Introduction

It’s time to talk about one of the few dividend kings on the market. Illinois Tool Works (NYSE:ITW) is one of the most fascinating cyclical dividend stocks on the market. Not necessarily because of its products but because of the way this company generates value.

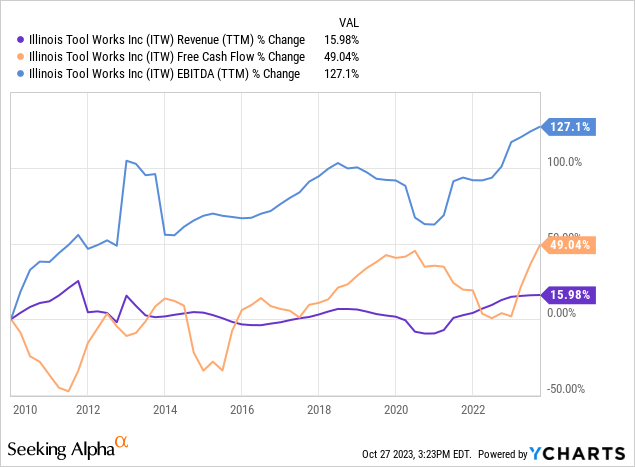

The company, which has hiked its dividend for more than 50 consecutive years, has grown its revenue by just 16% since 2010! That’s a very poor performance, as the company does not operate in a high-growth industry.

However, what makes this company so fascinating is its ability to boost margins. Since 2010, the company has grown its free cash flow by 49% and its EBITDA by 127%.

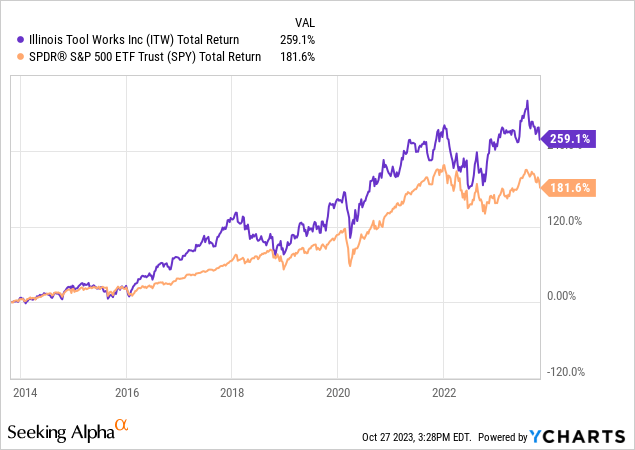

In this article, I’ll use the company’s recently released earnings and macroeconomic developments to assess the risk/reward of one of the most consistent dividend stocks on the market that has outperformed the market by a wide margin over the past ten years – despite subdued revenue growth.

So, without further ado, let’s get to the details!

All Eyes Are On The Valuation

Usually, I don’t start articles with a look at the valuation. However, I’m making an exception, as this article is aimed to make sense of the risk/reward for dividend investors.

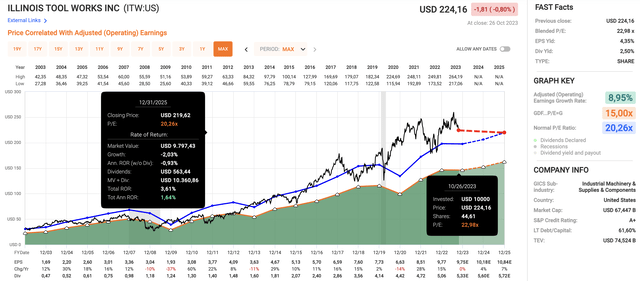

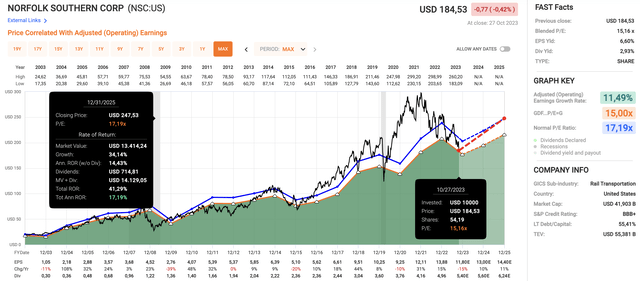

Historically speaking, ITW has traded at 20.3x earnings (the blue line in the chart below), which has guided the stock price very well over the past two decades. Currently, ITW is trading at 23x earnings.

