Recent data on the US employment market is sending mixed signals, raising concerns about potential turbulence ahead. While overall job numbers appear positive, three key indicators point to underlying weaknesses that could undermine the job market’s momentum.

Finding A Job Is Getting Increasingly Difficult

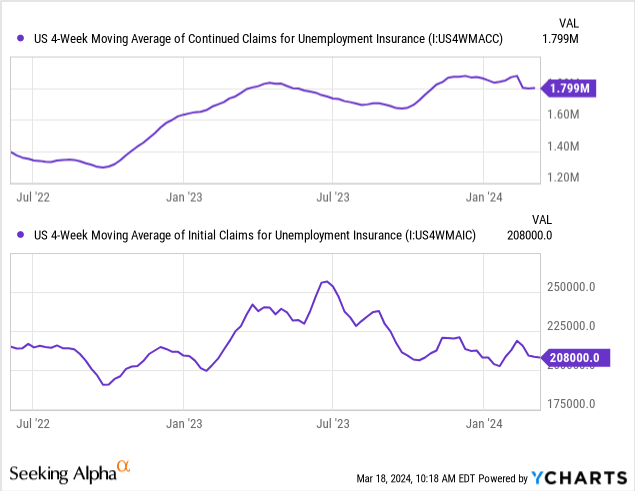

Continued claims for unemployment insurance have materially increased in the last 18-month period. This suggests that despite lower initial unemployment numbers, more workers are having difficulty finding new employment quickly, potentially indicating a softening labor market:

Back-of-the-envelope math informs us that the ratio of continued claims to initial claims for unemployment insurance benefits has risen from 6.8 weeks in September of 2022 to 8.7 weeks in March of 2024, signaling that finding new employment is taking longer today than it did 18 months ago.

Slowing Small Business Hiring Plans

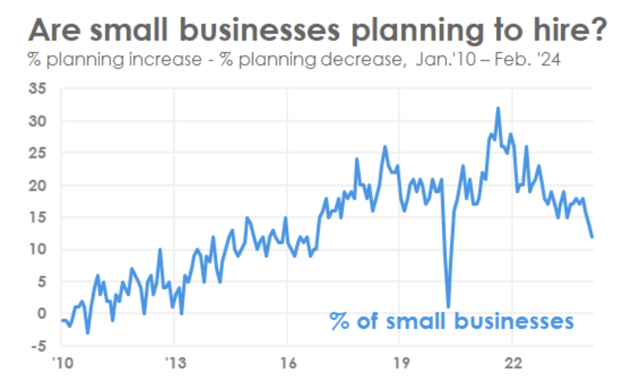

The following chart illustrates that the Small Business Hiring Plans Index has materially slowed down in the most recent monthly report as of February:

The NFIB Research Foundation

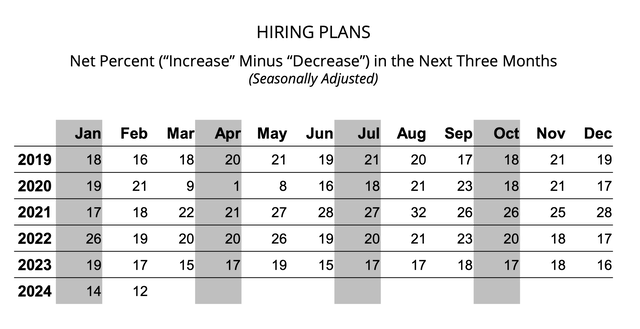

The below data table for the same series shows in more detail that the small business hiring plans have steadily deteriorated for four consecutive months, which has not happened at any other period in the last five years:

The NFIB Research Foundation

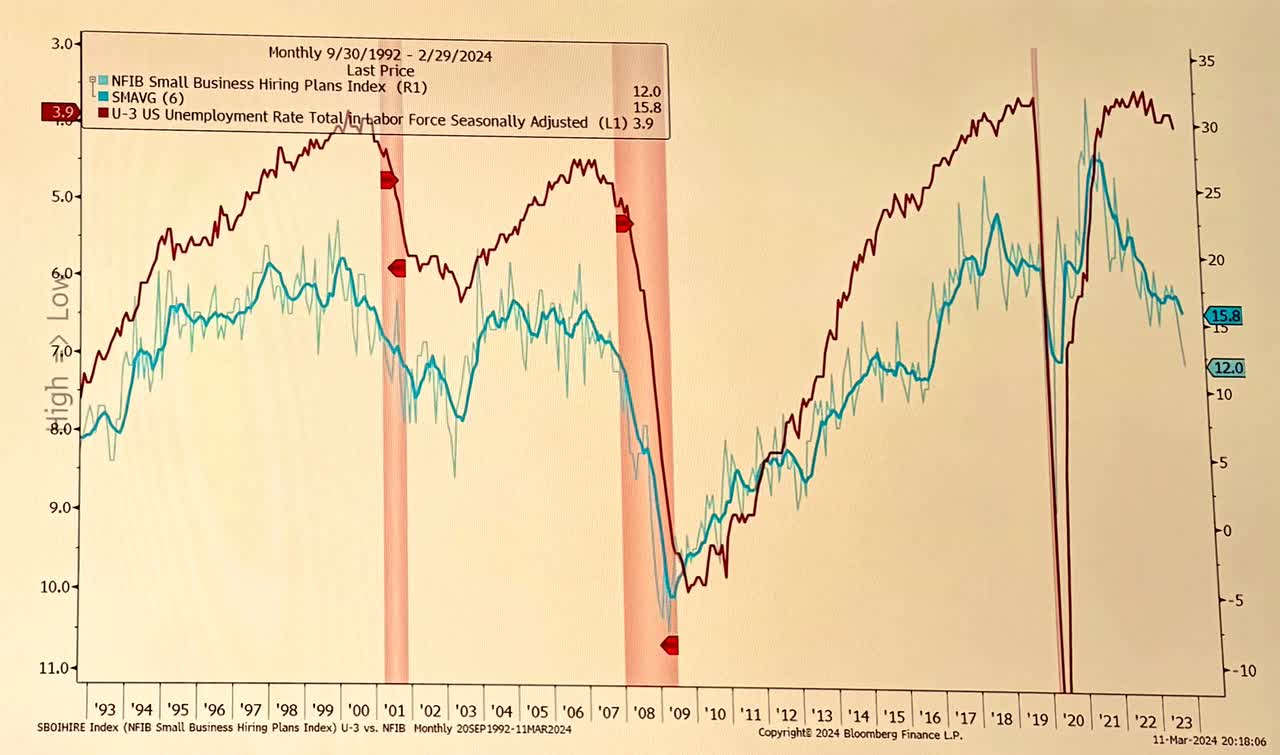

The following graph superimposes the U-3 US Unemployment Rate (inverted, left axis) with the above data series, NFIB Small Business Hiring Plans Index:

DoubleLine Capital

The substantial gap that recently formed between Small Business Hiring Index and the U-3 Unemployment Rate is informative and should be on the radar of macroeconomic analysts. In my opinion, the gap indicates that unemployment rates are set to increase in the coming periods.

