Company Profile And Performance

Cirrus Logic, Inc. (NASDAQ:CRUS), is a mid-cap fabless semiconductor stock, primarily noted for its expertise in providing low-power, low-latency audio components (items such as codecs, digital signal processors, digital/analog converters, etc) for the mobile and consumer markets. Besides, its core expertise in the audio domain (62% of group sales), CRUS is also increasingly focused on providing high-performance mixed-signal (HPMS) products such as camera controllers, battery & power ICs, and haptic and sensing products.

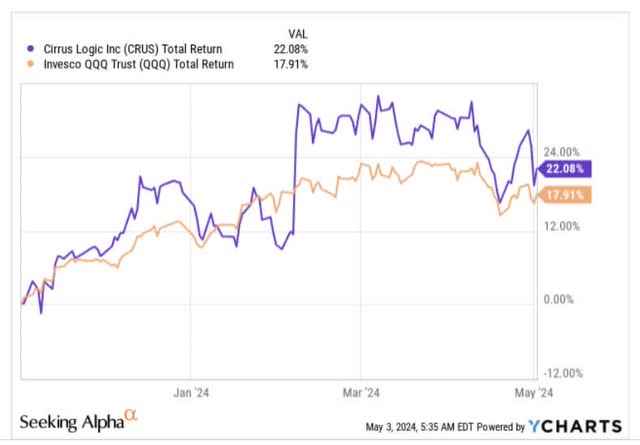

Over the past six months, the tech-heavy benchmark has managed to generate respectable returns of ~18%, but our focus stock has managed to overshadow the benchmark by roughly 400bps during the same time period.

YCharts

There’s now a potential catalyst on the anvil, which could be instrumental in seeing CRUS expand its degree of alpha, or even reverse this period of heydays. We’re referring to the company’s Q4-24 (CRUS follows a March year ending calendar) earnings event, which will take place a few days from now on the May 7, 2024. If you’re contemplating taking a position in Cirrus Logic’s stock ahead of the key event, here are a few considerations for your perusal.

Earnings-Key Considerations

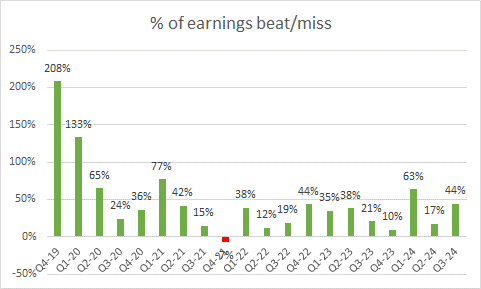

For context, if one is to consider Cirrus Logic’s 5-year track record in meeting or beating quarterly earnings estimates, we don’t see the need for investors to fret too much. To expand on this, note that this is a business that has failed to meet street estimates just once (in Q4-21) in the last 20 quarters; otherwise, you’re essentially looking at a firm that has a near-perfect record in not just beating street estimates, but trumping those numbers by around 47% on average, per quarter!

Seeking Alpha

Now, after a rather stellar Q3 (the December quarter), where CRUS ended up delivering record revenue and record non-GAAP EPS, things are expected to ease off in Q4.

In Q3, CRUS had delivered an impressive topline of $619m, implying 5% YoY growth, but in Q4, revenue will almost certainly contract on a YoY basis. At the Q3 earnings event, management had only guided to a revenue range of $290m-$350m, and currently, consensus is not even at the mid-point of that range at $315.6m. If we have to go with what consensus is expecting, we’re looking at a topline decline of 15% YoY, but even in the best-case scenario where management ends up hitting the upper end of its target range, we’ll still witness revenue contraction to the tune of -6% YoY.

On the EPS front, the expectation for Q4 is an adjusted EPS of only $0.64; that too would represent an earnings decline of 30%, relative to the adjusted EPS seen around a year ago.

Over the last few years, CRUS’s gross margins have tended to oscillate between the 49-51% levels, and in Q3 they managed to cross that range marginally (51.3%). In the current quarter, we would expect this to drop to levels of less than 51%, unless CRUS manages to increase the share of HPMS revenue (which is higher margin) in the overall mix. Of late, CRUS has largely been focused on providing audio amplifiers for an Android customer’s flagship phone, and in the months ahead, we would expect attention to remain in this terrain, given the launch of next-generation custom boosted amplifiers and the 22nm smart codecs.

Sentiment towards CRUS shares could potentially be boosted if management provides more clarity on future design opportunities in the notebook/laptop space, as it would reflect well on the company’s diversification efforts. As things stand, CRUS has tie-ups with the top-5 OEM players in this space, and recently also won a laptop power socket deal. CRUS is also well-placed to flourish in the high-end laptop segment, and that’s exemplified by its tie-up with Intel and Microsoft for the upcoming Lunar Lake Processor. For context, at the Q3 event, management suggested opportunities here could potentially start generating revenues within the low 10s of million threshold by next year. We would be looking for more granularity on this front, at the Q4 event.

