The residential solar industry in the US is still in its infancy, with less than 5% of single-family homes having solar panels installed. Of these, a whopping 44% are in California, where installs are over six times as common as they are in Arizona, the next leading state in terms of installs. These are the very early innings of solar becoming a more popular product.

In these early innings, Enphase Energy, Inc. (NASDAQ:ENPH) has come to a fairly dominant position, forming a duopoly with rival SolarEdge Technologies, Inc. (SEDG) that accounts for about 90% of the US inverter market share.

There is a clear distinction between the two companies, as Enphase sells microinverters while Solar Edge sells string inverters. As a primer, solar panels produce DC electricity, but your house consumes AC electricity. Enphase’s microinverters thus turn DC electricity into AC electricity at the panel level, such that each panel has its electricity converted as soon as it is produced. In a string inverter, the DC energy is all passed along to a larger central inverter that converts all the energy to AC in one location.

History

Historically, string inverters were invented first and remain dominant worldwide, especially considering that larger utility-scale deployments all use string inverters. Early string inverters had a particular problem, however, and Enphase was founded in order to address it.

The problem is the so-called Christmas-light effect, where if one panel in a string was shaded or underperformed for any reason, then the whole string would be brought down to match that poorly-performing panel.

However, due to advances in solar panels themselves and maximum power point tracking (MPPT), this problem largely does not exist anymore. Microinverters still outperform simple strings when conditions for solar are poor, such as heavy shading or multiple array angles, but it is also possible to add solar optimizers to accomplish the same thing as a microinverter without having the actual electrical conversion take place at the module level.

This background is important because Enphase’s technology was created to solve a problem that we can now solve in multiple other ways. This leaves Enphase in an awkward spot moving forward, especially when we consider the future of residential solar. I believe that the rise of battery technology will ultimately be a headwind for Enphase, as its technology is particularly poorly suited to solar-plus-storage solutions. As the residential solar market matures, competitors with more relevant technology will be positioned to take market share.

Micro vs. String Inverters

When considering installing solar on your home in the US, one of the biggest decisions is whether to go with a traditional string inverter or with Enphase’s microinverters. They both have their pros and cons, and I can really understand both sides. I do not wish to rehash the entire argument, as my thesis is focused more on the energy storage side of things. However, I do want to point out a few relevant qualities.

First, the inverter is potentially the most expensive and most important component in a solar installation. Do we really want them installed on the roof, exposed to extreme heat (over 150 degrees), wind, rain, squirrels, and so on? A string inverter can be installed indoors at the easily accessible ground level, where it should be much safer and less exposed.

Enphase proponents will point to the industry-leading 25-year warranty attached to their microinverters to refute this. There is also the argument (made even on their latest conference call) about having “No single point of failure.” The argument is that if a string inverter goes down, the whole system is useless. But if an Enphase microinverter goes down, only that panel is affected.

There is some very important information to consider as well. An Enphase system requires more components than simply the microinverters. For them to work, a combiner box is needed. For them to work without the grid, a system controller and a load controller are also needed.

Those are expensive components that represent single points of failure. If the combiner box goes down, all the microinverters will be useless until it is repaired or replaced. The important fact is that according to Enphase’s warranty information, the combiner box only has a 5-year warranty. The load controller also only has a 5-year warranty, and the system controller is 10 years.

While on the topic of warranty information, the microinverter warranty only applies if all the devices are “continuously connected to the internet.” A homeowner who changes their Wi-Fi password, then, must always remember to update their solar system, lest they risk voiding their warranty. This is not very confidence-inspiring and makes me seek a simpler product.

Home Energy Storage

Apart from all the traditional debate surrounding which inverter technology is better, microinverters have one glaring weakness: batteries.

Power stored in a battery is stored as DC, and no inverter is 100% efficient. Every time electricity is converted from AC to DC, and vice versa, some power is lost. For an Enphase system with an attached battery, then, inverter loss occurs three times: DC power from solar panels is converted to AC by the microinverters, which is then converted back to DC to be stored in the battery, which is then converted back to AC to be used by the household. This is silly from an engineering perspective.

