Thesis

The iron boot of the Fed has dropped on dividend-paying companies, with interest rates hitting REITs and mREITs especially hard. Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI) has been beaten down especially hard and now yields above 6%. However, the dividend is secure and growing steadily, supported by growing cash flows and operational resilience, making the shares a strong value buy.

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

HASI provides capital and services in the sustainable infrastructure markets in the United States, with projects in renewable natural gas, solar, wind, restoration, infrastructure upgrades, and energy transportation. With their investments, they seek long-term projects that have predictable cash flows connected. Some of the investments also include minority equity stakes or joint ventures, and they also generate quarterly fee revenue through asset management and the sale of investments.

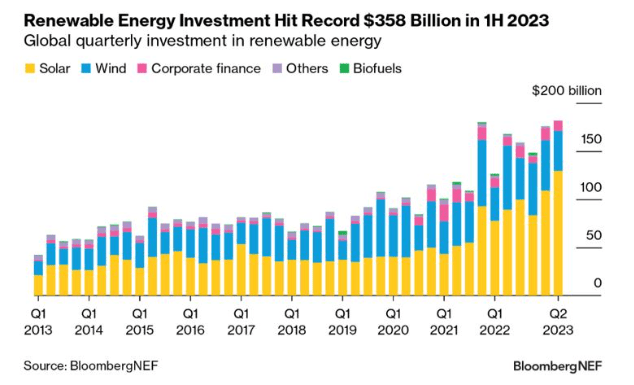

BloombergNEF

The need for new capital in the sector is also attractive and makes the future total addressable market for the stock both large and growing. The overall market is healthy, with solar investment especially showing strong momentum. From H1 2022 to H1 2023 solar managed to generate a more than healthy 43% yearly increase in funding projects. While the numbers themselves show a sector on the rise, a telling statistic is that the energy transition (or addition of renewables however you view it) is still facing a massive funding gap in order to hit ambitious net-zero models. Taking into consideration the acceleration in the market, plus this need for additional investment, new renewable investment could see capital investment of up to $700 billion a year, while still facing a shortage and funding gap. I view the sector’s performance as a sizeable tailwind to boost the company’s long-term performance and hit the growth outlooks provided by management.

Financials

Balance Sheet

HASI has tremendous balance sheet strength, with a positive, performing portfolio, and manageable, well-structured debt that alleviates from refinancing or near-term liquidity risk. The company is trading at levels that suggest it is facing extreme headwinds and potentially even facing bankruptcy. This is not the case, and earnings from operations continued the growth trajectory after a difficult 2022.

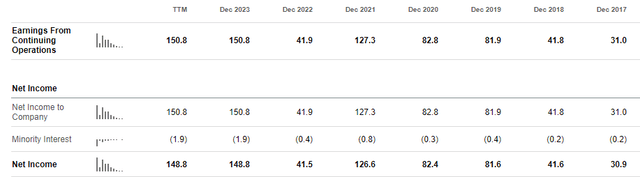

HASI Earnings (Seeking Alpha)

Operations remain strong, and it appears the market has unfairly punished the stock. Clearly, the company had a record 2023, producing highs for net income even when compared with 2021. Additionally, with the current portion of long-term debt sitting at only 47 million while possessing 62 million in cash, liquidity seems strong.

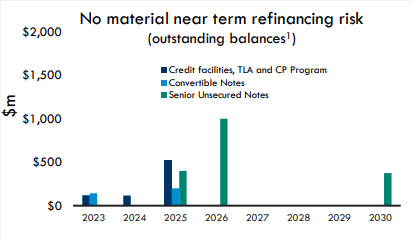

HASI Investor Relations

HASI has very little debt maturing in the near term, with significant refinancing likely only to occur for the 2025 and 2026 debt. HASI seems positioned to not just survive 2024, but also to avoid refinancing at an inopportune time or rate. Looking at the liabilities the company already has on the balance sheet, it is clear that the debt market views the business as stable and safe.

