Fed chairman Jerome Powell gave his speech at Jackson Hole, Wyoming this past Friday.

The takeaway from this speech is as follows:

“The time has come for policy to adjust.”

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

But, Mr. Powell ends up warning us,

“The limits of our knowledge demand humility and a questioning spirit focused on learning lessons from the past and applying them flexibly to our current challenges.”

The bottom line: the Fed will begin to adjust its policy, but…and this is a very important “but”…we, the Fed, will work this policy out depending upon…one…incoming data…two…the evolving outlook…and three…the balance of risks.

Mr. Powell, whatever policy he was promoting, has always tried to err on one side of the situation or the other.

When Mr. Powell and the Fed were trying to provide reserves to the banking system to fight the disruptions of the Covid-19 pandemic and the following recession, Mr. Powell and the Fed constantly worked to err on the side of providing too many reserves so as to reduce the possibility that the economy would become more of a disaster.

As Mr. Powell and the Fed fought inflation over the past two years or so, Mr. Powell and the Fed have always tried to err on the side of being tight for a very long period of time. The Fed has been conducting its policy of quantitative tightening for twenty-nine months.

In adjusting at this time to a new stance, Mr. Powell wants to make sure that he and the Fed are doing the right thing for a sufficient amount of time.

So, Mr. Powell and the Fed are not going to hurry right into a major movement into lower interest rates.

Mr. Powell and the Fed are going to “feel” their way into the future.

But, the future appears to be one where the Fed’s policy rate of interest is falling.

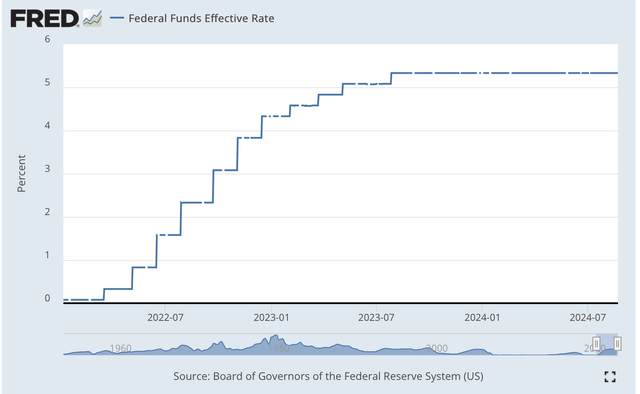

Here is the picture of how the Fed moved up the effective Federal Funds rate over the past two years.

Federal Funds Effective Rate (Federal Reserve)

The last movement in this policy rate was in late July 2023. So, this policy rate, an effective rate of 5.33 percent, has been in existence for more than one year.

The Fed policy has been composed of two parts: first, the action taken, and second, the “forward guidance” that Federal Reserve officials give the markets.

This approach has, at this time, brought investors’ inflationary expectations down to 2.1 percent for the next five- to ten-year period.

So, Fed actions in this part of the financial markets have seemingly convinced the investment community that the Fed is serious about achieving the Fed’s 2.0 percent target for inflation in the economy.

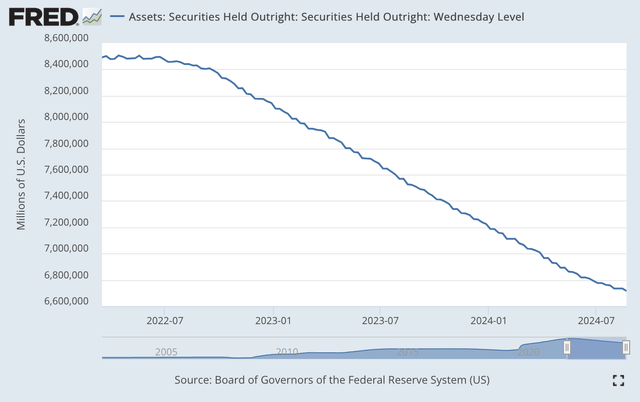

But, this is not all that the Federal Reserve has done over the past twenty-nine months. The Federal Reserve has also conducted a policy of quantitative tightening, where it has worked to reduce the size of the Fed’s securities portfolio.

Here is the Fed’s performance over the past twenty-nine months. The total reduction in the Federal Reserve portfolio has been just under $1.8 trillion. As can be seen, this reduction has occurred in a very steady and persistent manner.

Securities Held Outright (Federal Reserve)

Since June, the Fed has reduced the amount of securities it is letting run off the Fed’s balance sheet.

Still, the Fed has more than $3.0 trillion of securities in its portfolio than it did at the end of the time it began to pump reserves into the banking system to combat the effects of the Covid-19 pandemic and the subsequent recession.

The question has always been about when the Fed’s securities portfolio was going to return to a “more normal” level. Might Mr. Powell and the Federal Reserve begin a “new” regime of “quantitative” policy as they move forward and “adjust”?

