Dear readers/followers,

You may recall my work on Gerdau (NYSE:GGB) in previous articles and between 2022-2023, where I at one time owned and was long on Gerdau as a business. That is no longer the case here. At that time, Gerdau had outperformed the market by a fair margin, but as of the latest results during my last article about a year ago, the company’s results showed a softening that, in the context of valuation, made me change my rating for the company to a “HOLD”.

You can find that particular article here – and you may also see that the company, since the time of that article, has underperformed the market by more than 38%.

Seeking Alpha Gerdau Article (Seeking Alpha Gerdau Article)

This piece will act as an update for my thesis on Gerdau, and show you if it’s time to buy back the company at this time. Do note however that we’re currently in an environment where I would view any investment in risky sorts of plays with a lot of volatility as a “not the right sort of move”.

Instead, I would be careful to pick only the highest sort of quality – and in my last article, I rotated out due to macro risks and the availability of safer investment options, due to the trajectory of company earnings on a forward basis.

This, in my opinion, has materialized.

Gerdau – The investment option and the potential upside

Gerdau has been an interesting, and sometimes tricky investment. It’s one of those investments that had a lot of potential for upside, and a lot of potential for significant short-term downside as well. The volatility did not come as expected, but the development has still been “tricky.”

This is a very good example for that every investment should be made with a focus on your investment goals. My goals with Gerdau have been fairly clear – I wanted a possibility to make a short-term return because I saw the company as undervalued. My goal is not typically to 10-20x my investment capital in a short time, nor was this the case for Gerdau. I try to not take many “risks”, as such, because I have already made the capital I need to live life the way I want to. Instead, over 75% of my portfolio is aimed at providing me with qualitative and above-average/risk-free income, while also generating a potential capital appreciation from the valuation upside. This has averaged 15-25% per year for the past few years, and it’s more than enough for me (even above my expectations).

Only a very small portion of my portfolio is aimed at investments where I believe in 10x developments in a short timeframe. Gerdau is somewhere in between these two options. I expected, and generated a very high annualized sort of upside, in excess of my early expectations, but I also was aware that if the tides turned, as they did, I should be willing to “exit” rather quickly – and I was.

When it comes to Steel, you can (and I have) buy/bought a lot more stable businesses than Gerdau. While metals and basic materials are far from the most stable and uncyclical businesses out there, they are still part of the fabric of overall society, and as such, make for excellent investments if you buy them at the right valuation.

I actually invest in a few steel businesses, including Reliance (RS), Nucor (NUE), and more local European ones. I even bought some buy-writes on SSAB, a Swedish steel company, when I could find attractively premium 15% annualized RoR option plays.

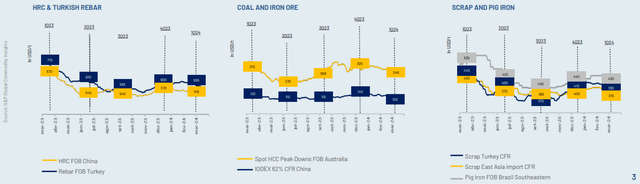

Gerdau’s latest results, which are the focus of this article, are 1Q24. And much like with other companies in the field, the current focus is on the global oversupply of Steel production.

Gerdau IR (Gerdau IR)

As you can see, this oversupply makes itself known in the global pricing trends. There’s also the overall geopolitical macro stage at this time, which I would argue as being more conflict-filled than in some time. This too is affecting the top line.

Brazil as a segment for Gerdau did fairly well. The import volumes were higher, even if the consumption of steel was lower. We are now seeing higher and higher penetration rates for the import of Chinese steel and now stands at 18.9%. But there are a number of means being aimed at reducing this – including a 25% increase in tax for volumes exceeding quotas.

Global shipments were down for Gerdau in part due to this oversupply, but also focus on investing in the business. Operating results were slightly higher, and we saw bottom-line improvements in all business divisions. Despite the downturn, Gerdau is still a very conservative player with low leverage at no higher than 0.4x net Debt/EBITDA with only R$11B of gross debt.