FAST Graphs

This year, analysts expect earnings per share growth to remain flat, followed by a potential surge of 4% in 2024 and 7% in 2025.

If we incorporate these numbers and a return to 20.3x earnings, we get an expected annual return of 1.6%, which can be seen in the chart above.

Again, that’s solely based on its historical valuation and EPS outlook.

Without having taken a look at the company’s numbers, this means two things:

- ITW is trading at a premium during an economic downswing. Historically speaking, that’s rare and not a great buying opportunity.

- A lot of cyclical stocks have come down a lot more than ITW, offering better buying opportunities.

For example, one of my favorite cyclical dividend growth stocks, Norfolk Southern (NSC), is trading at a discount with a potential annual return of 17% through 2025 – using its normalized valuation and expected EPS growth.

FAST Graphs

There are many more examples.

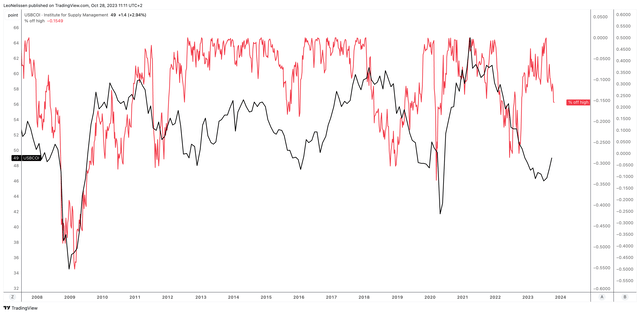

Furthermore, the chart below shows the relationship between the leading economic indicator, the ISM Manufacturing Index, and the distance ITW shares are trading below their all-time high (in %).

As I just mentioned, ITW tends to sell off when economic growth weakens. After all, ITW is a global manufacturer of diversified industrial products and equipment.

Historically speaking, ITW should trade between 5% and 10% lower than it is currently trading.

TradingView (ITW, ISM Index)

With that in mind, let’s dive into its numbers to assess why ITW is doing so well.

ITW Continues To Shine

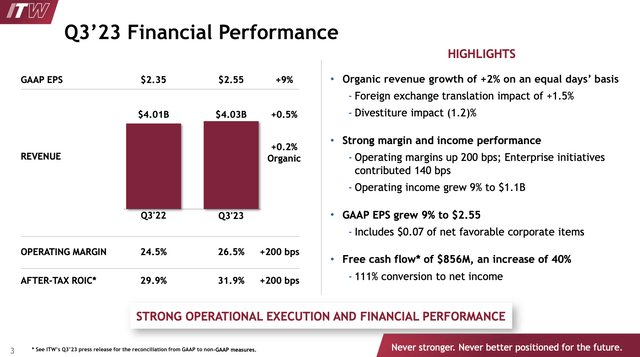

In light of economic challenges, ITW did very well.

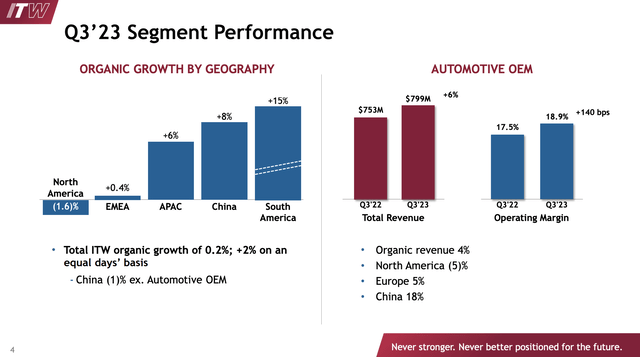

The company achieved a modest revenue growth of 0.5% in the third quarter.

Organic growth was essentially flat, but on an equal-day basis, it was up 2% due to fewer shipping days in the third quarter compared to the same quarter last year.

Foreign currency translation had a favorable impact of 1.5%, while divestitures reduced revenue by 1.2%.

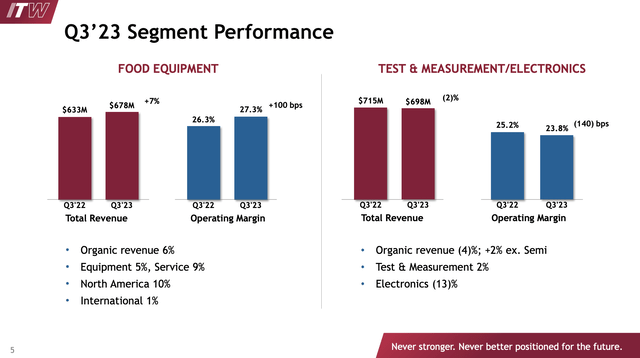

Illinois Tool Works

Also, as we’re used to by now, ITW reported improved margins as well.

