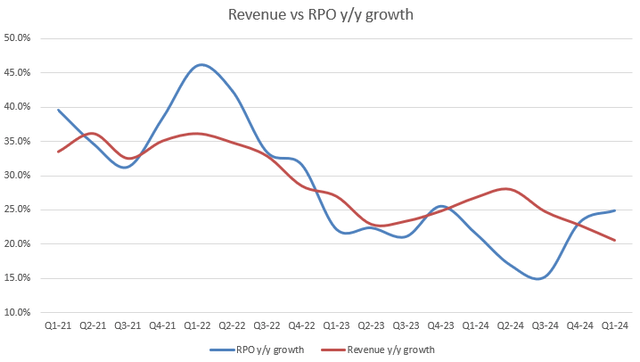

After multiple quarters of annual recurring revenue [ARR] CC growth deceleration since 2Q22 (38.1% growth), DT finally showed the first sign of stabilization as 1Q25 ARR grew 20% CC in line with 4Q24 growth of 20.2%. The notable aspect is that net-new ARR (NNARR) grew by 23% y/y CC, accelerating from the 1.4% y/y CC growth seen in 4Q24. Other signs of stabilization and demand improving include: (1) dollar-based gross retention rates [DBGRR] remained stable at mid-90% with a net expansion rate expanding by about 100 bps; (2) DT added 162 new logos, which grew 4.5% y/y, marking the first quarter of y/y growth acceleration after 3 quarters of deceleration (4Q24 saw -6.1 y/y new logos add growth); and (3) remaining performance obligations [RPO] growth accelerated for the second consecutive quarter, up from 23.2% in 4Q24 to 24.9% in 1Q25. The last point is worth highlighting because this is the first time since FY22 that RPO y/y growth accelerated beyond revenue y/y growth by such a big margin. While early, if this trend sustains, it could mark the start of DT’s next growth acceleration cycle.

Redfox Capital Ideas

Qualitatively, there are prominent developments that suggest growth will improve from here. First and foremost, on Dynatrace Platform Subscription [DPS], DT continues to see strong adoption, as it added 200 DPS customers in 2Q24, bringing the total number of DPS customers to >900, now representing 20% of the total customer base. The mix shift impact from an increasing base of DPS customers has an outsized impact on revenue and ARR growth that is not well reflected in the business today.

For instance, while DPS customers represent 20% of total customers, they represent >40% of total ARR. Management also noted that these customers are consuming significantly more than non-DPS customers. Put these together, and it’s not difficult to imagine ARR and revenue growth accelerating when DT continues to see more DPS adoption. Just to recap a little, DPS customers went from just 10% of total customers in 3Q24 to 20% in 1Q25 (just two quarters).

Given the momentum, I will not be surprised to see this percentage grow to 40% over the next two years, which means they may represent >80% of total ARR. Additionally, management also noted that the flexibility of the DPS pricing allows customers to try out newer modules, driving broader platform usage. This should enable DT to better cross/up-sell more modules over time as the friction to adoption is significantly lowered.

And those customers are consuming more of the platform at a much more significant rate than non-DPS customers. So we’re starting to see it manifest itself in consumption. 1Q25 earnings transcript

The second development is that DT has made great progress in revamping its GTM strategy. As of April, they have finalized the salesforce territory and coverage changes, and now they are increasing their investment in customer success to match the new sales force segmentation mapping. Additional efforts are also being channeled to the Expand Partner Enablement Program.

The new partner enablement program aims to further remove friction, which is certainly helpful in terms of distribution. The timing of this meaningful growth contribution from this revamped GTM strategy is still in line with my expectations (in FY26), as DT is going to step up their pace of hiring more sales capacity, mainly in the 2H25 to position for FY26 growth.

So while we’ll continue to do hiring of sales reps, I’d say the hiring is going to happen more substantively in the back half of the year. So I think we’re at a good place as far as the accounts settling in with reps. 1Q25 earnings transcript

Valuation

Redfox Capital Ideas

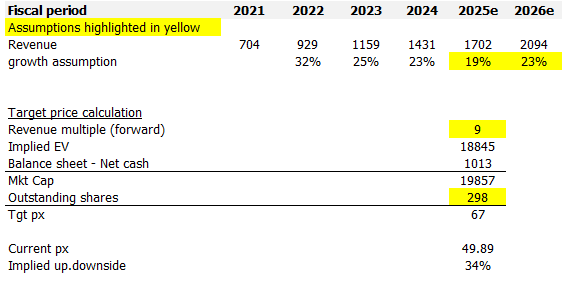

I model DT using a forward revenue approach, and using my assumptions, I believe DT is worth $67. I upgraded my growth and multiple assumptions for DT, as 1Q25 showed very positive developments and operating metrics.

I think growth will do much better than what I modeled previously and management guidance. Despite the strong 1Q25 performance (a seasonally weak quarter), management reiterated FY25 guidance to be conservative (reflecting the uncertain macro environment), even though they themselves noted that DT did not see any material change in macro vs. 4Q24. To size the potential outperformance, I looked at DT historical reported vs. guided figures and assumed the same trend (300 bps outperformance on average).

As I expect growth to accelerate faster than previously expected, I think DT deserves a higher multiple to reflect this strength. To reflect this, I assumed an additional 1x increase vs. my previous estimate of 8x.

Risk

Negative developments at the macro level could pressure DT’s ability to accelerate growth. Although DT has progressed well in revamping the GTM strategy-in that changes have been put in place-we have yet to see how this translates into revenue and ARR growth. For all we know, the new strategy fails to work as well as it should. In this case, it will hinder the growth outlook.

Conclusion

My view for DT is a buy rating as the business demonstrated strong performance in 1Q25, with solid revenue growth, improved profitability, and an improved FCF profile. There are also several factors suggesting that growth acceleration will happen. For instance, DT saw increased DPS adoption, and DT is well in progress to revamp its GTM strategy. If my view is right, there is a good chance for DT to beat its FY25 guidance, resulting in faster growth than my expected growth rates previously.

Read the full article here