Investment Thesis

Hims & Hers Health, Inc. (NYSE:HIMS) is a stock that has had an extraordinary performance of 130% YTD thanks to the high growth it has had.

Recently this enthusiasm was increased by the news that the company would offer GLP-1, a weight loss drug that has been in very high demand in recent months. While this is great news, I think that HIMS has potential that goes beyond this and this only reinforces the thesis of the good business model it has. In the past, the company has far exceeded its own growth expectations and has now become EBITDA-profitable without needing the help of GLP-1, so any benefit that comes from this drug is simply an add-on.

Business Model

Hims & Hers is dedicated to telehealth, which provides healthcare services remotely through digital channels such as video calls, improving the accessibility of healthcare while reducing the cost for customers.

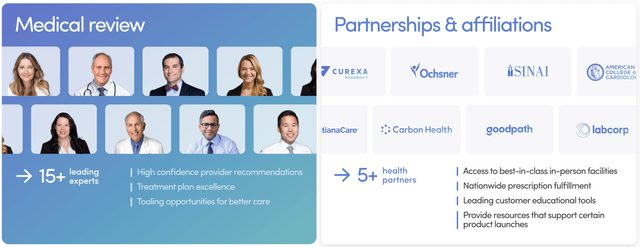

HIMS does this through a network of doctors that operate as independent contractors and the partnerships it has achieved with other health providers such as Labcorp Holdings Inc. (LH) or Carbon Health.

HIMS Investor Presentation

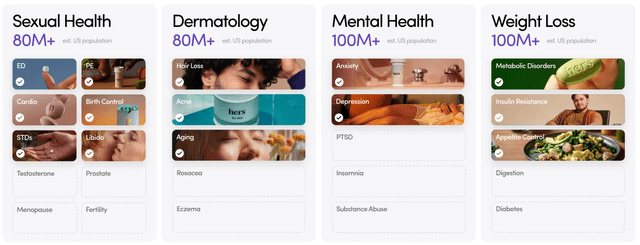

Taking advantage of its network of patients, the company offers not only medical care, but also the sale of products related to the consultation. The variety of products it sells ranges from prescription treatments related to sexual health to hair and skin care.

While the company began its growth by attacking markets that are sometimes overlooked by traditional medicine, such as dermatology or mental health, the business model is so flexible that it provides the possibility of expanding into other areas such as dental health, pregnancy, heart health or preventive medical check-ups without requiring a large investment.

HIMS Investor Presentation

GLP-1 Is Not The Thesis

An example of the potential that the HIMS business model has is the announcement made about access to GLP-1 injections.

For those who don’t know, GLP-1 is a medication used mainly for the treatment of type 2 diabetes because it plays an important role in regulating blood glucose levels. However, it was recently detected that patients lost their appetite when taking this medication and consequently lost weight. In this way, the potential market for GLP-1 went from patients with type 2 diabetes to people seeking to lose weight without starving themselves due to a strict diet.

So, taking advantage of its easy-to-access and well-valued platform among users, the company would now become an easy access point for people looking to use this medication, which should increase the company’s sales, and therefore the market reacted accordingly.

Now, to be clear, Hims & Hers is far beyond GLP-1 and the thesis doesn’t depend solely on this drug at all. This is just an example of how flexible its business model is and how it can quickly integrate popular medications within its network to benefit from demand.

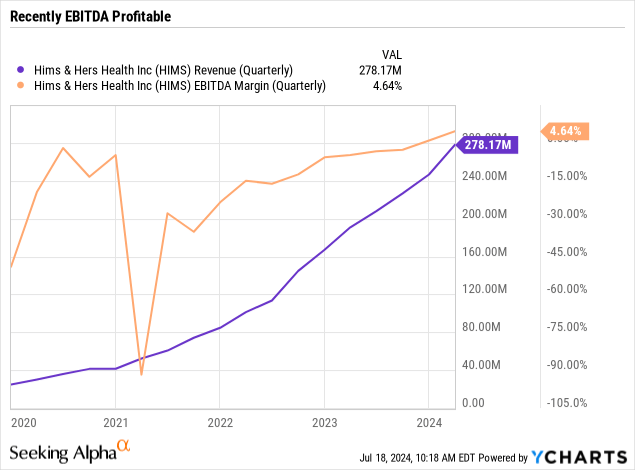

Before the announcement of GLP-1, the company had already achieved its first EBITDA-profitable quarter and revenue has grown at an extraordinary 100% annually since 2018. Any revenue that comes from GLP-1 is just added value in my view.