Contrast this with a string inverter, where power is only ever converted once. DC power from the panels can be sent directly into the battery, where it is stored in its original state, and only converted to AC when it is used by the household.

Enphase claims 90% efficiency for its latest 5p battery, meaning that 10% of energy is lost every time it flows through the battery. The exact percentages are not as relevant as the fact that Enphase microinverters are more expensive than traditional string inverter systems. The benefit is that they are more efficient, helping to offset the increased cost. When a battery is added to the equation, however, it actually becomes less efficient than string systems.

Further, when using a string inverter, adding a battery is only adding a battery. Each Enphase battery, however, comes with 6 embedded microinverters inside the battery. So every time you add a battery you have to add a battery and more inverters. For this reason, Enphase batteries cost around $640/kwh, while a DC battery costs around $250/kwh. This is going to have massive ramifications for the payback period or return on investment.

The Rise of Residential Batteries: NEM 3.0

Part of my thesis is that residential batteries are about to become much more popular. Firstly, battery prices have come down about 90% in the last decade. This trend is set to continue as many of the best minds and deepest pockets in the world research new battery technology. As batteries become more affordable, the economics start to make more sense for homeowners.

As a result of regulation, we are already seeing this play out in California. Before California’s new NEM 3.0 policy, homeowners could “sell” any excess power that they produced through solar back to the utility. Now they cannot, or at least they receive much less for their extra power. To compensate for this, there are dramatic new time of use (TOU) incentives, making power cheap at night and expensive during the day. With a battery, a homeowner can thus take advantage of cheap nighttime rates to charge their battery and discharge it during the day when rates are much higher. As a result, “under NEM 3.0, the payback period for a solar-plus-storage installation is now faster than for a solar-only install.” In essence, solar alone got less attractive, while solar-plus-storage got more attractive.

Enphase

Enphase confirms this in their latest earnings call: “As of last week, 60% of our California installations were NEM 3.0. These systems have a high battery attach rate over 90% compared to NEM 2.0 systems, which have an attached rate of 15%.”

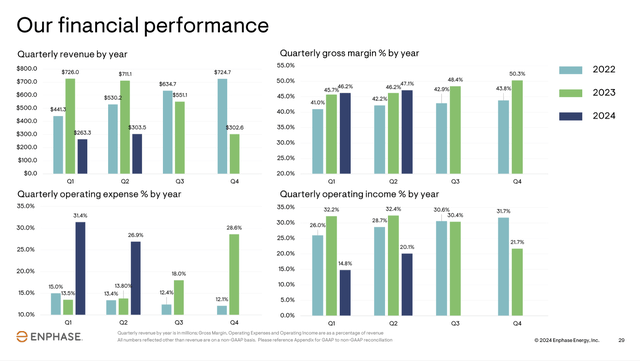

This represents a huge market shift, where demand for batteries is skyrocketing. In the third quarter, in both Europe and California, microinverter sales were essentially flat, but battery sell-through was up 14-18%. More and more of the financial results are being driven by battery sales, and this is set to continue. Here is a picture of Enphase’s recent financial performance:

Enphase Q2 Investor Presentation

Not a pretty picture. And this is despite continued growth in the battery business, from 75.5mwh in Q1 to 120mwh in Q2 and guiding for 170mwh in Q3 at the midpoint, much of this growth coming from California.

Competition

Batteries are exploding in popularity, given NEM 3.0 regulatory changes in California. Enphase has been profiting from and continues to expect to profit from this expansion. However, batteries are the primary weakness of Enphase’s technology.

Currently, if you want Enphase batteries to work as a backup in your system, you not only have to buy the battery (and the extra inverters in them), but you also have to purchase a $2k system controller and $500 load controller. Even the CEO recognizes how far behind they are in the battery technology game:

Backup is a little more complex. There are going to be more dollars the user has to shell out because the useful backup probably is about 20 kilowatt hours battery and for backup we are streamlining our balance of systems.