The third-quarter operating margin improved significantly, increasing by 200 basis points year-over-year to 26.5%.

This improvement was attributed to enterprise initiatives and a positive impact of 210 basis points from price-cost margins.

With regard to its enterprise strategy, this is what the company said in its 2022 10-K:

In late 2012, ITW began its strategic framework transitioning the Company on its current path to fully leverage the compelling performance potential of the ITW Business Model. The Company undertook a complete review of its performance, focusing on its businesses delivering consistent above-market growth with best-in-class margins and returns, and developing a strategy to replicate that performance across its operations.

ITW determined that solid and consistent above-market organic growth is the core growth engine to deliver world-class financial performance and compelling long-term returns for its shareholders. To shift its primary growth engine to organic, the Company began executing a multi-step approach.

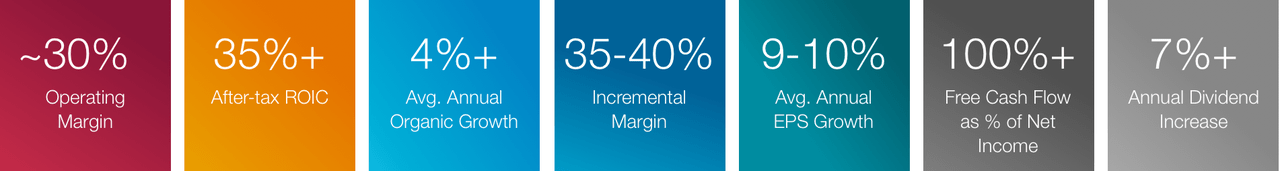

Its 2030 goals are to grow its operating margin to 30%, with an average annual organic growth rate of 4%, leading to at least 9% average annual earnings per share growth. If the company is able to achieve these goals, I have little doubt that it will continue to outperform the market.

Illinois Tool Works

Going back to the third quarter, GAAP EPS increased by 9% to $2.55. This increase included a net positive impact of $0.07 from favorable corporate items.

Thanks to strong margins and a healthy cash conversion ratio of 111%(!), free cash flow saw robust growth, increasing by 40% to $856 million.

Furthermore, a few segments stood out that I want to highlight.

- Food Equipment Segment: This segment delivered organic growth of 6%. Notably, North America within this segment saw growth of 10%, with institutional sales up in the mid-teens, restaurants up in the high single digits, and retail up in the high teens. The strong performance was attributed to new product rollouts, highlighting the segment’s ability to capture growth opportunities in various subcategories within the food equipment industry, which is an industry I like a lot.

Illinois Tool Works

- Automotive OEM Segment: While the overall Automotive OEM segment had mixed performance in different regions, China’s Automotive OEM segment stood out with impressive organic growth of 18%. This growth was largely driven by the Automotive OEM segment’s performance in China. Although North America was down 5%, and Europe was up 5%, the robust performance in China is a notable highlight within this segment, as it shows how ITW’s diversification allows it to capture regional strengths.

Illinois Tool Works

So, what does this mean for shareholders? And what’s next?

Shareholder Distributions & Outlook

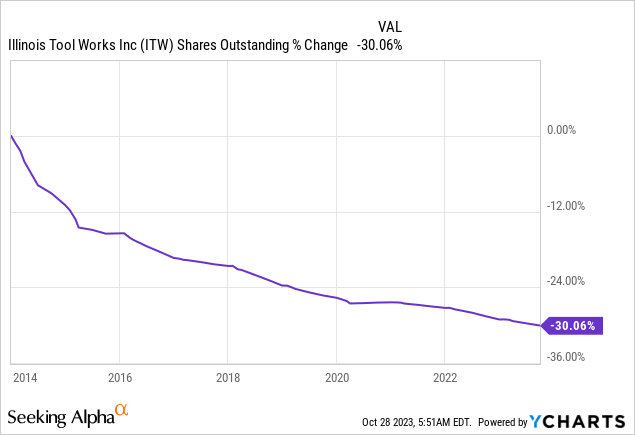

Thanks to a strong performance, the company repurchased $375 million of its shares in the third quarter.

