Electromed, Inc. (NYSE:ELMD) recently reported an impressive quarter, and noted beneficial expectations for the year 2024. With a total market opportunity of close to 4.2 million patients suffering from Bronchiectasis, I assumed that the total market opportunity could be around $8.4 billion. Given the current revenue line, there is significant room for improvement thanks to direct-to-consumer and medical marketing as well as internationalization efforts. If we also include the stock repurchase program and the recent price dynamics, I believe that Electromed is a buy. Yes, there are relevant risks out there coming from higher costs, longer delivery times, or supply chain issues. With that, I believe that ELMD does not trade expensively.

Electromed: Impressive Guidance, And Beneficial Quarterly Report

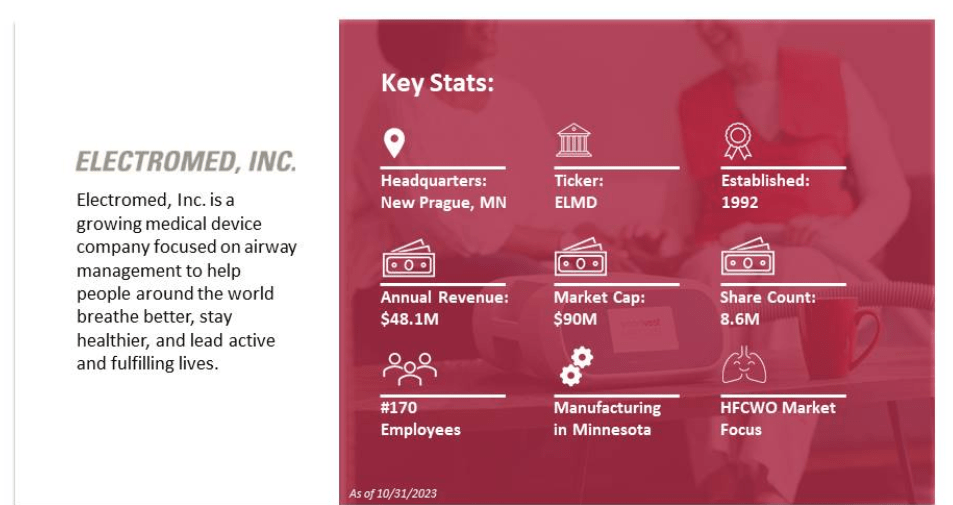

Electromed develops and manufactures airway clearance therapy devices, such as the innovative SmartVest System. Founded in 1992 and with manufacturing facilities in Minnesota, the company offers solutions that allow patients to breathe better and enjoy an improved life by minimizing exacerbations and promoting optimal respiratory function.