Widespread Deterioration

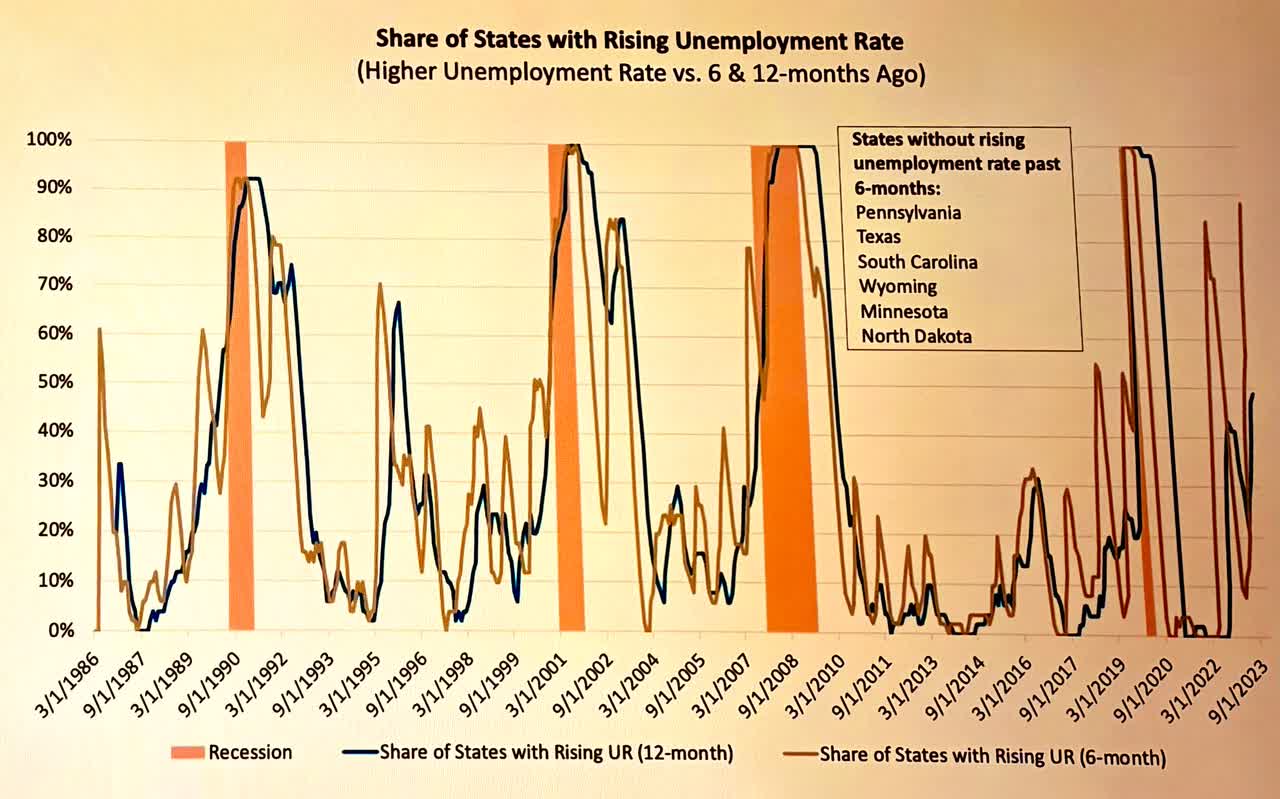

Furthermore, the following graph illustrates that the deterioration in the US employment market is not contained in a few of the states but is widespread, which is generally observed when the economy is headed into a recession:

DoubleLine Capital

I note that the share of states with rising unemployment in a six-month period has never been as high as it is today without a recession shortly following.

The Fed’s Hands May Be Tied

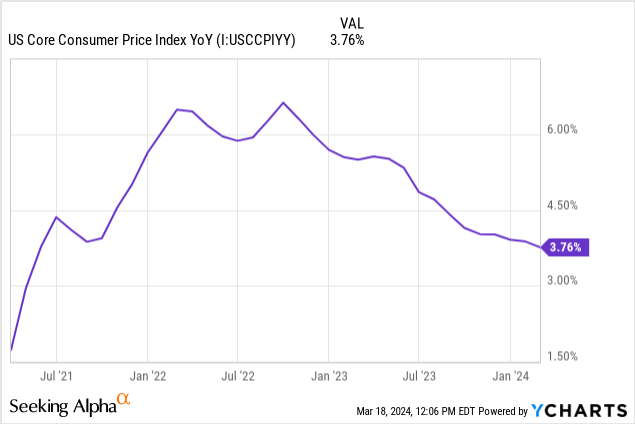

Those who believe the Fed has a lot of room to cut rates are assuming that the Fed is willing to cut rates to stop the deterioration in the employment market, but the Fed has made it clear that it wants to ensure the inflation rate is on a sustainable path down to the 2 percent target, and recent data may have tied the Fed’s hands for now.

The following chart illustrates that the Core CPI is signaling that the pace of disinflation in consumer prices has materially slowed down in recent months:

Looking beyond the Core CPI as of February, the Bloomberg Commodities Index has risen by 3.2 percent in the last 30-day period, signaling another month of inflation warnings for the Federal Reserve:

MarketWatch

Furthermore, even the Shelter component of inflation indices that was widely expected to decline has been taking longer than expected to do so, and recent data shows that rent growth may be accelerating:

Rents nationally continued to climb in February, experiencing the largest gains in over a year, with average rent prices rising by 2.5 percent on a yearly basis.

With commodities pricing rising and rent growth potentially turning up, the Federal Reserve’s hands may be tied for now.

Conclusion

The recent signals from the US employment market paint a worrisome picture. Rising continued claims, declining small business hiring intentions, and persistent inflation cast a long shadow over the positive job numbers. These trends, coupled with the widespread nature of labor market deterioration, point to a potential economic slowdown with rising unemployment rates looming on the horizon. While the Federal Reserve may be committed to tackling inflation, recent data may leave little room for policy maneuvers aimed at easing labor market pressures.

Investors should carefully consider the implications of these employment market trends. The widening gap between hiring plans and the unemployment rate suggests a mismatch that could lead to reduced consumer spending and corporate earnings. Sectors heavily reliant on discretionary spending or with strong ties to small businesses might be particularly vulnerable. As the labor market weakens and inflation remains a threat, a shift toward defensive investments and a focus on companies with strong balance sheets and pricing power may be prudent strategies.

Read the full article here