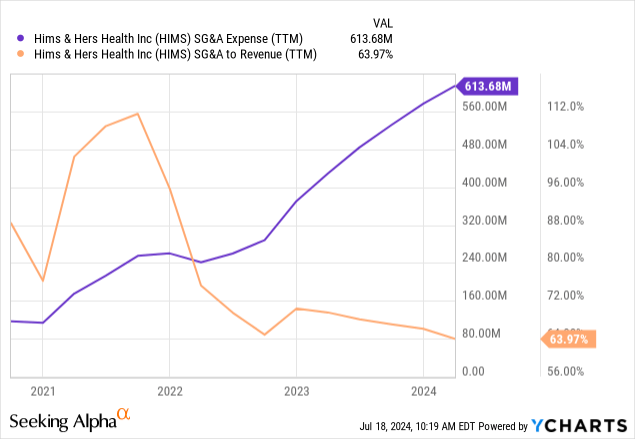

The fact that it has been EBITDA-profitable is so important because the company could begin to benefit from operating leverage since its costs are quite fixed because what it offers is basically software, and to reach new users it doesn’t take more than to reach them through marketing.

In fact, although SG&A expenses continue to increase strongly, revenue has increased much more, achieving this effect of being profitable despite continuing to invest in public awareness. Management’s goal is to achieve EBITDA margins of between 20 and 30% in the long term, maintaining gross margins in the mid-70% (currently it is a little above 80%).

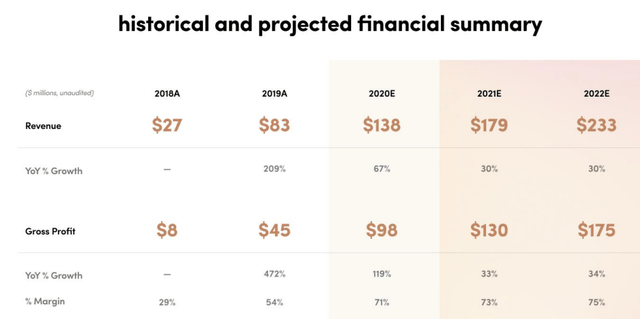

And the company is growing so much and has such potential, that even management itself has previously had trouble estimating its future potential precisely. If we see this slide from a 2020 investor presentation, the growth objective for 2022 was to reach $233 million in revenue with gross profit margins of 75%. In the end, the revenue for FY2022 was $527 million with margins of 77.5%.

HIMS Investor Presentation

Valuation

As I already mentioned, it appears that not even the management team itself is able to quantify the growth opportunity, making it difficult to value the company. For my assumptions, I’ll estimate an average annual growth of 35% over the next few years and a gradual improvement in EBITDA margin until it reaches 25%, the low range of the long-term target.

I think this growth is very realistic because the healthcare spending market in the United States is very large and more than $4 trillion is spent per year or $13 thousand dollars per person. It is evident that HIMS cannot serve those $4 trillion, but it shows that the almost $1 billion in revenue still has some way to go.

Author’s Compilation

With these projections, it’s clear that the value of HIMS is in the long term. That is, for the valuation to be justified five years from now, the company must maintain the aforementioned growth while improving margins, otherwise it would currently be expensive. I think that a multiple of 15 times EV/EBITDA is fair because the S&P500 usually trades at 12 times and HIMS would have considerably higher growth than the average. It currently has $192 million in net cash, which I added to the enterprise value to reach the market cap. Finally, I calculated the price per share based on the 210.9 million shares outstanding.

I believe the company will be able to achieve this growth and margins, and we must not forget that in the past it has even managed to exceed its own expectations, therefore, at the current price of $20 USD per share I would be buying.

Risks

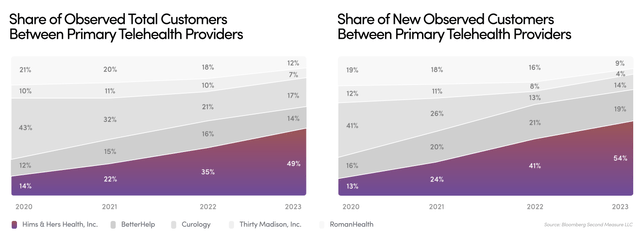

One of the main risks that I see is that the company competes in a highly commoditized market. Actually, the success of a healthcare company depends more on the good operational performance and the friendliness of the platform than on the service provided in my view, because HIMS doesn’t directly employ its medical doctors and therefore there wouldn’t be a difference between having a consultancy with Hims & Hers or having it with Teladoc, BetterHelp, Curology or any other telehealth platform. Therefore, it seems difficult for me to see that the company can develop something similar to a moat, beyond brand recognition and having the first-mover advantage.

HIMS Investor Presentation

Additionally, healthcare is a delicate industry. If the company were to have a public scandal related to medical errors or something similar, the brand image could be greatly damaged and I already mentioned previously that this seems to me to be one of the few competitive advantages that it can form.

Finally, high growth often attracts competitors. Not only new ones, but also the possibility of traditional players like UnitedHealth Group Incorporated (UNH) or Elevance Health, Inc. (ELV) deciding to implement their own digital platforms, which doesn’t seem that difficult to do.

The Bottom Line

Hims & Hers has proven to have a winning business model in a large and growing market. I believe the valuation could be fully justified as long as growth and margins continue on the current path of operating leverage.

While the risks are not to be taken lightly, I think the potential market is so large that there is room for several winners. Therefore, I think HIMS is a buy currently.

Read the full article here