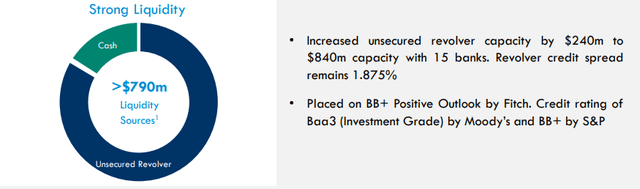

HASI investor relations

As you can see, the bond market puts a relatively low-risk premium on the company and the company is deemed investment grade by credit rating agencies. This further backs the claim that HASI is a strong, safe, investment for those with the risk tolerance to invest in individual common shares. Strong performance and a credit upgrade will help to widen the spread between cost of funding and loans or projects. The credit spread on the revolver is low and allows for easy profitability when making loans or investments. The variable nature of the rate partially explains the decline in the stock, however, I will look at net interest income later, and the margin has largely remained strong, with net interest income increasing year over year from 2022.

Income Statement

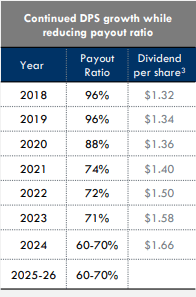

HASI shows resilience in producing ample distributable earnings to cover the dividend while increasing portfolio yield and establishing a pipeline of projects for future years. The slide from their latest yearly presentation shows that they have been steadily decreasing the payout ratio, de-risking the dividend and creating more opportunity for organic reinvestment and growth, all while the dividend growth has been accelerating since 2020.

HASI DPS and Payout ratio (HASI Investor relations)

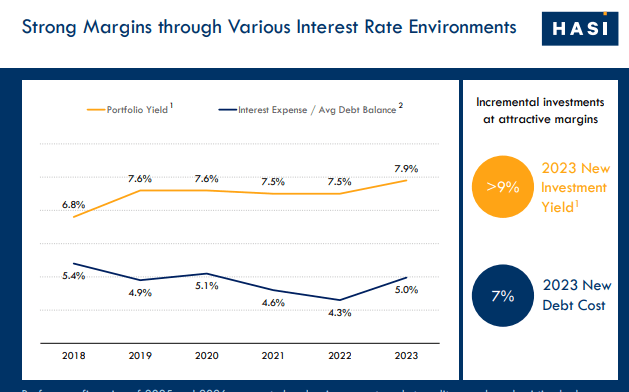

Since the stock has fallen so far since the inception of the current interest rate hiking cycle, it is fair to wonder if the rising interest rates have significantly impacted operations or turned the company earnings into a loss. However, this is not the case at all, and while HASI has faced some NIM margin erosion due to higher cost of funding, with portfolio yield minus interest expense now sitting around 2.9% compared with 3.2% for 2022. Overall, net interest has actually climbed yearly as the company has originated more loan volume and continued to drive growth.

HASI Margin by Year (HASI Investor relations)

The lending market for HASI differs from that of a commercial bank or many other common lending agencies, and therefore, the spread between funding and lending rates differs, as does the rate of change and reaction to Fed Funds rate increases. In this case, the forecast has NIM holding steady and the company views the potential to keep margin steady as strong.

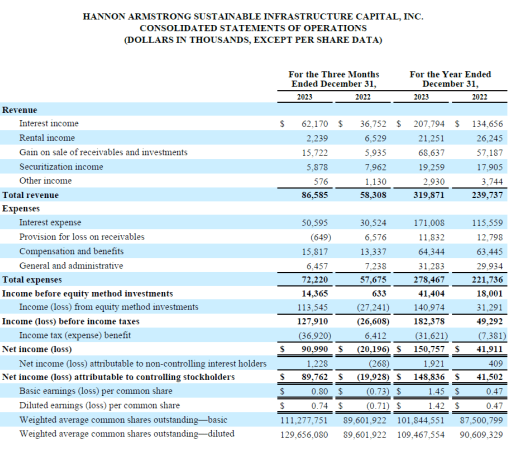

HASI Income Statement (HASI Investor relations)

Comparing the results from 2022 to 2023, you can see that while interest expense has seen a healthy rise, net interest income is climbing, and increased from around $19000 in 2022 to $36700 in 2023. It is worth noting also, that this momentum and growth is forecasted to stick around. For example, the current forecast provided by management projects an increase in distributable earnings of at least 8-10% for 2024 through 2026. Looking at the quarterly transactions, I see what looks like a healthy pipeline to not just sustain earnings but grow them, as HASI is breaking its origination records at an opportune time when yield is strong. So while HASI has seen a yearly decline of 1.7%, this decline is strongly connected to the rise in income alternatives and the discount rate used to value the future dividends, rather than company performance or a steep decline in operational profitability. I, and more importantly management, strongly believe that HASI will grow at a solid clip over a long time frame, providing an opportunity to buy growth at depressed multiples.