Source: Investment Presentation

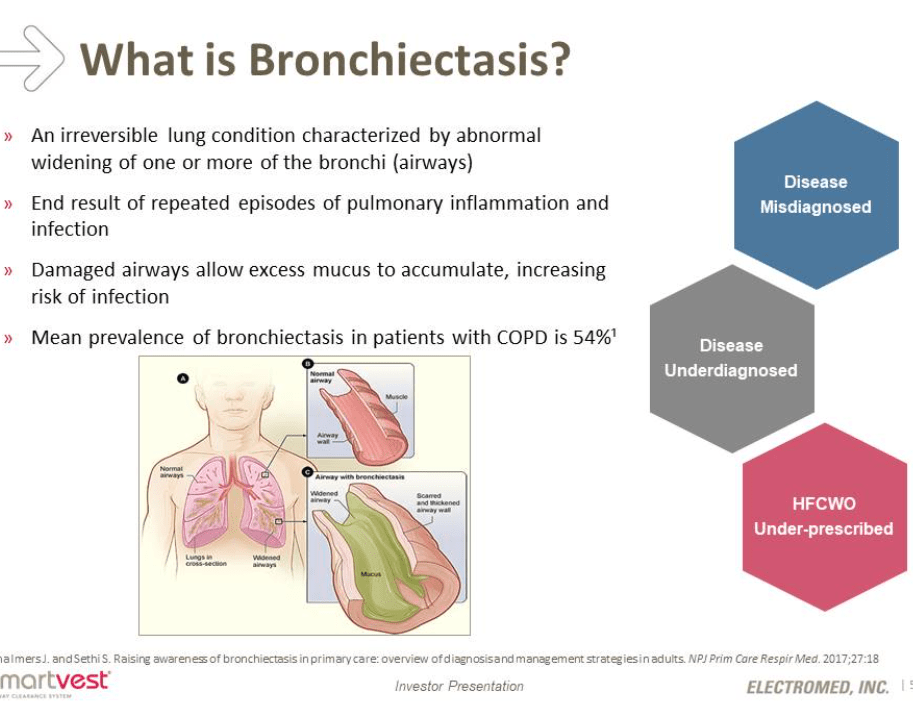

According to the last presentation given to investors, SmartVest System is ideal to treat Bronchiectasis, a lung condition characterized by abnormal widening of one or more of the bronchi.

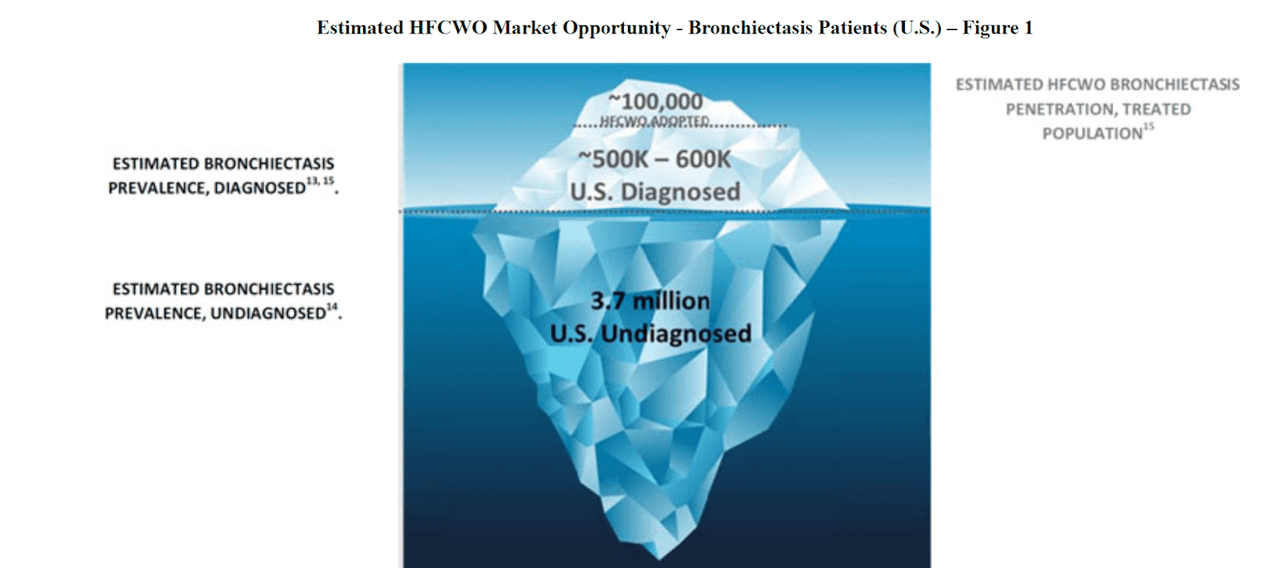

Electromed noted that many patients may not be diagnosed, so the market opportunity may be larger than expected. In the United States, there are close to 500k-600k diagnosed patients, and there may exist 3.7 million undiagnosed patients. According to pharma websites that I could consult, the SmartVest System has been sold for about $2k. If we assume a potential of 4.2 million patients and multiply by $2k, the total market opportunity could be close to $8.4 billion. With sales of less than $54 million, I would say that Electromed, Inc. could deliver significantly more net sales in the coming years.

