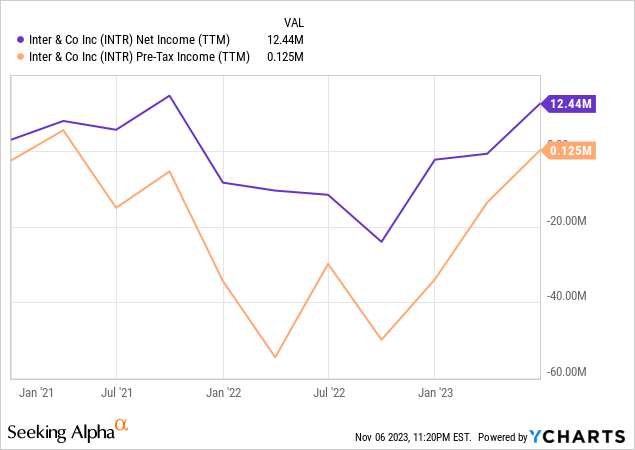

Inter & Co (NASDAQ:INTR) reported strong results in Q3 2023, highlighting a significant expansion in net profit and the reversal of losses compared to the same quarter last year.

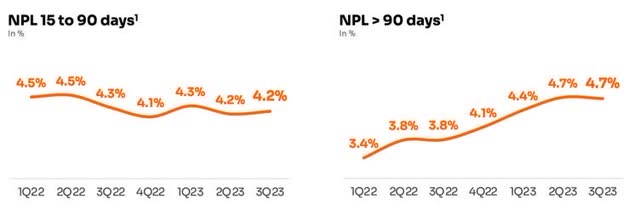

Additionally, despite a still low Return on Equity (ROE), it improved compared to the previous quarter and showed substantial growth compared to last year. The standout achievement for the bank was the stability in delinquency rates, indicating a potential turning point in the current credit cycle.

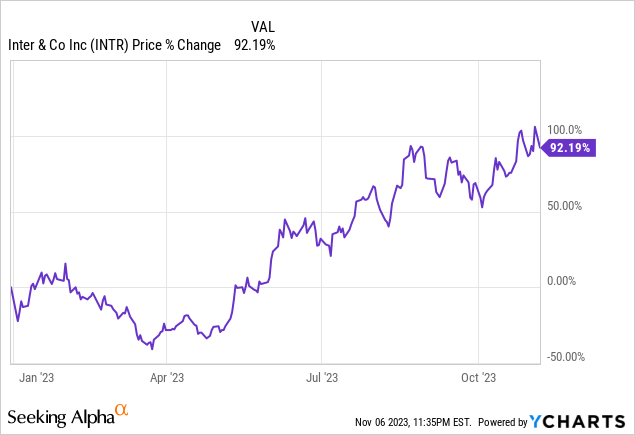

However, the quarter also had some negative aspects, such as decreased net interest income and a significant increase in personnel expenses. This likely explains why shares fell approximately 6% after the results were announced. Nevertheless, they are still up significantly, substantially increasing over 90% throughout the year.

Nevertheless, the bank’s outlook remains optimistic for a more profitable Q3, in line with its ambitious 60-30-30 plan for 2027 (aiming for 60 million clients, a 30% efficiency ratio, and a 30% ROE). This plan is the foundation for my bullish thesis, as outlined in my earlier article about Inter & Co.

Inter & Co Q3 Earnings

Inter & Co’s third-quarter presented positive and negative aspects. While the company’s reported results aligned with analyst consensus, I believe that, on the whole, the positive factors outweighed the negative ones.

Main Positive Points:

- Significant Increase in Net Profit: The Inter registered a substantial increase in net profit, with a 62.3% QoQ expansion, reversing a loss from the same period in the previous year.

- Improved Return on Equity [ROE]: The ROE improved significantly, showing a 2.1 percentage point increase QoQ and a 7.3 percentage point increase year-over-year.

- Stable Delinquency Rate: The stability of the delinquency rate at 4.7% suggests that the Inter may have reached a turning point in the credit cycle.

- Robust Customer Growth: The bank experienced robust growth in active customers, with a 6.7% QoQ and a 32.8% year-over-year increase.

- Improved Conversion Rate: The bank’s improved conversion rate led to the addition of more than 1 million active customers for the third consecutive quarter.

Main Negative Points:

- Declining Net Interest Margin [NIM]: The NIM was in retraction QoQ, negatively impacted by inflation [IPCA], and increased renegotiations under the “Desenrola” program.