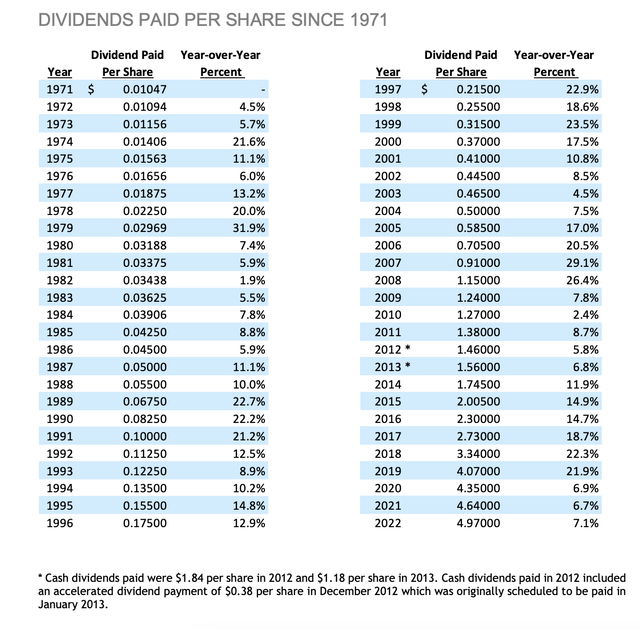

The company also raised its dividend by 7% to an annualized payout of $5.60 per share, marking its 60th year of raising the dividend.

It’s not only one of the few companies with more than 50 consecutive annual dividend hikes, but it’s also a company that still maintains elevated dividend growth rates!

Last year, the company also hiked by 7%. It did the same in 2021 and 2020. Prior to that, it had multiple years with double-digit hikes, as we can see in the table below.

Illinois Tool Works

Currently, the company pays $1.40 per share per quarter. This translates to a 2.5% yield. This yield is protected by a 57% 2023E earnings payout ratio and a balance sheet with a 1.6x 2023E net leverage ratio and an A+ credit rating.

On top of that, the company has also bought back almost a third of its shares over the past ten years, making it one of the most aggressive buyback companies on the market.

In other words, in light of its somewhat subdued revenue growth in the past, the company is showing how to consistently outperform the market and reward shareholders by making operations more efficient, taking care of financial health, and innovating to stay on top in key segments.

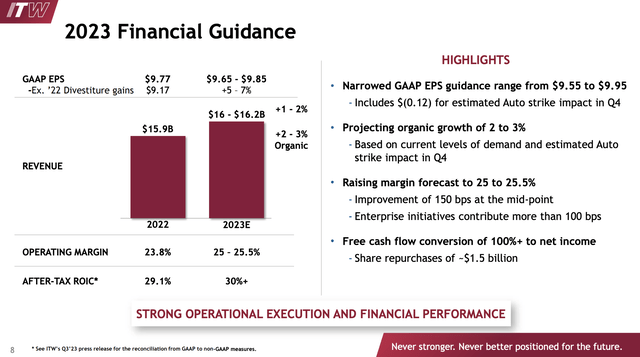

Looking forward, the company narrowed its earnings per share guidance for the year to a range of $9.65 to $9.85, which indicates between 5% and 7% full-year EPS growth.

Illinois Tool Works

The guidance incorporates a $0.12 adjustment to account for the impact of an auto strike in Q4.

Having said all of this, I believe that ITW is on track to continue to outperform the market on a prolonged basis. I just have doubts about its valuation. The current consensus price target is $234, which is 5% above the current price.

I agree with this consensus price target, which also means that I don’t really like the risk/reward in light of my earlier valuation assessment. The macroeconomic environment is vicious, and I wouldn’t rule out another 5% to 10% stock price decline.

If that were to happen, ITW would offer good value for long-term dividend growth investors.

Takeaway

Illinois Tool Works is a fascinating case in the world of dividend stocks. While it hasn’t seen significant revenue growth, it excels at boosting margins and generating consistent dividend growth.

ITW’s recent performance is commendable, with improved margins, strong cash flow growth, and standout segments like the Food Equipment and the Automotive OEM sectors.

Shareholders continue to benefit from consistent dividend increases, a strong buyback program, and a solid balance sheet.

However, the risk/reward balance is crucial, and the macroeconomic environment remains uncertain.

ITW’s valuation might not be ideal right now, but a potential price decline could make it an attractive choice for long-term dividend growth investors.

Read the full article here