Source: Investment Presentation Source: Investment Presentation

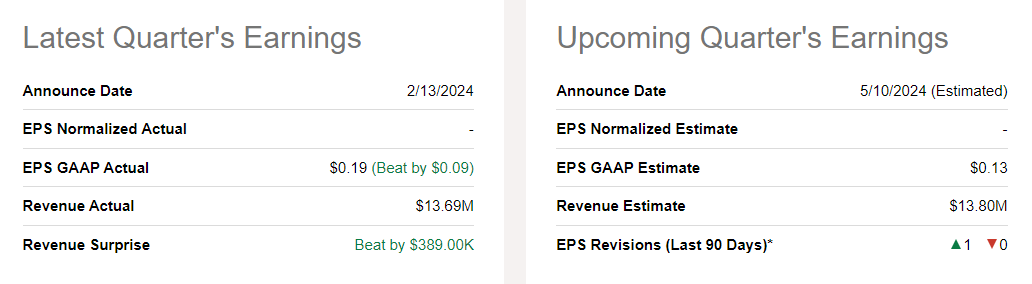

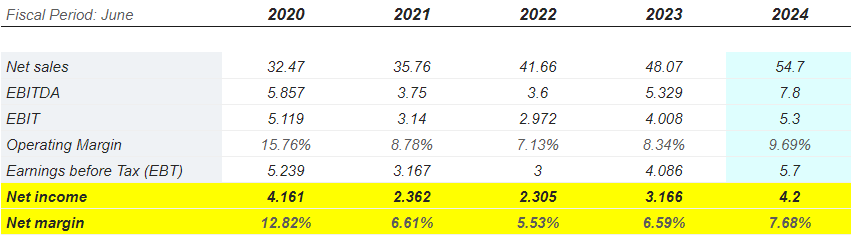

I believe that it is a great time for reviewing the company’s recent track record and expectations given the last quarterly earnings report. Electromed, Inc. noted better than expected EPS GAAP of $0.19 with quarterly revenue of $0.389 million. In addition, it is also worth noting that EPS revision increased in the last 90 days, and the stock price spiked up recently. There seems to exist a significant amount of optimism about the company right now.

Source: Seeking Alpha

With regard to the reaction of management, I believe that the following words are worth reading carefully. The company noted that investments are finally paying off. The company also noted beneficial expectations for the second half of fiscal year 2024.

The Company’s consistent growth strategy focusing on developing best-in-class products, exemplary customer service and disciplined commercial expansion is generating positive results. We see these investments paying off through continued revenue growth and increased profitability. The Electromed team and I remain focused on serving our customers and promoting our state-of-the-art airway clearance technology, Smartvest Clearway, to drive continued market penetration. We are moving from strength to strength, and we look forward to continued success in the second half of fiscal year 2024. Source: Press Release

Expectations with regard to future net sales and net income growth are also worth considering. 2024 net sales are expected to be close to $54 million, with 2024 EBITDA of $7 million, 2024 EBIT of $5 million, and 2024 net income of $4 million. I did use these expectations in my financial models, so I invite readers to have a look.