- Increased Personnel Expenses: The bank experienced a significant increase in personnel expenses due to bonus payments and profit-sharing agreements, reflecting higher profitability.

- Aggressive Targets: The company’s 60-30-30 plan for 2027, with goals of 60 million customers, 30% efficiency, and 30% ROE, is somewhat aggressive.

- Economic Factors: The negative impact of inflation and increased renegotiations on the net interest margin could pose challenges in maintaining profitability.

The bank’s primary indicator, net profit, was the highlight as Inter & Co reported a record result, reaching R$104 million, which signifies a 64% quarter-over-quarter (QoQ) expansion. Net revenue was also robust, totaling R$1.26 billion, marking a 10% QoQ increase and a significant 48.8% year-over-year (YoY) growth.

Inter & Co’s IR

Inter & Co clients reached 29.4 million, representing a quarterly increase of 5.8% and an annual increase of 29.0%. However, it’s important to note that the bank has been experiencing a gradual slowdown in client growth quarter after quarter. In addition, the number of active customers reached 15.5 million, marking a 6.7% increase in the quarter and an impressive 32.8% increase over the year. The activation rate reached 52.7%, showing a QoQ increase of 0.5 percentage points and a year-over-year increase of 1.5 percentage points. This indicates the addition of more than 1 million active accounts per quarter.

Inter & Co’s IR

A closely monitored metric for digital banks, the average revenue per active customer (ARPAC), ended the third quarter at R$47.7, reflecting a 3.9% YoY increase.

Customer Acquisition Cost (CAC) remained low, registering a significant -4.4% YoY decrease and an even more substantial 8.5% YoY decrease, amounting to R$25.9. This positive trend in CAC can be attributed to a new channel and data mix model.

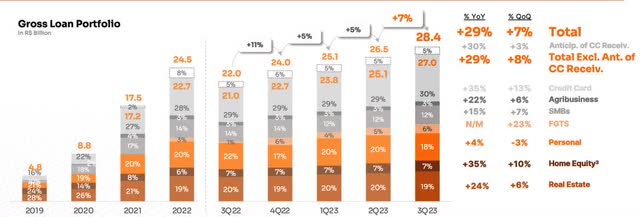

Turning to the loan portfolio without anticipating receivables, the bank reached R$27 billion, marking a growth of 7.6% QoQ and +28.7% year-over-year. Although the portfolio continued to show good growth, it has also slowed down. Notably, the bank resumed growth in the credit card portfolio, with a year-over-year increase of 12.6% and a substantial 34.9% year-over-year increase. This growth was facilitated by reallocating limits from higher to lower-risk clients and improving origination.

Inter & Co’s IR

In addition to credit cards, the FGTS portfolio and Home Equity products also demonstrated robust growth in quarterly and annual comparisons, highlighting the bank’s focus on more profitable products.

Net interest income ((NII) )amounted to R$819 million, reflecting a 2.1% QoQ increase and an impressive 48.9% YoY increase. The bank continued to benefit from an attractive net interest margin (NIM) of 7.8% despite a slight reduction of -0.3 percentage points QoQ and an overall increase of +1.5 percentage points YoY. In the quarter, the NIM was impacted by lower inflation levels and the higher volume of credit card renegotiations.

The cost of funding reached 66.5% of the CDI, showing a QoQ increase of 3.2 percentage points and a YoY increase of +3.0 percentage points. This increase was primarily due to Inter’s strategy called “Conta com pontos” (Account with points), which involved shifting a significant portion of demand deposits (down by 42% YoY) to term deposits (up by 18% YoY). Income from term deposits is converted into points and credited to customers’ accounts via the “Inter Loop,” aimed at reducing the compulsory reserves held at the Central Bank and freeing up liquidity for increased credit concessions.

The services and commissions line posted net revenues of R$316 million, indicating an 18.3% YoY increase and a substantial 45.4% YoY increase. This was mainly attributed to interchange revenues (15.5% YoY and 32.8% YoY) and commissions (22.5% YoY and 16.4% YoY), reflecting the expansion of transacted financial volume (TPV) and insurance. Management revenues were also a positive highlight in the quarter, showing an increase of 56.9% YoY and a remarkable 258.1% YoY increase.

Delving into delinquency, there may have been a turning point for Inter & Co. Provisions for doubtful debts (PDD) reached R$408 million, reflecting a 2.3% QoQ increase and a substantial 55.0% YoY increase, which mirrors a challenging scenario with high delinquency and portfolio growth.

