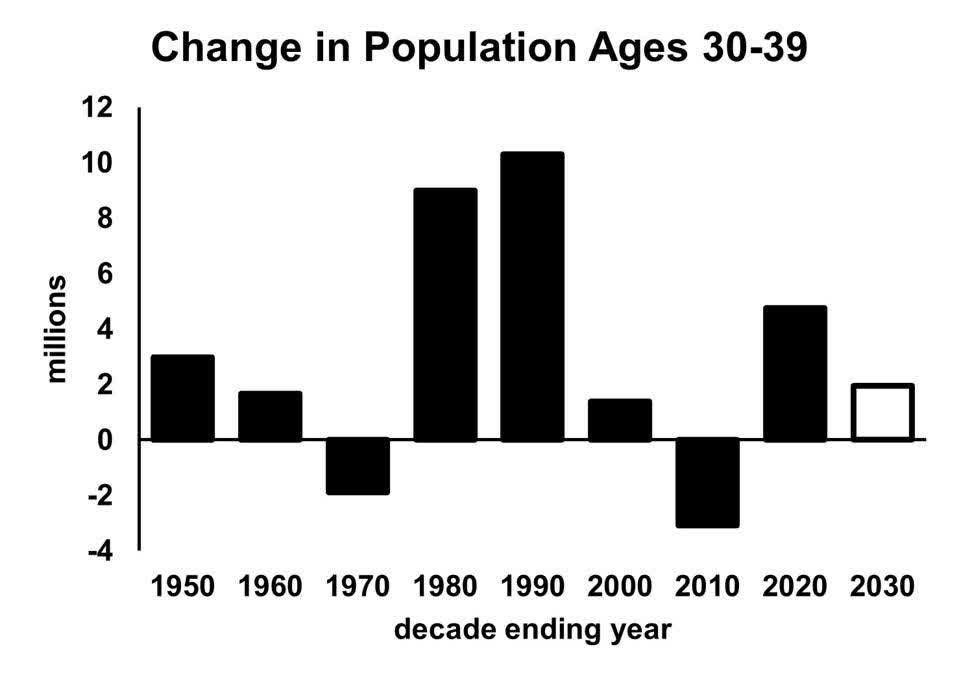

First-time homebuyers may grow in number this decade based on buying-age population projections recently updated by the U.S. Census Bureau. From 2020 to 2030, the number of people in their 30s – the average age of first-time home buyers – will grow by nearly two million people. That’s less growth than in the 2010s, but better than in the two preceding decades. This is important to the real estate industry as about one-third of all home sales involve first-time buyers.

Forecast based on Census Bureau projections (DR. BILL CONERLY BASED ON DATA FROM U.S. CENSUS BUREAU)

The projections must be taken with a grain of salt. For each age category, the Census Bureau predicts how many people will die and how many will enter the next age category. Then they add in immigrants (net of out-migrants) by age category. Immigration is a wild card, and the bureau is not really in a position to forecast political attitudes about policy. The bureau is only a little better at predicting foreigners’ efforts to enter the country without documents. Nonetheless, the projections are certainly in the ballpark, as all the people who will be of home-buying age in 2030 have already been born.

The age of first-time home buyers is not fixed but was recently estimated at 35 years by the National Association of Realtors, down from 36 in 2021. Previously the average was in the low 30s.

More issues than demographics drive actual transactions. Lower interest rates would, of course, lead to more home buying. But also incomes adjusted for inflation drive decisions about household formation. When stimulus checks and pay raises boosted personal finances in 2022, the number of households grew much faster than the total population. Young people moved out of their parents’ homes and single people moved out from their roommates. (A household is one or more people living in a dwelling unit. They can be family or unrelated people).

That shift in living arrangements boosted single-family home prices as well as apartment rents. People were not simply shifting from apartments to houses because of low mortgage rates; that would have pulled rents down, not up.

The pandemic probably led more people to want to live in houses rather than apartments. Houses tend to be larger, which suits people working from home. And a commute from the suburbs to downtown is less of an issue for people who only go into the office two or three or zero days per week.

The increased number of households reversed somewhat in 2023 due to high inflation reducing purchasing power. In 2024, economic slowdown (which I’m predicting) will limit household growth and thus new home demand. Thereafter, though, gains should be more stable.

Look for steady gains in first-time home buyers from 2025 on through the end of the decade.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here