Source: Market Screener

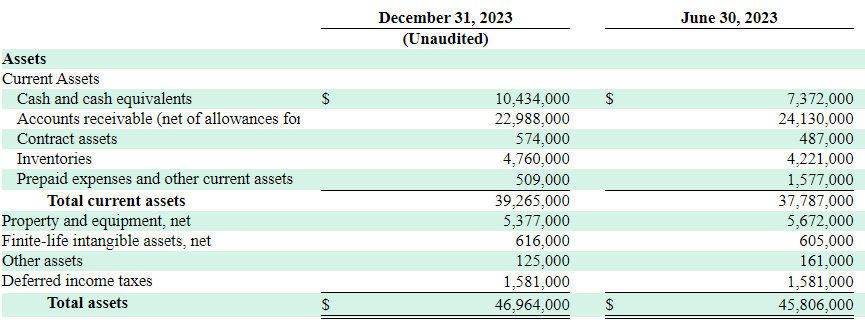

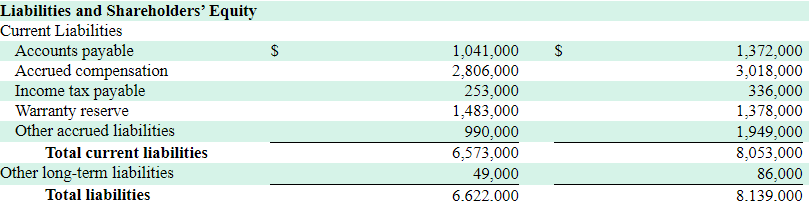

Stable Balance Sheet

As of December 31, 2023, the company noted cash and cash equivalents worth $10 million, accounts receivable of about $22 million, and inventories worth $4 million. Besides, total current assets stood at about $39 million, which implied a current ratio of more than 5x. In sum, I think that liquidity is not an issue here. Long term assets do not seem that significant. The largest long term assets are property and equipment worth $5 million, and total assets stand at about $46 million. The asset/liability ratio is larger than 3x, so I would say that the balance sheet appears quite stable.

Source: 10-Q

With regard to the total amount of liabilities, it is worth mentioning that the company does not seem to report financial debt. Most investments come from shareholders and some business providers. With accounts payable of about $1 million, total current liabilities are close to $6.5 million, and total liabilities stand at $6.6 million.

Source: 10-Q

It is worth noting that Electromed has access to several lines of credits if necessary. Electromed secured a $2.5 million revolving line of credit, renewed through December 18, 2023. As of June 30, 2023, there were no outstanding balances. Interest, if applicable, accrues at the prime rate less 1.0% or 8.25% as of June 30, 2023, and is paid monthly.

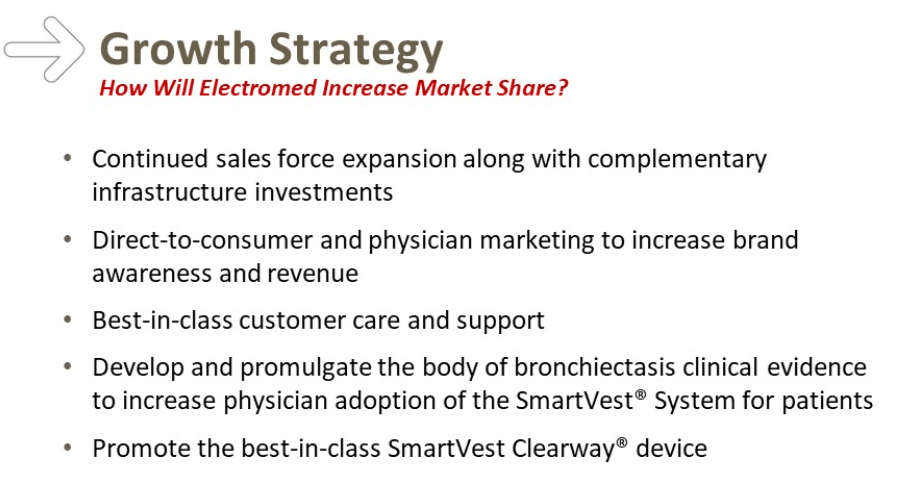

Growth Strategies Could Represent Net Sales Catalysts

I would expect the company to seek to gain market share and expand the addressable population, focusing especially on the adult pulmonology and bronchiectasis segment. Actions could include expanding the sales force in high-potential geographies, improving brand awareness through direct-to-consumer and medical marketing, offering superior customer service, and developing and disseminating clinical evidence to drive adoption of the SmartVest system by physicians. Under my best case scenario, I assumed that these strategies will bring net sales growth. I also assumed that economies of scale could bring increases in the FCF margin.