Inter & Co’s IR

The delinquency rate above 90 days (NPL 90+) stood at 4.7%, marking the first point of stability QoQ after several quarters of increases (up by 0.9 percentage points YoY). This stability in the quarter reflects improved dynamics in the delinquency of credit card customers, as new vintages outperformed the older ones. NPL 90+, excluding prepayment of receivables, remained stable QoQ at 4.9% and increased by 0.9 percentage points YoY. The coverage ratio stood at 132%, showing a 2 percentage point rise QoQ but a 9 percentage point decreases YoY, aligning with the recent historical average.

Finally, the main negative point of the quarter, in my view, was administrative expenses, which reached R$708 million, surpassing inflation with a 9.3% YoY increase and an even higher 8.4% YoY increase. This increase was primarily due to the personnel expenses line, which showed a substantial 13.1% YoY increase and an impressive 19.5% YoY increase, driven by remuneration associated with bonuses and profit-sharing agreements. Despite the rise in costs, the efficiency ratio (cost/revenue) improved to 52.4%, showing a QoQ improvement of -1.0 percentage points and a remarkable -22.6 percentage point improvement YoY.

What’s Next

In any case, the next few quarters should be more robust for Inter & Co, as management emphasizes a stronger focus on profitability. While Inter & Co’s 60-30-30 plan, which aims to be achieved within five years, may seem ambitious, especially to achieve a 30% Return on Equity (ROE), it’s worth noting that this target appears distant, considering that Brazil’s largest private bank, Itaú Unibanco (ITUB), and the largest state-owned bank, Banco do Brasil (OTCPK:BDORY), have ROEs of both 21%, and have established their operations over a more extended history. However, Inter & Co’s management has indicated that the bank is ahead of schedule for the plan by approximately a year and a half.

It’s noteworthy that in Q3, Inter & Co’s fastest-growing products were FGTS-guaranteed loans, which increased by 23% annually, and credit cards, with a 13% annual growth rate. These products have a high ROE, which is essential for profitability. Credit cards, in particular, remained stable and are transactional, helping to maintain customer loyalty.

Furthermore, as Inter & Co’s CFO Santiago Stel mentioned during the earnings call, the profit reported in Q3 alleviates the market’s doubts about Inter’s ability to monetize its “super app” model, which has been a recurring concern among investors.

In addition to these positive developments, Inter & Co’s growth in lending in Q3, expanding the credit portfolio by 8% during a more cautious market period, raises the possibility that this growth could potentially be even more robust in Q4, especially with a more optimistic market outlook due to lower interest rates in Brazil.

The Bottom Line

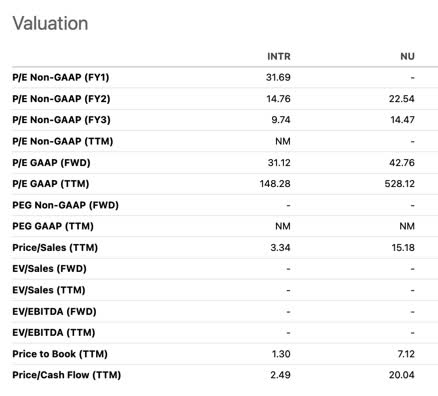

I remain committed to Inter & Co’s bullish thesis, driven by the Brazilian digital bank’s rapid growth and continuous pursuit of improved profitability. This, coupled with its more discounted valuations compared to its primary domestic competitor, Nu Holdings (NU), which trades at a premium of 7.1x price to book value compared to Inter & Co’s meager 1.3x, strengthens my conviction.

Seeking Alpha

The third quarter yielded positive results overall, marked by record net profit and a clear indication that the bank has successfully monetized its expanding customer base. Additionally, there was a notable achievement with the stabilization of NPL 90+ (excluding the anticipation of receivables), which is a positive development. However, some minor issues should be acknowledged, such as the reduction in the Net Interest Margin due to the prevailing inflationary conditions and the rise in personnel costs, which should see improvement in the coming quarters.

Aligned with the management’s statements, the aggressive 60-30-30 plan will be delivered ahead of the 2027 target. To achieve this, Inter & Co must prioritize profitability in the upcoming quarters to accelerate the optimization of its ROE, which currently stands at a modest 6%.

In any case, with a more attractively valued position when compared directly to other domestic digital banks, I reiterate that Inter & Co remains an excellent choice for long-term growth.

Read the full article here