Valuation

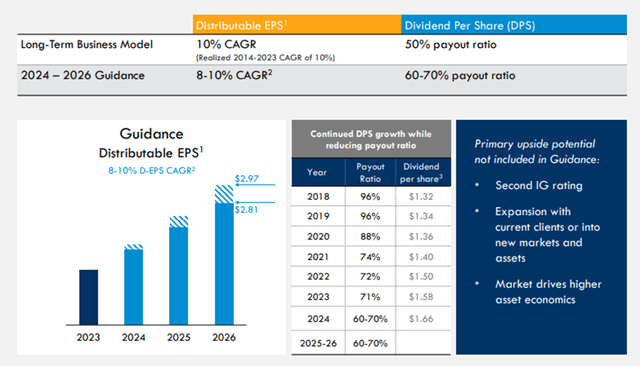

During late 2023 into 2024, HASI actually switched its tax status from REIT to C-corporation (with negligible impact to accounting or operations). However, the case remains true that HASI pays out a large proportion of earnings as dividends to shareholders. Therefore, the fair value of the stock is determined by the present value of future dividends. In order to project growth, company guidance was used, always on the low end in order to build in error and decrease risk to valuation of weaker than expected operations.

HASI Guidance (HASI investor relations)

Company management, guidance and execution has been solid and a dividend raise on par with expectations for 2024 further helps to de-risk my valuation.

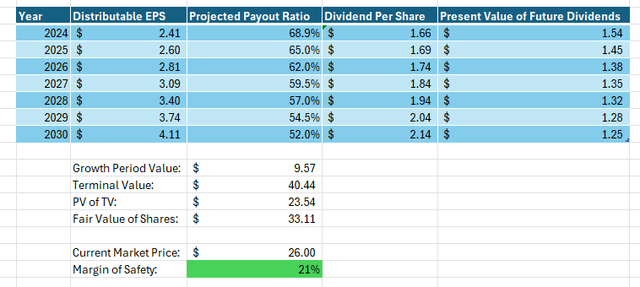

HASI Discounted Dividend Valuation (Author Created)

Using the discounted dividend valuation and applying the company guidance (8% growth used for 2024-2026, payout ratio declining to support growth), I see HASI as over 20% undervalued compared to where it currently trades. While price appreciation to meet fair value may not be a quick process, receiving a yield of over 6% while waiting for real-estate boosting rate cuts seems a dream setup for value investors.

Risks

Investment in common shares of HASI does carry some risk due to potential macroeconomic conditions and the volatility of the common shares. HASI trades with a surprisingly high beta of 1.8. For long-term investors, this actually presents great opportunities to continue to accumulate shares when the yield will jump to 6-7% and wait for shares to appreciate to fair value while collecting bond or cash destroying level yield. However, knowing the price fluctuations will occur, buying the common shares should be reserved for those with the proper temperament and patience. Lately, shares have bounced around as the Fed interest rate cut has seemingly been pushed back by new macroeconomic news. Continued delay of the cuts will result in further weakness. Finally, the stock is a small to medium cap, with the value predicated by future dividend growth, and failure to meet expectations would change the calculus for its fair value.

Conclusion

HASI has a stable, bright future supported by an organically growing portfolio, healthy margins on loans, and a balance sheet viewed positively by credit agencies. The dividend alone currently yields 6.3%, is growing faster than inflation at an almost 10% per annum clip and remains well-supported. While I expect shares to remain volatile as the Fed rate cut story continues to evolve, eventual rate cuts will be a tailwind for the valuation the market applies to the stock. For these reasons, I will continue to accumulate shares around this price and view HASI as one of the single best investment opportunities currently on the market.

Read the full article here