Source: Investment Presentation

Eliminating Intermediation Could Bring Significant FCF Margin Growth

The company obtains medical referrals, manages insurance claims, and provides the SmartVest system directly to patients, offering training for use at home. In addition to direct sales, the company markets the SmartVest in critical care settings. This device, with its programmable air pulse generator and therapeutic garment, offers effective therapy to clear the airways, improving patients’ quality of life and reducing costly hospital admissions. With this in mind, in my view, by eliminating intermediation in the traditional durable medical equipment channel, Electromed maximizes margins for manufacturers and distributors.

SmartVest Clearway platform Was Launched, So I Would Expect Marketing Expenditures To Accelerate Net Sales Growth

According to the last quarterly report, Electromed decreased significantly its R&D expenses because the company recently launched the SmartVest Clearway platform. In my view, with less investment in development, management may be able to use more funds for marketing and sales. As a result, I believe that we may see increases in net sales growth as seen in the last quarter.

Research and development expenses were $107,000 and $313,000 for the three and six months ended December 31, 2023, respectively, representing decreases of $47,000 and $139,000, or 30.5% and 30.8%, respectively, compared to the same periods in the prior year. The decreases were primarily due to reduced costs associated with our SmartVest Clearway platform development which has now been launched into the Homecare and hospital markets. Source: 10-Q

Internationalization Efforts Could Bring Significant Net Sales Growth

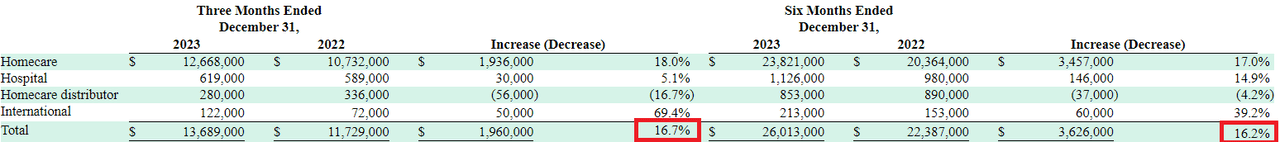

In the six months ended December 31, 2023, the company reported net sales growth of 16% and impressive international quarterly net sales close to 69%. In my view, further acceleration of net sales in the international markets could bring significant demand for the stock. The recent quarterly figures and financial figures for the year ended December 31, 2023 are worth having a look.

Source: 10-Q

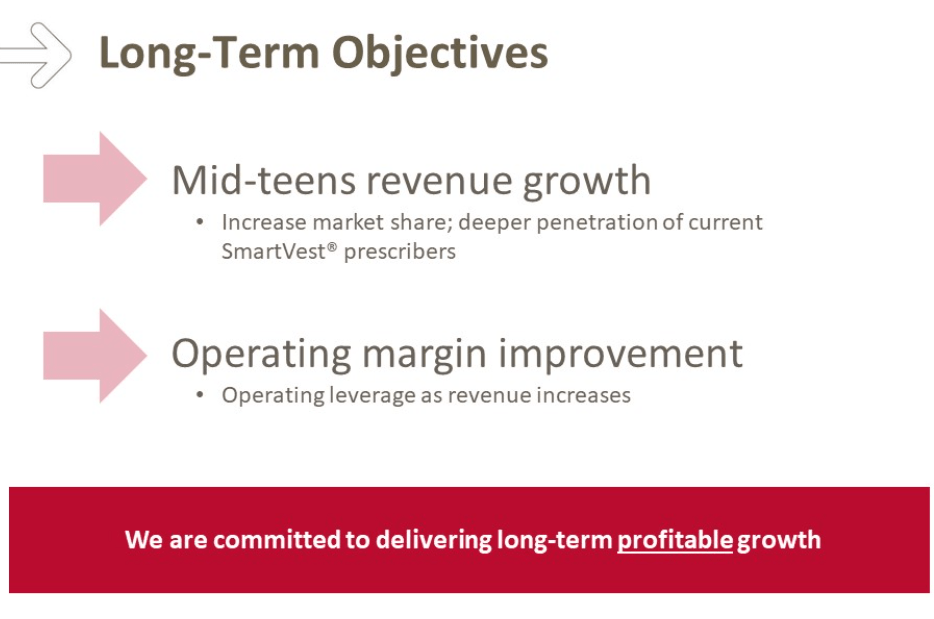

Expectations Include Mid-teens Revenue Growth And Operating Margin Improvements

Under my base case scenario, I assumed that the company’s long term objectives are realistic. With deeper penetration, an increase in market share, and operating margin improvements promised, I would say that expectations about the future could increase in the coming years. In this regard, the following slide given to investors is worth noting.

