GoGold: why now

In this article, I would like to bring to the attention of my readers GoGold Resources (OTCQX:OTCQX:GLGDF) (TSX:GGD:CA). I believe the company is materially undervalued and likely to rerate over the next six months. This undervaluation is the result of a market overreaction to the outcome of the recent elections in Mexico. The victory of the new left-wing President Claudia Sheinbaum has caused rumors that a law banning open pit mining (already rejected once under the previous administration) might be back on the table. Mining stocks in companies with operations in Mexico have sold off following the news. The reality is far more nuanced. First of all, it is the opinion of several practitioners that the new administration is more business-friendly than the previous one. Second, it remains unlikely that open pit mining will ever be banned completely, since 60% of mines in Mexico are open-pit and mining is a crucial part of the Mexican economy, representing 8.2% of its industrial GDP in 2023. Third, even if the process of permitting open-pit mines were to become more complex, GoGold would not be significantly affected.

The company’s main asset, its Los Ricos South mine, can be developed as a mainly underground operation. Only after 8-10 years, it would require transition to an open-pit design. This information is neither in the official company presentation, nor in the Preliminary Economic Assessment for Los Ricos South. Los Ricos South was initially planned to transition to open pit after only 4-5 years. But the management team has already discussed the new mine plan in several events and interviews. For informed investors, there is therefore an advantage in taking a position now, ahead of a number of catalysts. These catalysts include: the publication of the Definitive Feasibility Study for Los Ricos South containing the new mine plan and, following that, the awarding of the underground permit, which should not prove problematic. The company expects the former by the end of August and the latter by the end of September.

Overview of the company

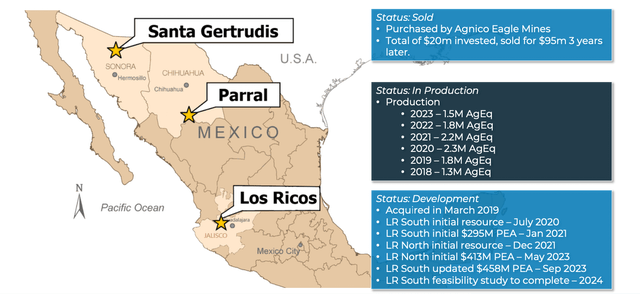

GoGold Resources is a Canadian-based silver and gold producer operating in Mexico. The company has a 100% interest in the Parral project, located in the province of Chihuahua, Mexico. This is a relatively small asset with a short life-of-mine. The mine has been in operation for about 10 years. It is expected to remain in operation for another five years, producing between 1.8 and 2 million of silver-equivalent ounces per year. Recently, the company has successfully installed a zinc circuit for total capital costs of $2 million. As a result, it expects close to $1 million in additional free cash flow from the sale of zinc and improved quality of its copper concentrate.

Besides Parral, the real reason to be excited about GoGold lies in its Los Ricos project. Los Ricos should be more properly characterized as a district because of its size (it is made up of 45 mineral concessions over 24,000 hectares). It contains at least two large projects, Los Ricos South and Los Ricos North. Los Ricos South is currently the most advanced of the two and will be the first to be developed.

Company’s Presentation

Company’s Presentation

In terms of position along the Lassonde curve, Los Ricos South is exiting the resource definition stage and entering the development stage. At the end of the exploration stage, the market value tends to be depressed, as the initial speculators sell the stock and interest is tempered by the uncertainties associated with the development of the mine. This undervaluation creates an opportunity for long-term investors: if the development of the mine is successful, the stock re-rates quickly as operations are ramped up and institutional investors enter the market. After development of Los Ricos South, GoGold will have a production profile and cost structure similar to SilverCrest (NYSE:SILV): Los Ricos South is expected to produce about 8 million silver-equivalent ounces at AISC of $9 per ounce (according to the PEA from May 2023). However, SilverCrest is currently trading at a $1.2 billion valuation, while GoGold at only $325 million, with no debt and $80 million in cash and cash equivalents. Construction of Los Ricos South is expected to take about 18 months and cost about $150 million in initial capex.

The investment thesis is therefore simple: invest now, taking advantage of perceived uncertainties about the permitting process, and wait for execution to force a rerate of the stock. This thesis is predicated on two assumptions. The first is that the permit for the underground mine will be issued. I believe this is almost certain. There is no opposition to underground mining in Mexico. There is also no specific opposition to the mine from the local communities. In fact, based on statements from the management team, the local communities themselves are exerting pressure on the authorities to issue the relevant permits as expediently as possible, since the mine will create thousands of jobs and bring significant economic benefit to the region. The permit for Los Ricos South is thus expected to be issued by the end of summer. It is possible that the change in presidency may cause some delays but, in any case, the permit should be in hand by the end of the year at the latest.