One of the more commendable aspects of the CRUS story is its cash-generating potential (with no financial debt). This is a firm that consistently generates positive operating cash flow on an “annual basis”, and last quarter’s CFO generation was particularly robust at over $300m! This was instrumental in sending CRUS’s cash and STI (short-term instruments) balance to record highs of over $500m. At $517m that accounted for the largest share of the firm’s total asset base (23% of total assets).

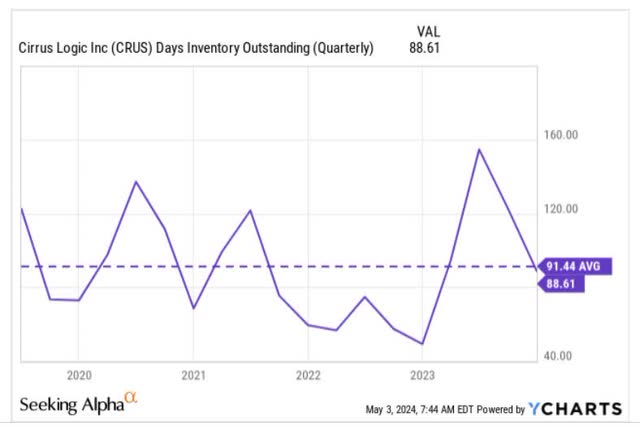

Note that CRUS’s FCF margin also came in at hefty levels of 49%, implying that almost half the sales were converted into cash. This is clearly not sustainable, and we would expect the FCF to normalize in the March quarter, particularly as CRUS would have beefed up its inventory; in Q4 it largely relied on drawing down existing inventory, bringing it below its 5-year average of 91 days.

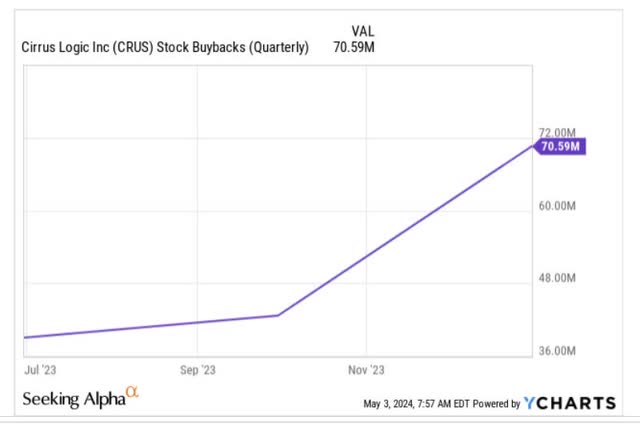

YCharts

A potentially lower FCF trajectory, may also likely have impacted the amount of cash deployed towards fulfilling CRUS’s ongoing $500m buyback plan (pending warchest of $365m as of 9M-24). Hitherto across the current fiscal, buyback spend per quarter, has been consistently trending up, but we wouldn’t be too surprised to see this trend down in Q4.

YCharts

Closing Thoughts- Is CRUS A Good Buy Now?

Given its historical track record, don’t be surprised to discover yet another quarter of earnings beat, but in the grand scheme of things, CRUS’s Q4 is unlikely to be too spectacular.

Looking ahead, CRUS has long-term ambitions to diversify away from its key customer, Apple (AAPL), and may eventually be able to reduce its dependence, but there’s no getting away from the fact that currently, a lot will depend on a pickup in Apple’s iPhone shipments (for context, last fiscal AAPL contributed 83% of CRUS’s sales). With the exception of Europe, iPhone sales have dropped across all regions, with the segment witnessing a 10% decline in the March quarter; the implication is that there could be another mid-single-digit decline for this segment in the June quarter as well.

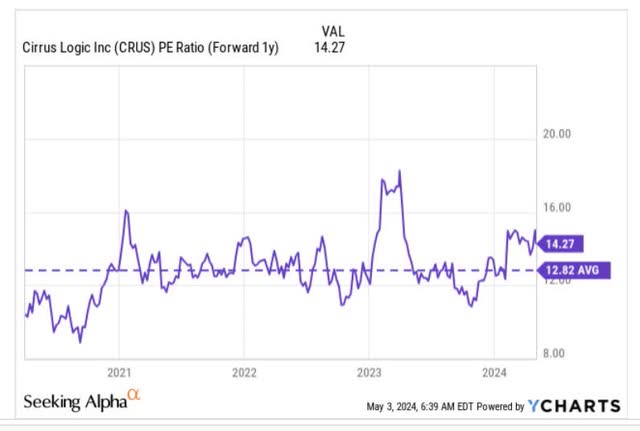

We also have some concerns over the stock’s current valuation (relative to its historical average), and the quality of earnings growth one is getting at those valuations.

YCharts

As things stand, CRUS is now priced at a forward P/E of 14.27x, which represents an 11% premium over the stock’s 5-year rolling average. To justify that premium, you’d want to at least see double-digit earnings growth, which would translate to a PEG (Price to earnings growth) of at least 1x, but rather look at what consensus is budgeting for next year.