They are working on “streamlining” what is needed because having to add all these extra parts just to add a battery is understandably not what people want. Again, the CEO himself recognizes this when he states directly: “As batteries become more common in California, there is some interest in a centralized inverter solution.” You can bet this is an understatement, as companies rarely highlight demand for their competitor’s products. As it stands, only half of Enphase installs in California actually use an Enphase battery. So customers are choosing to use Enphase’s microinverters with a competitor’s battery.

Tesla Powerwall 3

Two different analysts picked up on this weakness, especially in contrast to the success of Tesla’s (TSLA) recently released Powerwall 3:

When it comes to the 50% of your NEM 3.0 systems that are attaching a rival’s battery, I think we’ve been assuming that’s mainly been Tesla Powerwall 3…

Can you talk about the competitive landscape at all? Just thoughts around some reports Tesla Powerwall 3 gaining traction…

As background, Tesla made waves when it released its original Powerwall in 2015, as there was not anything else like it on the market. The second Powerwall was released in 2016 at double the capacity and power of the original. Since then, they have essentially dominated the home energy storage market, with a market share at the end of last year of around 47% compared to Enphase with the second-highest at just 17%. As storage gains popularity, there is little reason to think that the Powerwall will not continue to dominate.

Tesla

Compared to its predecessor, the new Powerwall 3 is 57 pounds lighter, can support 6 strings of solar vs. 4, and has double the output power (continuous and peak) and solar input capability. Plus it is a string inverter and battery all housed in one sleek unit.

To get the same power output from an Enphase 5p battery, you would need three of them, at a price of $3,200 each (on sale), more than the $9300 for the Powerwall. From a capacity perspective, the Powerwall comes in at a more expensive $810/kwh vs. $640/kwh for the Enphase.

But the Powerwall is also a solar inverter! The Enphase IQ8A can support a 400w panel for $223, or $0.58/watt. The Powerwall can support 20kw. To add that much solar with Enphase microinverters would cost another $11,600.

This would be maximizing the Powerwall. But let’s suppose a more common solar system size of 14kwh with 11.5kwh of battery capacity. The Powerwall can handle this for $9,300.

The Enphase system, at $640/kwh for the battery and $0.58/w for the inverters, would cost $7360 + $8120 = $15,480.

That leaves a whole lot of wiggle room. Remember that yes, the microinverters will be more efficient at collecting sunlight, but the Powerwall will recoup some of this by only having to convert the energy once as opposed to three times.

The Powerwall is the current market leader in solar + storage. Running these numbers, I just do not see a path for Enphase to close that gap. The product is just too expensive, and the technology does not make sense once batteries are added to the equation. With energy storage, including the Powerwall, achieving record profits and being the bright spot of Tesla’s earnings, I do not see Tesla slowing down their momentum.

My base case is that home battery adoption will continue to increase as the technology improves. Electric vehicles are also forms of home batteries. Solar panels can send energy straight through a string inverter into an EV battery. An Enphase system would convert the energy to AC, and then have to convert it back to DC to charge the car. Any gains from the microinverters will be potentially wiped out by the extra conversions needed.

Enphase’s Strategy

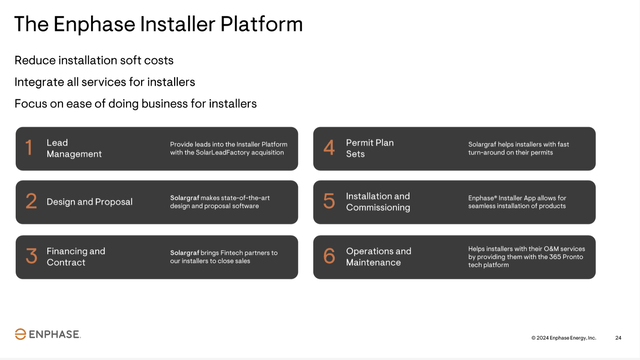

The question remains, why has Enphase been so successful in the US residential market thus far? They have been extremely proactive with their dealer and installer network, such that their systems are always presented to the consumer, sometimes with very few other options. This slide highlights their strategy, in a string of seven acquisitions over the past few years:

Enphase Q2 Investor Presentation

These are all companies tangential to inverter technology, focusing instead on sales and distribution. They make this explicit in their “Installer Platform” focus:

Enphase Q2 Investor Presentation

Enphase has gained market share not necessarily by having the best product (although their product was much more competitive in the past before batteries were as common), but by having the best distribution and installation network. They want to own every step of the process.

As Jeff Bezos famously quipped, “Your margin is my opportunity.” Tesla is distracted by being a car company, but if they woke up one day and decided to take over residential solar, I believe that they could. More importantly, residential solar is still in its infancy. If it continues to gain traction outside of California, there is too much opportunity for other companies to step up and offer homeowners alternatives that make more financial sense. This might not happen in the next quarter or two, but in the next decade, I see it as likely.

Financial Performance

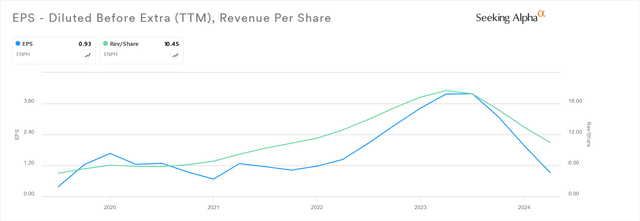

Enphase was one of the big winners in the post-pandemic period, when consumers were flush with cash and interest rates were close to 0. Since then, financial metrics have fallen off a cliff.

Seeking Alpha

Using TTM non-GAAP earnings of $2.34 and a stock price of 108.9, this gives us around a 46 p/e ratio. That kind of valuation would necessitate a very high growth rate.

Enphase has three exposures that materially affect its business and are outside of their control. They are heavily exposed to consumer discretionary income, as solar installations are low on the priority list during a recession. So Enphase relies on a strong economy in general.

Enphase is also reliant on low interest rates to improve economics for customers, a fact they mentioned three times in their conference call.

Lastly, Enphase is reliant on public policy. Their business in California is entirely dependent on regulation, swinging from one extreme to the other depending on the current energy policy. In the Netherlands, an important market, Enphase explained disappointing results by stating that “The country’s solar demand continues to be challenged by regulatory uncertainty.”

There are far too many variables here to make it a compelling long-term investment case. I contrast Enphase to First Solar, Inc. (FSLR) whose business model, focusing on technology, manufacturing, and utility-scale, is much more insulated. It is not as heavily exposed to consumer spending, interest rates, or government regulation (as both parties are interested in protecting domestic manufacturing). For exposure to the solar industry, FSLR is a much better bet, trading at a lower P/E with higher future growth expected as well.

Upside Risks

Since I am assigning a sell rating, the risks to my thesis are to the upside. Enphase has a strong net cash balance sheet and healthy margins, so I am not predicting an immediate demise. I believe they will lose out to competitors in the long run, but in the short term, demand for solar will be the primary driver of their performance.

SunPower’s recent bankruptcy and SolarEdge Technologies, Inc.’s (SEDG) ongoing woes do not bode well for the industry. There is a world in which a soft landing allows the US to lower interest rates while avoiding significant economic distress. Enphase may do well in such an environment, even capitalizing on the failures of their peers.

Regulatory changes friendly to solar in states other than California could also provide a significant boost, as Enphase is in the best current position to expand their offerings.

I do not see Enphase as a short, just a stock that I would not hold. I see TSLA continuing to take more market share with the Powerwall 3, and FSLR is a much better play to the upside in the solar industry.

Read the full article here