The second assumption is that the mine will be built with no significant delays and cost overruns. An important fact to mention in this regard is that the management team of GoGold is made up of experienced mine builders. The CEO Brad Langille, CFO Dana Hatfield and COO Anis Nehme have a multi-decade-long history of success developing gold and silver projects specifically in Mexico. Langille was one of the cofounders of Gammon Gold, where he helped build the Ocampo mine, a large underground gold-and-silver mine in Chihuahua, Mexico. He was also the cofounder of Mexgold. The company bought the El Cubo mine for $20 million, and later sold for $375 million after investing $45 million in it.

Besides being experienced mine builders, the management team also has a track record of value creation via exploration. Before Los Ricos, the company bought the Santa Gertrudis project for $9 million, invested $11 million to further define its mineral resource, and then sold it to Agnico Eagle in 2017 for $80 million. The money was reinvested to buy the Los Ricos district in 2019.

Building the Los Ricos district

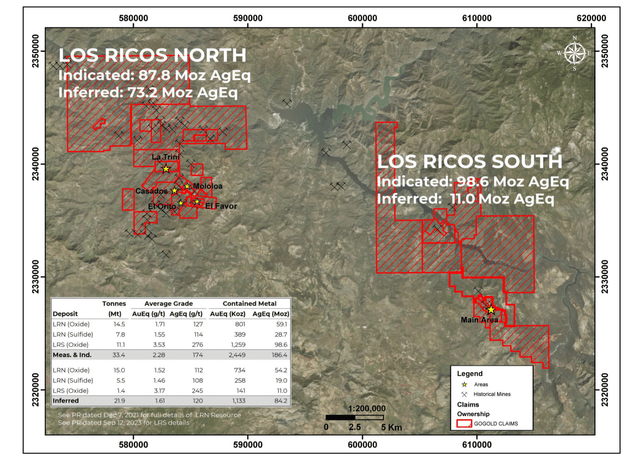

Over the last five years, the team has drilled more than 250,000 meters at Los Ricos and completed two economic studies, one for Los Ricos South and one for Los Ricos North. Both studies are Preliminary Economic Assessments. They identified total resources of over 240 million silver-equivalent ounces, of which 161 million in Los Ricos North and the rest in Los Ricos South.

Los Ricos South was planned as an underground operation, transitioning into open-pit after 4-5 years. This is also what is shown in the company’s presentation. However, during interviews and other investor events, management has stated that Los Ricos South can be built almost entirely as an underground operation. The intention is to skip the Preliminary Feasibility Study and publish directly a Definitive Feasibility Study, which should happen by August. This provides a crucial catalyst for the company. In the new Definitive Feasibility Study, Los Ricos South is going to be built as a 8-10 year underground operation, followed by a much smaller open pit than originally planned, which will bring the total life-of-mine to 12-14 years. With all-in sustaining cost just over $9 per ounce for Los Ricos South, and around $9.65 for Los Ricos North, both projects are expected to be highly free cash flow generating.

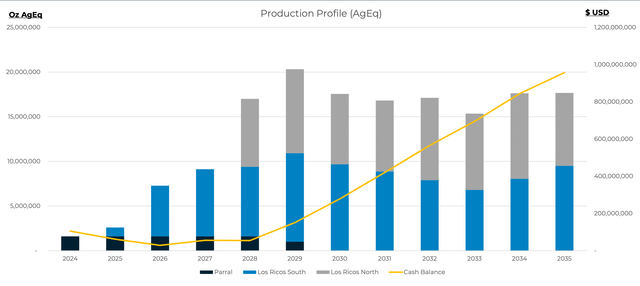

The plan going forward is therefore the following: finalize the DFS for Los Ricos South and obtain the underground permit by the end of summer; then, start construction of Los Ricos South right away. The construction will be financed partly from the company’s cash position, partly by raising additional debt. While Los Ricos South is under development, the company plans to work on a DFS also for Los Ricos North. Los Ricos North can also be built mainly as an underground operation. Its development is expected to cost around $200 million in initial capex, which will be largely financed using the cash flow from Los Ricos South. After Los Ricos North is brought into production, GoGold is aiming at maintaining an annual production of around 17 million silver-equivalent ounces per year, with silver representing about 60% in value at current prices. The company has an EV of $250 million. Even considering that the company needs to raise about $100 million in debt, its valuation seems far too cheap.

Company’s Presentation

Conclusions

Silver is likely in a multi-year bull market, thanks to its correlation with gold, increased industrial usage from the green energy transition, and persistent deficits. GoGold presents a very unique opportunity to buy leverage to future silver prices. The company has an experienced management team that has already built five mines in Mexico. If it can deliver again on its Los Ricos project, the stock could produce tremendous gains over a time horizon of a few years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here