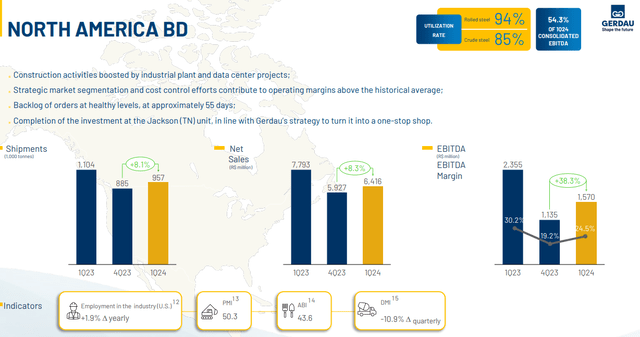

Like some other companies, segments like the US are seeing cushioning from certain types of projects, like data centers.

Gerdau IR (Gerdau IR)

As I expected, much of the stability and upside is also coming from specialized Steel, even if utilization here is down to around 52-66%. Exposure to LVP and HVP (vehicle production) is significant here. Overall South America, which marks a decent amount of the company’s quarterly EBITDA, remains problematic, with Argentina down (economic adjustments), Peru decent (mining and minerals), and JV’s which Gerdau has sold.

Really, Despite its South American profile, Gerdau is over 54% NA in terms of EBITDA, which really makes it into a North American sort of steel company.

Overall, despite top-line problems and oversupply, Gerdau had a good quarter with growth in every business division in terms of EBITDA, ending the quarter at over R$2.8B In EBITDA, which is growth of around 38% year-over-year.

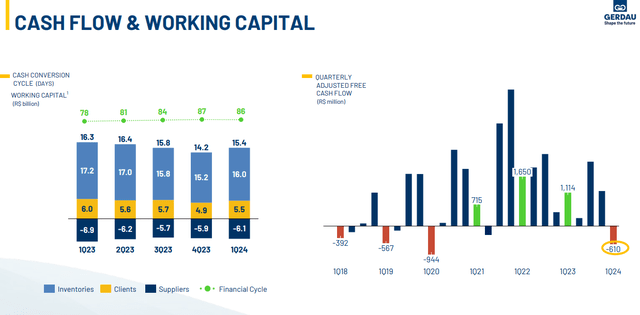

Cash flow and WC trends were decent, with a slight decline in the Cash cycle conversion.

Gerdau IR (Gerdau IR)

Overall, if the company was able to see some upside here in terms of valuation and earnings, I would consider it in a fairly positive manner. The company is also continuing to pay above the minimum level, a dividend distribution of R$0.28/share for the quarter.

It’s important to clarify however that we’re entering a period of high CapEx. Between new rolling mills, Meltshops, New facilities for casting, scrap processing, sustainable iron ore programs, mill expansions, and Forestry base expansions, we’re looking at 2026E total CapEx of upwards of almost R$12B,m distributed to get efficiency gains, cost reductions and more efficient input sourcing and handling.

Gerdau IR (Gerdau IR)

Fundamentally speaking, Gerdau remains one of the steel producers with a 100+ year history. It’s only BBB-, and that is to be taken into consideration when investing, because it’s less than some of its peers, and it’s one of the more cyclical producers due to its geographical exposures.

Also, the macro remains tricky here – with inflation, interest, feedstock pricing, and weaker demands in some areas, and because it’s actually a Brazilian business, it’s exposed to a non-trivial amount of political risk, despite its overall EBITDA mix.

For that reason, I am still cautious despite a positive quarterly EBITDA development.

Let’s look at valuation.

Valuation for Gerdau – So-So, better upsides and investments exist

When it comes to Gerdau, as I’ve written before in previous pieces, I always approached such investments with care and believe you should do the same.