Source: Investment Presentation

The Stock Repurchase Program Approved Could Bring Significant Demand For The Stock

In the past, the company approved a stock repurchase program, which may bring significant demand for the stock. As a result, the stock price could trend higher. It is also worth noting that Electromed, Inc. may be assuming that the stock valuation is too cheap. I do not believe that companies out there buy their own shares when they are expensive.

Our Board of Directors approved the repurchase of up to $3.0 million of outstanding shares of our common stock. The shares of our common stock may be repurchased under the authorization on the open market or in privately negotiated transactions subject to applicable securities laws and regulations. The current repurchase authorization does not expire and the approximate dollar value of shares that may yet be purchased under the plan as of December 31, 2023, was approximately $275,000. Source: 10-Q

Best Case Expectations

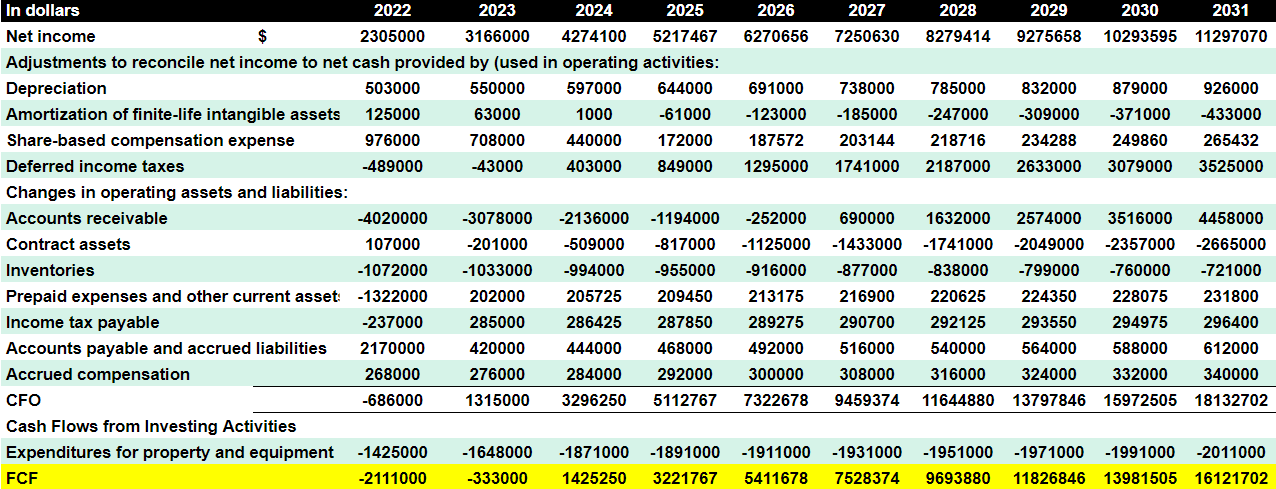

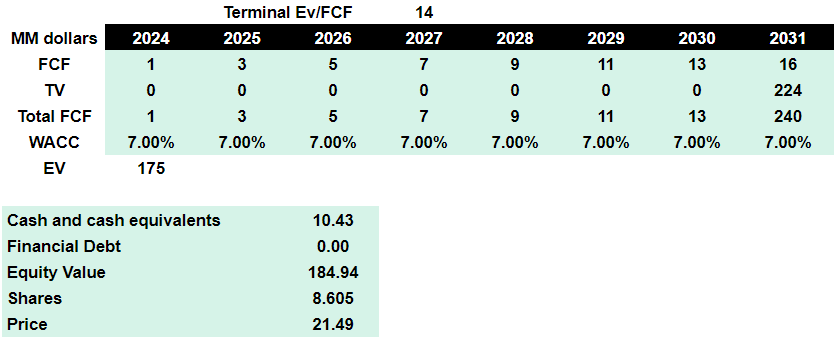

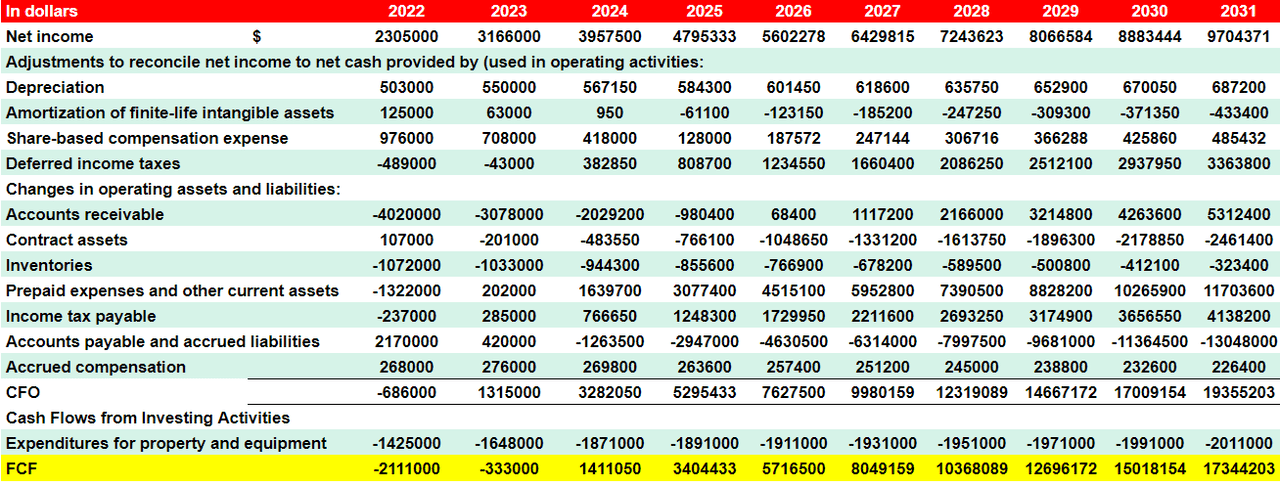

Under this case scenario, I included the following cash flow statement projections. With 2031 net income of close to $11 million, changes in contract assets of about -$3 million, and changes in inventories worth -$1 million, 2031 amortization of finite-life intangible assets would be close to -$1 million. With these figures, 2031 CFO would stand at close to $18 million. Moreover, by assuming 2031 expenditures for property and equipment of -$3 million, 2031 FCF would be $16 million.

Source: My Expectations

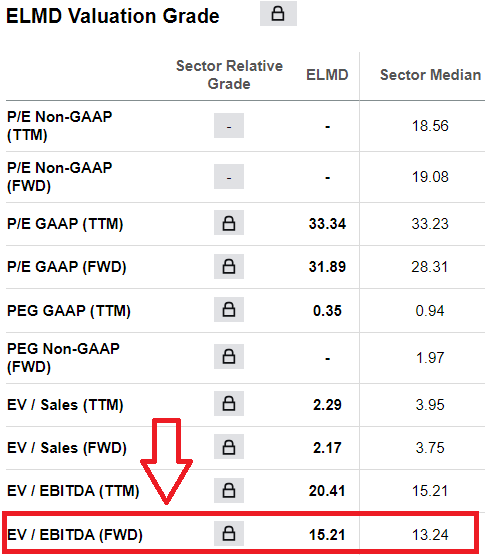

Given the sector median EV/EBITDA of close to 13x-14x, I believe that including an exit multiple of 14x makes sense. I also took into account a cost of capital of 7%, which I believe is conservative for a company with no debt, but small debt.