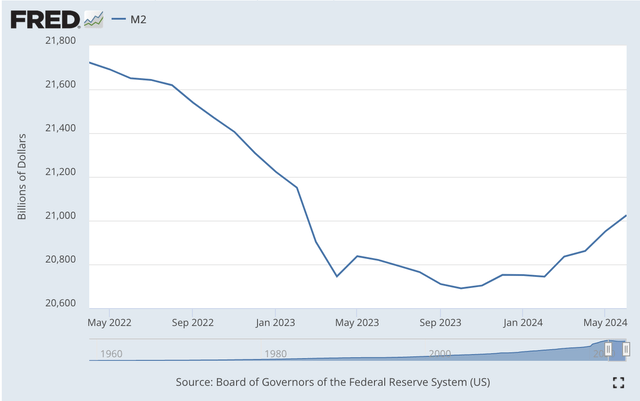

Then there is a third issue that gaining the attention of analysts these days and that is the concern over the reduction in the rate of growth of the M2 money stock.

The M2 money stock has been declining since April 2022. The U.S. economy has never gone through a period of monetary contraction this long without an economic recession taking place.

M2 Money Stock (Federal Reserve)

Economists and market participants are getting worried over the possibility of a recession happening because of what the Federal Reserve has done.

As readers of my posts know, I am not as concerned with this possibility because of all the money the Federal Reserve pumped into the economy as it was fighting the disturbances caused by the Covid-19 pandemic and following recession.

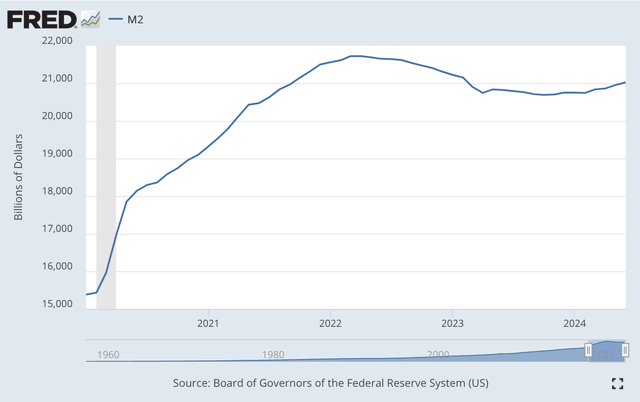

I believe that we need to add a few earlier months to the above chart.

M2 Money Stock (Federal Reserve)

This picture, I believe, puts the current reduction in the M2 money stock into the proper perspective.

The compound annual rate of growth of the M2 money stock during this time of expansion is over 8.0 percent.

Historically, this puts the current period into the class of “excessive” monetary growth.

The only reason, seemingly, that inflation did not get more “out-of-hand” is that people did not use the money stock at the same pace that they formerly had done. That is the velocity of monetary circulation fell.

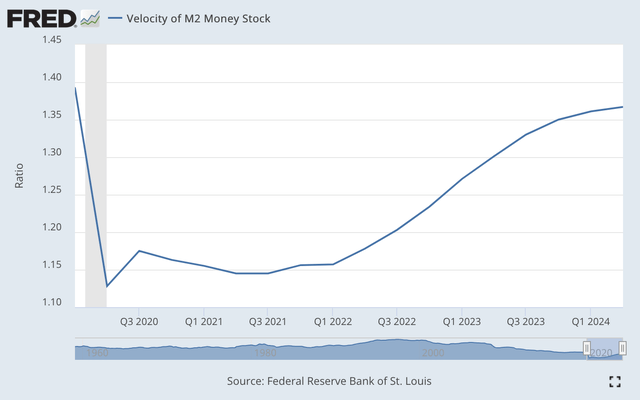

Velocity of M2 Money Stock (Federal Reserve)

Although the velocity of circulation of the M2 money stock has picked up, it has still not returned to earlier levels.

As a consequence, as I have frequently been writing about, there is a lot of money “lying around” in the financial system.

For example, the commercial banking system has about $3.3 trillion in “vault cash.”

This is one reason that the U.S. economy is still performing at a relatively satisfactory rate, and it is also the reason why the stock market has hit all the “historic highs” it did while the Federal Reserve was conducting a policy of quantitative tightening.

In fact, Mr. Powell, in his Jackson Hole speech, reviews the state of the economy and professes that the economy is in a relatively good place.

Economic growth, according to Mr. Powell, “continues…at a solid pace.”

“Prices have risen 2.5 percent over the past 12 months.”

“The labor market has cooled considerably from its formerly overheated state.” This is the result of “a substantial increase in the supply of workers and a slowdown from the previously frantic pace of hiring.” Not that bad.

So, the economy is in pretty good shape, but there are issues in the financial sector that need to be dealt with.

It is a time for policy adjustment.

But, Mr. Powell reiterates, the Federal Reserve should not go overboard in trying to get everything right in the next few months.

The Federal Reserve will move…but, just don’t expect it to move too rapidly.

Read the full article here