I’m very aware that mistakes can cause, and likely would cause, years of sub-par returns for any amount of invested capital. The time to buy such companies is few and far between, if you look over long periods of time. It’s because I’ve made such mistakes before, and I try to be very careful to not repeat mistakes.

Gerdau, for the GGB ticker, is (I argue), still trading from the highs of the 2020-2022 Steel spike, We’ve seen annual declines in earnings ranging from 22% to 39%, with another 34% in adjusted EBITDA decline for 2024, before it stabilizes to zero earnings growth or decline in 2025E – at least if we are to believe analysts (Source: Paywalled F.A.S.T Graphs link).

During that time, Gerdau traded in a very volatile manner. The current GGB-dividend yield is around 0.73%, which makes this one of the lowest yields in investible steel – but the debt is also very low.

However, I am a value investor. In my previous articles, I gave the company a sub-$5/share PT for the company’s GGB ticker due to macro and risks. We’re now at $3.36/share.

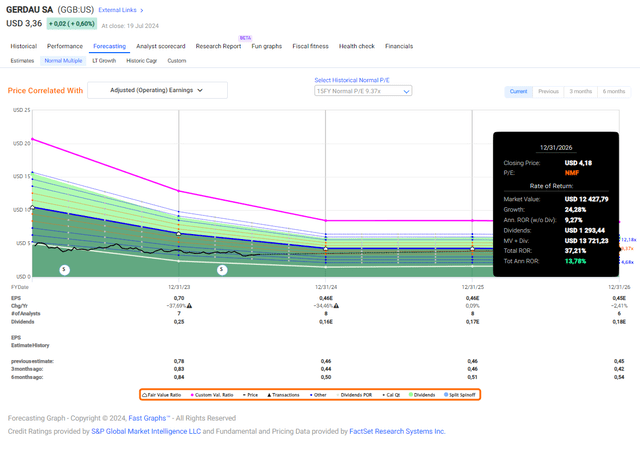

Technically, you could get a double-digit RoR from Gerdau at this time. If forecasted at a 15-year average, which I view as valid, the annualized upside inclusive of dividends approaches 14% here, even with the declines.

Gerdau Upside F.A.S.T Graphs (Gerdau Upside F.A.S.T Graphs)

But is this good enough for me to actually invest in here? I would say that I don’t want to invest in a declining earnings company yielding sub-1% at less than 15% annualized upside even at a 15-year discount. I believe there are better options out there at this time. While steel is a very volatile segment, which means that these forecasts are subject to change, I do believe that the general challenges, including macro and oversupply, will remain for some time.

For that reason, I no longer consider, even after a 17%+ decline since my last article around a year ago, the company to be worthy of a “BUY” here.

Also, my points made in previous articles about the peers remain – most, if not all, of them are better capitalized than Gerdau is, and any investment into Gerdau needs to deal with the fact that a large amount of the company’s EBITDA in fact comes from Brazil and South America, which again aren’t exactly stable geography by any means.

For that reason, I give Gerdau the following thesis as of 1Q24. What could change my mind here would be a valuation closer to maybe $3 or below, where a real discount and a 15%+ annualized upside could be seen.

Thesis

- While Gerdau has some appeal from a fundamental point of view, active in good geographies with growth potential, the company still needs to prove consistent returns above the cost of capital and debt. For the time being, this is being achieved thanks to outsized demands due to recovery.

- I view Gerdau as a “hold” here. The company no longer offers compelling value. Together with macro risk, I consider other investment options far more favorable here.

- The price target is below $4/share when tangible book value hits a 1X ratio at this time, and I’d give this a fair bit of consideration given the risk I see here, and given the state of the market as I am writing this article, I would be careful investing even at cheap valuations, because there’s equal or even better upside in some other plays.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

While the company does come with an upside, I don’t see this upside as being high enough for investing here. I say “HOLD”.

Read the full article here