Source: Seeking Alpha

With the previous assumptions, I obtained an implied enterprise value of $175-$176 million. With cash worth $10 million and no financial debt, I also obtained an equity value of $184 million. Finally, the fair price would be close to $21 per share.

Source: My Expectations

Competitors

In my opinion, the company stands out in a competitive market, competing with leading companies such as Baxter International Inc. (BAX) and Philips (PHG). Electromed introduced its own MedPulse Respiratory Vest system in 2000, challenging Baxter’s initial monopoly on the technology. I also think that Tactile Medical (TCMD), through its AffloVest, also competes in this sector, primarily through DME distributors. Product sales are driven by improvements in quality of life supported by clinical outcomes and reduced healthcare costs. Electromed distinguishes itself through technological innovations that improve the patient experience, such as the size and weight of the generator, thus consolidating its position in the market.

Risks

In my opinion, Electromed could face challenges in its supply chain, with increased lead times, material costs, and shipping rates. This disruption could affect product availability. It was already reported in 2023, and may occur in 2024.

In my view, the acquisition of components and the identification of alternative suppliers are measures taken to mitigate impacts on revenues and deliveries. High material and tariff costs could persist in the coming years. As a result, the company may suffer decreases in future FCF margins.

Macroeconomic uncertainty and preventive measures by other companies and governments may adversely affect the supply chain. Estimates and accounting judgments are made, affecting assets, liabilities, and financial reports, with the need to exercise significant judgments and subject to inherent uncertainty. Any further disruption to manufacturing processes could have a material adverse impact on the business, and significant increases in costs could reduce gross margins.

Worst Case Expectations

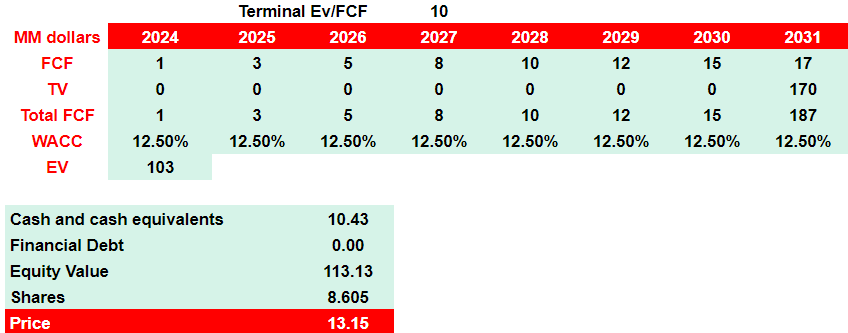

Given the previous risks and detrimental assumptions, I obtained the following financial expectations. I assumed 2031 net income of $9 million, with amortization of finite-life intangible assets close to -$1 million, changes in accounts receivable of $5 million, and changes in contract assets of -$3 million.

In addition, with changes in inventories of -$1 million, changes in prepaid expenses and other current assets of about $11 million, and changes in income tax payable close to $4 million, I also included changes in accounts payable and accrued liabilities worth -$14 million. Finally, my results would include 2031 CFO of $19 million, with expenditures for property and equipment close to -$3 million, and 2031 FCF of $17 million.

Source: My Expectations

With the previous cash flow projections, I also included an exit EV/FCF multiple of 10x, a WACC of 12.5%, and total enterprise value of $103 million. Finally, the equity valuation would stand at about $13.15.

Source: My Expectations

My Opinion

With many years operating in the industry, in my view, Electromed stands out for its commitment to excellence in the development of devices for the medicinal industry, such as the SmartVest System. The recent quarterly earnings report and guidance for 2024 seemed to send a lot of optimism to the market, which may be the gasoline that pushed the stock price recently. Besides, if we take into account recent long-term objectives, the stock repurchase program, or the double digit international sales growth, I think that Electromed is a buy. Yes, supply chain challenges, higher costs, longer delivery times, and the actions of other competitors could be detrimental for future FCF growth margin. With that, I believe that the company appears cheap at its current price mark.

Read the full article here