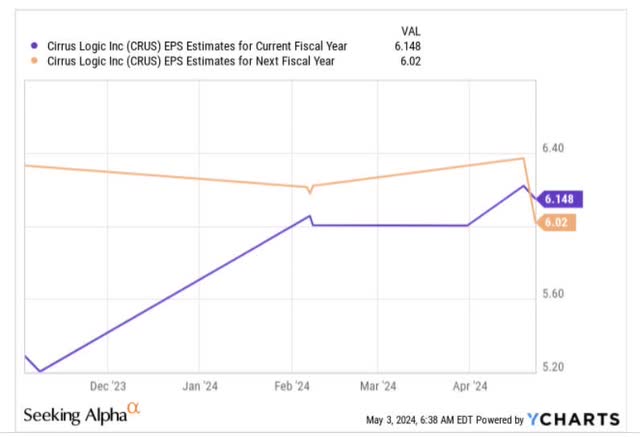

YCharts

After likely delivering an EPS in the ballpark of $6.148 in FY24, CRUS is now poised to witness an earnings contraction of -2% for FY25, which certainly isn’t a great pitch for a business priced at double-digits P/E.

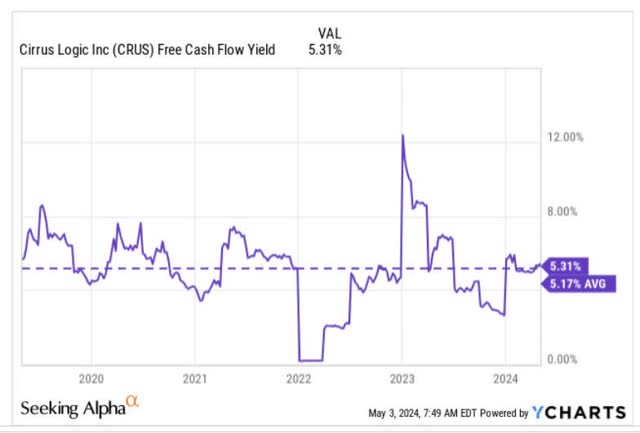

We also touched upon CRUS’s exceptional FCF performance in the December quarter, but that was only good enough to push the FCF yield a little above its 5-year average. In the March quarter, we would expect the FCF to take a hit, given inventory pressures (as discussed in the previous section), thus resulting in a lower FCF yield versus its historical average.

YCharts

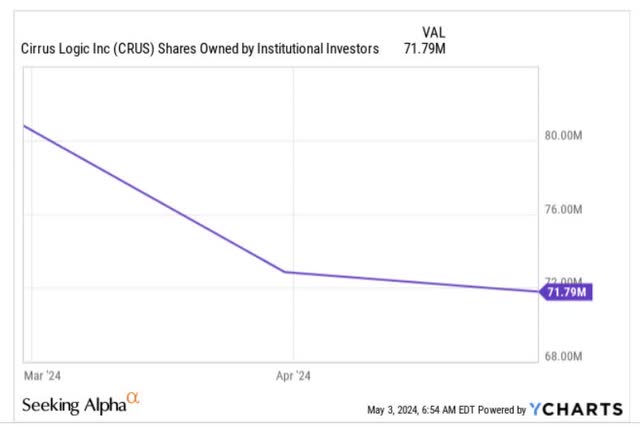

It’s also worth pondering if CRUS will make a great rotational pick for those interested in the mid-cap growth sector. The smart money doesn’t appear to hold that view, and over the past three months, we’ve seen them trim their net holdings in the CRUS counter by 11%.

YCharts

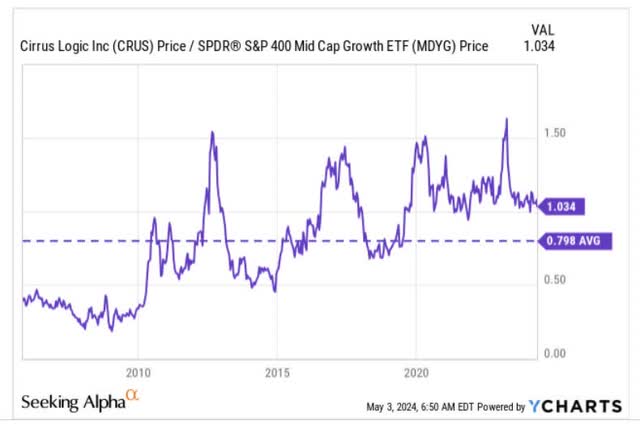

Regardless, note that on average, CRUS’ relative strength ratio vs other mid-cap growth offerings has come in at less than 0.8x, but as things stand, that relative strength ratio is around 30% higher than the long-term average, and could be susceptible to some mean-reversion going forward.

YCharts

All in all, considering all these developments, we don’t think CRUS would make a good BUY at current levels.

Read the full article here